MH Daily Bulletin: December 7

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell 4% Tuesday to their lowest levels this year with WTI and Brent both falling below $80/bbl, a response to increasingly uncertain market conditions.

- In mid-morning trading today, WTI futures were down 1.9% at $72.87/bbl, Brent was down 1.5% at $78.16/bbl, and U.S. natural gas was up 0.7% at $5.51/MMBtu.

- U.S. natural-gas prices are down 25% since Thanksgiving due to milder weather and greater domestic stockpiles.

- U.S. crude stocks fell by 6.4 million barrels last week, while gasoline and distillate stocks rose, according to the American Petroleum Institute. Government data is due today.

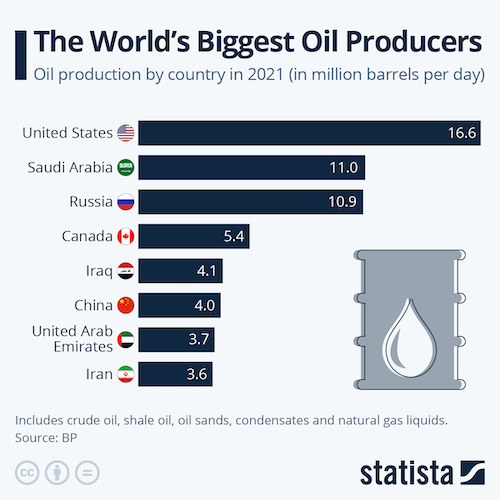

- The U.S. administration slightly raised its 2022 forecast for crude output growth while predicting next year’s production will hit a record 12.34 million bpd, reversing previous estimates for a decline.

- Premium U.S. gasoline is selling at a near-record spread with regular fuel as producers pay more to supply its higher octane content.

- The U.S. launched a sale of wind rights offshore California this week, a first for the West Coast.

- U.S. power usage will hit a new high this year due to increased economic activity, according to the Energy Information Administration.

- Exxon Mobil started production at a new $500 million polypropylene unit at its Baton Rouge complex that adds 450,000 metric tons of output per year.

- More energy news related to the war in Europe:

- Some 20 oil tankers are facing extended queues in Turkey due to insurance rules the country adopted ahead of the G7’s price cap on Russian oil.

- Russia may attempt to set an oil price floor in response to the G7’s price cap that took effect Monday.

- European power and heating demand will surge the next two weeks as an Arctic blast brings severe winter conditions.

- Hungary scrapped a domestic price cap on fuels Tuesday after the measure led to low imports and shortages across the country.

- Top U.S. and British officials agreed on a plan to boost LNG exports to the U.K.

- Russia’s year-to-date oil and gas condensate production is up 2.2% but will start to decline with new Western sanctions, Moscow officials said.

- France is banning some short-haul domestic flights that could be taken by train to reduce emissions.

- Credit Agricole, France’s biggest retail lender, stopped financing new oil extraction projects.

- JetBlue Airways is pledging to halve jet fuel emissions by 2035 with greater investments in low-carbon solutions. Industry analysts say consumers will see higher ticket prices from the transition to green fuels in aviation.

- Italy’s transport minister asked lawmakers to abandon plans for a 2035 ban on new sales of gas-powered vehicles.

- Houston-based NRG Energy will acquire Vivint Smart Home for $2.8 billion as it looks to integrate its home-energy services with other home systems.

Supply Chain

- At least one county in North Carolina declared a state of emergency following a third full day of blackouts caused by a weekend attack on two power facilities.

- U.S. diesel prices dropped sharply last week to an average of $4.97 per gallon, the lowest in two months. Gasoline prices continue to fall much faster.

- The price of shipping fuels has fallen to pre-Ukraine war levels on flagging demand.

- Shipping rates from China to the U.S. West Coast fell further in November and are down 90% from a year earlier as the industry braces for a possible price war in 2023 due to weak demand and overcapacity.

- New orders for Class 8 trucks fell for the second straight month in November after a record September as concerns grow about a possible “freight recession.”

- The Port of Savannah is shifting some breakbulk cargo operations to a nearby port in order to clear up space for container operations.

- CMA CGM will acquire two container terminals at the Port of New York and New Jersey, expanding its presence in the crucial trade hub.

- CMA CGM, Cosco Shipping and Evergreen Line are shifting capacity from the Pacific due to stronger trans-Atlantic freight rates.

- The Port of Los Angeles is on track for its second busiest year on record despite a recent slowdown in cargo volumes.

- Daily less-than-truckload tonnage at Old Dominion Freight Line fell 8.6% in November, almost double the pace of decline from the third quarter.

- Four months of protests have ended at a massive seaport under construction in the south Indian state of Kerala.

- Spain’s Port of Valencia will spend $1.67 billion to build a fourth container terminal.

- XPO Logistics is delaying the divestiture of its European business due to weakened capital markets.

- Taiwan’s TSMC expects to see annual revenue of $10 billion from its two Arizona chip plants when they are fully operational by 2026.

- U.S. senators scaled back a proposal to put new curbs on the use of China-made chips by the U.S. government and federal contractors following pushback from business groups.

- Airbus scrapped its forecast for full-year jet deliveries amid persistent supply-chain issues.

- Michelin is scaling back layoffs in France to safeguard production.

- In the latest news from the auto industry:

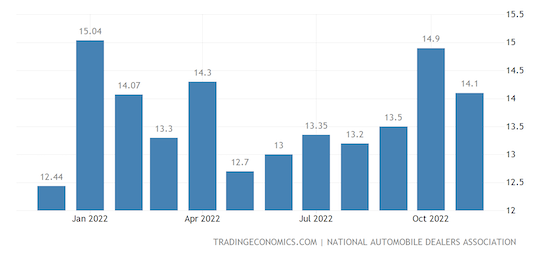

- U.S. light-vehicle sales rose 7.9% year over year to 14.1 million units in November, as availability continued to improve:

- About two-thirds of Ford dealers have opted in to selling electric vehicles, which requires that they invest up to $1.2 million.

- Global prices for lithium-ion batteries rose 7% this year, the first increase in records going back to 2010. Higher prices could delay the arrival of affordable electric vehicles, experts say.

- Envision AESC, a former battery unit of Nissan, will invest $810 million to build a battery supply plant for BMW in South Carolina.

- Apple is reportedly pushing back plans to scale up self-driving tech and to unveil its first car.

- Mexico says rising business incentives will propel its auto-parts production to a record $107 billion this year, up 13% from 2021.

- Japan’s two biggest steelmakers are considering large new investments in production of electrical steel, once a niche metal with magnetic properties that reduce energy loss in electric-vehicle motors.

- Volkswagen is in talks to fund coding schools in Mexico and Brazil as part of a strategy to recruit employees with tech skills.

- This week in Japan, Mercedes-Benz opened its first-ever dealership selling only electric vehicles.

- New car sales in Russia plummeted 61.6% year over year in November.

- High shipping costs are pushing Israeli firms to import more goods from Turkey over China.

- British commodities giant Glencore cut 2023 production guidance across its portfolio, citing higher costs and power instability across the globe.

- A new European law will require companies looking to sell into the EU market to show their supply chains do not contribute to global deforestation.

Domestic Markets

- The U.S. reported 54,377 new COVID-19 infections and 586 virus fatalities Tuesday. Some 42% of adults have antibodies indicating previous infection, according to new research.

- COVID-19 hospitalizations rose 27% last week as part of a post-Thanksgiving viral surge, leading the CDC to encourage more mask-wearing.

- COVID-19 statistics are rising in New York and California, particularly Los Angeles and San Francisco.

- Amid rising infections, New York City is closing its COVID-19 mass-testing lab due to low demand and the availability of at-home tests.

- U.S. lawmakers are prepping to remove the military’s COVID-19 vaccine mandate.

- Pfizer says it will boost investment to launch new products amid falling revenue from its COVID-19 vaccine.

- The largest U.S. banks say inflation and falling consumer demand will lead to worsening economic conditions next year.

- U.S. goods exports fell 2.1% to a total of $176 billion in November, the lowest in seven months.

- U.S. steel imports rose 7.2% from September to October.

- Boeing has officially ended production of its 50-year-old 747 jumbo jet, what some industry analysts call the end of an era.

- BlackRock, Morgan Stanley and Adobe are the latest big firms to freeze hiring or cut staff ahead of predicted slowdowns.

International Markets

- Beijing loosened some of its restrictions on public movement and COVID-19 testing Tuesday, leading some to fear an imminent rise in cases.

- China’s trade surplus fell to its lowest level since April last month as weak demand led to sharp declines in both imports and exports:

- Japanese manufacturer and service-sector sentiment is the highest in months, new data shows.

- The World Bank upped its forecast for GDP growth in India this year, noting its unusual resilience in the face of pandemic pressures.

- The Italian government sharply downgraded the nation’s GDP growth forecast next year from 1.9% to 0.4%.

- The latest purchasing managers’ index shows Canadian economic activity expanded at a quickened pace in November, while its trade surplus came in higher than expected.

- Top Mexican banking officials say the central bank will start to slow its pace of interest-rate hikes following four straight 75-point increases.

- At a meeting Tuesday, Chile’s central bank declined to continue raising interest rates beyond the current level of 11.25%.

- Low-income countries now spend over one-tenth of their export income to service debt, the highest proportion since 2000, according to the World Bank.

- Countries are imposing trade restrictions at an increased pace, particularly on food, feed and fertilizers, the World Trade Organization says.

- Toronto saw just 4,544 home sales in November, down 49% from a year ago amid a massive market correction.

- Cabin staff at Portuguese flagship carrier TAP will launch the first in a planned series of strikes this week.

- Global airlines are expected to post their first industry-wide profit since 2019 next year.

Some sources linked are subscription services.