MH Daily Bulletin: December 2

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose 3% Thursday after the EU floated a $60/bbl price cap on Russian crude, a move that could prompt Russia to cut production, tightening global supply.

- In mid-day trading today, crude futures were marginally lower, with WTI at $79.89/bbl and Brent at $85.29/bbl. U.S. natural gas was down 4.8% at $6.41/MMBtu.

- U.S. LNG exports were flat in November as the arrival of colder weather led utilities to build up inventories for domestic use.

- Chevron is unlikely to expand Venezuelan production in the near-term despite gaining a new operating license from the U.S. this week, its chief executive said. Competition is rising among U.S. refiners to secure Chevron’s first cargoes from the nation.

- On Thursday the EPA proposed an overhaul of decades-old rules that would force refiners to blend more biofuels into their products and, for the first time, incorporate electricity generated from biomass into blending calculations.

- More oil news related to the war in Europe:

- The EU executive body’s recommended $60/bbl price cap on Russian oil is well below international benchmarks and will need signoff from all 27 member states as well as G7 nations ahead of Monday’s deadline for implementation.

- High infrastructure and climate costs are inhibiting European industry efforts to substitute natural gas for diesel to produce power.

- Upstream oil and gas investment in Russia will plunge this year and continue slumping over the next few years due to Western sanctions, analysts say.

- Moscow is reportedly eyeing Turkey as a potential hub to work around sanctions on fuel shipments.

- Officials in Kyiv, Ukraine, told residents to stock up on essentials and move outside the city, if possible, as Russian air strikes heighten the risk of a total power blackout.

- The global energy crisis has accelerated conservation spending, with global investments in energy efficiency up 16% this year over 2021.

Supply Chain

- Drought-stricken California cities will only get about 5% of requested water supply from the state next year, officials say.

- Hurricane Ian and other natural disasters caused some $115 billion of insured losses so far this year, well above the 10-year average.

- Average U.S. diesel prices dropped to $5.14 per gallon last week, the lowest in two months.

- Congress on Thursday passed legislation to force a labor deal and avert a crippling U.S. rail strike, with the measure now sent to the president for approval ahead of next week’s strike deadline.

- FedEx will begin a voluntary furlough program Sunday, offering drivers a $300 weekly stipend and a guaranteed return to work in March.

- Shipments worth over $1.2 billion and counting have been lost due to South Korea’s ongoing trucker strike.

- The chief of the Port of Los Angeles expects a contract agreement with dockworkers to be reached by February.

- Developers are proposing an intermodal terminal with 850,000 square feet of warehouse space in Jacksonville, Florida, for an unnamed tenant.

- Japan’s Mitsui OSK Lines will invest almost $3 billion in its real-estate business as it seeks to shrink its exposure to volatile ocean shipping.

- Greek container-ship owner Costamare is starting a dry bulk operation by year’s end.

- Rising jury awards are sending insurance rates for trucking companies skyrocketing.

- Upbeat comments from big U.S. retailers suggest supply-chain constraints have eased, allowing companies to focus on getting rid of excess inventories.

- The U.S. administration is open to tweaking its latest incentive laws in a bid to give European firms more access to domestic semiconductor and renewables markets.

- U.S. investment firm Piper Sandler slashed its revenue and iPhone sales estimate for Apple’s December quarter, citing lockdown chaos in the company’s supplier hub of Zhengzhou.

- The U.S. baby formula market’s biggest brand says the country’s year-long product shortages will likely remain until spring.

- In the latest news from the automotive industry:

- Record-high lithium prices could fall in half by 2025 as global investment in production expands.

- Tesla made the first-ever deliveries of its long-delayed electric semitruck on Thursday but offered little updates on future output or pricing for the vehicles.

- GM’s Cruise driverless-car unit is seeking regulatory approval to test a shuttle that has no steering wheel or manual controls.

- Volkswagen and its battery subsidiary PowerCo SE are searching for locations in North America to build the automaker’s first battery cell factory.

- Ford will put an additional $180 million into boosting electric-vehicle output in northern England.

- The carbon footprint of copper-heavy electric-vehicles is spurring BMW to invest in companies with technology to source copper more sustainably.

- China Evergrande Group’s electric-vehicle unit is cutting a tenth of its workers as it confronts capital constraints.

Domestic Markets

- The U.S. reported 116,258 new COVID-19 infections and 611 virus fatalities Thursday.

- The U.S. added a greater-than-expected 263,000 jobs in November, leaving the unemployment rate at a low 3.7% and causing concern the Federal Reserve will extend its historic pace of interest rate increases.

- First-time jobless claims fell by 16,000 to a total of 225,000 last week, indicating continuing strength in labor markets. Recurring applications, meanwhile, hit their highest level since February, suggesting out-of-work Americans are having more trouble finding jobs.

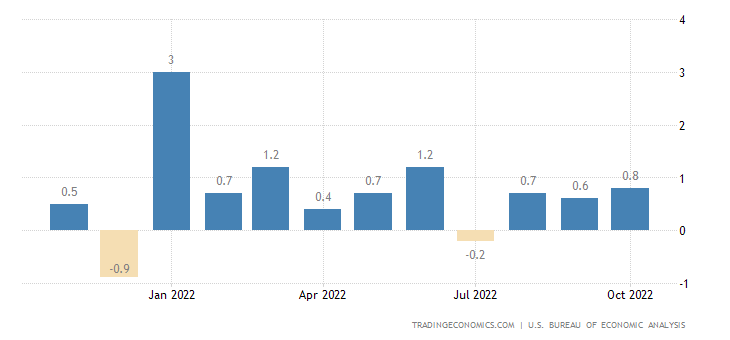

- U.S. consumer spending rose 0.8% in September, higher than initially thought on a surge of new-vehicle sales.

- Prices of U.S. services excluding housing and energy — a key indicator of future inflation — rose just 0.3% in October, the smallest increase in months.

- Traders see an 89% chance of the Federal Reserve raising its benchmark rate by just 50 basis points in December, down from the multiple 75-point hikes imposed this year.

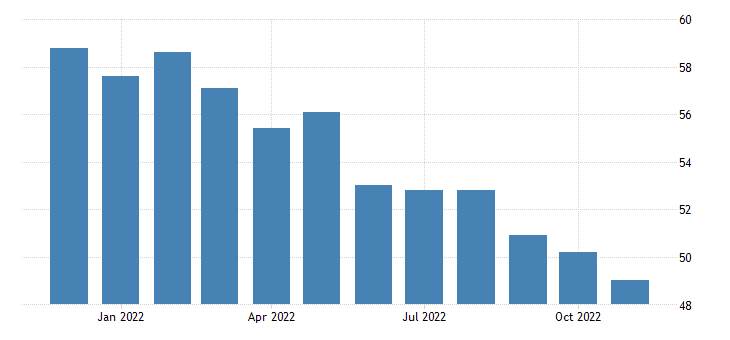

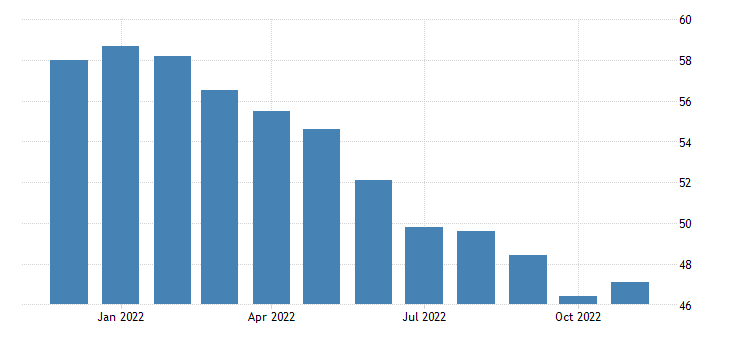

- The Institute of Supply Management’s manufacturing index fell below 50 in November, indicating manufacturing activity shrank for the first month in 2.5 years.

- At the same time, a measure of input prices paid by factories fell for a second month, supporting views that inflation is cooling.

- Americans are saving at the lowest rate since 2005, underscoring the impact of inflation on personal finances.

- U.S. banks saw third-quarter profit rise 3.2% to a total of $71.7 billion from a year earlier, according to the Federal Deposit Insurance Corporation.

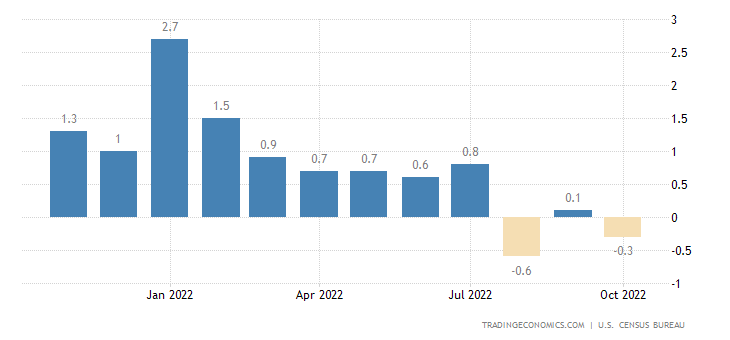

- U.S. construction spending fell in October, pulled down by weakness in single-family homebuilding, new data shows.

- Mortgage rates have fallen from over 7% in early November to 6.49% last week, the biggest three-week decline in over a decade.

- The Federal Reserve is considering raising bank capital requirements to help protect financial institutions from unexpected market shocks.

- JPMorgan cut its 2023 earnings forecast for S&P 500 companies by 9%, citing weaker demand and pricing power.

- Wells Fargo began cutting hundreds of jobs in its mortgage business across the U.S.

- Morgan Stanley is making job cuts across the globe as dealmaking slows down.

- Kroger raised its annual guidance for the third time this year following another quarter of solid sales growth.

- Supply-chain costs will eat further into Dollar General’s full-year profit, the company said.

- Costco shares dropped more than 7% Thursday after the membership-only retail chain reported slower sales growth in November.

- Food-delivery platform DoorDash will cut 6% of its corporate staff, or about 1,250 workers, after overexpanding during the pandemic.

- Soaring grain and livestock prices are expected to push U.S. farm incomes to a historic high this year.

International Markets

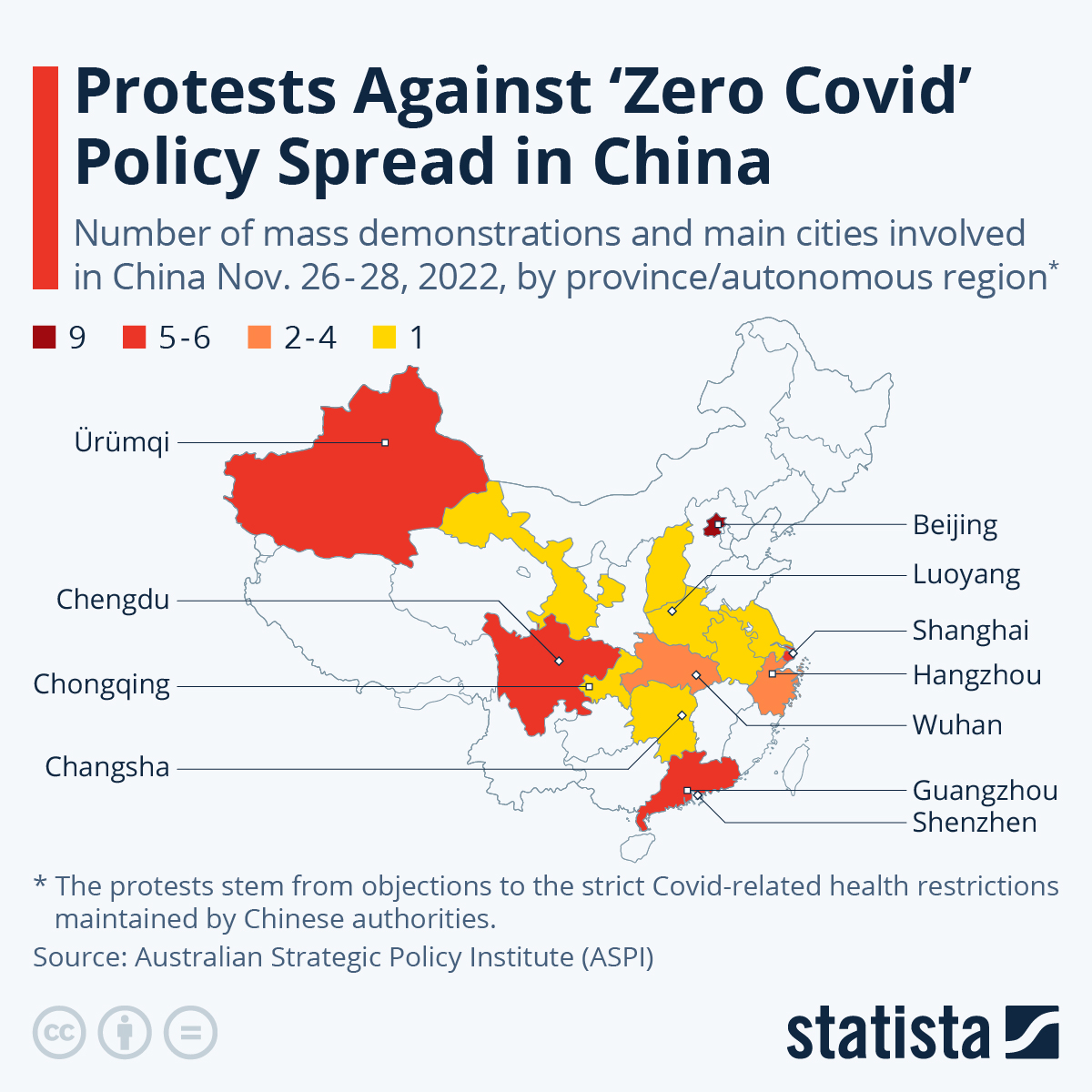

- China reported 34,980 new COVID-19 infections Thursday, the third straight day of declining cases. The government is preparing to ease some quarantine and mass-testing protocols at the same time authorities clamp down on internet and assembly privileges after widespread protests.

- Chinese cities are running out of funding to support mass testing and quarantine enforcement under the nation’s zero-Covid policy.

- New data suggests China’s COVID-19 vaccine drive stalled as officials directed more resources to mass testing and quarantine programs in a bid to keep cases at absolute zero.

- China’s manufacturing activity contracted at the steepest pace in seven months in November.

- New home prices in China fell for a fifth month in November amid growing financial troubles among the nation’s property developers.

- Global economic growth could fall below 2% next year due to continued impacts from the war in Ukraine, the IMF says.

- The collective debt service of the world’s low-income nations rose 35% the past year, increasing the risk of defaults, according to the World Bank.

- A five-month downturn in euro-zone manufacturing activity eased in November, with S&P Global’s purchasing managers’ index rising from 46.4 to 47.1. A reading below 50 indicates industry contraction.

- British manufacturing activity fell for a fourth month in November as businesses faced the weakest overseas demand in 2.5 years.

- British businesses said they raised prices by 7.2% on average in the 12 months to November, the smallest amount since April in a positive sign for inflation.

- South Korea’s consumer prices rose 5% in November from a year earlier, the slowest pace since April.

- India’s factory activity expanded at its fastest pace in three months in November as input-cost inflation fell to a two-year low.

- Canadian manufacturing activity kept shrinking in November despite picking up from the previous month’s level.

- Canada’s biggest banks are beginning to set aside more money to cover potential loan defaults by inflation-hit customers.

- Canada’s TD Bank posted a surge in fourth-quarter profit on higher revenue from its U.S. retail business. The bank widely outperformed its peers.

- Mexico will raise its minimum wage by 20% to $10.50 a day beginning in 2023, the fifth annual double-digit hike in as many years.

- Brazil’s economy rose by just 0.4% in the third quarter as higher interest rates impacted household spending. The nation’s trade with China is beginning to ramp up.

- Executives say European budget airlines are set for strong bookings this winter as travelers prepare to fly with zero COVID-19 restrictions for the first time in three years.

Some sources linked are subscription services.