MH Daily Bulletin: April 12

News relevant to the plastics industry:

At M. Holland

- Establishing corporate sustainability goals and using reporting platforms are quickly becoming an expectation from every stakeholder in the plastics industry. Click here to read how M. Holland is working with more and more customers every year to incorporate sustainable materials into plastic products and further environmentally friendly practices.

- We’re proud to share that M. Holland was named a finalist for the Manufacturing Leadership Awards in the Transformational Business Cultures category. Thank you to the Manufacturing Leadership Council for this recognition, and congrats to all 2023 finalists! Click here to read more.

Supply

- Oil rose 2% Tuesday on hopes that the Federal Reserve might ease up on rate hikes at its next meeting in May.

- In mid-morning trading today, WTI futures were up 1.4% at $82.68/bbl, Brent was up 1.5% at $86.85/bbl, and U.S. natural gas was down 2.1% at $2.14/MMBtu.

- U.S. crude stocks unexpectedly rose by 377,000 barrels last week, according to estimates from the American Petroleum Institute. Government data is due today.

- The Energy Information Administration expects crude supply to outstrip demand this year and next, despite production cuts by OPEC+.

- Exxon Mobil’s reported interest in acquiring Pioneer Natural Resources signals that producers in the Permian Basin, the hottest U.S. oilfield, are set to bulk up through acquisitions.

- Production from OPEC+ fell by 680,000 bpd in March, the biggest decline in 10 months, with Russia and Nigeria accounting for most of the drop. The news comes as non-OPEC countries are set to account for a higher percentage of oil production gains through 2024.

- Previously unknown news of a February cyberattack on Canada’s energy infrastructure by pro-Russian hackers did not cause any physical damage, officials said.

- Global demand for oil could see a small boost as France restarts the last of four refineries shuttered by a month-long worker strike.

- Russia’s current-account surplus plunged by an annual $51 billion in the first quarter amid slowing oil revenues. Separate data showed the nation’s crude exports falling to a multi-month low last week.

- U.S. utility Dominion Energy plans to buy Longroad Energy’s 108 MW solar project in Virginia, which could power up to 17,000 households.

- G7 nations are at odds over a timeline for phasing out coal-fired power generation ahead of a planned meeting of international delegates next week.

- A fire at a plastics recycling plant in Richmond, Indiana, spread toxic fumes and forced the evacuation of nearby residents. It is expected to burn for days.

Supply Chain

- Longshore workers at the ports of Los Angeles and Long Beach staged a work slowdown that delayed the opening of cargo terminals early this week. A strike at the West Coast ports would cost the nation $500 million per day, according to the National Association of Manufacturers.

- The U.S. retail price for diesel fuel fell below $4.10 per gallon, less than the price before the Ukraine war.

- U.S. spending on nonresidential construction was up 17% year over year in February as a building boom in industrial plants and infrastructure helps offset weakening home construction.

- Federal regulators are asking U.S. railroads to review train-car construction following a series of high-profile derailments.

- Russia and Venezuela announced plans to launch a joint dry-bulk shipping operation.

- Russia’s largest cargo airline must pay over $400 million to BOC Aviation due to losses suffered by the aircraft lessor following Russia’s invasion of Ukraine, a U.S. judge ruled.

- Black Sea grain traffic is stalled as international negotiators seek changes to a deal already brokered by the United Nations, officials said.

- In the latest news from the auto industry:

- The U.S. administration is considering slashing mileage ratings for electric vehicles, potentially forcing automakers to sell more low-emission cars.

- Ford announced plans to convert an Ontario SUV assembly plant into an electric-vehicle production facility by the second quarter of 2024.

- Hyundai broke ground on South Korea’s first electric-vehicle (EV) plant and plans to invest over $18 billion in EV capacity in the nation through 2030, the automaker announced Tuesday.

- Japanese automakers are lagging other manufacturers in efforts to build electric-vehicle supply chains, analysts say.

- British electric-cargo van maker Arrival plans a second merger with a blank-check firm as it struggles to raise cash.

- Used-car retailer CarMax saw better-than-expected quarterly profit as cost-cutting measures softened the blow from a slowdown in demand.

- BMW says it is still on track for slightly higher sales this year even after a dip in demand in the first quarter. In a bright spot, the automaker’s electric-vehicle sales rose 83.2% the past three months.

- A major U.S. transport union is opposing a request by autonomous-vehicle makers for self-driving semis to be exempted from rules requiring warning devices to be placed near trucks stopped along roadways.

Domestic Markets

- The Consumer Price Index rose just 0.1% in March compared with February, better than economists expected, and was up 5.0% year over year.

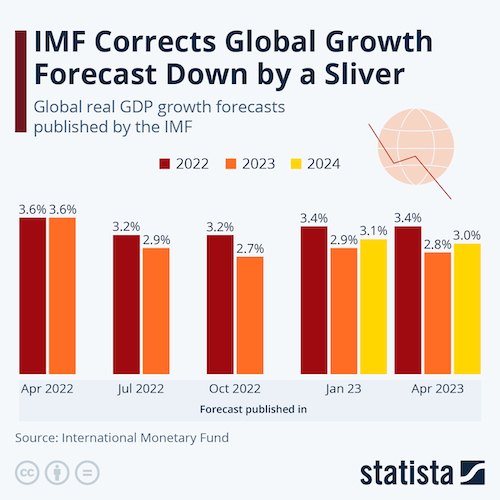

- Tighter bank lending, a reaction to the U.S.’s recent banking crisis, will probably slow the nation’s economic growth this year, the International Monetary Fund says.

- Companies are responding to lingering labor shortages and rising wages by sending more jobs overseas that can be performed remotely.

- A new proposal from the U.S. administration would require California to reduce its use of Colorado River water more than currently planned and potentially by as much as 25% next year.

- Boeing delivered 130 airplanes in the first quarter, up 27% from a year earlier and inching past rival Airbus’ 127 deliveries.

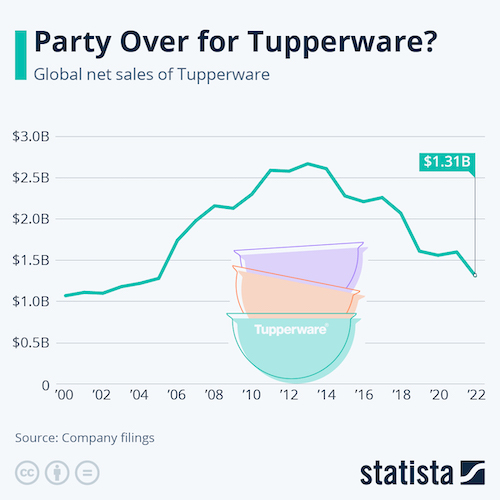

- Shares of Tupperware Brands rebounded slightly Tuesday, a day after losing half their value when the plastic-container maker flagged doubts about its ability to continue as a going concern.

International Markets

- The International Monetary Fund is warning that lurking vulnerabilities in the financial system could slam global economic growth this year.

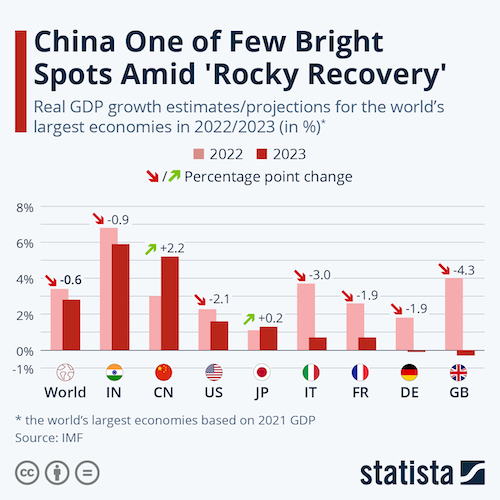

- Chinese consumer inflation rose 0.7% in March, the slowest pace since September 2021, while a decline in factory-gate prices accelerated amid persistently weak demand.

- China will likely be forced to raise its retirement age in coming years as local governments run out of money just as a wave of retirements hits.

- Mexico added over 420,000 jobs in the first quarter, a record for the period.

- Britain is set for a shallower economic hit this year than previously thought, economists say, but is still on course to suffer the sharpest contraction among the world’s big economies at -0.3%. Economic complications are rising from continued strikes among thousands of the nation’s doctors and healthcare workers.

- Airbus’ deliveries were down 11% in the first quarter, new data shows.

Some sources linked are subscription services.