MH Daily Bulletin: August 17

News relevant to the plastics industry:

At M. Holland

- The U.S. reinstated the Superfund Excise Tax on July 1, 2022. It applies to chemicals and substances commonly used in the plastics industry. How is it impacting producers, distributors, importers and processors? Click here to read more.

- M. Holland Company has appointed Ton Koenders as its inaugural director of sales for Europe to support international growth and address customer needs in Europe. Click here to read the press release.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell 3% Tuesday to their lowest level since before Russia’s invasion of Ukraine, with WTI settling below $87/bbl.

- In mid-day trading today, WTI futures were up 0.8% at $87.23/bbl, Brent was up 0.4% at $92.74/bbl, and U.S. natural gas was down 0.6% at $9.27/MMBtu. U.S. natural gas has risen 70% since the end of June.

- The American Petroleum Institute reported a larger-than-expected crude draw of 448,000 barrels this week after another release from U.S. strategic reserves. Government data is due today.

- Barclays cut its Brent price forecasts by $8/bbl for this year and next on forecasts for a large surplus of crude in the near-term due to resilient Russian supplies.

- Exports of crude oil and condensates from Latin America, excluding Venezuela, have dropped from July highs as more countries use crude in their domestic refineries.

- U.S. shale producers could lose over $10 billion from derivative hedging losses this year if oil prices remain around $100/bbl, according to Rystad.

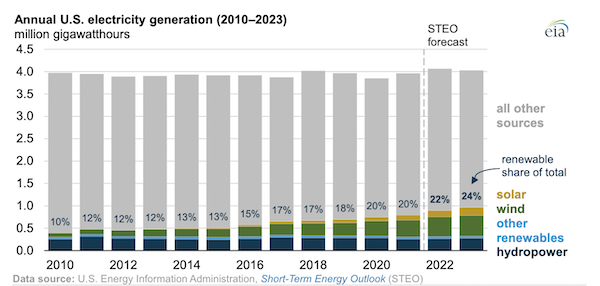

- Renewables accounted for 20% of U.S. electricity generation in both 2020 and 2021 but are expected to rise to a greater share of the overall energy mix this year and next:

- More oil news related to the war in Europe:

- European natural gas prices settled near all-time highs Tuesday as scorching heat triggered unusually high demand. Russia claims prices could surge an additional 60% by winter.

- German power prices are up 500% the past year, driven largely by Russia’s moves to slash gas supply.

- A second shipment of crude from a U.S. Gulf of Mexico offshore field has sailed for Germany, as European refiners test potential replacements for Russian oil. Similarly, the U.K. is about to receive LNG from Australia for the first time in at least six years.

- Germany will soon begin LNG imports at two new floating gas terminals as a short-term method of boosting supplies before winter.

- Gazprom says its natural gas exports slumped 36.2% year-to-date after deliveries to Europe plummeted.

- Germany plans to postpone closing its last three nuclear power plants as it braces for an energy shortage this winter. The shortage could force energy rationing even if gas stockpiles are built to planned targets by November, according to officials.

- Santos, one of Australia’s largest energy companies, plans to proceed with the $2.6 billion development of a large oil field in Alaska which could produce up to 80,000 bpd by 2026.

- Venezuela is starting to export larger volumes of petcoke as more countries scramble for inexpensive fuel to power industries.

- A South African coal producer plans to invest $730 million to build a 450 MW wind farm to kickstart its foray into renewable energy.

Supply Chain

- Extreme drought will force several states in the U.S. West to reduce water use from the Colorado River next year, according to federal officials, who yesterday lowered its condition to a Tier 2 water shortage.

- China’s Sichuan province ordered all factories to shut down for six days to ease a power shortage caused by a scorching heat wave. Authorities also began the rare move of limiting electricity supply to homes, offices and malls.

- U.S. southwestern cotton growers could abandon some 40% of drought-damaged acres planted this spring, prompting forecasts for the weakest U.S. harvest in more than a decade. Cotton futures are up more than 20% this month to the highest levels in a decade.

- The average U.S. diesel price dropped to $4.91 a gallon Monday, the lowest since March.

- The world’s biggest container lines are on course to post combined profits of around $256 billion this year, smashing last year’s profit record by 73%, according to Blue Alpha Capital.

- South Korean container line HMM warned of weakening demand after reporting a $4.6 billion net profit in the first half of the year.

- Georgia’s Port of Savannah posted an 18% gain in overall container volumes in July, including a 10.5% rise in loaded imports.

- Bookings are surging again on China-Europe freight rail services as shippers seek to get around port congestion.

- Third-quarter volumes at Union Pacific are up 2% from last year on improved staffing levels and easing congestion, the rail operator said Tuesday.

- Cargo volume at Germany’s Frankfurt airport tumbled 11% in the first six months of the year.

- Chinese shipyards are starting to cut prices for new vessels as steel and other material costs recede.

- Chipmakers’ revenue growth could slow by half this year from 2021 as major manufacturers warn of weaker export orders, according to research firm Gartner.

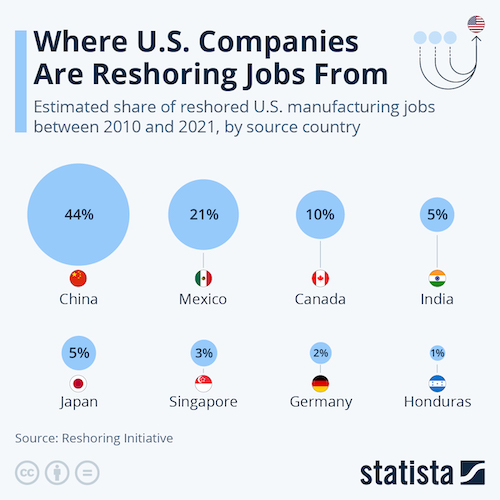

- Over 90% of C-suite executives surveyed say their company is considering moving production out of China, while around 80% say they are considering bringing some production back to the U.S.

- Dozens of Amazon employees at the company’s San Bernardino air hub walked off the job Tuesday in a protest over wages and heat safety.

- Amazon plans to charge an additional fee to certain sellers during the upcoming holiday season to offset rising costs of labor and logistics.

- Newell Brands, the company behind Yankee Candle, Sharpies and other consumer products, plans to spend some $100 million this year to consolidate its distribution centers around the U.S.

- Top U.S. retailers Walmart and Target say baby formula supplies are improving after months of acute shortages that caused a panic among parents.

- In the latest news from the transportation industry:

- Trailer orders declined 28% from June to July as most manufacturers limited bookings due to supply disruptions.

- Toyota was among the manufacturers forced to halt operations for six days in China’s Sichuan province due to low power supplies.

- Resale prices for some Toyota models have topped list prices for new cars due to an extreme shortage in inventory, with buyers willing to pay more to skip the waitlist.

- The U.S. government on Tuesday announced winners for over $1.6 billion in funding that will be used to build low-emission and zero-emission municipal bus fleets.

Domestic Markets

- The U.S. reported 98,229 new COVID-19 infections and 415 virus fatalities Tuesday.

- COVID-19 infections in New York state fell 18% last week, while virus hospitalizations remained flat.

- Florida reported just 54,353 new COVID-19 cases last week, its lowest in 2.5 months.

- Carnival Cruise says bookings doubled over pre-pandemic levels Monday after the company scrapped COVID-19 testing requirements for passengers.

- Simon Fraser University, Canada’s lone football team in the NCAA, will play four home games in Washington state due to Canada’s vaccination mandate for visitors.

- The U.S. president approved a $430 billion bill Tuesday that is seen as the biggest climate-change package in U.S. history, including substantial new investment in clean energy. More than $21 billion is allocated for rebates and federal tax deductions for household energy-saving upgrades over the next 10 years.

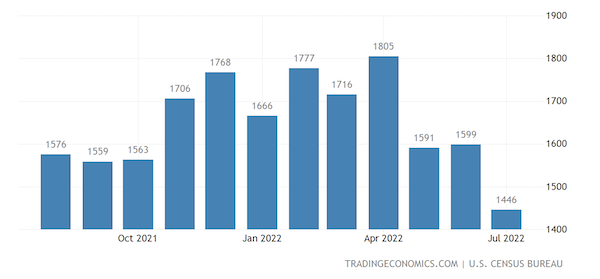

- U.S. homebuilding dropped 9.6% to the lowest level in nearly 1.5 years in July, weighed down by higher mortgage rates and prices for construction materials.

- Failed U.S. home purchase deals jumped to about 16% of total properties under contract in July, according to Redfin.

- The average U.S. asking rent is 23% higher than the same time in 2019, according to the Census Bureau.

- Market turmoil in the first half of 2022 erased some $3.4 trillion from 401(k) and IRA retirement accounts, threatening a decline in living standards for a large portion of Americans.

- Twenty states have either lowered or abandoned their sales tax for at least a few days this year as inflation remains near a four-decade high.

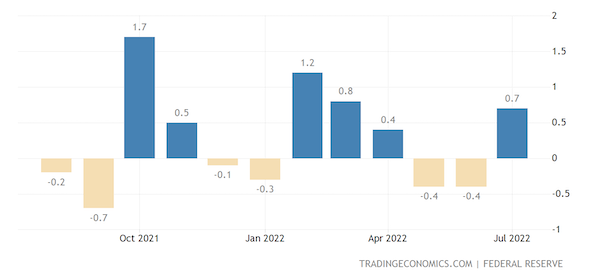

- U.S. manufacturing output rebounded 0.7% last month on a boost from auto plants, pointing to underlying manufacturing strength despite ebbing business confidence.

- More than 75% of U.S. businesses prefer to hire freelancers rather than full-time employees while economic conditions remain uncertain, according to market surveys.

- Walmart’s sales rose 8% in the fiscal second quarter, surpassing analyst expectations as consumers turned to the discounter for groceries and essentials. The firm also reported progress on reducing inventory bloat and supply-chain costs.

- Target’s revenues were in line with expectations but profits fell nearly 90%, badly missing analyst estimates, as the company shed inventory in the most recent quarter.

- Home Depot beat quarterly projections with 5.8% sales growth in the second quarter, as demand from builders and higher prices helped cushion the blow from a drop in store visits.

- Frontier Airlines plans to aggressively expand with up to 20% greater capacity by the end of the decade after the recent collapse of a deal to merge with rival Spirit Airlines.

- American Airlines is moving forward with pre-orders for dozens of supersonic jets still under development by Boom Supersonic, which may take until the end of the decade to start carrying passengers.

- Those hard of hearing will be able to buy hearing aids over-the-counter as soon as October after the recently signed Inflation Reduction Act eased prescription requirements.

International Markets

- COVID-19 cases in Japan are up sevenfold over the past month, while fatalities are back to February highs above 200 per day.

- Swedish furniture giant IKEA has decided to liquidate its Russian unit, further scaling back operations after more than a decade-long presence in the country.

- A U.S. aid agency announced plans to buy over $68 million worth of Ukrainian wheat in the largest such export deal since Russia’s invasion.

- The U.K.’s annual rate of inflation hit 10.1% in July from a year ago, up from 9.4% in June for the fastest pace in more than four decades.

- Canadian inflation cooled in July on sharply lower fuel prices but still rose 7.6%, likely pushing the Bank of Canada to continue delivering aggressive rate hikes.

- Japanese imports jumped 47.2% year over year to a new record in July, boosted by global fuel inflation and a weak yen.

- Confidence among Japanese manufacturers improved in August after last month’s stall, while the mood for service-sector firms rose for a second month to the highest level in nearly three years.

- Brazil’s trade surplus will likely fall short of forecasts this year as a spike in the costs of imported fuel and fertilizer offset strong exports of other raw materials.

- H&M, the world’s No. 2 fashion retailer, resumed sales on a popular e-commerce platform in China this week more than a year after the Swedish brand was virtually erased from the Chinese internet.

Some sources linked are subscription services.