MH Daily Bulletin: April 4

News relevant to the plastics industry:

At M. Holland

- Todd Waddle, Director of M. Holland’s Wire & Cable and Sustainability groups, joined a recent Art of the Possible podcast episode hosted by IPC. Click here to access the episode, which focuses on the growth in electrification, sustainability efforts across the manufacturing industry and the Electrical Wire Processing Technology Expo (EWPTE) 2023.

- M. Holland will be closed Friday, April 7, in observance of the Easter holiday.

Supply

- Oil jumped 5% Monday after OPEC+ announced new production cuts, sending shockwaves through global markets. Goldman Sachs lifted its forecast for Brent to $95/bbl by the end of the year and to $100/bbl for 2024 following the move.

- In mid-morning trading today, WTI futures were down 0.4% at $80.13/bbl, Brent was down 0.6% at $84.46/bbl, and U.S. natural gas was down 0.5% at $2.09/MMBtu.

- OPEC’s surprise decision to cut oil production could lead to higher U.S. export demand from Europe and Asia, encouraging some producers to boost output.

- Morgan Stanley interpreted OPEC+’s announced production cut as an admission of waning crude demand and cut its price forecast for this year and next.

- U.S. natural gas prices dipped below $2/MMBtu last week, hitting a 30-month low on rising output and a mostly mild winter. Meanwhile the operational return of Freeport LNG’s massive export terminal in Texas sent the nation’s shipments to an all-time high.

- Russia’s flagship Urals crude averaged $47.85/bbl in March, about half that of the same time a year ago even as the nation’s seaborne crude flows reach record levels.

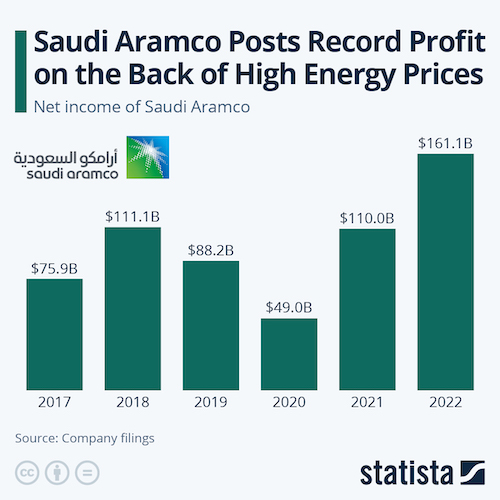

- Saudi Aramco posted record profit of $161 billion last year, up 47% from 2021 as oil and gas prices surged in the wake of Russia’s invasion of Ukraine:

- Coal prices in the U.S. have plummeted this year as utilities continue turning to natural gas.

- Renewable energy production is set to overtake coal for the first time globally in 2027, experts say.

- French lawmakers are in talks on a major new plan to offer tax breaks and subsidies for green energy projects in the country, a response to the U.S. Inflation Reduction Act.

Supply Chain

- The Port of New York and New Jersey saw 288,314 TEUs of loaded container imports in February, down 25.2% from a year earlier.

- Maersk-owned APM Terminals will double handling capacity at a Port of Rotterdam container terminal in a $1.1 billion project.

- Croatia awarded a $3 billion, 50-year concession for Maersk’s APM Terminals to build and operate a container terminal at the Port of Rijeka, canceling a previous tender given to three China-owned companies.

- Annual profit at Chinese container carrier Cosco Shipping Lines jumped 26% last year to $19.2 billion.

- Freight forwarder DB Schenker’s annual operating profit rose 49% last year to about $2 billion.

- Glencore’s unsolicited $22.5 billion offer for copper and zinc miner Teck Resources was rejected Monday.

- In the latest news from the auto industry:

- Many car companies reported higher first-quarter sales in the U.S., with some manufacturers, such as GM and Hyundai, posting double-digit gains thanks to having more cars on dealership lots. Toyota, an outlier, saw U.S. sales fall 8.8% for the period.

- Tesla beat estimates with a record 422,875 deliveries in the first quarter, 36% higher than a year earlier.

- Electric-vehicle startup Rivian maintained its annual production forecast of 50,000 vehicles despite suffering a drop in production in the first quarter due to recent supply-chain issues.

- Amazon’s in-house logistics arm has delivered more than 75 million packages to U.S. customers with Rivian electric vans since the fleet’s rollout last summer, the company said.

- Logistics company Ryder plans to add 4,000 GM electric vans to its lease and rental fleet through 2025.

- Diesel-engine maker Cummins will invest more than $1 billion across its U.S. manufacturing network to support new clean energy technologies.

Domestic Markets

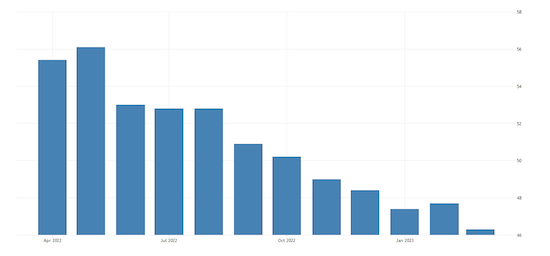

- U.S. manufacturing activity slumped in March to the lowest level in nearly three years as new orders continued to contract, according to the latest figures.

- U.S. construction spending fell by 0.1% in February as investment in single-family homebuilding continued to fall.

- Home prices across the U.S. rose 0.16% in February, the strongest one-month gain in almost a year.

- Sales of apartment buildings plummeted 74% in the first quarter compared with a year ago, the biggest decline since the Great Recession in 2009.

- U.S. cities are shrinking their number of parking spaces and freeing up the land for other uses as remote work becomes a fixture of the economy.

- Apple and McDonald’s announced new job cuts on Monday.

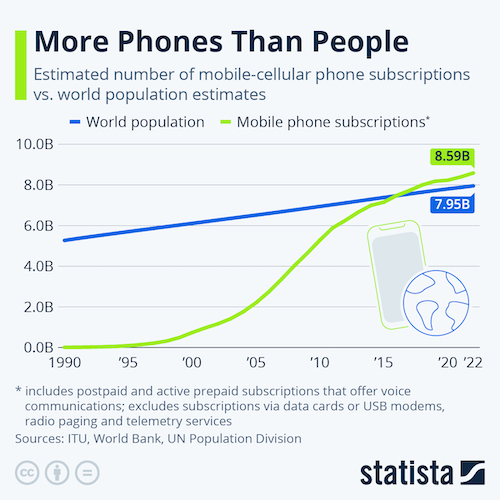

- Yesterday marked the 50th anniversary of the first mobile phone call as the number of mobile phones globally now tops the world’s population:

- American Airlines will join other carriers in cutting some flights this summer after the FAA relaxed minimum flight requirements.

- Insurers could take a profit hit this year as rising interest rates eat into reserves they are required to hold to deal with rate fluctuations.

- Cosmetics giant Revlon will cut $2.7 billion from its debt and exit bankruptcy later this month following court approval of the plan Monday.

International Markets

- March saw six interest-rate hikes by major central banks, even as the scale of increases tapered off amid turmoil in the banking sector.

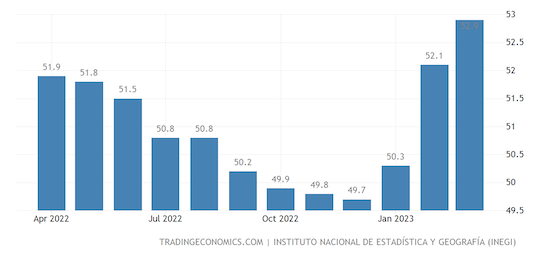

- Mexico saw manufacturing activity rise in March along with business sentiment, with a gauge of business confidence jumping to 52.9, the highest in over a year:

- The Bank of Israel raised its benchmark interest rate by 25 basis points Monday, the ninth straight increase.

- The U.K. announced plans to join the multi-nation Trans-Pacific Partnership trade alliance that the U.S. exited in 2017.

- India’s surging services exports could shield its economy from external risks happening across the globe, experts say.

- China’s yuan surpassed the U.S. dollar as the most traded currency in Russia, while China and Brazil reached agreement to accept trade settlements in their respective currencies in a challenge to U.S. currency dominance.

- China is in talks on a new round of plane orders from Airbus, potentially for dozens of jets.

Some sources linked are subscription services.