MH Daily Bulletin: February 1

News relevant to the plastics industry:

At M. Holland

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- Every year, M. Holland’s market managers take time to reflect on the major trends of the past 12 months. Click here to read M. Holland’s 2023 Plastics Industry Trends & Predictions, including business insight and recommendations for the 3D printing, automotive, color and compounding, electrical and electronics, healthcare, packaging, rotational molding, sustainability, and wire and cable markets.

- Automotive, Electrical & Electronics and Wire & Cable were top performers in 2022 as electrification incentives and digitalization efforts expanded market opportunity. Click here to read 2023 predictions from our market managers for these three markets.

Supply

- Oil rose 1% Tuesday, recovering from three-week lows on data showing that demand for U.S. crude and petroleum products rose to a five-month high in November.

- In mid-morning trading today, WTI futures were down 0.4% at $78.58/bbl, Brent was down 0.7% at $84.86/bbl, and U.S. natural gas was off 3.0% at $2.60/MMBtu.

- U.S. crude stocks likely rose by 6.33 million barrels last week, according to the American Petroleum Institute, spurring oversupply concerns among traders.

- Refiners Marathon Petroleum and Phillips 66 beat Wall Street profit expectations as margins soared amid tight supplies and high demand for refined products.

- In a blow for environmentalists, the White House is considering approving a scaled down ConocoPhillips plan for oil drilling in Alaska.

- More news related to the war in Ukraine:

- European gas prices shot up 11% Tuesday in anticipation of a cold spell across the continent.

- Power output dropped in France Tuesday as workers walked off the job in protest over pension reforms.

- Gazprom’s piped natural-gas exports to Europe fell almost 30% in January to a record-low.

- The Libyan government rejected an $8 billion gas deal that the nation’s state-owned oil firm signed with Italy’s Eni.

- Tightened Chinese restrictions on exports of solar technology could delay U.S. plans to build a domestic supply chain, as China currently accounts for nearly all global production of several key components.

- United Airlines announced a joint venture with LanzaTech and PJT Partners to develop sustainable aviation fuel using ethanol.

Supply Chain

- A large portion of the U.S. was hit by a winter storm Tuesday that forced the cancellation of over 1,700 flights and disrupted travel from Texas to West Virginia.

- Seven western states that rely on the Colorado River failed to meet a Jan. 31 deadline to revamp their century old agreement on water allocations from the river, which is drying up after two decades of drought.

- A Clarksons Research index of daily port congestion dropped to 31.5% this week, down from a high of 37.8% in July and in line with pre-pandemic levels.

- U.S. trucking executives expect to see a return to a more normal ordering cycle in the second half of 2023, with bigger volumes seen ahead of the autumn shopping season.

- A surge in first-half freight rates last year led Hapag-Lloyd to a 38% gain in annual revenue to a total of $36.4 billion.

- Orders for new railcars in the U.S. fell 57% in the fourth quarter.

- Demand and output for cardboard boxes and other packaging material fell sharply in the fourth quarter.

- Economists say China’s reopening is pressuring supply chains and raising commodity prices, with the potential to worsen global inflation.

- South Korea’s SK Hynix, the world’s second-largest memory chipmaker, reported a record fourth-quarter operating loss and said it expects an industry downturn to worsen in the first half of 2023.

- U.S. chipmaker AMD reported a 98% decrease in quarterly profit to $21 million, a result of higher operating costs and weak PC demand.

- In the latest news from the auto industry:

- Tesla is upping output at its Shanghai plant after its recent price cuts spawned a spike in orders.

- According to Mexico officials, Tesla is considering building an assembly plant near a new Mexico City airport to serve as an export hub.

- Volkswagen is in talks to build a battery cell factory in Ontario, according to reports.

- GM Lithium Americas is set to develop the Thacker Pass Mine in Nevada with the aim of producing lithium hydroxide for electric-vehicle batteries.

- Stellantis expects to be able to build ethanol-powered hybrid vehicles in Brazil by the end of this year, an executive said.

- Converting the existing U.S. car fleet to electric vehicles would require more lithium than the world currently produces.

- The automotive supply chain is widely expected to face another challenging year due to the pandemic’s lingering effects and continued computer-chip shortages.

- Levi Strauss says it was unable to fill about $40 million in wholesale orders last quarter due to capacity constraints at U.S. distribution centers.

- Maersk started using drones to manage inventory counts in its warehouse network.

- Sony moved production of cameras sold in Japan, Europe and the U.S. from China to Thailand.

- Procter & Gamble is opening a distribution center in Greece that will be its main logistics hub for Europe.

Domestic Markets

- About 18% of people with long-COVID haven’t returned to work for more than a year after falling ill, according to a recent study.

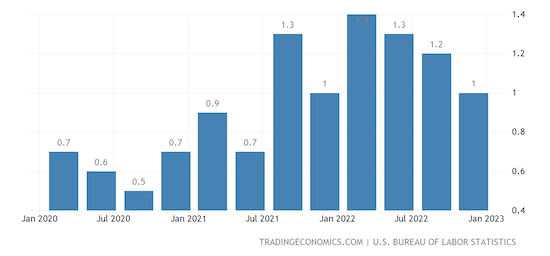

- U.S. wage growth slowed to a 1% pace last quarter, the lowest in a year, bolstering expectations that the Federal Reserve will hike rates by just 25 basis points at its meeting this week.

- According to ADP, private sector employment grew by 106,000 in January, while wages were up 7.3% from a year earlier.

- U.S. stock indexes saw strong monthly gains in January due to increasing confidence that interest rates are nearing their limit.

- U.S. consumer confidence unexpectedly fell in January as households continued to worry about economic prospects over the next six months, the Conference Board said.

- U.S. home-price inflation slowed further in November, according to the latest Case Shiller index.

- In the latest news from quarterly earnings season:

- Caterpillar saw earnings slide 29% due to higher manufacturing costs and currency fluctuations, even as sales grew 20%.

- UPS posted a surprise decline in quarterly revenue after delivering fewer items during the holidays than a year earlier.

- Snack food maker Mondelez International saw net revenue rise 13.5%, beating market expectations.

- Amgen saw sales fall 4% on lower revenue from its deal to manufacture COVID-19 antibody treatments for Eli Lilly.

- Homebuilder PulteGroup reported a 19% boost in sales on the back of persistently high home prices.

- Payments firm PayPal announced plans to cut 7% of its workforce, or some 2,000 employees.

- Amazon-owned grocer Whole Foods is requesting help from suppliers to reduce prices on packaged groceries as inflation subsides.

- Boeing has delivered its last 747 aircraft, marking the end of production for the “Queen of the Skies” jumbo jet that revolutionized air travel in the 1970s and remained in use for decades.

- Boeing’s CEO hinted at a potential increase in jet production this year on expectations of market recovery in China.

International Markets

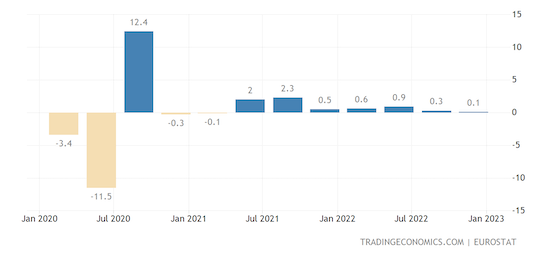

- The euro zone economy grew marginally in the final three months of 2023, managing to avoid a recession despite sky-high energy costs.

- The euro zone’s full-year growth of 3.5% outpaced that of China and the U.S.

- Up to half a million teachers, civil servants and transit workers walked off their jobs yesterday, “Walkout Wednesday,” demanding better pay.

- The number of companies going insolvent in England and Wales rose 57% last year to the highest level since 2009.

- Italy’s economy contracted by 0.1% in the fourth quarter, increasing concerns about a potential recession.

- China’s official gauges measuring manufacturing, services and construction activity all rebounded sharply in January, with the Purchasing Managers Index rising above 50, the demarcation between expansion and contraction.

- Profits at China’s industrial firms fell 4% in 2022 due to the impact of COVID-19 curbs, but an expected recovery this year could revive the sector’s sales.

- Canada’s economy grew by 0.1% in November and likely stayed flat in December.

- Banks are trying to reduce unsold loans from buyouts in the cheap-money era by refinancing the debt or selling chunks in secondary markets, limiting their capacity to underwrite M&A transactions.

Some sources linked are subscription services.