MH Daily Bulletin: April 26

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell 4% Monday to their lowest level in two weeks, a reaction to demand slowdowns in COVID-hit China. Prices are down 25% since hitting a 14-year high in early March.

- In mid-morning trading today, WTI futures were up 0.5% at $99.07/bbl, Brent was up 0.5% at $102.80/bbl, and U.S. natural gas was up 2.8% at $6.85/bbl.

- U.S. oil refiners are expected to post strong first-quarter earnings beginning this week.

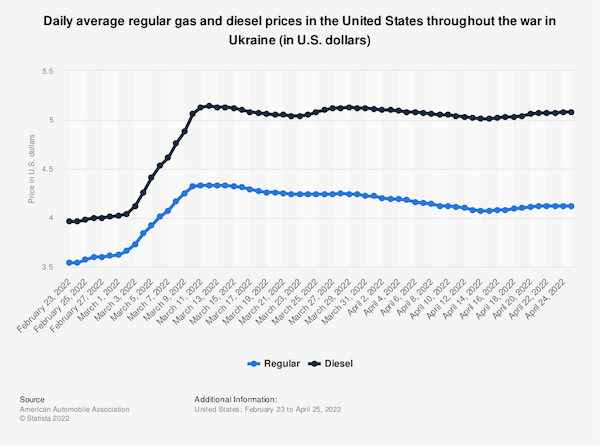

- U.S. gasoline prices rose for the first time in more than a month yesterday:

- Libyan oilfields may resume full production within days, officials said, after force majeure was declared on over 550,000 bpd last week due to political turmoil.

- India’s crude oil import bill doubled last year to $119 billion despite a comparatively small increase in tonnage.

- Guyana sold its first 1 million barrels of crude from a new platform to Exxon Mobil for $106/bbl, as the nation ramps up output after becoming an exporter just three years ago.

- The state energy firm of Indonesia plans to spend $4 billion to double geothermal capacity by 2028.

- More oil news related to the war in Europe:

- European gas futures settled at multi-month lows yesterday on the growing likelihood that buyers will find a workaround to Russia’s demands for ruble payments.

- Rosneft received zero bids for its most recent 6.5-million-tonne crude sale after the Russian producer demanded prepayment in rubles.

- TotalEnergies chartered its first tanker of Abu Dhabi crude in two years in a sign that more UAE exports could be used to replace Europe’s supply of Russian energy. In related news, a supertanker of U.S. crude was delivered to Spain for the first time in six years.

- U.S. officials expect rising domestic oil production to soon make up for the 1.5 million bpd of lost Russian imports.

- India is turning to the U.S. and Australia to expand coal imports as normally plentiful Russian deliveries get held up by payment complications.

- Suspected Russian cyberattacks on European wind-energy infrastructure are becoming more frequent.

Supply Chain

- Dangerous wildfires are burning in several states in the drought-stricken U.S. southwest. Evacuation orders were lifted yesterday for Arizona’s Tunnel Fire, now 20% contained after burning over 21,000 acres last week.

- Dallas-Forth Worth International Airport is recovering after storms canceled or delayed over 700 flights since Sunday.

- Hundreds of miles of I-94 reopened in the Dakotas and Montana yesterday after a late-season blizzard shuttered traffic over the weekend.

- Prices for commodities dipped Monday on fears of demand slowdowns resulting from Chinese lockdowns and U.S. interest rate hikes.

- U.S. truckload rejection rates are down to their lowest level in almost two years while spot rates have dropped sharply since mid-January. Bank of America warned the trucking industry is “near freight recession levels” as demand slows.

- Hapag-Lloyd was fined over $820,000 for a spate of U.S. demurrage and detention violations.

- Over 230 container ships were queued outside China’s Shanghai and Ningbo ports last week, a 35% increase from the same time last year. Ships are burning more fuel while idling and filling up at nearby ports, causing demand to drop sharply in Singapore, the world’s largest bunker hub.

- China’s Jiangnan Shipyard will resume operations after closing for a month amid shipbuilders’ widespread declarations of force majeure caused by lockdowns.

- Driver shortages are hampering online grocery services in Shanghai, a vital lifeline for the city’s food supply.

- GE posted solid first-quarter results but warned that supply chain challenges will impact the outlook for the full year.

- Shares of Philips fell over 11% Monday after the Dutch health-products giant reported a 32% decline in first-quarter core profit and flagged multiple growth risks for the coming year.

- Appliance maker Whirlpool cut its full-year guidance after sales declined 8.2% in the first quarter.

- U.S. mattress makers say higher inflation is starting to slow U.S. demand for furniture and furnishings.

- Logistics disruptions are causing shortages of much-needed U.S. medical equipment, including wheelchairs, crutches and exam tables.

- Almost 90,000 vehicles were removed from production across the globe last week due to supply shortages.

- Volkswagen is slowly resuming production in Shanghai and the northeastern Chinese city of Changchun, the automaker said.

- Indonesia’s export ban on cooking oil will reverberate through global food and consumer-goods markets, economists warn.

- New research shows U.K. imports from the EU collapsed 25% after Brexit and led many small British businesses to give up exporting to the continent altogether.

- The number of Chinese imports arriving as “de minimis” shipments in the U.S. surged tenfold over the past decade as importers use the exemption to legally circumvent tariffs.

- More supply chain news related to the war in Europe:

- Cargo aircraft lessors could start charging higher rates amid losses from Russia’s takeover of large parts of their fleets.

- Cargo volumes at the Port of Rotterdam fell 1.5% in the first quarter as shippers stopped taking Russian container bookings.

- MAN, a German maker of commercial vehicles, resumed production after a six-week shutdown caused by wire harness shortages from Ukraine.

- Rare-earth mining is not keeping pace with the EU’s accelerated plans to transition to green energy, likely prompting years of supply difficulties for electric vehicles and wind turbines, experts say. Across the globe, production squeezes could lead to higher prices and shortages of electric vehicles.

- The world’s longest single-charge trip made by an electric delivery van is 260 miles, set last week.

- Pittsburgh received $100,000 to study “smart” loading zones across the city, potentially enabling faster pickups and drop-offs and reducing emissions from idling trucks.

- U.S. regulators are urging railroads to commit to net-zero emissions by 2050.

Domestic Markets

- The U.S. reported 59,101 new COVID-19 infections and 283 virus fatalities Monday. Total virus fatalities are set to pass 1 million in the coming days, the most in the world.

- At 13%, COVID-19 was the third-leading cause of death in the U.S. for the second year in a row in 2021.

- COVID-19 positivity rates in New York City are back up to mid-February levels, while California’s rate jumped nearly 50% the past week.

- Just six states are still reporting new COVID-19 cases every day compared to all 50 states a year ago.

- U.S. regulators granted the first full approval for Gilead’s remdesivir COVID-19 treatment in infants as young as 28 days old.

- The U.S. administration will outline plans today to expand the availability of free COVID-19 antiviral pills at U.S. pharmacies.

- Two-thirds of surveyed workers said they would consider seeking new jobs if forced to return to working in-person.

- New data shows manufacturing activity jumping in New York this month and slipping slightly in Texas.

- Four in 10 small U.S. businesses say they plan to raise prices by at least 10% this year to account for inflation. In a separate survey, over 90% believe inflation, logistics disruptions and labor shortages are negatively impacting business.

- U.S. home prices were up 19.8% in the 12 months ending in February as price inflation accelerated.

- Coca-Cola crushed market expectations with an 18% jump in organic revenue growth last quarter, although full-year earnings could be dented by the firm’s pullout from Russia.

- Verizon is adding parcel lockers to 250 stores as part of a growing retail trend for “buy online pick up in store,” or BOPIS. Home Depot announced similar measures as it revamps its customer experience.

- A certification delay could push back deliveries of Boeing’s new 777X jets by another year to 2025.

- Landscapers are pushing back against state and local mandates for electric lawn-care equipment, saying the popular consumer technology is not yet strong or cost-effective enough for use by professionals.

- GM hopes a new energy-repurposing technology will extend battery performance in its electric vehicles, including an electric Corvette set to launch next year.

- Over 40 companies, including Airbnb, Lyft and several consumer-goods makers, wrote a letter to Congress asking for more incentives for clean-energy projects.

- Citigroup and Bank of America will soon roll out recycled plastic credit cards.

International Markets

- Shanghai’s lockdowns entered their fourth week yesterday as infections slightly fell and fatalities rose, while orders for mass testing in Beijing sparked panic-buying over fears that the Chinese capital could be destined for a fate similar to Shanghai’s.

- New data shows up to half of Canadians may have been infected with COVID-19, primarily from the nation’s most recent Omicron surge. Authorities further relaxed some rules for incoming travelers yesterday.

- South Korea became one of the first nations to downgrade COVID-19’s status to an illness on par with the seasonal flu, as new daily infections dipped below 30,000 for the first time in 76 days.

- Only about 1 in 3 people have fully recovered from COVID-19 a year after infection, according to new research out of Britain.

- Swiss drugmaker Roche saw first-quarter sales jump 10% but said falling demand for COVID-19 tests and antibody treatments will cause growth to slow.

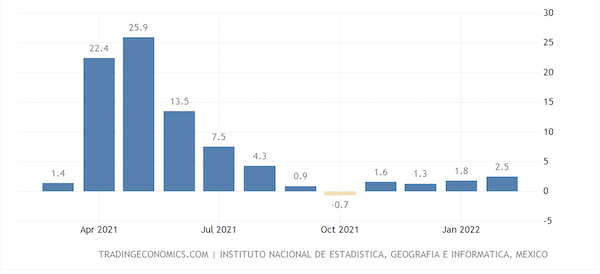

- Economists expect Mexico’s GDP expanded for the first time in three quarters from January to March, driven by a rebound in exports. Growth hit a better-than-expected 2.5% in February:

- China’s economy fell sharply into deterioration territory in April, according to a broad set of economic indicators from Bloomberg.

- Russia’s president conceded that the nation faces “unprecedented pressure” from Western economic sanctions.

- Global venture funding for startups dropped 19% in the first quarter as valuations remained high, signaling further slowdowns in the months ahead.

- First-quarter profits at London banking giant HSBC fell 28%, while Switzerland’s UBS saw gains on higher trading activity.

- Spanish producer prices rose 46.6% in March, a record in data going back to 1976, largely due to higher energy costs.

- Chinese lending to African governments fell 78% to a 16-year low in 2020, new data shows.

- Top polysilicon producers in China reported surging first-quarter profits as demand stays strong for the key solar panel material.

- Pony.ai received China’s first license to operate autonomous taxis in Guangzhou province.

Some sources linked are subscription services.