MH Daily Bulletin: December 9

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil fell for a fifth straight session on Thursday, dropping 1% on an increasingly uncertain demand outlook.

- In mid-morning trading today, WTI futures were up 1.0% at $72.16/bbl, Brent was up 0.8% at $76.76/bbl, and U.S. natural gas was up 6.1% at $6.32/MMBtu.

- Canada’s TC Energy shut its 622,000-bpd Keystone pipeline Thursday, cutting the flow of Canadian oil to U.S. refiners after 14,000 barrels of crude spilled into a creek in Kansas, marking one of the largest U.S. spills in nearly a decade.

- U.S. gasoline prices are now lower than they were a year ago, with the average dropping to $3.33 per gallon Thursday.

- Exxon Mobil and Chevron plan to boost spending on energy projects next year to a combined $42 billion, about half the level from the last time prices touched $100/bbl in 2013.

- Exxon Mobil and Shell are pushing back the $4 billion sale of a joint production venture in California while awaiting regulatory approval.

- Commodity trader Trafigura booked a record profit of $7 billion for the year ending in September amid unprecedented volatility in energy markets.

- A global lull in crude demand has pushed down earnings for giant supertankers by as much as 62% in recent weeks.

- A new energy agreement will see the U.S. double its LNG exports to Britain from 2021 levels, officials say.

- Saudi Arabia posted a budget surplus for the first time in over a decade thanks to high oil prices.

- More oil news related to the war in Europe:

- TotalEnergies will take a $3.7 billion impairment charge and withdraw its board representation in Russian gas producer PAO Novatek.

- Millions of crude barrels remain stuck on ships in Turkey’s Bosphorus strait amid heightened scrutiny of insurance guarantees. Turkey is resisting international pressure to speed up approvals even as $13 million in freight costs pile up.

- Oil tanker traffic leaving Russian ports fell by 50% in the two days following the newest European and G7 sanctions on Russian crude.

- Azerbaijani oil firm SOCAR paused purchases of Russian crude for its Turkish refinery, a sign of Western sanctions hitting operations even in countries that did not join the G7’s price cap.

- Official approvals are delaying Germany’s efforts to open its newest floating LNG terminal in Lubmin. Due at the beginning of December, the project is still set to be completed in record time.

- New data shows Russia’s Gazprom boosting natural gas flows to China by around 16%, while much lower volumes are sent westward to Europe.

- Russia is heavily discounting crude sold to Asia amid weak demand and poor refining margins, new data shows.

- Shell spent over $1.5 billion backing its British retail energy arm this year due to wild swings in gas and power prices.

- Exxon Mobil could see charges as high as $2 billion next year from European windfall taxes on energy producers.

- European officials continue to disagree over proposals to cap gas prices across the bloc.

- NTPC, India’s top power producer, plans to build a massive nuclear fleet by 2040 to help the nation transition from coal.

- French power group EDF and energy group Fortum are studying plans to develop conventional and miniature nuclear sites in Scandinavia.

- China and Saudi Arabia are in early talks to cooperate on boosting hydrogen production with greater levels of direct investment.

- U.S. budget carrier JetBlue Airways says it will step up investments in sustainable aviation fuel instead of buying carbon offsets for domestic flights in 2023.

Supply Chain

- Power has been fully restored in North Carolina after weekend firearm attacks partially shut down two substations. The attacks have shined a light on other recent power station attacks in Oregon and Washington.

- Lingering restrictions and sporadic COVID-19 outbreaks are slowing the pace of recovery for logistics services in China.

- Foxconn scrapped its “closed-loop” system for the world’s largest iPhone factory in Zhengzhou after thousands of employees quit during the two months it was imposed. The Apple supplier’s overtures likely contributed to Beijing’s decision to ease pandemic curbs, reports suggest.

- Next week’s strikes planned by British border-control workers could soon spread to air, rail and maritime ports, some warn.

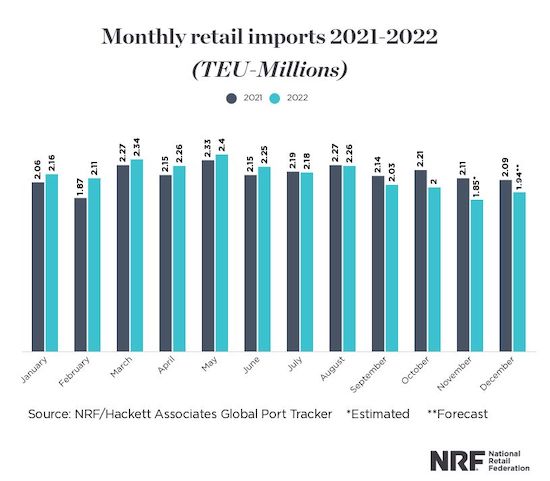

- Imports into major U.S. ports likely fell 12.3% year over year to 1.85 million TEUs in November, according to the Global Port Tracker.

- The World Trade Organization slashed its projection for global growth in goods trade from 3.4% to just 1% next year.

- The U.S.’s four major Class I railroads say some services are nearing pre-pandemic levels thanks to recent improvements in staffing.

- New orders from Evergreen, Yang Ming and CMA CGM are set to push the global boxship orderbook further into record territory.

- U.S. maritime regulators are mulling new rules to establish greater antitrust oversight over container line alliances.

- Construction on a $900 million port in southern India resumed Thursday following months of protests.

- The U.S. is expected to announce new sanctions today on Russia for its use of Iranian drones in its war with Ukraine and on China for Pacific Ocean fishing violations.

- In the latest news from the auto industry:

- U.S. dealerships report having the most pessimism in years as interest rates and uncertainty hit demand, according to Cox Automotive.

- Hyundai and South Korea’s SK On announced plans to build a battery plant in Georgia.

- Volkswagen postponed plans to build a gigafactory in eastern Europe due to uncertain market conditions.

- GM leadership expects new U.S. vehicle sales to continue rebounding next year as consumer demand remains strong.

- Volkswagen’s financial services unit will see a slowdown next year amid generally worse economic conditions, executives say.

- Renault and Nissan are expected to continue negotiating an overhaul of their alliance well into 2023.

- Tesla is discounting China-made cars and shortening shift hours at its Shanghai factory amid slowing demand in the world’s largest auto market.

- China’s car sales fell 9.5% year over year in November, hampered by the country’s zero-COVID approach.

- Honda signed a seven-year agreement for Chinese battery giant CATL to supply its China-made cars.

- Chinese electric-vehicle giant BYD will start selling in Malaysia as part of a $113 million partnership with Malaysian automaker Sime Darby Motors.

- Germany will install over a dozen battery-swapping stations made by Chinese automaker Nio, offering a potentially faster way to juice up electric vehicles on the road.

- Schneider National will buy 100 electric tractors made by Freightliner for its intermodal operations in Southern California.

- China’s semiconductor imports fell 14.4% in the first 11 months of 2022.

- Airbus’ chief executive says European aerospace suppliers will continue moving operations to the U.S. if the EU is unable to quickly approve new tax incentives.

- Major Japanese apparel companies and their suppliers are shifting overseas production from China to Southeast Asia.

- More U.S. retailers are using traditional store locations as e-commerce fulfillment hubs.

Domestic Markets

- The U.S. reported 96,412 new COVID-19 infections and 788 virus fatalities Thursday.

- Los Angeles County entered the federal government’s “high” category of COVID-19 risk, paving the way for a return of indoor mask mandates.

- The FDA approved Omicron-tailored booster shots from Pfizer and Moderna for children as young as six months old.

- U.S. hospitals are 80% full, the highest occupancy level of the pandemic, as respiratory illnesses spike.

- The Producer Price Index was up 7.4% annually in November, higher than expected but still down from October.

- Wells Fargo joined the chorus of big U.S. banks expecting the global economy to grow at a slower pace in 2023.

- The Fed’s campaign to hike interest rates has led to record-high rates for retailer-branded credit cards.

- Prices for online goods in the U.S. fell at a nearly 2% annual pace in November, the fastest decline of the pandemic.

- Sixty-percent of the estimated 450,000 underwater home borrowers in the U.S. bought their homes in 2022.

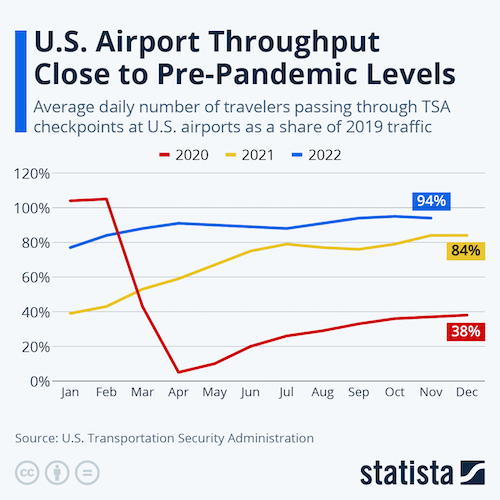

- United Airlines says it is readying to announce a major order for Boeing 787 Dreamliners next week.

- The FTC sued Microsoft to block its $75 billion acquisition of video-game-maker Activision Blizzard over antitrust concerns.

- Costco missed quarterly sales forecasts as consumers cut back on spending and operating expenses surged.

- Lululemon forecast holiday-quarter revenue well below estimates as shoppers turn cautious on higher-priced clothing.

- Broadcom’s forecast for current-quarter revenue topped expectations, signaling strong demand for chips used in data centers and networking equipment.

- Unilever is reportedly looking to sell a portfolio of U.S. ice cream brands, including Klondike and Breyers, in a deal that could run up to $3 billion.

- A new study suggests that plastics, which comprise 4.5% of global carbon emissions, could provide a carbon capture sink through a “circular bioeconomy.”

International Markets

- COVID-19 cases in China could be quietly surging after Beijing eased testing requirements in its latest pandemic policy shift. Many Chinese businesses are choosing to keep tight restrictions amid fears that the nation’s health infrastructure will be unable to handle a spike in cases.

- China’s shift away from COVID-zero could depress economic growth for the foreseeable future if infections begin to spike, analysts say.

- China’s producer prices fell 1.3% year over year in November, the second straight decline, while consumer inflation also slowed, indicating weak activity and soft demand.

- The EU is suing China through the World Trade Organization over punitive trade restrictions that Beijing imposed on Lithuania last year.

- Canada raised banks’ capital requirements by 50 basis points to 3% Thursday in response to rising economic uncertainty.

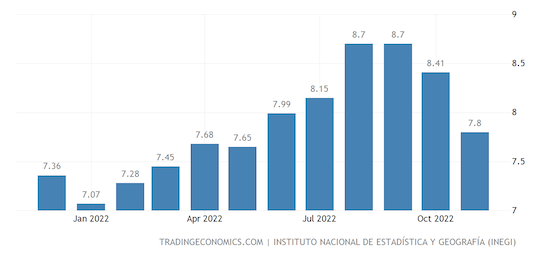

- Mexican consumer prices rose 7.8% year over year in November, the slowest pace in six months.

- The International Monetary Fund raised its projection for near-term financing needs of low-income nations by tens of billions of dollars due largely to impacts from Russia’s war in Ukraine.

- Cabin staff at Portuguese flagship carrier TAP launched the first in a series of planned strikes Thursday, forcing the airline to reduce service.

- Airfares on major corporate travel routes could surge as much as 25% next year due to the stronger U.S. dollar and persistent labor and aircraft shortages, analysts say.

Some sources linked are subscription services.