MH Daily Bulletin: April 28

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose only modestly yesterday even after Russia made good on threats to cut gas supplies to Poland and Bulgaria.

- In mid-day trading today, WTI futures were up 2.7% at $104.80/bbl, Brent was up 1.9% at $107.30/bbl, and U.S. natural gas was down 4.1% at $7.04/MMBtu.

- The U.S. government said crude stocks rose by just 692,000 barrels last week, short of expectations, while distillate inventories including diesel and jet fuel fell to their lowest levels since 2008. The drop in distillates pushed U.S. heating oil to a record close at $4.67 a gallon.

- The White House approved more requests to export LNG to nations without a free trade agreement with the U.S., including Europe. The exports would come from two U.S. plants under development in Texas and Louisiana.

- Chinese commercial gas demand is falling due to lockdowns.

- More oil news related to the war in Europe:

- Russia’s Gazprom halted gas supplies to Poland and Bulgaria yesterday over their failure to pay in rubles. European gas prices settled 4.1% higher after a turbulent day of trading, while Asian LNG prices rose 16%. The EU — and notably its largest economy Germany — vowed to push back on Russia’s demands.

- North Sea crude purchases are at multi-year highs on increased demand from European refiners looking to replace Russian supplies. Climate activists, sharply opposed to more North Sea production, succeeded in halting some German crude flows yesterday in protest.

- Russian seaborne oil exports rose 420,000 bpd in April but are expected to drop sharply when new sanctions take effect in May. Moscow predicted crude exports could fall 17% this year.

- A change of control at a Rosneft-operated refinery in Germany could soon complete the nation’s planned halt of Russian oil imports.

- Exxon Mobil declared force majeure on its 273,000-bpd Sakhalin-1 operations in Russia’s Far East. Meanwhile, India cannot find a vessel to transport 700,000 barrels of crude from the site.

- Shell said it would no longer accept refined oil blended with Russian products.

- TotalEnergies will take a $4.1 billion charge as sanctions stall its massive Arctic LNG2 project in Russia originally slated to begin production next year.

- India will boost coal imports over the next three years as electricity demand rises to a four-decade high. In a similar measure, Germany could bring decommissioned coal-fired power plants back for a second life.

- The U.S. government is prepping for potential lease sales for wind farms offshore Oregon and the Central Atlantic.

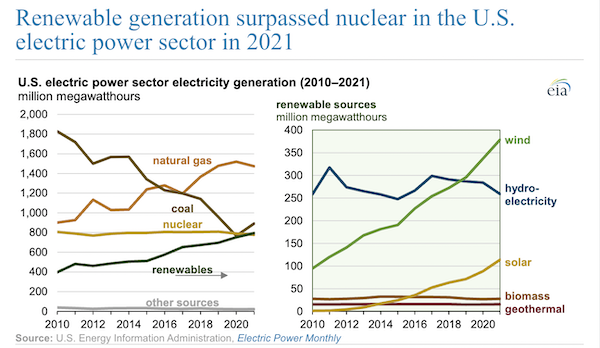

- Renewables surpassed nuclear power generation in the U.S. for the first time ever in 2021, new data shows:

- Japan’s Mitsubishi Heavy Industries plans to develop nuclear reactors small enough to be delivered on trucks by 2040.

- Sembcorp Marine and a unit of conglomerate Keppel Corp — both controlled by Singaporean state investment firm Temasek — agreed to a merger that will create the world’s largest builder of oil rigs.

- Walmart is increasing discounts on gasoline to prompt more consumers to join its Walmart+ subscription service.

Supply Chain

- One of the world’s biggest shipping companies, Taiwan-based Yang Ming Marine Transport, says recent signs of easing port congestion could lead to improved freight conditions in the second quarter. FEU prices were down 20% since late February at the Port of Los Angeles last week, while TEU prices were 50% of last August’s levels.

- Hapag-Lloyd plans to equip its entire 3 million-TEU container fleet with real-time tracking devices, an industry first.

- In the latest supply chain news from first-quarter earnings season:

- Knight-Swift Transportation raised its outlook after reporting a 49% jump in revenue and a 60.5% jump in profit to $208.3 million.

- Florida-based trucker Landstar System saw record revenue and earnings on 27% higher rates and a boost in volumes.

- Wisconsin-based Marten Transport, a hauler of time- and temperature-sensitive goods, posted record revenue and saw a 52% jump in profit.

- Paccar’s total revenue increased 10.6% as the trucker began using several more efficient truck models.

- Trans-Pacific revenue at Hong Kong-based Orient Overseas Container Line grew 83% despite a 15.4% decline in container volume.

- Port Houston’s container volumes expanded 20% year over year, including a 26% increase in loaded container imports.

- Global smartphone shipments fell 11% in the quarter, with Chinese vendors losing market share to Samsung and Apple.

- The Port of Oakland saw 69,878 TEUs of loaded exports last month, a 12% increase from February but a 25.8% decline from a year ago.

- U.S. auto sales are expected to fall 23.8% in April on rising interest rates and continued low inventories.

- Toyota produced a record 866,775 vehicles across the globe in March despite factory stoppages and demand shortfalls in the Japanese market.

- Mercedes expects inventories to remain high in the second quarter as supply disruptions hamper deliveries.

- Nissan delayed the launch of a second new model vehicle due to semiconductor shortages at a Japanese factory.

- A South Korean consortium led by LG Energy Solution will invest $9 billion in Indonesia to build a mines-to-manufacturing supply chain for electric vehicles.

- Indonesia, the world’s biggest edible oils exporter, widened the scope of its export ban on cooking oil to include crude and refined palm oil, a sharp turnabout from official policy announced the previous day.

- Prices for soybeans (+27%) and corn (+37%) are up sharply this year, raising pressure on global food markets.

Domestic Markets

- The U.S. reported 88,780 new COVID-19 infections and 800 virus fatalities Wednesday.

- New York state reported a 37% rise in COVID-19 infections and a 24% rise in hospitalizations last week.

- At least a dozen U.S. colleges reimposed mask mandates this month due to rising COVID-19 cases, primarily of the BA.2 subvariant of Omicron.

- The CDC is investigating Princess Cruises after 253 COVID-19 infections were reported in numerous outbreaks on its ships over the past five weeks.

- Moderna requested authorization to use its COVID-19 vaccine on children as young as six months old.

- Top U.S. health officials say the nation has made it out of the first and worst stage of the pandemic and should have more control in subsequent stages.

- First-time jobless claims fell by 5,000 last week to 180,000, near historic lows.

- The U.S. economy shrank 1.4% in the first quarter, surprising economists who expected 1.0% growth.

- The U.S. trade deficit in goods widened unexpectedly to a record $125.3 billion in March, up 18% from the previous month, on a surge in the value of imported industrial supplies.

- Inflation worries have dampened U.S. consumer confidence, according to a recent survey, with just 20% of respondents rating the economy as excellent or good.

- The average U.S. mortgage rate rose to 5.37% last week, the highest since June 2009, while mortgage applications declined for the second week in a row and pending home sales fell for the fifth straight month.

- With Florida’s population growing faster than any state but Texas, the state has quickly become one of the least affordable for both renters and homeowners.

- Employment in U.S. daycare services remains more than 10% below pre-pandemic levels, as the profession saw one of the worst flights of workers during the pandemic.

- In the latest news from first-quarter earnings season:

- Qualcomm’s earnings and sales beat expectations, helping dispel fears that chip demand is slowing after a pandemic-fueled surge the past two years.

- Samsung reported record quarterly revenue and saw net profit jump 59% on resilient demand for computer chips and rising smartphone sales.

- Boeing reported a worse-than-expected $1.24 billion loss as production setbacks stack up for its jetliner and military programs. Long-stalled deliveries of its 787 Dreamliner — with pending orders topping $25 billion — could resume by this summer.

- Revenue improved at T-Mobile on a gain in customers undeterred by higher prices for products and service plans.

- Medical-device maker Boston Scientific attributed a 10% gain in revenue to a rise in medical procedures and upped its full-year sales outlook.

- Harley-Davidson’s sales fell 5%, primarily in North America, as supply shortages held back production. The firm expects a planned spinoff of its electric motorcycle division to be finalized by the middle of this year.

- Procter & Gamble’s organic sales rose 10%, the biggest jump in 20 years, as the firm warned that shoppers may begin to balk at higher prices.

- Consumer-goods giant Unilever raised prices an average of 8.3% last quarter, the most of any competitor, and suffered a 1% decline in overall volumes.

- American agriculture giants including Archer Daniels Midland, Bunge and Cargill reaped gains on the global rise in commodity prices and said tight crop supplies could continue for several years.

- Kraft Heinz beat market expectations and raised its full-year sales forecast as pandemic-era demand for packaged meals and condiments remains high.

- PayPal posted revenue slightly above market expectations but reduced full-year guidance by several percentage points as more consumers return to in-store shopping.

International Markets

- Global COVID-19 fatalities fell to 15,000 last week, the lowest weekly total since March of 2020, according to the WHO.

- Shanghai reported 12,309 new COVID-19 cases Wednesday, its lowest level in weeks, while Beijing reported more cases as it tries to test its 22 million residents three times over the next five days.

- Authorities also began mass testing in Hangzhou, a city of around 12 million that is home to a small but notable network of tech companies.

- China’s central bank said it would step up monetary support to help avert the impact of lockdowns.

- Taiwan reported over 11,000 new COVID-19 cases yesterday, a record.

- Up to 80% of Europeans may have been infected with COVID-19, new research suggests, as the bloc enters a post-emergency phase in which mass reporting of cases is no longer necessary, officials say.

- The BA.2 subvariant of Omicron now accounts for over 90% of cases in Japan, as calls to remove travel restrictions grow.

- Reinfections with COVID-19 were 10 times higher in the latest Omicron surge than at any time during the pandemic, new research out of Britain shows.

- Testing for COVID-19 is down 70%-90% across the world, making it more difficult for health officials to monitor for new strains.

- More news related to the war in Europe:

- Russian officials predict the nation’s economy could contract as much as 12.4% this year as inflation surges past 20%, although reports suggest the nation’s economic data cannot be trusted.

- Renault is in talks to sell its 68% stake in Russia’s largest automaker to a state-backed entity.

- The EU proposed temporarily removing all tariffs and quota requirements on Ukrainian exports.

- The White House will provide $670 million in food aid to nations at dire risk of hunger due to fallout from Russia’s invasion.

- The Japanese yen weakened to a 20-year low against the dollar yesterday as the nation’s economy remains sluggish.

- North American and European firms are giving employees more stock grants as they seek to retain talent amid labor shortages.

- S&P Global predicts climate change could lead to a 4% loss of global economic output by 2050.

Some sources linked are subscription services.