MH Daily Bulletin: December 19

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

- M. Holland will be closed Friday, Dec. 23 and Monday, Dec. 26, in observance of Christmas.

Supply

- Oil slid 2.4% Friday, erasing gains from earlier in the week on fears of a looming global recession.

- In mid-morning trading today, WTI futures were up 0.5% at $74.69/bbl, Brent was up 0.4% at $79.36/bbl, and U.S. natural gas was down 9.4% at $5.98/MMBtu.

- Active U.S. drilling rigs fell for a second week, slipping by four to a total of 776, according to Baker Hughes.

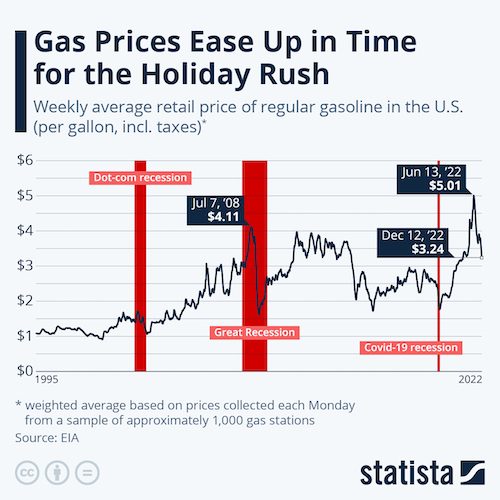

- The average U.S. gasoline price fell to $3.24 a gallon last week, the lowest level in more than a year:

- The U.S. government started buying back oil for strategic reserves Friday, marking the first purchases since this year’s record sale of 180 million barrels. The government will profit by some $4 billion from the sales.

- Several states are starting to block or delay power companies from investing in clean-energy grid upgrades to save consumers from rapidly rising energy bills.

- A 5.4 magnitude earthquake, the fourth strongest in Texas history, struck Friday afternoon in a western region of the state that’s home to oil and fracking activity. A similar earthquake struck a month ago, raising concerns about higher costs for producers as regulators look to crack down on fracking wastewater disposal practices tied to seismic activity.

- OPEC further trimmed its forecast for U.S. shale oil supply last week amid investor caution that is curbing expansion.

- Harbour Energy, Britain’s biggest North Sea producer, is backing out of an ongoing licensing round due to the nation’s windfall taxes on North Sea operators.

- Uzbekistan suspended exports of liquefied petroleum gas exports until the end of the year to meet rising domestic demand as the country faces serious energy shortages.

- More oil news related to the war in Europe:

- Russia’s currency hit a seven-month low against the U.S. dollar today in reaction to Western sanctions and falling oil and gas prices.

- Coal is taking a greater share of power generation in Germany this year as Europe’s largest economy turns to the dirty fuel to power it through an energy crisis.

- The EU’s executive arm approved the acquisition of Uniper SE by the German government, paving the way for a full nationalization of the gas trader after it nearly collapsed when Russia stopped supplying gas.

- Britain is encouraging consumers to cut energy use as part of a campaign aimed at scaling back demand for power and natural gas in the face of soaring energy bills.

- The latest Arctic blast in Ireland has created a rush to buy home heating oil, with some fuel distributors being forced to restrict supplies.

- India is importing an ever larger share of heavy sour crude from Russia and remains the world’s top buyer for the second month in a row.

- A barrage of Russian shelling knocked out power and water across Ukraine Friday. Power was only partially restored over the weekend.

- EU negotiators reached agreement Sunday on overhauling the bloc’s carbon trading market by raising its overall emissions-reduction target, among other measures.

- The Japanese government committed to bringing back nuclear power as the nation’s key energy source amid surging fossil fuel prices.

- Latin America is emerging as a hot spot for investment in carbon-friendly jet fuel.

- California regulators approved a plan to reduce the state’s CO2 emissions 85% by 2045 to reach carbon neutrality that includes cutting petroleum usage to one-tenth of the current level.

- LyondellBasell Industries boosted its target for reducing emissions from 30% to 42% by 2030.

- The 21-nation Asia-Pacific Economic Cooperation forum said the cleanup of plastic in oceans and waterways is being hindered by tariffs and trade and port restrictions.

Supply Chain

- A massive U.S. storm system knocked out power to hundreds of thousands of people across seven states Thursday. Dozens of tornadoes struck the South.

- A massive winter storm that spawned deadly tornadoes in the U.S. South and pummeled the Northern Plains with blizzard-like conditions earlier last week arrived in the Northeast over the weekend, bringing heavy snows and high winds.

- Global airfreight tonnage the first two weeks of December fell 17% compared to a year ago, including a 22% drop in Asia traffic.

- The U.S. will extend tariff exclusions on 352 Chinese import product categories that were set to expire at the end of 2022 for an additional nine months, including many industrial components.

- Intel will delay construction of its planned $18 billion German chip plant as it seeks more in government subsidies.

- China banned the export of certain types of chips deemed strategically important.

- Foxconn is selling its stake in China’s semiconductor giant Tsinghua Unigroup for $772 million, a mark of further global isolation for Beijing’s chip industry.

- In the latest news from the auto industry:

- Auto and battery firms are awaiting U.S. Treasury guidance expected within days that will help determine how broadly new tax credits on Jan. 1 can be used.

- Self-driving trucking company TuSimple plans to potentially cut half its workforce this week as it scales back efforts to build and test autonomous driving systems.

- Tesla is finalizing plans to build an electric-vehicle assembly plant in an industrial area of northeastern Mexico, with an announcement expected this week. The company is reportedly building 3,000 of its Model Y vehicles per week at its new plant in Texas, a milestone.

- PepsiCo plans to roll out 100 heavy-duty Tesla Semis in 2023 to make deliveries to major retail customers such as Walmart and Kroger.

- Volkswagen will soon decide on the location for a planned battery plant in Eastern Europe and begin searching for an additional location in Canada.

- Volkswagen is targeting margin parity between electric and combustion cars within three years.

- Shares of U.S. electric-vehicle company Faraday Future tumbled 21% Friday after the company said production plans for its much-delayed luxury car hinged on securing $170 million in additional financing.

- Werner Enterprises is equipping its trucks with more tracking and monitoring tools as part of an effort to double annual revenue to $5 billion through greater adoption of cloud computing and artificial intelligence.

- U.S. auto regulators launched an investigation into the self-driving system used by GM’s Cruise unit over reported issues with inappropriate braking and stalling.

- Car repossessions are back to near pre-pandemic levels as borrowers wrestle with high inflation.

- A massive copper mine in Panama is in limbo following a breakdown in tax talks between Vancouver-based operator First Quantum Minerals and the Panamanian government.

- China Mineral Resources Group, a new state-owned agency, is set to be the world’s biggest iron ore buyer as soon as next year when it will start procuring for about 20 of the largest Chinese steelmakers.

- Aluminum-makers are set to boost low-carbon metal output by 10% next year and even more in the years ahead, driving down costs for firms seeking climate-friendly supplies.

Domestic Markets

- The daily average for new COVID-19 cases fell to 65,067 last week from 65,569 the week before, while average fatalities decreased to 386 from 426. The U.S. has now logged over 100 million COVID-19 cases since the start of the pandemic, new data shows.

- Omicron-tailored booster shots cut the COVID-19 hospitalization risk by at least 50% in adults, according to new federal data. Protection rates were even higher for people over age 65.

- The CDC is recommending that residents across 10 New York counties begin wearing masks indoors and on public transportation amid a new uptick in COVID-19 cases.

- Philadelphia public schools will impose an indoor mask mandate for the first 10 school days in January to limit the spread of respiratory illnesses from exposures during the holiday season.

- Long-COVID results in an average of $9,500 in medical costs for workers and their employers in the first six months after diagnosis, according to a study.

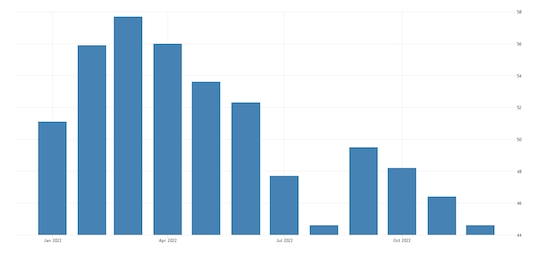

- U.S. business activity contracted in December for a sixth consecutive month, matching the lowest level since mid-2020, according to S&P Global’s composite purchasing managers’ index:

- Factory gauges in the New York and Philadelphia regions weakened this month.

- A majority of U.S. voters believe the economy will be in worse shape in 2023 than it is now, according to a Wall Street Journal poll.

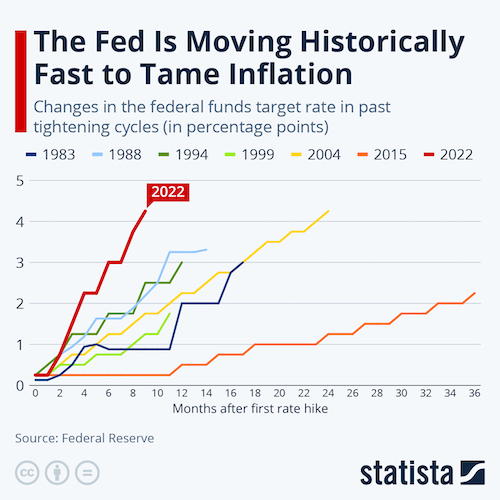

- Several Federal Reserve officials have suggested the central bank could lift borrowing costs above a peak 5.1% terminal rate and potentially keep them there into 2024:

- Fed officials now expect so-called core inflation — which excludes food and energy — to end this year around 4.8%, up from the 4.5% figure forecast in September.

- Goldman Sachs plans to lay off as many as 4,000 employees, or roughly 8% of its workforce, by early next year as it struggles to contain a slump in profit and revenue.

- Air India is closing in on a purchase of more than 200 Boeing jets as part of a massive fleet upgrade.

- Starbucks workers at 100 U.S. locations went on strike over the weekend as part of an effort to boost unionization at the coffee chain’s stores.

International Markets

- In the latest China news:

- Panic-buying of essential items continues in China, while Shanghai ordered schools to hold classes online.

- China’s abrupt lifting of COVID-19 restrictions could result in over 1 million virus fatalities through 2023, according to projections from U.S. researchers. The nation, so far, has reported only two virus deaths in the past month, far less than other more vaccinated nations, raising suspicion that the true tally of virus fatalities is being underreported.

- Mainland Chinese residents are increasingly traveling to Macau to get BioNTech-made vaccines, one of the only places they are allowed.

- Many economists expect China’s economy to grow around 3% in 2022, what would be its worst performance in nearly half a century.

- Business surveys and emerging data from governments suggest that a significant slowdown in the global economy is underway that may last for many months.

- Euro zone business activity shrank at the slowest pace in four months in December, suggesting a looming recession could be shallower than previously thought.

- More investment banks have raised forecasts for euro zone interest rates, now expecting them to peak at around 3.25%. Britain’s peak rate is expected to hit 4.25%.

- The downturn across most British businesses eased slightly in December but the economy is still likely to contract this quarter, according to S&P Global.

- The Italian economy is expected to grow by 0.4% next year, a sharp slowdown compared with 3.8% in 2022, the central bank said.

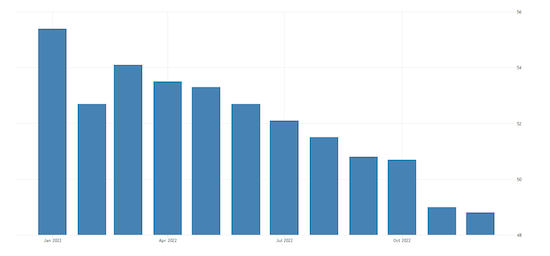

- Japanese manufacturing activity contracted in November at its steepest pace since October 2020:

- Germany’s Henkel completed the spinoff of its Russia business after the chemical and consumer goods company announced its exit from the country earlier this year.

- Global consulting giant Accenture warned that a pullback in client spending, especially in retail, will prompt a miss of quarterly sales targets.

- More airlines are limiting ticket sales for flights to London’s Heathrow Airport during planned strikes by workers over Christmas and New Year’s Eve.

- China plans to increase flights with a goal of restoring its daily passenger volumes to 70% of pre-pandemic levels by early January.

Some sources linked are subscription services.