MH Daily Bulletin: December 21

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

- M. Holland will be closed Friday, Dec. 23 and Monday, Dec. 26, in observance of Christmas.

Supply

- Oil rose slightly Tuesday, buoyed by a softer dollar and the U.S.’s plan to start restocking petroleum reserves.

- In mid-morning trading today, WTI futures were up 2.1% at $77.80/bbl, Brent was up 2.0% at $81.61/bbl, and U.S. natural gas was up 4.4% at $5.56/MMBtu.

- U.S. crude stocks fell by 3.07 million barrels last week, according to the American Petroleum Institute. Government data is due today.

- TC Energy submitted its plan to restart the Keystone pipeline to U.S. regulators, nearly two weeks after the 622,000-bpd line ruptured in the U.S.’s worst oil spill in nine years.

- Updated forecasts show a smaller-than-expected shortage in French fuel supplies from January onward, helped by reduced demand from consumers.

- Norwegian crude and natural gas production was well below government forecasts in November, new data shows.

- More oil news related to the war in Europe:

- An explosion during repairs on a section of a Europe-bound natural gas pipeline in western Russia killed three people on Tuesday. Officials said the explosion did not affect export supplies.

- Russia’s seaborne crude shipments plummeted 54% the first week after Europe’s ban came into effect on Dec. 5.

- Exxon Mobil is asking shipowners to prove that the tankers they hire have not shipped oil cargoes linked with Russia in any way.

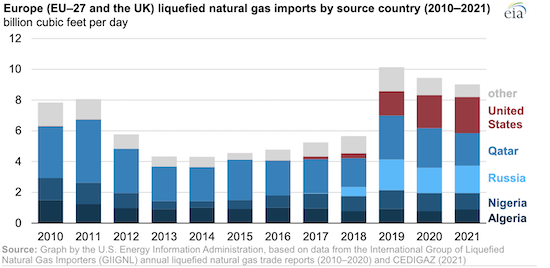

- The share of Russian gas in Germany’s gas mix has fallen from 55% to 20% the past year. Russia was among Europe’s main suppliers before it invaded Ukraine.

- Refining margins for independent Chinese refiners are surging as they negotiate steeper discounts for Russian crude grades following implementation of the G7’s new price cap.

- The EU’s executive arm approved a $36 billion state bailout for German gas giant Uniper SE, paving the way for imminent nationalization.

- Russia continued shelling oil and gas facilities in eastern Ukraine early this week.

- Finland is in talks to provide temporary grants to subsidize 60% of some households’ electricity bills from January to April.

- Solar power in Europe soared by almost 50% this year following a record 41.4 GW of installations.

- Tesla’s energy division has installed over 500,000 solar panel and solar roof installations, equal to about 4 GW of clean energy.

- German scientists say they achieved a new world record for solar cell efficiency, potentially marking a breakthrough for consumer solar use.

Supply Chain

- The Midwest and Great Lakes region could see a major blizzard starting Thursday, while cold air moving east could bring a rapid temperature drop across the country, according to the National Weather Service. Over 40 million Americans are under winter storm warnings.

- Canada’s second busiest airport in Vancouver halted all flights Tuesday morning amid heavy snowfall from a winter storm blanketing Pacific Canada.

- Tens of thousands of Californians are without power after a 6.4-magnitude earthquake struck the coast Tuesday morning, killing two.

- British train drivers announced another day of strikes in January as part of a long-running dispute over pay, adding to strikes planned by tens of thousands of logistics workers to start the new year.

- Many Chinese factories are coping with severe staffing shortages amid rising cases of COVID-19.

- Containers at the ports of Los Angeles and Long Beach waited an average of 2.8 days for handling in November, the shortest dwell time since July 2020.

- The Port of Houston, the U.S. Gulf Coast’s busiest port, reported an 11% jump in container volumes in November, bucking a trend of year-over-year declines at other major U.S. ports. Demand for steel imports slowed, while auto imports soared 141% year over year.

- U.S. trucking conditions hit an 18-month low in October, while a gauge of for-hire tonnage saw its largest monthly decrease of the pandemic in November, according to the American Trucking Association.

- An Australian government report says congestion and delays continue to disrupt operations at the country’s ports.

- CMA CGM’s air cargo unit is considering launching operations in Vietnam.

- FedEx said Tuesday it would cut $1 billion more in costs after weak demand ate into its quarterly profit by 24%. The shipper reported a fourth consecutive quarter of declining package volumes.

- Shippers using FedEx and UPS can expect 8%-10% rate increases in 2023.

- Truckload carrier Knight-Swift Transportation plans to test a rig outfitted with self-driving technology from U.S. firm Embark.

- Europe’s largest copper smelter Aurubis scrapped its dividend policy and announced $562.44 million of growth-oriented investments, including expansions to plants in the U.S. state of Georgia and in Hamburg, Germany.

- Houston-based Great Lakes Dredge & Dock, the largest provider of dredging services in the U.S., lowered quarterly earnings guidance due to supply-chain issues and weather.

- Major container lines including Hapag-Lloyd, ONE, Yang Ming and HMM are finalizing plans to replace smaller ships on Asia-North Europe trade lanes with newbuilds of 23,500-TEU megaships.

- In the latest news from the auto industry:

- Despite heavy investments in new semiconductor manufacturing capacity globally, computer chips are expected to be in short supply throughout 2023.

- The U.S. Postal Service announced a nearly $10 billion plan to electrify its truck fleet and start exclusively buying electric vehicles by 2026.

- Vietnam-based VinFast gained approval to sell its electric vehicles in the U.S. potentially as soon as this month.

Domestic Markets

- The U.S. reported 53,328 new COVID-19 infections and 564 virus fatalities Tuesday.

- Rising cases of respiratory illness among children have led CVS and Walgreens to limit purchases of children’s pain-relief medicine. Sales for these medicines are currently up 80% from the same time last year.

- The effectiveness of original COVID-19 vaccines among children dropped sharply with the arrival of the Omicron variant, new research shows.

- Minnesota launched a new telehealth program that will put people who test positive for COVID-19 in touch with a licensed clinician for evaluation, a first in the U.S.

- U.S. lawmakers are scrambling to approve a $1.6 trillion funding bill that will keep the federal government running beyond the end of the week.

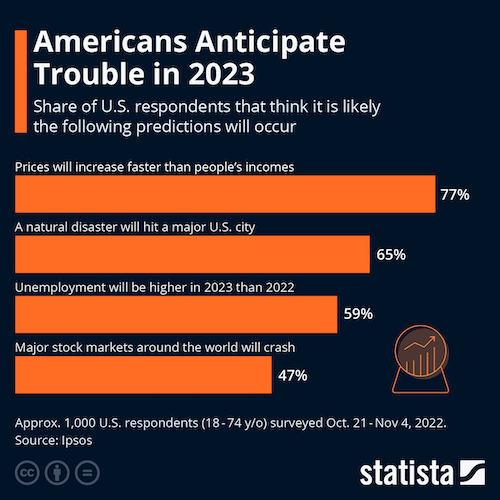

- Bloomberg economists say there is a 70% chance that the U.S. economy will sink into a recession next year, higher than the 65% odds forecast last month. The news coincides with flagging consumer sentiment:

- U.S. companies are forecast to register the slowest full-year profit growth since the start of the pandemic next year, according to economists.

- The savings rate of Americans fell to 2.3% in October, down from 7.3% a year ago and near the all-time low 2.1% set in 2005.

- U.S. companies borrowed 9% more in November to finance equipment investments compared with a year ago, according to the Equipment Leasing and Finance Association.

- Congress is set to pass a bill that raises the required age to start withdrawing retirement money from 72 to 75, among other provisions.

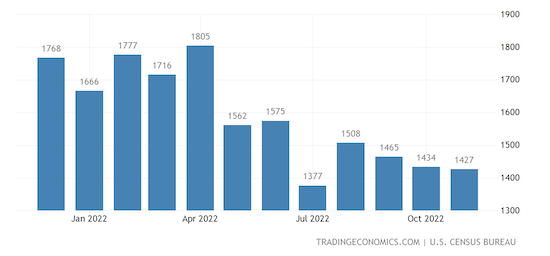

- A growing number of Americans are choosing to delay home purchases amid the highest interest rates in 15 years. Overall, housing starts fell 0.5% last month:

- Researchers at the Cleveland Federal Reserve released new data showing a rapid decline in the inflation rate of rentals across the U.S.

- Nike reported one of its best quarters of revenue growth in over a decade and beat profit expectations as North American shoppers rushed to stock up on its heavily discounted products before the holidays.

- General Mills said quarterly sales at its high-margin pet business took a hit due to key retailers cutting back on inventory, leaving sales flat at about $593 million.

- Minnesota-based 3M says it will stop making PFAS, so-called forever chemicals, and cease using them by the end of 2025 amid rising criticism and litigation over health and environmental impacts.

- Boeing won backing from Congress to lift a looming deadline on updating the cockpits of its best-selling 737 MAX aircraft, with the waiver attached to a bill to fund the U.S. government.

International Markets

- In the latest China news:

- Cities across the country have been racing to add hospital beds and build fever-screening clinics as international concern mounts over Beijing’s abrupt decision to end its COVID-zero policy.

- Authorities narrowed the definition of what constitutes a death from COVID-19, adding weight to skepticism about the nation’s reporting of virus data, as residents in Beijing face long waits to have relatives cremated.

- Roughly 60% of the nation’s population of over 1 billion could contract COVID-19 in the next three months, health experts say.

- Several local governments in China encouraged people with mild COVID-19 cases to continue going to work this week.

- Top U.S. officials are warning China’s COVID-19 outbreak is now of concern to the rest of the world given the size of its economy and the risk of further mutations.

- The World Health Organization said surging cases could delay the global end to the emergency phase of the COVID-19 pandemic.

- The World Bank slashed its China growth outlook for this year and next on expected fallout from rising COVID-19 cases.

- British health officials warn that strikes among tens of thousands of nurses and ambulance workers pose an increasing risk to patient safety.

- Corporate earnings growth in many countries is expected to slow in the year ahead as high inflation and rising interest rates collide in a global economic downturn. A decade of stellar growth in private debt markets could also reverse.

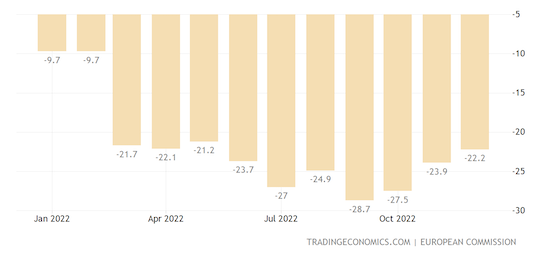

- The euro area’s index of consumer confidence rose slightly this month, continuing its recovery from an all-time low in September:

- Canadian retail sales rose by 1.4% from September to October, the biggest gain in five months, new data shows.

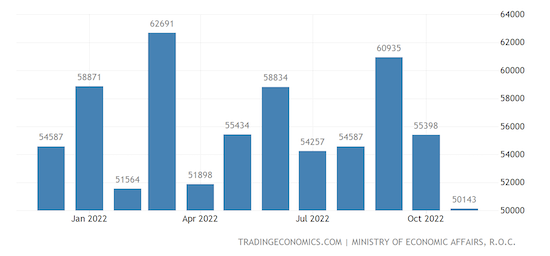

- Orders for Taiwanese exports, a bellwether of global tech demand, tumbled 23.4% in November from a year earlier, the largest annual decline since March 2009:

- The World Bank approved an additional financing package totaling $610 million to address relief and recovery in Ukraine. The U.S.’s latest spending bill would direct an additional $45 billion to the country.

- Amazon reached a settlement with the EU in three antitrust probes, saving it from a fine of up to 10% of its global turnover.

- Canadian software firm BlackBerry said the sales cycles for its key cybersecurity business has grown longer, leading to flat sales in the first half of 2023.

- The EU’s antitrust watchdog plans to open an investigation into chipmaker Broadcom’s planned $61 billion acquisition of American cloud computing company VMware.

- Ethiopian Airlines, Africa’s biggest carrier, expects passenger business to recover to pre-pandemic levels in its financial year ending in June.

- Ryanair reached a four-year pay deal with its Irish pilots’ union, including restoration of pay that was cut to help the airline through the pandemic.

Some sources linked are subscription services.