MH Daily Bulletin: December 28

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

- M. Holland will be closed Monday, Jan. 2 for the New Year’s holiday.

Supply

- Oil held steady at three-week highs Tuesday as more refineries on the U.S. Gulf Coast resumed operations from Winter Storm Elliott. Some U.S. refiners will be unable to restart operations until January after the storm led to widespread disruption, spurring a loss of about 20% of U.S. motor fuel output.

- Natural gas production in the Appalachian Basin, the nation’s largest producing region, fell a record 27% after Winter Storm Elliott froze wells and equipment.

- Energy prices reversed course today on surging COVID-19 infections in China. In mid-morning trading, WTI futures were down 2.2% at $77.76/bbl, Brent was down 2.3% at $82.37/bbl, and U.S. natural gas was down 12.0% at $4.65/MMBtu.

- The average U.S. price of gasoline is forecast to hit $3.49 per gallon next year, down 50 cents from 2022.

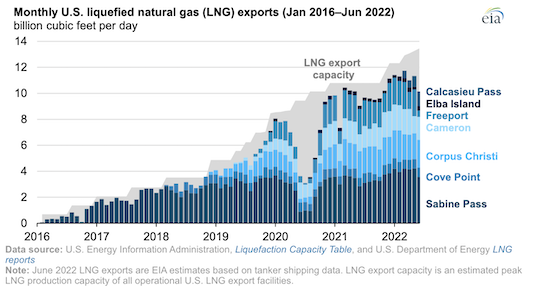

- The U.S. became the world’s largest LNG exporter during the first half of 2022 at an average of 11.2 billion cubic feet per day:

- A lack of transport infrastructure threatens to halt production growth in Argentina’s booming Vaca Muerta shale region.

- India is preparing a $2 billion incentive program for the green hydrogen industry.

- Over 40% of German firms surveyed plan to boost their activities in Africa next year, especially in areas such as green hydrogen and LNG.

- More oil news related to the war in Europe:

- A mild winter is keeping European natural gas and power prices down.

- Russia signed a decree Tuesday that bans the supply of oil and oil products to nations participating in the G7’s price cap for five months starting in February.

- Moscow is prepared to cut oil output by about 6% in early 2023 due to impacts from the G7’s price cap, officials said. The nation’s budget deficit will run higher than expected next year as a result of the program.

- Russia plans to ramp up oil exploration in the nation’s east as it looks to boost supplies of gas to Asian partners.

- The European Commission will force Germany’s Uniper to sell one of the country’s most advanced power plants as a condition of Uniper’s takeover by the German government.

- Japan’s government asked insurers to take on extra risks by providing coverage for LNG shippers in Russian waters, mainly to keep supply flowing from the Sakhalin-2 project in Russia’s Far East.

- Japanese firms signed multiple deals Tuesday for long-term imports of LNG from Oman and the U.S.

- Consumer groups sued the EPA and plastic container-maker Inhance Technologies to force Inhance to halt production over allegations it is violating “forever chemicals” restrictions.

Supply Chain

- In the latest news from Winter Storm Elliott:

- The storm’s fatality count is up to 64, including more than 30 deaths in Buffalo, New York.

- Air travel remains disrupted, while the U.S. government launched a probe into Southwest Airlines after it canceled more than 60% of its schedule Tuesday and said more cuts would follow.

- Plunging supply of natural gas sent wholesale U.S. power prices surging over 6,000% in some parts of the country, with heating bills expected to skyrocket in the coming weeks.

- Millions of gallons of water are leaking across the U.S. South after Elliott caused pipe systems to burst.

- South Africa has seen 200 days of power cuts this year due to old and poorly maintained power stations.

- Low temperatures and fog disrupted transport in parts of India Tuesday.

- Experts say cross-border freight between the U.S. and Mexico will remain strong in 2023 as more companies nearshore manufacturing to North America.

- Rising energy costs in Europe are stunting the continent’s manufacturing exports while spurring European businesses to invest overseas, particularly in the U.S.

- Going viral on social media can deliver unexpected supply-chain snags for retailers, with so-called social commerce shopping growing by 27% last year to a total of $37 billion, according to analysts.

- U.S. intermodal rail transported about 250,000 cars last week, down 7.5% from 2021, according to the Association of American Railroads.

- North American Class I railroad employment reached its highest level since the start of the pandemic in mid-November, new data shows.

- Ocean shippers spending billions on low- and no-carbon ships could lead to higher costs amid lingering questions over which alternative fuels will prevail as the industry grows.

- Japanese container line ONE will acquire controlling stakes in three U.S. container terminals at the ports of Los Angeles and Oakland.

- Global semiconductor inventories are at their highest level in over a decade, leading more manufacturers to slash production amid weak demand forecasts.

- Chinese semiconductor startups are seeing a windfall in new investment as the nation pushes chip development in response to U.S. sanctions.

- Kyocera, a Japanese firm specializing in ceramics and electronics, will spend almost $10 billion starting next year to boost production of chip-making equipment.

- Copper futures are surging on expectations of a revival in Chinese demand.

- In the latest news from the transportation industry:

- Supply-chain issues have led to a global order backlog of over 12,000 aircraft, creating a capacity shortage expected to keep airfares elevated for the foreseeable future, according to Jefferies.

- Aircraft lessor BOC Aviation ordered 40 Boeing 737 MAX planes for 2027-2028 delivery, providing a year-end boost to the U.S. plane maker’s orderbook.

- U.S. regulators released tougher emissions standards for heavy-duty trucks for the first time in 20 years this week.

- Tesla shares plummeted Tuesday on reports that the automaker will extend production cuts at its Shanghai plant through much of January.

- Average prices in the U.S. used-car market fell 4% between July and November, led by steep declines for luxury electric vehicles.

- Chinese electric-vehicle-maker Nio unveiled two new car models Tuesday as well as a new generation of battery swapping stations to allow hundreds of drivers to get fresh batteries every day.

Domestic Markets

- The U.S. reported 84,029 new COVID-19 infections and 343 virus fatalities Tuesday.

- Health experts warn the U.S. could see a sharp uptick in respiratory infections including COVID-19 in the weeks following holiday gatherings.

- Some schools in Boston are considering new mask mandates as COVID-19 hospitalizations rise sharply across the city.

- Learning loss could shave $70,000 off the lifetime earnings of children who were in school during the pandemic, according to new projections.

- New York City’s transit system surpassed 1 billion riders in 2022 for the first time since the start of the pandemic.

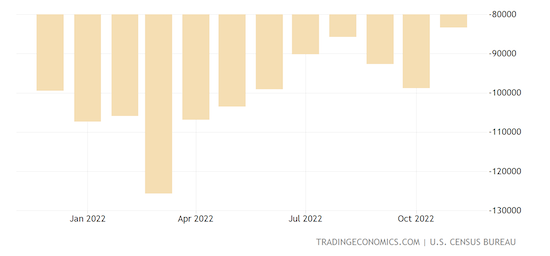

- The U.S. goods-trade deficit narrowed in November to a two-year low after a 13% plunge in imports.

- U.S. wholesale inventories rose 1% to a total of $933.6 billion in November, the 28th straight monthly rise, and were up 21% year over year:

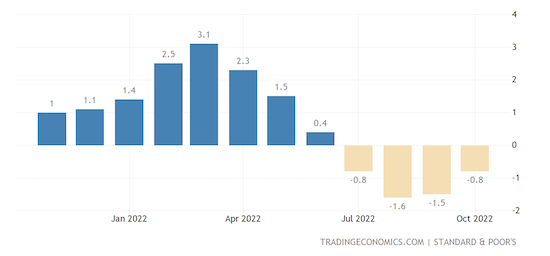

- Annual price growth in the U.S. housing market slid into single digits in October for the first time in about two years, according to two widely tracked surveys. The month-over-month reading for the Case-Shiller 20-city index fell 0.8%, its fourth month of declines

- Most laid off tech workers are finding jobs shortly after beginning their search, a new survey shows, as employers continue to scoop up workers in a tight labor market.

- Apparel-maker Patagonia is testing new windows at its California headquarters that double as solar power generators.

International Markets

- In the latest China news:

- Beijing will start distributing Pfizer’s COVID-19 antiviral pills to the city’s health centers this week as local infections surge.

- Local reports from doctors suggest China’s hospitals are quickly becoming overwhelmed with COVID-19 patients.

- Chinese authorities plan to start publishing COVID-19 data once per month after the virus’ severity was downgraded to a less dangerous respiratory infection last week.

- Surging COVID-19 cases will likely delay the revival of China’s multi-billion dollar travel industry even after rules are relaxed for inbound travelers in January. In contrast, signs point to a coming surge in outbound travel from China.

- The U.S. is weighing new precautionary measures for travelers entering the U.S. from China, while Japan will now require a negative COVID-19 test for all travelers from mainland China.

- Japan recorded 438 new COVID-19 fatalities Tuesday, the highest daily tally since the start of the pandmeic.

- Japanese factories slashed output for a third consecutive month in November, dragged down by weak global demand for machinery products.

- Japanese retail sales rose by 2.6% year over year in November, the ninth straight month of gains.

- Britain’s cost-of-living crisis will result in more retail failures next year as larger firms continue snapping up competitors, according to experts.

- German companies expect only a mild recession next year despite headwinds from the energy crisis, raw material shortages and a tepid global economy, according to a new survey.

- Spain unleashed its third support package of the year to help with surging consumer inflation, bringing its total spending to almost $50 billion.

- The volume of M&A deals in Latin America fell 35% this year to $86 billion, with bankers expecting a slow recovery next year, according to data firm Refinitiv.

- The Russian ruble is on track for a sharp monthly decline on forecasts for lower export revenue from sales of oil.

- Russia’s economy is expected to contract for a second year in 2023 as consumer demand continues to fall after the country’s invasion of Ukraine.

Some sources linked are subscription services.