MH Daily Bulletin: August 15

News relevant to the plastics industry:

At M. Holland

- M. Holland Company has appointed Ton Koenders as its inaugural director of sales for Europe to support international growth and address customer needs in Europe. Click here to read the press release.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell 2% Friday on expectations that supply disruptions in the U.S. Gulf of Mexico would be short-term. Prices rose about 3.5% for the week.

- Oil prices dropped by more than $4/bbl Monday as demand concerns in China weighed heavily on markets after new data showed the nation’s refinery output dropped to 12.53 million bpd in July, its lowest since March 2020.

- In mid-morning trading today, WTI futures were down 4.2% at $88.25/bbl, Brent was down 4.0% at $94.18/bbl, and U.S. natural gas was down 2.3% at $8.57/MMBtu.

- Active U.S. oil and gas rigs fell by one last week to a total of 763, the second week of declines.

- A damaged oil pipeline that disrupted 600,000 bpd of output from several offshore U.S. Gulf of Mexico platforms was repaired late Friday, according to Louisiana officials, allowing Shell, Chevron and Equinor to reactivate some of the halted production.

- California’s governor offered utility PG&E a $1.4 billion loan to extend the life of a nuclear plant by as much as a decade as the state seeks to bolster power reliability.

- Saudi Aramco nearly doubled quarterly profit to $48.4 billion, the most since its shares went public in 2019, on the back of high oil prices and strong refining profit.

- Mexico, which imports nearly all the natural gas it consumes, plans to use its proximity to U.S. shale gas to become a top LNG exporter, with several of eight planned export projects potentially coming online by 2023.

- Pemex asked the Mexican government for $6.5 billion in additional funding to help build its new “Dos Bocas” refinery, whose costs have spiraled to nearly $15 billion.

- More oil news related to the war in Europe:

- Europe’s supply of fuels, including coal and petroleum, face further disruptions this week as water levels on the Rhine River sink below navigable levels.

- Spot LNG prices in Asia climbed to near-record levels last week as buyers sought to secure supplies ahead of winter, narrowing the LNG price spread with Europe.

- Kazakhstan will shift some crude exports to a new pipeline through Azerbaijan after Russia threatened to shut its main route that travels through Black Sea ports.

- Europe’s newest natural gas pipeline could come online by the second half of next year to connect France and Spain, officials said.

- Germany’s gas-storage facilities reached a fill level of 75% two weeks ahead of schedule, as Europe’s biggest economy tries to shore up supplies cut by Russia.

- Germany set its new gas tax, intended to distribute the burden of higher energy costs due to the war in Ukraine, at between 2 and 3 euro cents per kWh, amounting to an additional 400-600 euros per year for an average family of four.

- Gazprom stepped up gas flows to Hungary for the rest of August following a request by the Hungarian government.

- China’s state-owned oil giants Sinopec and PetroChina announced plans to delist from the New York Stock Exchange amid a growing dispute with the U.S. over audit and disclosure rules.

- Brazilian power company Eletrobras, Latin America’s largest utility, said second-quarter net income fell by 45% on steep investment losses.

- Argentina announced a new package of tax and customs benefits for the oil and gas industry meant to attract dollars to the ailing South American economy.

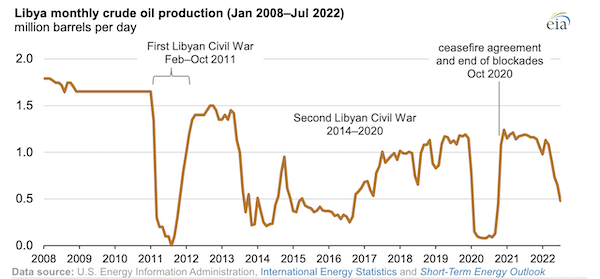

- Libyan crude production averaged nearly 1.2 million bpd in 2021 before a sharp drop-off amid civil unrest early this year:

Supply Chain

- Water levels in Germany’s Rhine River could fall to just 11.8 inches near Frankfurt this week, choking off transport of vital commodities to parts of inland Europe. Much of Europe has seen weeks of baking temperatures, with wildfires raging in France and parts of England facing severe drought amid successive heatwaves.

- China’s weather bureau warned that the country’s average ground temperatures have risen much faster than the global average over the past 70 years and will remain significantly higher as the challenges of climate change mount.

- A 22-year mega-drought hitting California and the rest of the U.S. West is believed to be the driest period in 1,200 years, with the potential of a 10% reduction in water supplies by 2040.

- The Baltic Exchange gauge for very large crude carrier pricing turned positive this month for the first time since January 2021.

- Global container shipping schedule reliability improved to 40% in June, the highest level in more than a year, according to data firm Sea-Intelligence.

- The average global price for jet fuel declined to $3.47 a gallon in July, down 16% from June but 84% above a year ago.

- Deutsche Post DHL’s second-quarter operating profit jumped 12.2% to about $2.3 billion, while group revenue surged 23.4% to over $24 billion.

- DSV plans to aggressively expand operations in the U.S. through acquisitions that could see it surpass Kuehne + Nagel and Deutsche Post DHL as the world’s largest freight forwarder.

- Europe’s robust warehouse market appears to be faltering under rising interest rates and cooling e-commerce demand.

- The U.S. on Friday adopted new export controls on technologies used to build advanced computer chips and gas turbine engines, citing national security.

- China’s Huawei Technologies saw revenue decline 5.9% in the first half of 2022 to $44.7 billion, as Western sanctions limited its access to computer chips needed for core products.

- Samsung Electronics plans to begin making semiconductor parts in Vietnam next year, the nation’s first substantial new project in the industry since 2006.

- U.S. tomato paste and ketchup prices are surging as drought shrinks California’s major crop.

- Wine makers in Europe are stressing as scorching weather threatens grape crops.

- In the latest news from the auto industry:

- Mercedes-Benz is the first automaker to enter a supply agreement for battery parts from the $7.56 billion factory that China’s CATL plans to build in Hungary.

- Mazda asked parts suppliers to increase stockpiles in Japan and produce components outside China after COVID-19 lockdowns in Shanghai severely destabilized supply.

- Canadian electric truck and bus maker Lion Electric swung to a $3.5 million second-quarter loss despite increasing deliveries.

Domestic Markets

- COVID-19 infections across the U.S. are continuing to fall, with cases down 20% in more than a dozen states as the nation reported 103,105 new COVID-19 infections and 413 virus fatalities Sunday.

- The newest BA.4.6 variant of COVID-19 is already dominant in four states and quickly becoming a larger percentage of new cases.

- New York City will close all its city-run COVID-19 vaccination sites for children under five years old due in part to low demand, officials said.

- Wall Street closed higher Friday on signs that inflation may have peaked in July, with the Nasdaq and S&P 500 notching a fourth week of gains, their longest win streak since November.

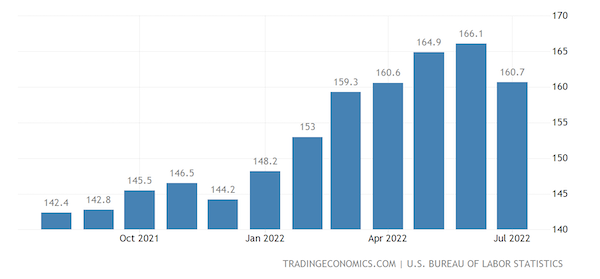

- U.S. import prices fell for the first time in seven months in July, helped by a strong dollar and lower fuel and non-fuel costs:

- Export prices also fell by 3.3% from a month earlier, the first drop in seven months:

- The University of Michigan’s gauge of U.S. consumer sentiment rose several points to 55.1 in August, the highest in three months. Meanwhile, a measure of consumers’ one-year inflation outlook fell in August, signaling price pressures may have peaked.

- The number of U.S. workers is down by 400,000 since March after approaching pre-pandemic levels earlier in the year, according to the Labor Department. Stalled improvement could increase the risk of recession within the next two years, economists say.

- The U.S. House of Representatives approved a $430 billion bill Friday that is seen as the biggest climate-change package in U.S. history, paving the way for final approval from the administration sometime this week.

- Nearly 15% of pending U.S. home sales were canceled in June, the highest rate of the pandemic, according to Redfin. Institutional landlords are also canceling contracts at a faster clip.

- U.S. housing affordability hit its lowest level since 1989 in June as record-high prices combined with rising mortgage rates to push more buyers out of the market.

- Peloton plans to cut over 800 jobs, raise prices for its workout machines and close most retail locations after suffering a punishing slowdown in the past year, including a 90% fall in its stock price.

- The U.S. summer box office sold about $3.03 billion worth of tickets through Aug. 7, more than double last year’s haul but still about $600 million behind pre-pandemic levels.

- The U.S. administration will soon put over $3 billion into two programs to help communities with floods, wildfires, extreme heat and other problems related to climate change, officials said.

International Markets

- Global COVID-19 fatalities fell 9% last week while new cases remained relatively flat, according to the World Health Organization.

- COVID-19 cases in Japan rose 9% last week to nearly 1.5 million, the most in the world for the third straight week.

- Shanghai extended its weekly COVID-19 test requirement until the end of September in a bid to keep cases at zero. The city will reopen all schools Sept. 1 after months of pandemic closures.

- China’s locked-down resort island of Hainan reported over 1,000 new COVID-19 cases Sunday as protests erupted among hundreds of stranded tourists. Authorities indicated tourists may soon be able to return home with an exception to travel requirements.

- New Zealand reported 2,618 new COVID-19 cases Sunday, its lowest daily total since the Omicron wave began in February.

- The U.K. became the first country to approve Moderna’s updated COVID-19 vaccine targeting both the Delta and Omicron strains of the virus.

- Japan’s economy grew 2.2% in the latest quarter on a revival in consumer spending after an easing of COVID-19 restrictions.

- Thailand’s economy grew 2.5% in the latest quarter, the fastest pace in a year, on a rebound in economic activity and tourism.

- Ukraine entered default, according to global ratings agencies S&P and Fitch.

- British paper and packaging firm Mondi will sell its largest plant in Russia for $1.6 billion.

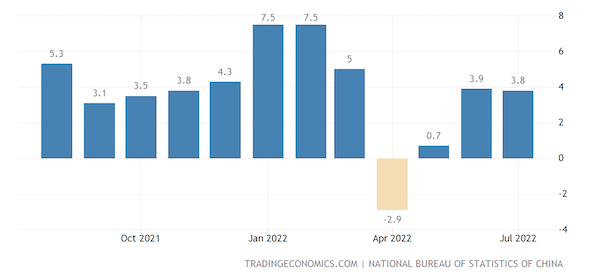

- China’s central bank cut interest rates today as the nation’s economic recovery unexpectedly weakened in July as fresh COVID-19 outbreaks weighed on consumer and business spending. The nation’s retail sales grew at a slower-than-expected pace of 2.7%, while industrial production missed forecasts with a 3.8% growth rate.

- China’s home prices fell for an 11th month in July amid the nation’s spiraling real estate crisis.

- Scandinavian airline SAS reached a $700 million financing deal to continue operating through bankruptcy, less than a month after wage talks between the airline and its pilots collapsed.

- The U.S. government issued a shelter-in-place warning for its employees in Tijuana and the state of Baja California in Mexico after a spate of cartel-related violence broke out Friday.

Some sources linked are subscription services.