MH Daily Bulletin: April 10

News relevant to the plastics industry:

At M. Holland

- We’re proud to share that M. Holland was named a finalist for the Manufacturing Leadership Awards in the Transformational Business Cultures category. Thank you to the Manufacturing Leadership Council for this recognition, and congrats to all 2023 finalists! Click here to read more.

Supply

- Oil prices posted their third straight weekly gain last week as markets reacted to OPEC’s production cuts and falling U.S. crude stocks.

- In mid-morning trading today, WTI futures were up 0.1% at $80.76/bbl, Brent was off 0.1% at $85.06/bbl, and U.S. natural gas was up 7.1% at $2.15/MMBtu.

- Exxon Mobil is reportedly in talks to acquire Midland Basin producer Pioneer Natural Resources in a deal that would make the firm the largest Permian producer.

- Active U.S. oil and gas rigs fell by four last week to a total of 751, marking the second straight week of decline.

- More than 1,300 offshore oil and gas workers in the North Sea are moving forward with a 48-hour strike set for April 24, which will likely shut down dozens of rigs.

- Two of the U.S.’s largest utilities, Dominion Energy and National Grid, are weighing potential sales of parts of their natural-gas pipeline networks as more towns and cities look to phase out residential use of the fuel.

- State lawmakers in Texas voted last week to add more natural gas-fired capacity to the state grid, a response to reliability concerns stemming from severe weather in recent years.

- Norway has become Europe’s largest supplier of natural gas as Russia throttles back exports.

- Three of China’s largest state-owned energy firms plan to invest at least $14.5 billion in the renewable energy sector by 2025, a bid to make China the world’s top player in the emerging hydrogen market.

Supply Chain

- A severe ice storm hit Canada late last week, killing two and cutting power to more than 1 million people.

- A substantial number of workers at the ports of Los Angeles and Long Beach failed to show up on the job last Thursday evening, forcing an effective shutdown of the U.S.’s busiest ocean-trade gateway on Friday.

- Construction spending on manufacturing facilities in the U.S. reached a record $108 billion last year, with much of the growth coming in the high-tech fields of electric-vehicle batteries and semiconductors.

- U.S. employers cut 11,800 warehouse and storage jobs from February to March, leaving the segment’s total employment at its lowest level in more than a year, according to new jobs data.

- About one-third of supply chain managers surveyed expect inventory levels to return to normal by the end of 2023.

- Researchers predict commercial delivery drones will replace military drones as the largest revenue contributor to the drone market by 2025.

- First-quarter operating revenue at Orient Overseas Container Line dropped 57.8% from a year ago to $2.175 billion, spurred by falling rates and a 3.2% decline in volumes.

- Third-party logistics companies were the top lessors of new big-box warehouses in the U.S. last year.

- Apparel retailer Uniqlo is rolling out new technology that allows shoppers to simply drop their goods in RFID-equipped bins at automated checkout stations, greatly reducing the difficulty of self-checkouts and improving inventory management.

- Airbus plans to double production capacity in China for its A320 passenger jet after new data showed the plane-maker’s deliveries falling 11% in the first quarter, underscoring continued pressure on its supply chains.

- Global sales of personal computers plunged 29% in the first quarter compared with the prior-year period.

- Samsung plans to make a “meaningful” cut to computer-chip production after reporting a worse-than-expected 96% plunge in first-quarter profit.

- A venture between India’s Vedanta Resources and Foxconn to build a $19 billion semiconductor plant in India has failed to gain financial backing or a partner, according to reports.

- Corrugated box demand in the U.S., a barometer of goods demand, was down 12% in the first quarter from the year-ago period and off 4% from the prior quarter.

- In the latest news from the auto industry:

- The EPA is expected to announce extensive new limits on vehicle tailpipe emissions this week in a bid to move U.S. automakers toward majority electric-vehicle sales.

- U.S. sales of secondhand electric vehicles spiked 32% in the first quarter as prices fell an average of 4% from a year ago, according to Cox Automotive.

- South Korea plans to extend $5.32 billion in financial support to battery-makers looking to invest in North American infrastructure as they contend with the U.S. Inflation Reduction Act.

- Tesla cut its U.S. vehicle prices between 2% and 6% last week, the automaker’s fifth and largest cut of the year, ahead of reductions in electric-vehicle tax credits.

- Tesla plans to build a factory in Shanghai to make its Megapack energy storage product, with construction slated to begin in the third quarter of 2023.

- Foxconn, the world’s largest contract manufacturer, plans to invest $820 million in new manufacturing activities in southern Taiwan over the next three years, furthering the company’s electric-vehicle ambitions.

- Toyota plans to build 10 new battery-powered car models by 2026 in a bid to sell 1.5 million vehicles per year globally.

- Chinese automaker BYD plans to double production capacity to overtake Tesla as the world’s biggest manufacturer of electric vehicles.

Domestic Markets

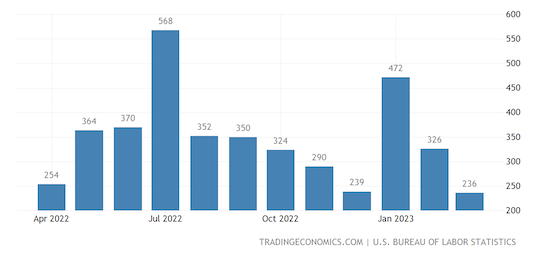

- Economists expect the Federal Reserve to continue with another interest-rate hike at its May meeting after new jobs data showed a near historically low U.S. unemployment rate of 3.5% and a near historically strong 236,000 jobs added in March. On the other hand, hourly wage gains slowed to an annual pace of 4.2% after logging a 4.6% gain the month prior, potentially contributing to lower inflation.

- Corporate reporting season kicks off this week, with analysts expecting companies in the S&P 500 to report a second consecutive quarterly decline in earnings.

- McDonald’s is expanding its cost-cutting drive by slashing pay packages for some employees, according to reports.

- Quarterly sales at Levi Strauss rose 6% but inventory was up 33% and remains an issue at the apparel-maker.

- Bed Bath & Beyond struck a $120 million agreement to help boost inventory at the beleaguered retailer’s stores.

- Costco’s same-store sales fell 1.1% in March, the first monthly decline in nearly three years.

International Markets

- Higher borrowing costs and concerns over a banking crisis sent Canada’s first-quarter M&A activity to pandemic lows, but dealmakers expect a return to strength in the second half of 2023.

- Births in Italy dropped to a record-low last year, adding to an overall population loss that has been gaining steam since 2014.

- Russia says its federal budget deficit deepened to $29 billion in the first quarter amid heavy spending and falling energy revenues.

- Icelandair Group signed a deal to purchase 13 Airbus next-generation A321XLR single-aisle jets, with deliveries expected to start in 2029.

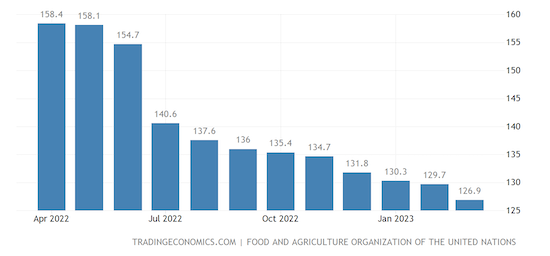

- Global food prices fell in March for a 12th straight month and are now down 20.5% from a record-high reached following Russia’s invasion of Ukraine.

Some sources linked are subscription services.