MH Daily Bulletin: April 3

News relevant to the plastics industry:

At M. Holland

- Todd Waddle, Director of M. Holland’s Wire & Cable and Sustainability groups, joined a recent Art of the Possible podcast episode hosted by IPC. Click here to access the episode, which focuses on the growth in electrification, sustainability efforts across the manufacturing industry and the Electrical Wire Processing Technology Expo (EWPTE) 2023.

- M. Holland will be closed Friday, April 7, in observance of the Easter holiday.

Supply

- Oil rose by $1/bbl Friday, capping a second week of gains as supplies tightened in some parts of the world.

- Oil prices surged today after OPEC+ made a surprise announcement that it will cut production by more than 1 million bpd. In mid-morning trading today, WTI futures were up 6.4% at $80.50/bbl, Brent was up 6.2% at $86.20/bbl, and U.S. natural gas was down 5.0% at $2.11/MMBtu.

- Active U.S. drilling rigs fell by three last week, according to Baker Hughes.

- U.S. crude production rebounded in January to 12.46 million bpd, the highest in three years.

- U.S. demand for diesel fuel is falling as manufacturing activity continues to sputter on fears of a recession.

- U.S. south-central natural gas storage saw record-low withdrawals this winter amid unusually warm weather, according to the administration.

- The U.S. agreed to allow Japan to buy Russian crude above the G7’s $60/bbl price cap, highlighting Japan’s reliance on Russia for fossil fuels.

- OPEC crude production fell by 70,000 bpd in March, largely due to operational issues stemming from a broken pipeline in Kurdistan.

- Brazilian oil exports jumped 75.4% to a record-high in March, despite the government’s new export tax.

- U.S. officials are describing Puerto Rico’s shift to renewable forms of energy as a life-or-death priority amid years of failures in the territory’s power grid.

- Funded by the Inflation Reduction Act, the White House is making available $1 billion for rural small businesses and farmers to invest in clean energy projects.

- Nuclear technology company Last Energy signed deals in the U.K. and Poland to supply 34 small nuclear reactors (SMRs), each capable of providing 20 MW of electricity.

Supply Chain

- A powerful storm system hit the central U.S. Friday, killing at least 32 people across eight states and outing power for hundreds of thousands.

- The global market for third-party logistics services grew 14.5% last year to a total of $1.47 trillion.

- Amazon workers in the U.K. plan to strike for six days this month in a pay dispute.

- Lone Star Express is expanding its regional parcel capacity amid concerns over potential labor disruption at UPS.

- Nestle says inflation pressures are easing as costs decline for raw materials, transport and packaging.

- Twenty-five railcars derailed in Montana yesterday on a train operated by Montana Rail Link.

- Settling further in line with the U.S., Japan will restrict exports of 23 types of semiconductor manufacturing equipment, part of a bid to curb China’s ability to make advanced chips.

- South Korea’s computer chip exports were down 41.8% year over year in February, the biggest drop since the 2008 financial crisis.

- In the latest news from the auto industry:

- The U.S. unveiled tighter rules for electric-vehicle tax credits, cutting incentives on some models in order to reduce reliance on China’s electric-vehicle battery supply chains.

- The U.S. EPA approved California’s plan to require half of all new heavy-duty trucks to be fully electric by 2035.

- Toyota’s global car sales reached a record high in February as part shortages eased.

- Ford raised prices on some models of its popular F-150 Lightning electric trucks last week, the latest in a series of price hikes.

- Shares of electric-truck startup Nikola plunged almost 18% Friday after the firm said it plans to sell shares and raise $100 million to deal with high production costs.

- BMW says it is not looking to invest in mines, a bet that efficient design and recycling will do more to bring down its battery costs, executives said.

- Honda is shutting down some production in Pakistan amid the country’s deepening financial crisis.

- Top lithium producers in China agreed last week to set a floor price of $36,380 per tonne for lithium carbonate, a bid to slow steep declines in the price of the battery material.

- Volkswagen will not produce another combustion-engine model of its popular Golf hatchback, marking the end of the half-century-old car.

- Toyota’s factory in St. Petersburg, Russia, has been handed over to a state entity, according to officials.

- The official reboot of the alliance between Renault and Nissan may be delayed over disagreements about electric vehicles and intellectual property, according to reports.

- BP plans to give Uber drivers incentives to charge their electric vehicles on its network of chargers in several markets across the globe.

- Volkswagen doubled down on plans to expand its electric-vehicle rollout in China despite issues such as intensified competition and weak demand.

- Stellantis announced plans to invest heavily in South America starting in 2025.

Domestic Markets

- A widely tracked gauge of U.S. consumer sentiment fell for the first time in four months, according to the University of Michigan.

- Analysts expect the Federal Reserve to impose at least one more interest-rate hike, even as new data shows inflation cooling.

- Investors have moved $508 billion into cash year-to-date, the largest quarterly inflow since the beginning of the pandemic, Bank of America says.

- Main trust funds in the U.S. Social Security system will likely be depleted in 2033, one year earlier than estimated, officials say.

- A hiring boom at restaurants, hotels and music venues is making U.S. tourist destinations some of the best job markets in the country, new figures show.

- Investment banks will continue to see lower fee income as U.S. financial turmoil dampens the outlook for initial public offerings.

- California joined three other states and the U.S. Justice Department in opposing the $3.8 billion takeover of Spirit Airlines by JetBlue Airways, citing antitrust concerns.

International Markets

- The World Bank expects growth in the 23-nation East Asia and Pacific region to rise to 5.1% this year, up from 3.5% in 2022.

- A gauge of Chinese manufacturing activity dropped from 52.6 in February to 51.9 in March, raising doubts about its post-COVID recovery.

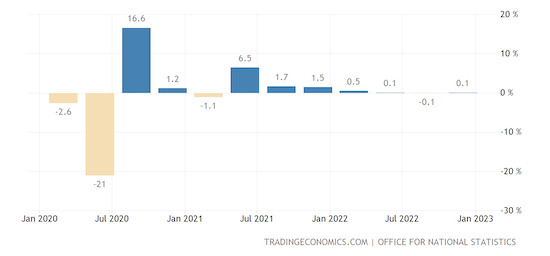

- Britain’s economy expanded 0.1% in the final quarter of 2022, narrowly avoiding a recession, according to official data.

- German import prices rose 2.8% year over year in February, the smallest increase in two years.

- Boosted by a quickening pace of “nearshoring,” the Mexican economy could grow up to 3% this year and next, officials predict.

- The unemployment rate in Mexico fell to a historic low of 2.7% in February.

- Core inflation in Tokyo slowed to 3.2% in March but remained well above the central bank’s 2% target.

- South Korean factory output slumped 3.2% in February, signaling an uneven economic recovery, while the nation’s exports fell for the sixth month in a row.

- Global mergers and acquisitions activity plummeted 48% in the first quarter of 2023, hitting the lowest level in a decade on a combination of economic impacts.

- Canada last week approved a $14.8 billion deal for Rogers Communications to acquire Shaw Communications, creating the nation’s second-largest telecom firm.

Some sources linked are subscription services.