MH Daily Bulletin: December 20

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

- M. Holland will be closed Friday, Dec. 23 and Monday, Dec. 26, in observance of Christmas.

Supply

- Oil rose slightly Monday, buoyed by optimism over China relaxing its COVID-19 restrictions.

- In mid-morning trading today, WTI futures were up 0.7% at $75.69/bbl, Brent was up 0.6% at $80.27/bbl, and U.S. natural gas was down 8.0% at $5.38/MMBtu.

- The U.S. is poised to become a net exporter of crude for the first time since WWII next year, the latest figures show.

- French energy giant EDF delayed the restart of some of its nuclear reactors from early next year to at least June, extending the nation’s tight energy supply.

- Refiner Citgo Petroleum is on track for $2.5 billion in profit this year that it will use to repay debt and boost the reliability of its operations.

- More oil news related to the war in Europe:

- EU energy ministers agreed on Monday to a bloc-wide gas price cap of 180 euros per MWh that will start in mid-February. The cap would have been triggered on more than 40 days this year.

- Japan is considering a restart of Russian oil imports for the first time since June.

- Orders for new LNG carriers surged 95% across the globe this year on expectations of years of high demand.

- Europe faces a much tougher task to rebuild gas stocks next year with little to no deliveries expected from Russia. Governments may need to implement energy rationing that they have so far avoided, experts say.

- Germany’s raft of planned and newly installed floating storage units will allow the country to replace roughly half the volume of pipeline gas that flowed from Russia last year.

- Uniper SE shareholders approved a state bailout Monday that has so far cost the German government more than $53 billion.

- Azerbaijan plans to boost natural gas exports to Europe next year.

- EU countries voted Monday in favor of weakening the bloc’s planned law to cut methane emissions in the oil and gas sector, a reversal of priorities outlined at the recent COP27 climate conference.

- Norwegian aluminum-maker Norsk Hydro plans to build an onshore wind farm costing up to $405 million on Norway’s west coast to supply nearby industry.

- Danish renewables firm Orsted will spend more than $145 million developing a facility in Sweden to produce low-carbon shipping fuel.

- Rolls-Royce says its next-generation jet engine will deliver a 10% improvement in fuel efficiency compared to current engines.

- Investor groups managing a combined $1.3 trillion in global assets are urging major oil producers to tighten emissions reduction targets for 2030.

- BlackRock, the world’s biggest asset manager, announced that it will stick with its engagement efforts on environmental and social issues despite recent investor backlash.

- Exxon Mobil began production at its new, 80-million-pound-per-year advanced recycling plant in Baytown, Texas, among the largest chemical recycling projects in North America.

Supply Chain

- Forecasters expect a major snowstorm to travel through the central and eastern U.S. this weekend.

- Rising COVID-19 cases in China are threatening factory output and bringing widespread disruption to the movement of goods.

- Chinese e-commerce giant JD.com dispatched 1,000 workers to Beijing to clear a delivery backlog that built up during recent lockdowns.

- Britain’s striking rail workers are taking a toll on the nation’s pre-Christmas shopping numbers.

- Some Amazon workers in Germany and Britain are planning strikes in the weeks ahead.

- Container lines are readying to cancel about half of sailings out of Asia around the Lunar New Year holiday in late January.

- Spot freight rates on trans-Atlantic routes are headed for a collapse after capacity issues kept rates unusually high compared to other routes, analysts say.

- The ports of Los Angeles and Long Beach scrapped a program that threatened to fine ocean carriers for long-dwelling cargo, another sign of easing congestion on the West Coast.

- Union Pacific will pause its use of embargoes to alleviate congestion amid rising scrutiny from shippers, labor officials and federal regulators. The rail carrier has issued 886 embargoes through October of this year, up from 27 in all of 2017.

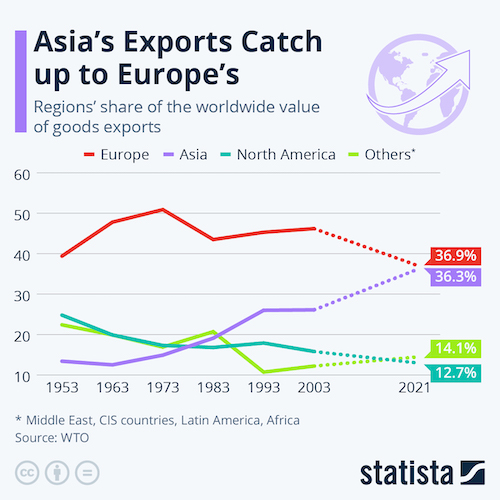

- Asia’s share in the global value of goods exports has almost caught up with Europe:

- South Korean conglomerate Hanwha will pay $1.52 billion to take over Daewoo Shipbuilding and Marine Engineering.

- Lockheed Martin is expanding its partnership with contract additive metal manufacturer Sintavia to explore using 3D printing as an alternative to traditional castings and forging.

- Walmart’s drone delivery service is now available in Arizona, Florida and Texas, part of a wider plan to offer the same-day delivery option in six states by year’s end.

- In the latest news from the auto industry:

- The U.S. Treasury will delay until March its guidance on sourcing requirements for electric-vehicle batteries, leaving automakers in limbo despite a revamped tax credit taking effect Jan. 1.

- LG Energy Solution plans to invest $3.1 billion over the next four years to build a new battery manufacturing site in South Korea.

- Stellantis plans to shrink its factory footprint in China amid increasingly stiff domestic competition and complications with a local partner that built and distributed Jeep SUVs.

- Hyundai, formerly one of Russia’s biggest automakers, began laying off workers at its St. Petersburg factory, which has stood idle since March.

- Chinese tech giant Baidu plans to significantly expand its self-driving taxi service next year.

- Oregon will prohibit the sale of internal combustion cars beginning in 2035, the fourth state to impose such a ban.

Domestic Markets

- The U.S. reported 57,973 new COVID-19 infections and 262 virus fatalities Monday.

- America’s “tripledemic” of influenza, RSV and COVID-19 appears to have peaked, with weekly flu and RSV figures dropping 30% week over week.

- Top health officials are urging Americans to get updated COVID-19 vaccines ahead of holiday gatherings.

- COVID-19 hospitalizations in Florida are up 33% from the same time last year.

- COVID-19 cases and fatalities have doubled in Los Angeles County in recent weeks.

- The U.S. government will stop footing the bill for Pfizer’s COVID-19 antiviral Paxlovid within months, potentially impacting availability for vulnerable populations.

- A U.S. appeals court struck down the White House’s requirement that federal contractors ensure their workers are vaccinated against COVID-19.

- November housing starts fell 0.5% from the prior month, the third consecutive monthly decline, while building permits slid a greater-than-expected 11.2%, suggesting further contraction in the housing market.

- U.S. homebuilder sentiment contracted for a 12th straight month in December, while some 35% of builders dropped prices:

- Higher interest rates and surging home values have pushed the monthly mortgage payment on a median-priced house to more than $2,000, up from about $1,100 before the pandemic.

- Sixty-three percent of Americans were living paycheck to paycheck in November, up from 60% in October and near the high of 64% set in March.

- Job cuts and remote work are colliding to reshape San Francisco, the center of the U.S. technology boom.

- New York City’s subway may trim some Monday and Friday services as remote work continues to depress ridership.

- Discount retailers are adding hundreds of new stores, while Barnes & Noble plans to add 30 stores next year, the latest signal that retailers are expanding again after years of shrinking their real-estate footprints.

- Seeds and pesticides company Corteva plans to cut U.S. jobs next year after its exit from Russia reduced demand for commercial sunflower seeds produced in California.

- Oreo-maker Mondelez International has agreed to the $1.35 billion sale of its North American and European chewing gum business, including brands such as Trident and Dentyne.

- Bankrupt cosmetics giant Revlon reached a restructuring agreement Monday that would turn over ownership of the company to its lenders and wipe out current shareholders.

- Congress is prepared to extend the key deadline for Boeing to update the cockpits of its best-selling 737 MAX aircraft.

- Investors this year pulled more money from funds marketed as “sustainable” than they added for the first time in more than a decade.

International Markets

- In the latest China news:

- New modeling suggests that China’s sudden pivot from its COVID-zero stance could result in 2.1 million fatalities.

- Police and security guards were stationed outside a Beijing crematorium reportedly designated to handle COVID-19 fatalities amid international skepticism over the nation’s reporting of COVID data.

- China is in the first of an expected three waves of COVID-19 cases this winter, according to the nation’s top health officials.

- Authorities are working to speed up procurement of COVID-related drugs in preparation for domestic shortages.

- The streets of major Chinese cities are falling silent as more people stay inside, either with COVID-19 or in fear of contracting it.

- The sprawling metropolis of Chongqing is allowing some employees who test positive for COVID-19 to go to work, a sharp turnaround from lockdowns imposed just weeks ago.

- China’s central bank left its key lending rates unchanged in December for the fourth straight month, as expected.

- COVID-19 cases in Japan rose nearly 20% last week.

- Hong Kong plans to further ease pandemic restrictions, including social distancing.

- COVID-19 remained the leading cause of death in Spain for a second year in a row despite overall cases declining by about a third.

- German business sentiment rose more than expected in December despite the nation’s energy crisis and high inflation, a survey showed Monday.

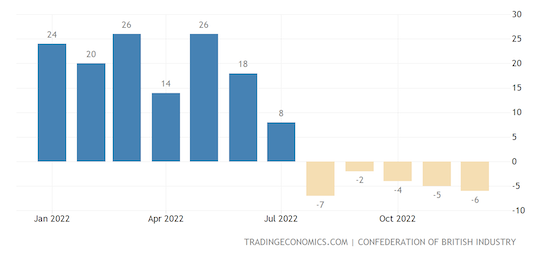

- Among big countries in Europe, the U.K. is projected to see the harshest economic effects of a looming global slowdown, experts say. New data shows the nation’s factory output slid for a fifth consecutive month to the lowest level in over two years.

- The Bank of Japan surprised financial markets today by expanding the trading range for long-term bond rates, sending the yen to a four-month high against the U.S. dollar.

- Asia-Pacific mergers and acquisitions were held at eight-year lows in 2022 by financing costs, weak equity markets and China’s pandemic controls.

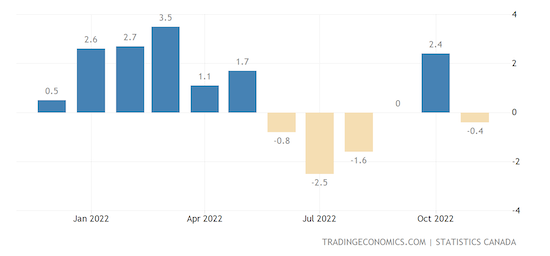

- Canadian producer prices fell by 0.4% from October to November, as expected, with the biggest downward pressure from declining prices for refined petroleum products:

- Ghana on Monday suspended payments on most of its external debt, effectively defaulting as the country struggles to contain a growing economic crisis.

- French airport operator Vinci will invest $820 million to renovate an airport in the Mexican business hub of Monterrey.

- Mexico is in talks with Boeing to rent aircraft for a carrier run by the military as soon as next year, officials said Monday.

- A United Nations summit approved a landmark global deal to protect nature and direct billions of dollars toward conservation efforts.

Some sources linked are subscription services.