MH Daily Bulletin: December 27

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

- M. Holland will be closed Monday, Jan. 2 for the New Year’s holiday.

Supply

- Oil prices rose 3% Friday, notching their second straight week of gains after Moscow warned it might cut crude output.

- Late Monday, WTI climbed above $80/bbl and Brent rose above $85/bbl after China announced it will ease quarantine restrictions for inbound travelers and a severe winter storm settled across much of the U.S. In mid-morning trading today, WTI futures were up 1.4% at $80.65/bbl, Brent was up 1.2% at $84.90/bbl, and U.S. natural gas was up 1.8% at $5.17/MMBtu.

- Winter Storm Elliott disrupted U.S. exports of LNG and shut down as much as 1.5 million bpd of Gulf Coast refining capacity late last week. Several other large refineries went offline due to the extreme cold, while utilities from Texas to New York City urged customers to conserve power to protect natural gas supplies.

- The active U.S. drilling rig count rose by three last week to a total of 779, about a third higher than the same time last year, according to Baker Hughes.

- TC Energy is close to restarting the ruptured segment of its Keystone oil pipeline in Kansas after receiving approval from U.S. regulators.

- Pemex further delayed plans to fire up its eighth and newest refinery from the end of this year to July 2023, with full production capacity expected by September, 2023.

- Saudi Arabia and Japan signed a preliminary agreement to cooperate in the emerging fields of carbon recycling, clean hydrogen and fuel ammonia.

- More oil news related to the war in Europe:

- Government and analyst projections show Russia’s crude and natural-gas output falling sharply in the months ahead due to tightened sanctions from the West. Insurance issues, meanwhile, will hamper seaborne exports.

- Three big Japanese insurers announced they would stop covering ships in all Russian waters, potentially affecting Japan’s LNG imports.

- Russia says it is willing to resume gas supplies to Europe through the Yamal-Europe pipeline for the first time since December 2021.

- The world is on track for record coal consumption in 2022, led by higher demand from energy-starved Europe, according to the International Energy Agency.

- Nearly 9 million people in Ukraine remain without electricity after weeks of Russian attacks on Ukraine’s power grid.

Supply Chain

- In the latest news from Winter Storm Elliott:

- “Life threatening” temperatures settled over a wide swath of the U.S. and Canada over the weekend, disrupting holiday travel and leaving millions without power or under threat of rolling blackouts. Dozens of deaths were recorded, including in hard-hit western New York, which saw over six feet of snow and 28 deaths in its fiercest winter storm in decades.

- Airlines have canceled or delayed thousands of flights since late last week, while road travel remains treacherous, delaying millions of last-minute holiday deliveries due to shutdowns at major shipping hubs.

- Airline woes hit Southwest the hardest, with about 80% of its flight schedule remaining canceled or delayed Monday, a situation that continued to worsen while other airlines fared better at the start of the week.

- PJM, a massive electric grid stretching from Illinois to New Jersey, declared a system-wide emergency and ordered some customers to curtail demand.

- North Carolina-based Duke Energy, one of the top power companies in the U.S., urged customers to avoid using large appliances and to turn down thermostats due to severe supply constraints.

- Four power substations in Washington State were attacked Dec. 25, disrupting service to thousands of residents.

- Thousands of staff at Britain’s airports and rail lines began striking over the weekend, widely disrupting holiday travel. Rail workers in France also walked off the job.

- A key road for mining transport in Peru has been cleared after days of political protests.

- Apple’s Australian workers launched a strike late last week that could dent the tech giant’s peak-season sales.

- Pandemic-related transportation snarls have largely been resolved, experts say.

- Retailers are moving away from using chartered ships to get around logistics disruptions as supply-chain pressures ease.

- Cardboard mills are slashing production worldwide, a sign of slowing global trade.

- Amazon is selling excess space on its cargo planes, the firm’s latest effort to adjust to slowing e-commerce growth.

- Amazon officially launched its drone delivery service known as Prime Air in Lockeford, California, and College Station, Texas, Friday, with a goal of delivering packages weighing under five pounds in 60 minutes or less.

- China’s imports of semiconductor-making equipment plunged 40% in November from a year earlier as tightened U.S. export controls took effect.

- Samsung intends to boost chip production capacity at its largest plant next year, a sharp contrast with rival chipmakers who are scaling back investment.

- In the latest news from the auto industry:

- Tesla suspended production at its Shanghai plant on Saturday and extended a planned eight-day stoppage as the automaker faces a wave of COVID-19 infections among its workers and suppliers.

- Tesla doubled discounts to a total of $7,500 for its two highest-volume models in the U.S., adding to indications that the automaker is struggling with demand.

- Toyota’s global car output rose 1.5% in November to a record 833,104 units, led by solid demand in North America. The automaker said its outlook remained uncertain, however, due to chip shortages and COVID-19 cases in China.

- Used-car retailer CarMax will pause hiring, halt share buybacks and cut expenses after reporting an 86% drop in third-quarter profit on sharply lower demand.

- Boeing says it slowed production of its 787 Dreamliner in South Carolina due to parts delays.

- Workers at Audi’s Mexico plant plan to strike on Jan. 1 if new contract talks fail.

- Stellantis is in talks to buy a large stake in the hydrogen joint venture between France’s Faurecia and Michelin.

- Rising availability of battery-swapping stations are quickly turning Kenya’s pollution-heavy motorbike segment electric.

Domestic Markets

- The daily average for new COVID-19 cases rose to 69,623 last week from 65,067 the week before, while average fatalities increased to 422 from 386. Daily average cases are up 24% in the past two weeks.

- Some U.S. schools are reinstating mask mandates or canceling classes as COVID-19 cases among students and staff spike around winter break.

- U.S. life expectancy fell to 76.4 years in 2021, a 26-year low largely due to COVID-19, the CDC said. Meanwhile, the nation’s population grew 0.4% this year, continuing a streak of historically slow growth suppressed by the pandemic.

- Congress gave final approval to a $1.66 trillion funding bill about an hour before deadline on Friday, avoiding a government shutdown.

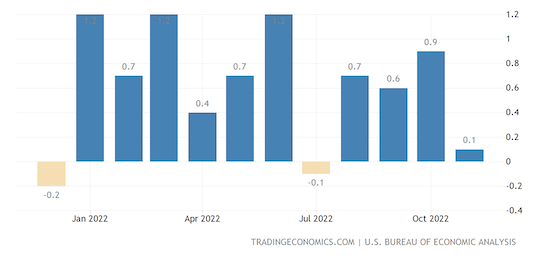

- U.S. consumer spending rose 0.1% in November, a pullback from the robust 0.9% increase in October:

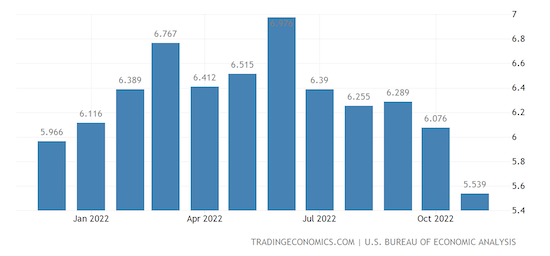

- The Federal Reserve’s preferred gauge of inflation rose 5.5% in November from a year earlier, the slowest pace in over a year:

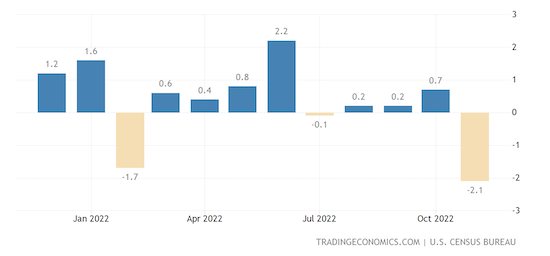

- Orders for U.S. manufactured goods sank 2.1% in November, one of the sharpest decreases since the beginning of the pandemic in another sign of slackening demand, new data shows:

- The one-year inflation outlook among consumers fell to 4.4% this month from 4.9% in November, the lowest in 18 months, according to the University of Michigan.

- U.S. retail sales rose 7.6% between Nov. 1 and Dec. 24 as steep holiday discounts lured deal-hungry customers, according to Mastercard.

- Over $760 million in retail purchases were returned in 2021, new data shows, up from $309 million in 2020.

- Midwest egg prices hit a record $5.36 a dozen this month, up 30% year-to-date, as an avian-flu outbreak shrinks flocks across the U.S.

- U.S. restaurant employment is only about 2.1% down from pre-pandemic levels, new data shows.

- Sales of new single-family homes rose for a second month in November as Americans took advantage of a retreat in mortgage rates, even as the overall housing market remained depressed. The number of U.S. homes for sale is down 29% nationwide in the five years that ended in October.

- AT&T and investment giant BlackRock are forming a joint venture to operate a U.S. fiber-optic platform, the companies announced.

- Congress passed new legislation to expedite the timeline for kicking Chinese companies off the New York Stock Exchange and Nasdaq if Washington regulators can’t fully review their audit work papers.

International Markets

- In the latest China news:

- China is likely seeing the world’s largest COVID-19 outbreak with up to 37 million people infected on a single day last week, according to records from the government’s top health authority. As much as 18% of the nation’s population likely caught the virus in the first three weeks of December, causing economic activity in major cities to plummet.

- Doctors say hospitals are overwhelmed with five- to six-times more patients than usual. The nation is probably seeing at least 5,000 COVID-19 fatalities a day, according to experts.

- China’s top health regulator announced Sunday it will stop publishing daily COVID-19 data, widely seen as unreliable by the international community. In recent days, local Chinese officials have been reporting hundreds of thousands of daily infections above the official national tally.

- A Shanghai hospital told its staff to prepare for half of the city’s 25 million people to suffer COVID-19 infections by the end of this week.

- China will lift COVID-19 quarantine requirements for inbound travelers on Jan. 8, marking one of the country’s biggest steps to ease restrictions since the pandemic began.

- China’s central bank made its biggest weekly liquidity injection into the banking system in nearly two months in a bid to counteract a year-end rush for cash.

- India will now require a negative COVID-19 test for travelers arriving from China, Japan, South Korea, Hong Kong and Thailand.

- Major central banks hiked interest rates at the fastest pace in two decades this year, delivering 2,700 basis points of tightening in 54 separate meetings.

- Japan’s core inflation rose rose 3.7% in November, the fastest pace in 41 years, the government said.

- Tens of thousands of British health workers announced a fresh round of strikes planned for January.

- More than 75% of small British firms say the country’s exit from the EU has made it difficult for them to boost sales or grow their business, new surveys show.

- The Canadian economy grew by grew by 0.1% in October and likely saw the same pace of growth in November, new data shows.

- Tens of billions of dollars are set to flow to Ukraine from the U.S. and other G7 nations this year.

- Sister firms Mitsubishi Electric and Mitsubishi Heavy Industries agreed on a joint venture to integrate their power generator businesses and seek global expansion.

Some sources linked are subscription services.