MH Daily Bulletin: December 8

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell another 2.5% Wednesday, forfeiting all the gains spurred by Russia’s invasion of Ukraine. Brent settled at $77.17/bbl and WTI settled at $72.01/bbl.

- In mid-morning trading today, WTI futures were down 0.7% at $71.52/bbl, Brent was off 1.2% at $76.21/bbl, and U.S. natural gas was up 5.0% at $6.01/MMBtu.

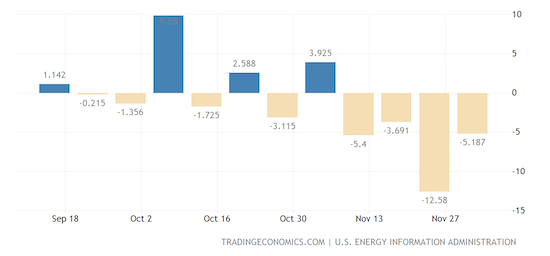

- U.S. crude stocks fell by a larger-than-expected 5.2 million barrels last week, according to the Energy Information Administration. Distillate stocks and gasoline inventories climbed.

- The U.S. exported a record 11.8 million bpd of oil and oil products last week.

- New Mexico is set to overtake Mexico’s crude oil production this month.

- The U.S. administration is poised to ban new and retrofitted federal buildings from using fossil fuels by 2030.

- China’s November crude oil imports rose 12% from a year earlier to their highest in 10 months.

- Saudi Arabia, the world’s largest oil exporter, pledged to maintain long-term energy cooperation with China, the world’s largest oil importer.

- Several major producers including BP and Equinor agreed to work toward electrifying offshore platforms in the North Sea.

- Britain approved the opening of its first deep coal mine in over three decades, a potential blow to the nation’s environmental efforts.

- More oil news related to the war in Europe:

- Early data suggests Russian crude exports are plummeting following the G7’s price cap imposed this week. Moscow is considering options, including banning oil sales to some countries to counter the measure.

- A lack of regulatory tools could allow Russian-sourced fuel to arrive in Europe by passing through other countries to avoid sanctions.

- Profit at Rosneft, Russia’s largest oil producer, fell 15% over the first nine months of 2022.

- Europe and India are negotiating measures to secure adequate gas supplies next year.

- The U.S. government’s first-ever sale of wind rights offshore California drew over $750 million in winning bids this week, mainly from European firms.

- Rising U.S. wildfire activity could cut down on key solar output in years ahead.

- The president of Peru, the world’s second largest copper producer, was removed from office and jailed after attempting to dissolve congress in violation of the nation’s constitution.

- British commodities giant Glencore warned that lagging development for copper production could slow the world’s energy transition.

- G7 nations offered $15 billion for Vietnam to speed up its transition away from coal.

- Ineos is buying a 50% interest in Sinopec’s Tianjin Nangang Ethylene Project, which is due to start a 1.2-million-tonne-per-year ethane cracker by the end of 2023.

Supply Chain

- South Korea ordered truckers in the steel and petrochemical industries to return to work after a 12-day strike cost the nation over $2.6 billion.

- November’s Logistics Managers’ Index fell several points to 53.6, its second-lowest reading on record, indicating rapidly slowing North American freight activity:

- Falling costs across U.S. supply chains are easing inflationary pressures in the economy.

- December cargo volumes into U.S. ports will likely fall well short of records set earlier this year as most holiday merchandise is already on store shelves or in warehouses.

- U.S. transportation capacity continued to grow at a fast pace in November, putting strong downward pressure on prices.

- Shipping conditions on the lower Mississippi River are starting to return to normal as rain picks up and water levels improve.

- Road freight volume in China fell for the third straight week even as authorities eased some COVID-19 measures.

- Logistics firms looking for extra help during the holidays are leasing temporary package-handling robots, dubbed “surge bots,” with plans to return the machines to manufacturers when the seasonal rush cools down.

- U.S. regulators are proposing to shrink the scope of driving-time waivers granted to truckers in supply-chain emergencies.

- Maritime-service companies report being increasingly short of workers.

- The U.S. and EU are weighing new tariffs on Chinese steel and aluminum as part of efforts to fight carbon emissions and global overcapacity.

- Dutch officials are planning new controls on exports of chipmaking equipment to China, potentially aligning their trade rules with U.S. efforts to restrict Beijing’s access to advanced technology.

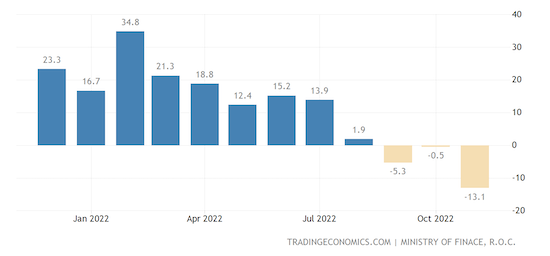

- Taiwan exports, a bellwether for global tech demand, fell by a worse-than-expected 13.1% in November, the sharpest fall in seven years:

- In the latest news from the auto industry:

- On Wednesday, workers at a GM-LG Energy battery cell joint venture in Ohio began voting on a measure to unionize.

- Mobileye, Intel’s self-driving spinoff, beat estimates for revenue and earnings in its first quarterly report after going public in October.

- More than 40 major manufacturers, shippers and industry groups are calling on the EU to mandate all freight truck sales be zero-emission models by 2035.

- Volkswagen will invest $482 million by early 2025 to boost electric-vehicle production at its plant in Wolfsburg, Germany.

- Tesla opened bookings for its cars in Thailand this week.

- Honda will start selling micro-sized commercial electric vans in Japan by early 2024.

- Vietnamese electric-vehicle-maker VinFast applied to go public in the U.S.

- Uber and driverless tech firm Motional launched a fully autonomous robotaxi service in Las Vegas.

- Swedish electric self-driving truck startup Einride plans to raise $500 million of capital from a variety of sources.

- BMW will start shipping automotive parts into Vietnam for local assembly of two sedan models.

- Volkswagen’s Bentley expects a slight drop in production next year as shutdowns in China slow orders.

- Dollar General says delays in warehouse openings added $40 million in supply-chain costs in the third quarter.

- Mondelez cut the ribbon on a new 450,000 square-foot, $122.5 million fulfillment center near Richmond, Virginia.

- The EU proposed tougher requirements for commodity firms trading in derivative markets, a bid to avoid the liquidity issues faced by some companies after Russia invaded Ukraine.

- A French firm completed its first trials of an automated kite propulsion system for trans-Atlantic cargo vessels that is expected to reduce fuel consumption and emissions by an average of 20%.

Domestic Markets

- The U.S. reported 142,748 new COVID-19 infections and 1,037 virus fatalities Wednesday.

- COVID-19 hospitalizations in Los Angeles are skyrocketing.

- Rapidly evolving variants of the COVID-19 Omicron strain continue to outpace vaccine development, according to new research.

- First-time jobless claims rose by 4,000 to 230,000 last week.

- U.S. worker productivity rebounded at a faster pace than initially thought in the third quarter, although labor costs remained elevated.

- U.S. mortgage rates fell for a fourth week to 6.41%, marking the longest stretch of declines since before the pandemic.

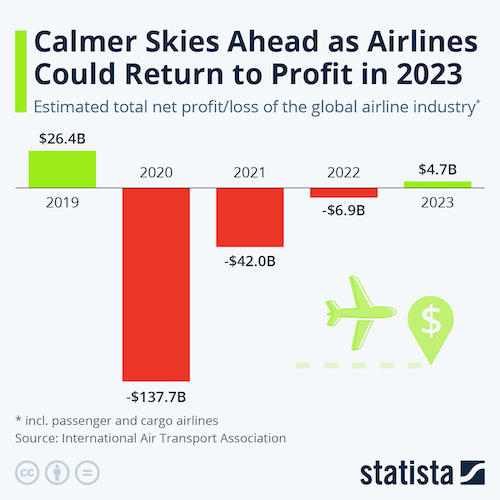

- Southwest Airlines became the first major U.S. carrier to reinstate its quarterly dividend since the pandemic.

- Boeing could be closer to canceling MAX 7 and MAX 10 jet orders after U.S. lawmakers declined to extend a grace period for the plane-maker to meet updated regulatory requirements.

- Citigroup expects investment banking fees to plummet 60% this quarter as dealmaking stalls.

- Campbell Soup boosted its outlook after sales and profit rose at double-digit rates in its fiscal first quarter.

- Shares of Carvana dropped 40% Wednesday on reports that creditors may work to restructure the beleaguered used-car seller’s debt.

- Vanguard, the world’s largest mutual fund manager, announced plans to pull out of a major investment-industry initiative on tackling climate change.

International Markets

- China on Wednesday announced the most sweeping changes to its COVID-zero regime since the pandemic began, loosening rules to allow infected people to quarantine at home and dropping testing for people traveling domestically. The moves could trigger a wave of infections and overwhelm healthcare facilities, experts warn.

- China saw a 9% year-over-year decline in November exports, the steepest drop since the first month of the pandemic.

- Hong Kong is considering scrapping its outdoor mask mandate and shortening isolation periods for people with COVID-19.

- Euro zone GDP growth was revised slightly upward for the third quarter, in line with reports of resilient household spending.

- Consumer expectations for year-ahead inflation in the euro zone rose from 5.1% to 5.4% in October.

- Japan’s economy shrank less than initially thought in the third quarter.

- In the latest on the global wave of monetary tightening:

- The Bank of Canada raised interest rates by 50 basis points to 4.25%, its sixth straight hike and likely its last increase of the current cycle.

- Britain is expected to raise rates by 50 basis points to a total of 3.5% next week, part of a continued battle to cool 41-year high inflation.

- India raised its key policy rate by 35 basis points to 6.25%, a three-year high.

- Peru raised its benchmark interest rate for a 17th consecutive month to 7.5%.

- Poland and Brazil left their main interest rates unchanged, betting that a slowdown in the global economy will help bring inflation under control.

- Europe’s and the G7’s new sanctions on Moscow are expected to significantly curtail Russia’s economic activity in the coming months, including slashing funding needed for its war with Ukraine.

- The EU’s executive arm is looking to pass a ninth package of sanctions on Russia.

- Workers at several major British airports, including Heathrow, will go on strike for eight days this month in a dispute over pay, threatening disruption to Christmas travel.

- Air New Zealand boosted its earnings forecast for the first half of next year, helped by strong travel demand and declining fuel prices.

- The EU proposed rules that would make airlines pay more for required carbon permits on intra-Europe flights.

Some sources linked are subscription services.