MH Daily Bulletin: April 7

News relevant to the plastics industry:

At M. Holland

- M. Holland has launched a new Healthcare Packaging line card to meet the product needs of medical device and pharmaceutical packaging manufacturers.

- M. Holland’s Color & Compounding experts shared insight on the current pigment shortage and how it’s impacting the industry.

- M. Holland will be exhibiting at MD&M West in Anaheim, California, from April 12-14. MD&M West is the largest medtech conference in the U.S. If you’re attending, please stop by Booth #4111 to meet our Healthcare experts!

- In case you missed it, watch M. Holland’s Plastics Reflections webinar about the current and future state of the North American plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell over 5% to a three-week low on Wednesday after the International Energy Agency said it would release an additional 60 million barrels of crude reserves in addition to the U.S.’s planned release of 180 million barrels. This marks the second IEA release this year and effectively boosts global supply by 2 million bpd for the next two months.

- In mid-morning trading today, WTI futures were up 0.4% at $96.64/bbl, Brent was up 0.2% at $101.20/bbl, and U.S. natural gas was up 2.2% at $6.16/MMBtu.

- U.S. crude stocks rose by 2.4 million barrels last week, according to the government, while analysts had expected a drawdown. Output also rose, hitting 11.8 million bpd, the most since late last year.

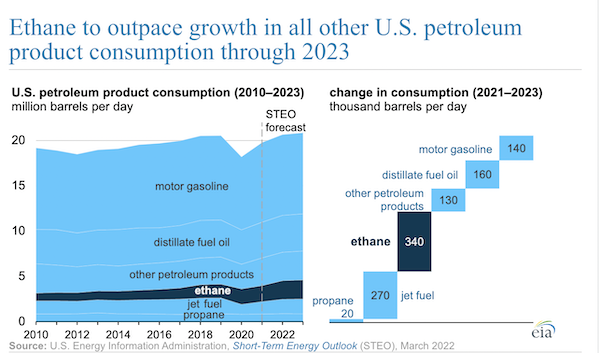

- U.S. consumption of ethane, a key feedstock to produce ethylene, has increased in every year since 2010 and is now greater than that of either jet fuel or propane:

- Houston LNG developer NextDecade signed a deal to provide a Chinese firm with 1.5 million metric tonnes of gas per year.

- Wind power generated more U.S. electricity than both nuclear and coal for the first time ever Tuesday.

- More oil news related to the war in Europe:

- Shell said its withdrawal from Russia will result in up to $5 billion of impairments and warned investors that extreme energy price volatility in the first quarter could hit cash flow.

- Chinese refiners are reportedly avoiding new Russian oil contracts despite steep discounts as caution mounts over Western sanctions. Meanwhile, India continues to ramp up its purchases of Russian crude at the expense of Saudi supplies.

- European coal buyers are scrambling to secure more shipments from across the globe as EU member nations weigh a proposal to ban Russian imports of the fuel.

- Hungary, breaking with Europe, says it is willing to pay for Russian gas in rubles. Chinese firms that bought Russian coal in March have paid in yuan, in some cases.

- Germany unveiled a spate of clean-energy initiatives Wednesday aimed at reducing reliance on Russian energy imports, including the goal of doubling green power to 80% of its total energy mix by 2030. On the consumer side, household power battery sales are expected to jump sharply this year.

- Greece opened a 204 MW solar park yesterday while its government pledged to speed up permits for renewable projects, part of a war-induced acceleration of efforts to wean itself off fossil fuels. At the same time, the nation will boost coal use for the next two years to avoid importing Russian gas.

Supply Chain

- Much of Puerto Rico’s 3.3 million population remains without power after a fire at the Costa Sur power plant shortly after 9 p.m. last night.

- Twenty-five million people in Alabama, Tennessee, Georgia and Florida faced storms, floods and tornadoes yesterday as a string of extreme weather continued to batter the U.S. southeast.

- Cargo operations at Shanghai’s Pudong International Airport, the nation’s busiest, have ground to a halt.

- Contracted ocean-container shipping rates rose 96.7% on average in March from the same time last year, including a 7% gain from February to March, according to Xeneta.

- Crane Worldwide Logistics is taking a new strategy toward air cargo with the freight forwarder essentially acting as a quasi-airline, including buying up full flights and rerouting planes to smaller airports with less congestion, such as Cincinnati.

- European budget supermarket chain Lidl has registered a new container shipping company with plans to take a sizeable chunk of its transport needs from existing carriers.

- A record 61% of all ship orders in the first quarter were for vessels powered by alternative fuels, including LNG — the largest share — as well as methanol, ethane, batteries ammonia and hydrogen.

- Six firms, including Maersk, are working to build Southeast Asia’s first facility to make methanol fuel out of captured CO2, with a minimum production capacity of 50,000 tons per year.

- Old Dominion Freight Line is adding or upgrading seven facilities to expand its less-than-truckload capacity.

- German logistics group DB Schenker’s gross revenue rose 32.7% last year to nearly $26 billion.

- Real estate firm Hunt Midwest plans to build 18 million square feet of logistics and manufacturing space on 3,300 acres near Kansas City International Airport, creating Missouri’s largest logistics park.

- Toyota lowered its projection for U.S. car sales this year from 16.5 million to 15.5 million due to parts shortages and supply chain constraints.

- Autonomous trucking provider Aurora Innovation will expand routes and place new terminals in El Paso, Houston and Fort Worth, Texas, by next year.

- Third-party food delivery apps like DoorDash are increasingly looking at grocery stores as their next frontier to maintain surging pandemic growth rates. The shift comes as grocery-centered deliverers, including Instacart, see growth slowing sharply, setting up a fierce competition for market share.

- Samsung expects record revenue and a 50% rise in first-quarter operating profits on continued high demand for memory chips and a robust rollout of its latest smartphones.

- More supply chain news related to the war in Europe:

- A third underwater mine was detected Wednesday along Turkey’s Black Sea coast, one of the world’s most important shipping chokepoints.

- Russian car sales fell an annual 63% in March, the ninth straight monthly decline spurred by logistics disruption and a major drop in the value of the ruble.

- Russian Railways missed a bond repayment worth over $600 million.

- Global prices for cooking oils are rising sharply on declining exports from Ukraine.

Domestic Markets

- The U.S. reported 40,176 new COVID-19 infections and 1,241 virus fatalities Wednesday.

- COVID-19 cases are up 27% in Massachusetts over the past week.

- Colorado may turn to a statewide system of wastewater analysis to track and measure future COVID-19 outbreaks.

- Top U.S. health officials predict the BA.2 subvariant of Omicron will prompt another rise in cases, which may trigger the need for an updated vaccine that targets virus variants. The news comes even as FDA regulators suggest asking people to get frequent booster shots is not sustainable and that the U.S. should develop a long-term strategy to mitigate COVID variants.

- CDC officials are encouraging Americans over age 50 to get a second COVID-19 booster dose.

- The FDA suspended the use of a COVID-19 antibody treatment from Britain’s GlaxoSmithKline due to ineffectiveness.

- U.S. healthcare workers may face combat-like trauma from their experiences over the past two years, new research suggests.

- The labor market tightened further last week, with first-time unemployment claims falling by 5,000 to 166,000, well below analyst estimates of 200,000.

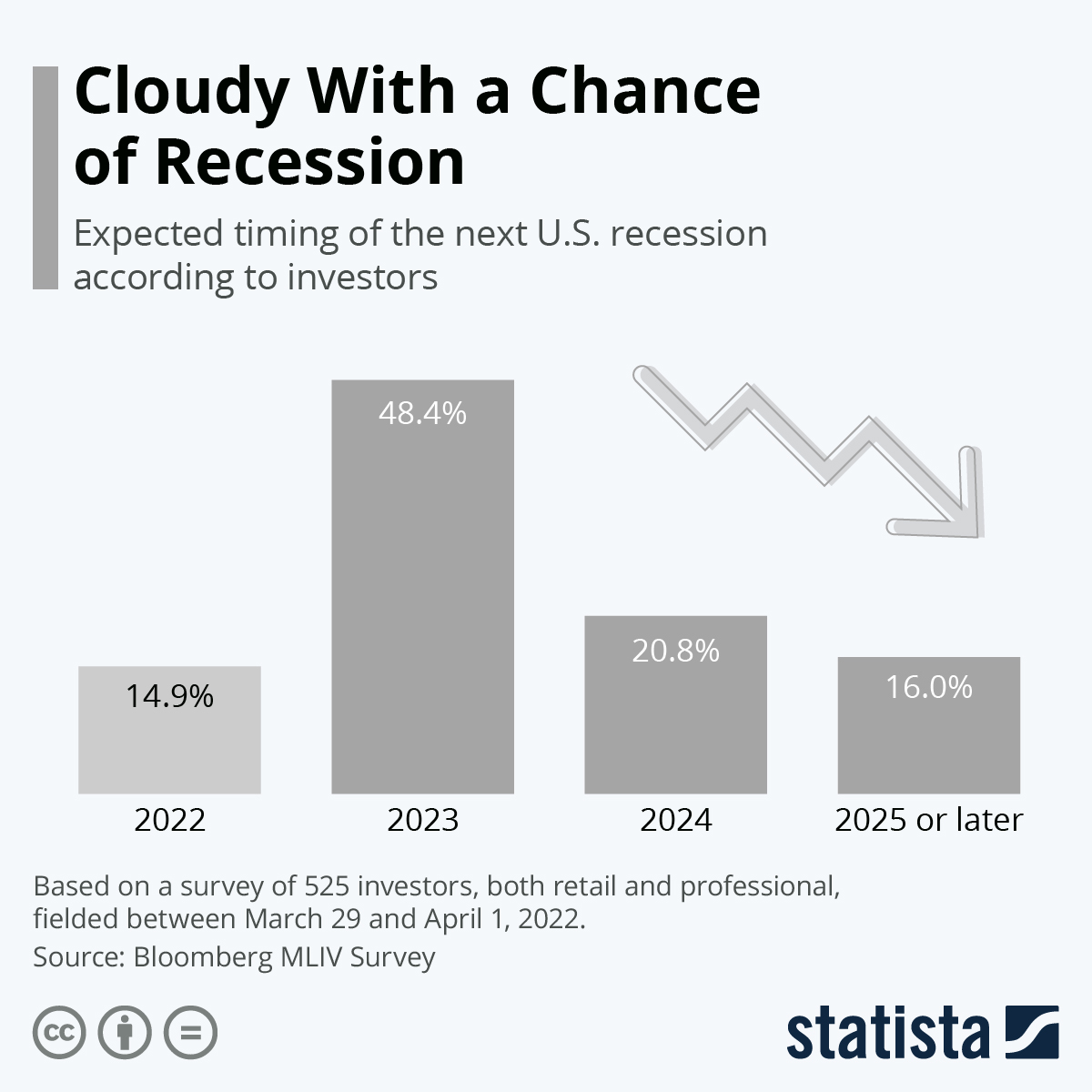

- Federal Reserve minutes released yesterday show the central bank was planning to raise rates by 50 basis points at its most recent meeting but opted for a smaller hike due to the war in Ukraine. Markets reacted poorly over expectations of more aggressive Fed tightening throughout the year:

- Two in three U.S. small businesses have raised their prices over the past year, with 85% saying they are worried about persistent inflation, according to the U.S. Chamber of Commerce.

- Applications for home-purchase mortgages fell 8.48% in February compared with the same time last year, according to Redfin.

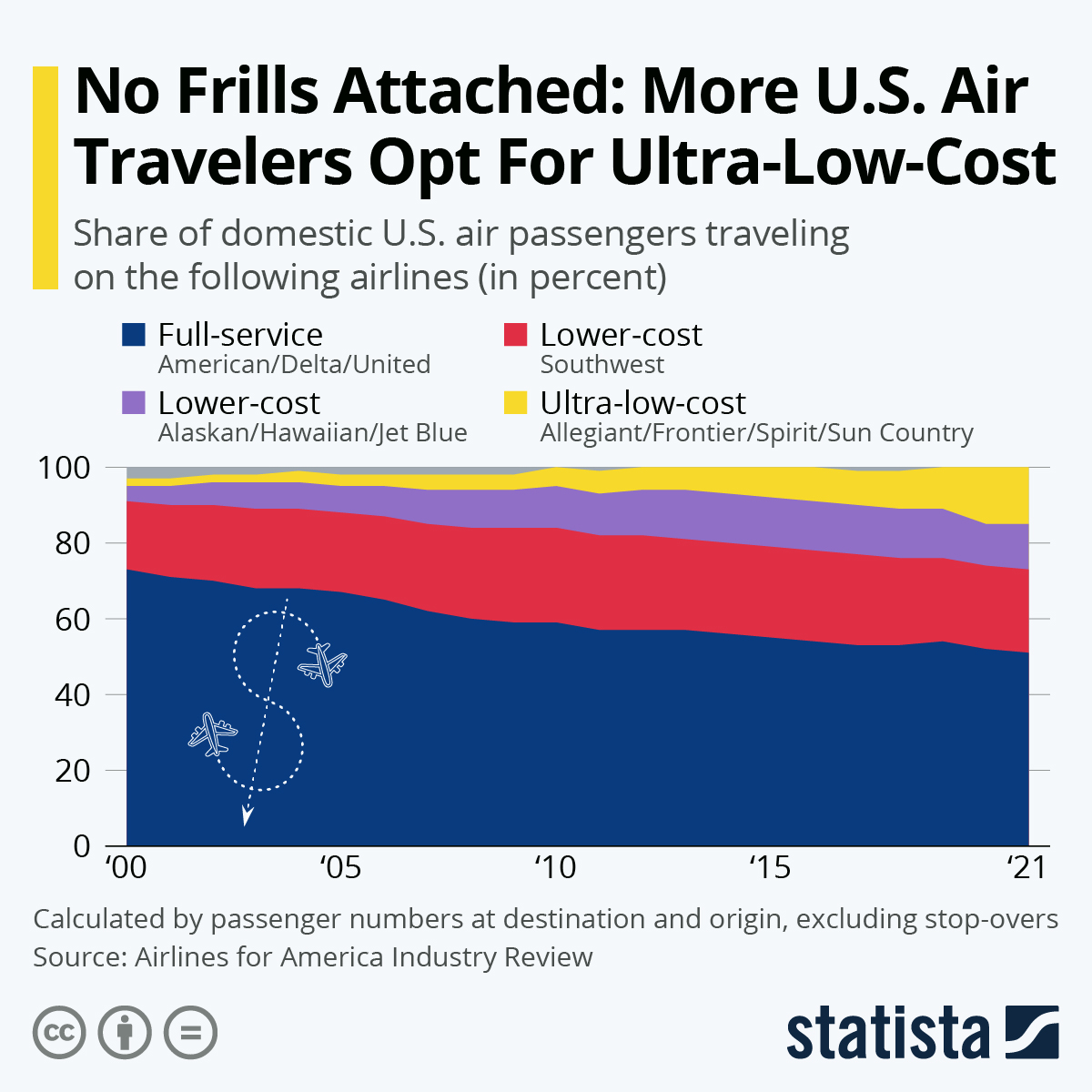

- The airline industry’s outlook has weakened this year as rising fuel prices force carriers to increase fares.

- Wall Street banks, once among the most rigid in their office culture, are becoming more open to permanent remote work as top applicants demand more flexibility.

- The U.S. is preparing for 2.5 million weddings this year, the most since 1984, after many ceremonies were delayed by the pandemic. Sales of wedding-related products and services are expected to boom.

- Boeing is hiring the three biggest U.S. cloud-computing providers — Amazon, Microsoft and Google — to digitally revamp its software for plane designers and developers.

- Electric vehicle maker Rivian said it is on track to reach its halved production target of 25,000 vehicles this year even after making just 2,553 vehicles in the first quarter.

International Markets

- The BA.2 subvariant of Omicron accounted for 94% of new COVID-19 cases across the globe last week.

- China reported a record of over 20,000 new COVID-19 cases Wednesday, with the majority in locked-down Shanghai. More Shanghai office workers are sleeping at their place of work to ensure continuity of the financial hub’s business. Nationwide, Chinese service-sector activity fell at its fastest rate of the pandemic last month, deep into contraction territory.

- International airlines have been told to ensure that flights into Shanghai are less than half full.

- Taiwan is abandoning its zero COVID-19 strategy, leaving only China and Hong Kong as developed governments still striving for zero infections.

- March saw the U.K.’s highest COVID-19 infection rate of the pandemic, with roughly 1 in 16 tests coming back positive. The nation’s health service, battered by heavy demand, severe staff shortages and rising infections, issued an unusual plea for families to help discharge infected relatives from hospitals even if they are positive.

- Ontario has returned to daily COVID-19 levels near the January peak of Omicron, health experts say.

- Health officials in the Americas are warning against a false sense of security from broadly declining COVID-19 infections, as nearly 240 million eligible people remain unvaccinated.

- Greece is offering fourth COVID-19 vaccine doses to people over age 60.

- Overseas airlines that lifted mask rules are being forced to cancel flights due to rising COVID-19 infections among crews and staff.

- More news related to the war in Europe:

- The U.S., working with G7 nations and the EU, barred new investment in Russia yesterday while imposing new sanctions against Russia’s largest banks and most prominent families. A similar move was taken by Britain.

- The U.S. Senate voted unanimously today to approve a ban on imports of Russian oil and end normal trade relations with the country.

- Tightened sanctions on Russia have cut its ability to pay back bonds in U.S. dollars, bringing the country closer to default. Consumer prices in the nation are already up 10% this year, as fears of an unemployment crisis grow.

- Britain’s GlaxoSmithKline is cutting one-third of its consumer healthcare products from Russian store shelves.

- Russia’s invasion is weighing on Italy’s GPD growth, with the most updated forecast falling from 4.7% to 3.1% this year.

- Canada will ban most foreigners from buying homes for two years and provide billions of dollars to spur construction in an attempt to cool its surging real-estate market.

- Poland’s central bank made a surprise move to raise interest rates by a full percentage-point to 4.5% yesterday, a response to the highest inflation in two decades.

- Volkswagen plans to cut 60% of combustion-vehicle production by the end of the decade.

- Uber is hinting it may enable British users to book all sorts of travel, including trains, buses, planes and car rentals, through its app this year.

- Chilean energy company HIF Global secured $260 million, including investments from Porsche, to build an e-fuel plant that uses wind power to produce green hydrogen.

- Toyota is closing its 60-year-old plant in Sao Bernardo do Compo, Brazil, its first outside Japan, as it moves operations to Sao Paulo.

Some sources linked are subscription services.