MH Daily Bulletin: April 29

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- How can healthcare organizations improve the environmental impact of their healthcare packaging, increase the recyclability of products and reduce overall waste? Read the insight from our experts here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose about 3% Thursday on the likelihood that Germany would join a complete European ban on Russian oil.

- In late-morning trading today, WTI futures were up 1.3% at $106.70/bbl, Brent was up 2.0% at $109.70/bbl, and U.S. natural gas was up 2.7% at $7.08/MMBtu.

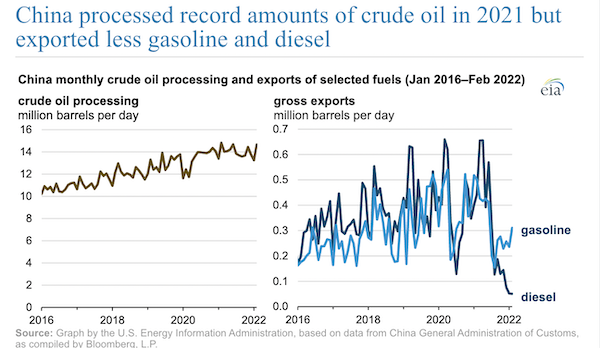

- Diesel prices are up 42.8% year to date compared to a 26% jump in gasoline, with analysts pointing to structural changes that could widen the crude-diesel spread in the future. Chinese diesel exports slumped during the second half of 2021 as the nation tried to ensure domestic supplies:

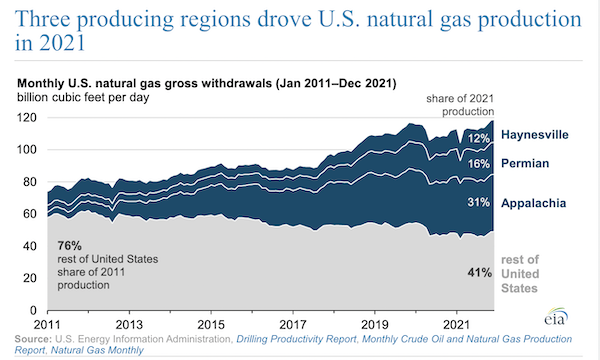

- Supply disruptions are limiting how much U.S. frackers can boost output this year, projected at just 8% compared to a 20% rise the last time oil prices hit $100/bbl in 2014. The Permian Basin will be one of the main sources for new production:

- Japan’s Mitsubishi Heavy IndustriesU.S. and European officials indicate they are more open to longer-term deals to ship American fuel across the Atlantic, helping assure investments in U.S. LNG export projects.

- Sinopec, Asia’s biggest oil refiner, expects Chinese demand for refined products to recover this quarter as COVID-19 outbreaks are brought under control.

- OPEC+, which includes Russia, is expected to maintain its modest pace of increasing output when it meets next Thursday, analysts say.

- Waste Management will invest $825 million over the next four years to turn methane from at least 17 garbage dumps into biomethane, a natural-gas substitute.

- More oil news related to the war in Europe:

- Swiss commodities trading giant Trafigura Group will join other vital trading firms in ceasing most business with Russia, dealing a blow to the nation’s oil industry beyond Western sanctions.

- German officials said Thursday the nation is ready for a complete European halt on Russian oil purchases.

- German power utility Uniper will pay for Russian gas in euros via a Russian bank account, a potential workaround to Moscow’s demands for payment in rubles.

- Russia is rejecting purchase offers from its former German retail trading unit that was nationalized by the German government, despite the firm’s proffer of ruble payments.

- Middle Eastern diesel exports are fast replacing Europe’s lost imports from Russia.

- A new gas pipeline between Bulgaria and Greece will help ease Bulgaria’s loss of Russian gas shipments.

- Exxon’s year-over-year earnings doubled last quarter and Chevron’s tripled, but the results for both companies missed analyst estimates.

- TotalEnergies plans to buy back up to $2 billion of its own shares this quarter, doubling last quarter’s buyback as earnings surge alongside higher oil prices.

Supply Chain

- Water levels in Nevada’s Lake Mead fell to a new low as extreme pre-summer drought conditions threaten water and power supplies for millions of people in the U.S. West.

- The northern port of Qinhuangdao is the latest Chinese commodities hub to get hit by lockdowns. The port handled nearly 50 million tons of mostly coal and metal ore products in the first quarter.

- Hundreds of commercial vessels remained backed up off the world’s largest port of Shanghai:

- Japanese ocean carrier ONE saw record profits and a 109% increase in revenue last fiscal year but said its 2022 outlook remained uncertain due to congestion risks.

- Supply disruption will prevent the electric vehicle industry from meeting surging demand over the coming years, analysts say.

- U.S. power company Southern said a gigawatt of its planned solar projects would be delayed by a year due to supply disruption, the latest in a string of similar warnings from the industry.

- With dwell times up 22% from the prior year, U.S. rail gridlocks are spreading through the agricultural supply chain, threatening higher food prices.

- Indonesian trade groups expect the nation to resume exports of cooking oil as early as May.

Domestic Markets

- The U.S. reported 62,252 new COVID-19 infections and 424 virus fatalities Thursday.

- COVID-19 infections in Los Angeles County rose 40% last week, while hospitalizations also rose.

- Rising COVID-19 infections prompted San Francisco’s rapid transit authority to reinstitute a mask mandate through July 18.

- Over 40% of U.S. small businesses surveyed were forced to temporarily close at some point last year due to staff infections with COVID-19.

- Wage rates in the U.S. rose 1.4% in the first quarter, the highest quarterly increase in four decades.

- Consumer spending in the U.S. rose a higher-than-expected 1.1% in March.

- The U.S. economy’s 1.4% first-quarter contraction was the nation’s weakest since early in the pandemic and stemmed largely from a widening trade deficit. Positive signs included a record 2.7% increase in consumer spending and a 9.2% increase in business spending.

- Personal loans to Americans surged to the most in a decade last year as fears about the pandemic’s shock on household finances never materialized.

- The median price for a U.S. home rose to $375,300 in the first quarter, up 15% from a year ago, as most homes were still sold above list price. More than half of Americans surveyed say they would consider a second job to afford down payments.

- Former retail high-rises are finding new life as upscale apartment buildings in many densely populated cities, a convergence of disruption to business districts and rising demand for housing.

- In the latest news from first-quarter earnings season:

- Amazon reported a net loss of $3.8 billion primarily due to a faltering investment in electric-vehicle maker Rivian. Revenue rose 7%, slightly below expectations, as the firm downgraded second-quarter forecasts amid a shift from growth to streamlining its sprawling logistics network. Amazon’s cloud-computing revenue rose 37%, while e-commerce sales slowed in line with consumers’ return to retail shopping.

- Apple reported a larger-than-expected 9% gain in revenue but said COVID-19 lockdowns in China and other supply disruptions could cost up to $8 billion in sales this quarter. Sales of all product categories besides the iPad increased.

- Intel’s sales fell almost 7% to $18.35 billion, missing estimates as consumer PC purchases declined. The firm’s chief executive predicted chip shortages will last beyond 2023 as manufacturers struggle to buy enough equipment.

- Ford posted a $3.1 billion loss primarily on its investment in flailing electric-vehicle startup Rivian. The automaker’s core business appeared healthy, with its expected revenue decline limited to 5% as higher prices offset the production fallout from industrywide supply shortages.

- Volvo reported an 8% gain in first-quarter revenue as higher prices offset a 20% decline in production.

- Southwest Airlines posted a $278 million loss but said rebounding demand will raise revenue up to 12% this quarter.

- Twitter posted 16% higher revenue but canceled its future guidance pending a takeover of the firm.

- McDonald’s U.S. locations raised menu prices by an average of 8% for the quarter, boosting comparable sales by 3.5%. High labor costs could prompt more price increases this year.

- Domino’s Pizza, the nation’s largest pizza company by revenue, said staffing shortages, reduced hours and rising food costs contributed to a nearly $27 million profit decline.

- Caterpillar’s order backlog rose to over 50% of last year’s total sales as construction activity remained strong but supply constraints held back production. Revenue was up 14%.

- Stanley Black & Decker reported a 20% jump in sales on higher prices but said commodities and transport costs would rise an extra $600 million this year.

- U.S. Steel’s profit rose to $882 million from $91 million a year ago, attributed to higher prices and rising demand for pipe used in oil and gas development.

- Merck (+50%) reported year-over-year sales growth with help from higher sales of COVID-19 antivirals.

- Mastercard’s net revenues rose 28% on healthy consumer activity and a surge in travel spending.

- Hershey saw revenue rise 16% as demand for candy and snacks held up even with higher prices.

- Fidelity plans to hire 12,000 workers by September to help manage a surge in individual investing activity.

- Volkswagen may expand its Chattanooga, Tennessee, plant to produce new models of electric trucks and vans.

- Thefts of catalytic convertors containing coveted precious metals surged over 400% in the first year of the pandemic, the latest available data, causing a spike in business at dealership service centers.

- U.S. plastics recycling weight fell almost 6% from 2019 to 2020 as the pandemic upended recycling collection.

- East Jordan Plastics, one of the largest horticultural container manufacturers in North America, is building a $44 million logistics site in Georgia to be turned into a recycling plant over the next five years.

International Markets

- An estimated 46 cities in China are on strict or partial lockdown, affecting 343 million people.

- Beijing closed more gyms, malls, schools and apartment blocks yesterday and stepped up contact tracing as mass testing continued in an effort to avoid Shanghai-like lockdowns.

- New cases in Shanghai fell to 9,330 Wednesday, down 22% from a day earlier and the lowest in nearly a month. More than half the city’s residents will be able to leave their homes for the first time in weeks, while authorities work on plans to further reopen manufacturing.

- South Korea will ease an outdoor mask mandate starting next week as its most recent COVID-19 wave declines.

- South Africa is leading another rise of COVID-19 cases on the African continent, driven primarily by subvariants of Omicron.

- Denmark became the first country to halt its COVID-19 vaccine program but said further campaigns would likely return in the fall.

- The global economic reopening has revealed global pent-up demand for divorces, particularly among younger couples, as inquiries and petitions surge.

- More news related to the war in Europe:

- The White House doubled its aid request for Ukraine to $33 billion.

- Russia may be forced to ground two-thirds of its commercial aircraft by 2025 to use them for spare parts after aircraft servicers and plane-makers exited the nation following its invasion.

- Eastern Europe’s biggest discount carrier scrapped flights to Russia and Ukraine through the summer.

- India’s Tata Motors is looking to quadruple production of electric vehicles this financial year.

- Stellantis is putting $200 million into a new electric vehicle production site in Serbia.

- BP and Volkswagen are partnering to build 8,000 fast-charging spots for electric vehicles across Europe by 2024.

- Beijing authorities gave more authorizations for self-driving taxis to operate in its suburbs without a driver present.

- Airbus is in the early stages of developing pilot programs for flying taxis in Italy.

Some sources linked are subscription services.