MH Daily Bulletin: December 13

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- WTI rose 3% and Brent was up 2.5% Monday on the potential for a prolonged outage of TC Energy’s Canada-to-U.S. Keystone oil pipeline, which suffered a leak in Kansas last week.

- In mid-morning trading today, WTI futures were up 2.6% at $75.07/bbl and Brent was up 3.0% at $80.29/bbl. U.S. natural gas futures spiked 10% on forecasts of colder weather Monday and were 6.5% higher today at $7.01/MMBtu.

- U.S. oil and natural-gas output will hit new records in January even as the monthly pace of gains continues to slow, according to the Energy Information Administration (EIA).

- Bank of America predicts Brent crude could quickly return to $90/bbl if the Federal Reserve slows its pace of interest-rate hikes this week and China’s economic reopening is successful.

- Britain called up two coal-fired power plants to stand ready to send more electricity to the grid Monday due to a short-term energy crunch caused by freezing temperatures.

- Saudi Aramco is in talks with investors about a $110 billion gas development located in the eastern part of the kingdom, what would be one of the world’s largest unconventional gas fields.

- Libya lifted a force majeure on oil and gas exploration in a bid to win back foreign oil companies.

- Weather-related damage knocked out half of Ecuador’s most productive oil wells this week, biting into the nation’s crude output, which had reached 385,000 bpd.

- Argentina secured nearly $700 million in extra financing from Brazil to build the second stage of a crucial natural gas pipeline in the massive Vaca Muerta shale region.

- U.S. scientists working on nuclear fusion technology retrieved more energy from a reaction than they put in for the first time, a milestone that could one day push commercial development of the abundant, carbon-free electricity source.

- More oil news related to the war in Europe:

- The oil tanker backup in Turkey’s Bosphorus Strait continued to shrink Monday as insurance issues got resolved.

- Almost 90% of Russian crude exports have gone to Asia since Europe banned seaborne imports from Russia a week ago, new data shows.

- A top Russian insurer of oil tankers declined to fill the void left by the G7’s Dec. 5th sanctions against insuring Russian crude carriers, leaving questions of how tankers moving the nation’s oil will get proper coverage.

- Top European officials are holding several meetings this week to discuss measures aimed at bringing down energy prices in the coming years, including joint purchases of gas and a bloc-wide cap on gas prices. The International Energy Agency says Europe has enough gas for winter but could start facing shortages next year.

Supply Chain

- Over a dozen states faced blizzard or storm warnings Monday as a strong winter storm marched from the Pacific to the nation’s interior. Weather impacts will stretch as far east as New York City over the coming days.

- Heavy snowfall blanketed parts of Britain Monday, disrupting airports, train networks and roads.

- Britain’s largest container port of Felixstowe reached a labor deal with workers, who were among the first to launch a summer strike that has since extended to many other parts of the nation’s economy.

- Maersk ‘s CEO will step down next month and be replaced by a company veteran as the shipping giant works to develop its land-based logistics business amid a potentially sustained period of slowing container demand.

- At 1.95 million TEUs, total U.S. container imports in November dropped 12% from October and 19.4% from the same time a year ago.

- Container lines face sharply lower profits next year while the tanker and dry-bulk sectors look more stable, according to ratings agency Fitch.

- California will spend $175 million to improve truck access to the Port of Oakland.

- A truck driver shortage in Japan is spurring some logistics providers to launch new air cargo services.

- Costco Wholesale will take a $93 million charge as it drops its ship-chartering operation.

- The spread between spot freight rates in the U.S. and higher contract rates is at a high, prompting contract shippers to tap the spot market and putting pressure on contract prices.

- In the latest news from the auto industry:

- The U.S. and other Western countries announced an alliance to produce and buy key electric vehicle minerals from countries with strong environmental and labor standards, a move that could reduce business with market leader China.

- Toyota is preparing to overhaul its electric-vehicle strategy starting early next year, according to reports.

- The U.S. administration finalized a $2.5 billion loan to help GM and LG Energy build battery manufacturing facilities in Ohio, Tennessee and Michigan.

- Stellantis formed a partnership with Michigan’s largest renewables producer to power 70 of its in-state facilities with solar energy by 2026.

- Chaevi, a South Korean maker of supercharging stations, is considering building a U.S. manufacturing base as it works to build an ultra-fast network in the country.

- U.S. car rental companies will likely serve as the primary gateway to get consumers to test and switch to electric vehicles, an industry group says.

- The overall efficiency of the U.S.’s new-vehicle fleet was flat between 2020 and 2021, new data shows, as automakers sold more SUVs and pickups compared to cars.

- Workers at an Ultium Cells electric-vehicle battery plant in Ohio voted to unionize.

- Switzerland proposed curbing the use of electric vehicles in the event of a power crunch.

- Volvo is lobbying the Australian government to change laws that prevent use of heavy-duty electric trucks due to battery weight issues.

- Contract talks for thousands of Italian workers at Stellantis, Ferrari, CNH Industrial and Iveco are expected to extend into next year.

- Luxury car brand Lamborghini is rolling out its first electric model.

- Zeekr, one of Chinese automaker Geely’s upmarket electric brands, applied to go public in the U.S. in a bid to raise over $1 billion.

- Chinese electric-vehicle-maker Li Auto expects deliveries to surge in the current quarter.

- China launched a dispute at the World Trade Organization that takes aim at U.S. computer-chip export controls.

- Japan preliminarily agreed to raise controls on exports of chipmaking equipment to China, potentially aligning its trade rules with U.S. efforts to restrict Beijing’s access to advanced technology.

- Apple contract manufacturer Foxconn plans to invest $500 million to expand its supply chain in India.

- EU policymakers are considering putting carbon tariffs on imports of polluting goods such as steel and cement to prevent domestic firms from being undercut by cheaper goods made in countries with weak environmental rules.

- Industrial metals prices are rallying on signs that China will reopen its economy.

Domestic Markets

- The U.S. reported 56,694 new COVID-19 infections and 212 virus fatalities Monday.

- U.S. consumer prices in November rose a better-than-expected 0.1% over October and 7.1% from a year ago.

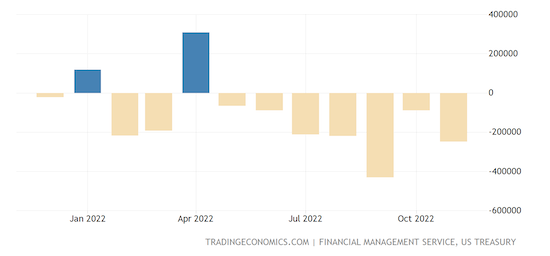

- The November U.S. budget deficit jumped by $57 billion, or 30%, from a year earlier to a total of $249 billion, a record for the month:

- Some 60% of Americans surveyed plan to buy fewer gifts for fewer people this holiday season amid decades-high inflation. A similar percentage are cutting back on holiday travel:

- Average U.S. rent prices jumped about 14% from 2021 to 2022, including gains of as much as 22% in high-demand areas.

- United Airlines placed a $30 billion order with Boeing for 100 787 Dreamliner jets with an option for 100 more, the largest order ever in the U.S. and a big win for Boeing over European rival Airbus.

- Lennar, one of the biggest U.S. homebuilders, has offered to sell thousands of homes to rental landlords as sales to everyday buyers plummet.

- Goldman Sachs plans to cut several hundred more jobs from its loss-making retail banking operations.

- Oracle saw quarterly revenue rise a better-than-expected 18.5% on strong demand for its cloud software.

- The U.S. will add $325 million in funding to help smaller-scale farmers cut their greenhouse gas emissions, pushing the total investment in climate-friendly farming to over $3 billion.

International Markets

- China’s sudden abandonment of its COVID-zero policy could create economic chaos and overwhelm the healthcare system, with potential fatalities topping 2 million people. As infections spread among healthcare workers, some hospitals are reporting staffing shortfalls of over 20% and urging those infected to continue working if their symptoms are mild.

- Long queues of people lined up outside clinics across China Monday, a sign of rapidly spreading COVID-19 in contrast to official reporting. Officials sought to downplay the health risks of Omicron to relieve pressure on hospitals.

- COVID-19 cases in Japan rose eightfold last week, with Tokyo seeing the biggest share.

- COVID-19 cases hit a three-month high in South Korea Monday, prompting officials to consider reimposing mask mandates.

- The northern Mexico state of Nuevo Leon reimposed a public mask mandate due to spiking COVID-19 cases.

- New bank lending in China rebounded less than expected in November due to fallout from COVID-19 flareups, data shows.

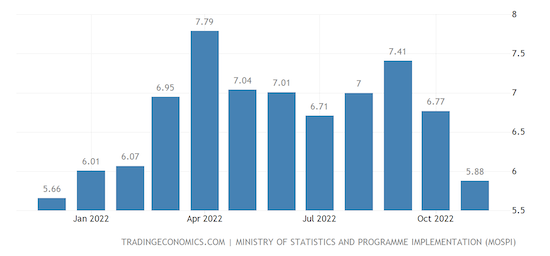

- India’s annual retail inflation eased from 6.77% in October to 5.88% in November, the slowest pace of growth in 11 months:

- The U.S., Japan and other nations kicked off negotiations aimed at setting economic rules and standards in the Indo-Pacific region.

- Global private and public debt remained well above pre-pandemic levels in 2021 despite dropping substantially from 2020, according to the International Monetary Fund.

- The U.S. plans to commit $55 billion to investment in Africa over the next three years.

- Nestle will invest $42.88 million to launch a new production facility in western Ukraine, one of very few international companies to announce new investments in Ukraine since Russia invaded the country.

- Spending by Americans in Europe rose more than 40% during Black Friday week compared to pre-pandemic levels as tourists took advantage of the strong U.S. dollar.

- Microsoft purchased a 4% stake in the London Stock Exchange’s parent company as part of a deal to provide cloud services for its financial data and trading platforms.

- Belgium will start taxing private jets and some short-haul flights to reduce noise and air pollution.

Some sources linked are subscription services.