MH Daily Bulletin: April 25

News relevant to the plastics industry:

At M. Holland

- M. Holland is the Headline Sponsor of the upcoming Injection Molding & Design Expo, a two-day tradeshow highlighting the latest technologies, materials, equipment and opportunities in injection molding. The show takes place in Detroit on May 25-26 and admission is free. Click here for more information.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices slipped Friday to end the week 5% lower after the IMF warned of further cuts to global growth forecasts.

- Oil futures fell further in mid-morning trading today, with WTI down 5.5% at $96.51/bbl and Brent down 5.3% at $101.00/bbl. U.S. natural gas futures were up 2.1% at $6.67/bbl.

- Active U.S. drilling rigs rose by two to 695 last week, up 58% from a year ago on the fifth straight week of gains.

- The U.S. kicked off a record-setting release from strategic reserves with the sale of 30 million barrels last Thursday, officials said.

- North American oil producers will boost spending by 40% this year, Baker Hughes predicts.

- LyondellBasell will close one of the largest refineries in the U.S. in Houston by late 2023 amid the firm’s previously announced exit from the refining business. The move comes amid an industry-wide reckoning over the future of gasoline use, with refinery closings since early 2020 having stripped 1 million bpd from the U.S. market.

- A near-record 120,000 bpd of gasoline imports will reach the U.S. West Coast this month as more domestic refiners shut down for scheduled maintenance. California already has the highest gasoline prices in the nation at $5.69 a gallon.

- Profits for Houston-based oilfield firms soared in the first quarter, including a 70% rise for Schlumberger and a 55% rise for Halliburton. Baker Hughes also posted a first-quarter profit but said supply constraints hampered earnings.

- Kinder Morgan’s first-quarter profit fell an unsurprising 53% compared to its lofty earnings following last year’s Texas Freeze, when the firm made $1 billion in a week.

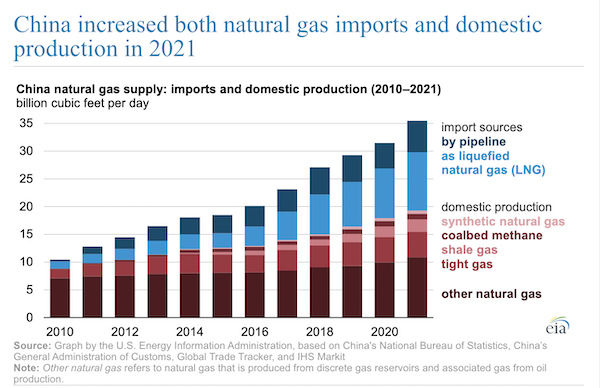

- Chinese demand for gasoline, diesel and aviation fuel is on track to slide 20% this month, analysts say, while spot prices for LNG headed to Asia fell 23% last week, a sharp reversal from last year’s record demand levels:

- British regulators dealt a blow to the proposed merger of Noble Corporation and Maersk Drilling over antitrust concerns.

- Local protests are throwing into doubt oil exploration plans for South Africa’s southwest coast.

- An explosion at an illegal refining depot in Nigeria killed over 100 people late Friday night.

- The cost of materials is hampering U.S. efforts to revive stalled LNG export projects as foreign demand for the fuel surges.

- Honeywell plans to invest $200 million in petrochemicals and green aviation fuel production in Egypt.

- More oil news related to the war in Europe:

- Explosions and large fires erupted at a Russian oil depot near the Ukrainian border, though no cause has been cited.

- Reports suggest oil firms are circumventing Western sanctions by trading fuel with up to 49.99% Russian origin, dubbed the “Latvian blend.”

- The Russia-Kazakh Caspian Pipeline Consortium resumed full exports Friday after more than a month of disruptions.

- The Netherlands said it plans to stop using Russian fossil fuels by the end of this year.

- Halliburton will further reduce operations in Russia as the impacts of sanctions spread.

- The European Commission affirmed last week that countries should continue to pay in euros and dollars for Russian gas.

Supply Chain

- Drought stricken New Mexico is experiencing dozens of severe wildfires, which have burned hundreds of buildings and forced thousands to evacuate, marking an early kickoff off for the U.S. Southwest’s wildfire season.

- Arizona will get 18% less water this year from the Colorado River as drought brings regional cutback agreements into play, likely impacting the state’s crop production.

- The transport of goods into Shanghai has ground to a halt due to trucking backups, shippers say. China already accounts for 30% of containerships stuck outside ports across the globe, as U.S. importers on the West Coast brace for a surge in delays once cargo volumes from Asia rebound.

- Chinese officials are sparing some key suppliers, such as Apple’s Foxconn, from new pandemic restrictions in the manufacturing hub of Zhengzhou.

- Despite just 40 ships waiting off the coast of Southern California — compared to over 100 at the height of the supply-chain crisis — it still takes an average of 111 days for goods to reach a U.S. warehouse from factories in Asia, more than double the pre-pandemic time.

- South Africa says it will need $120 million to fully restart operations at the flood-damaged port of Durban, which handles 60% of the nation’s shipments.

- The Port of Montreal could see rising cargo volumes as delays on the East Coast make the longer route more attractive.

- U.S. steelmakers saw better-than-expected profits in the first quarter as higher raw material costs allowed them to raise prices on finished products.

- With few cargo flights available between China and Mexico, Mexpress Transportation is having good success with its expedited air-road service that links air delivery to the U.S. with a border crossing to factories in Mexico by truck.

- U.S. rail regulators proposed a new rule that would expand the ability of shippers to compel rail service, including track-sharing among rivals, in emergency situations.

- U.S. regulators advanced plans to allow 18- to 20-year-old truck drivers on interstate routes as apprentices with firms that join the program.

- U.S. maritime regulators finished an initial round of meetings with ocean shippers last week in an ongoing investigation over export strategies alleged to have blocked U.S. exports, especially of farm goods.

- More rate hikes are in the works at the U.S. Postal Service, after the carrier raised rates on first-class parcels earlier this month.

- CSX started advancing future wage adjustments to workers in a bid to smooth contract negotiations that have dragged on for over two years.

- Regional carrier Alpine Air Express acquired Omaha-based Suburban Air Freight to expand its Western operations to more shippers, including DHL Express.

- Honda will cut production by 50% on two lines at a Japanese factory next month due to computer chip shortages.

- Hobbled by supply constraints, orders for Volvo’s heavy-duty trucks, sold under brands including Mack and Renault, fell 47% year over year in the first quarter.

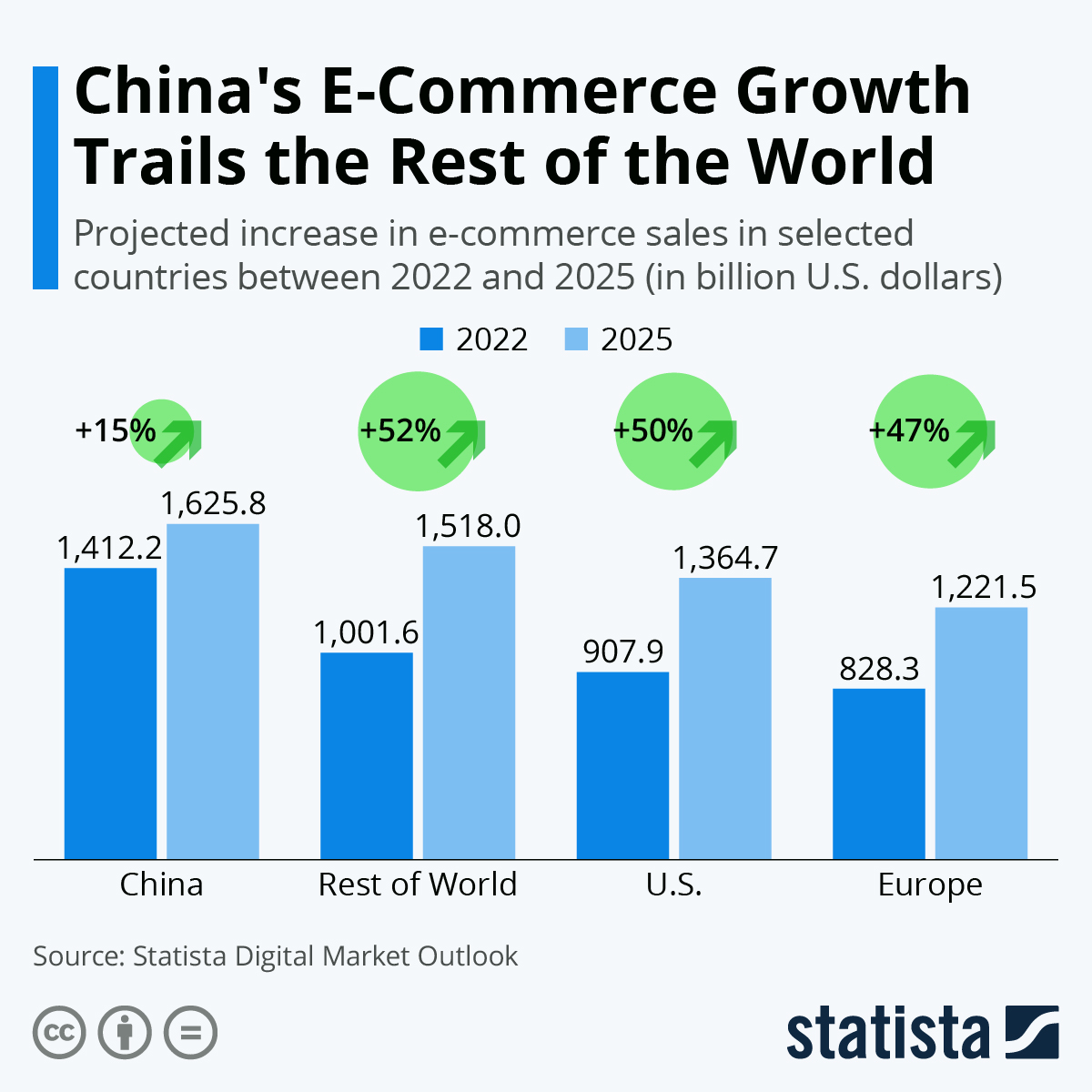

- New forecasts suggest China will see the worst e-commerce growth rates over the coming years:

- Investors are pumping capital into startups that make electric-powered cargo drones and helicopters.

- Agility Robotics raised $150 million in a funding round last week, boosting prospects that its intelligent, walking robots will reach more factory floors.

- The world’s first commercial vessel powered by hydrogen fuel cells will soon be servicing multiple stops along San Francisco’s waterfront.

- Indonesia, the world’s biggest palm oil producer, will ban all exports of cooking oil and its raw materials amid a domestic shortage.

- More supply chain news related to the war in Ukraine:

- Nestle’s efforts to keep its Ukrainian plants afloat include turning underground rooms into bomb shelters and adjusting production lines for frequent stops and starts.

- Ukraine is halting some rail exports due to the massive shift of cargo from Russia-occupied waters to overland transport.

- The U.S. administration blocked exports to Russian cargo airline Aviastar over sanctions violations.

Domestic Markets

- Daily new COVID-19 cases in the U.S. averaged 52,565 last week.

- The U.S. will keep proof-of-vaccination mandates for incoming travelers at land ports and ferry terminals, despite dropping the measure for air travel.

- S&P Global’s U.S. composite purchasing managers index fell to 55.1 this month from 57.7 in March, signaling a slowdown in manufacturing and services activity.

- Roughly one-fifth of prime-age working Americans expect to leave their job within a year for higher-wage positions, new survey results show.

- Many job jumping professionals are suffering buyer’s remorse upon finding their new jobs fall short of their lofty expectations. The “boomerang” rate of workers returning to their former employers rose to 4.5% in 2021 from 3.9% in 2019.

- American Express saw spending on its network rise 30% last quarter, a positive sign even as higher expenses impacted earnings.

- Verizon’s first-quarter profit fell 13% as the telecom giant warned that inflationary pressures are raising expenses and slowing new subscriptions.

- Electric vehicle makers had a blockbuster first quarter, with sales up in the double-digits for Tesla (+81%) and the EV units of Volkswagen (+65%) and Mercedes (+37%).

- Ford’s much-hyped all-electric F-150 will launch tomorrow. The company said the model is sold out for 2022.

- Over 85% of consumers under age 44 showed a willingness to pay more for sustainable packaging in a recent survey.

- Inspired by success at Starbucks and Amazon, more employees at Apple’s U.S. retail stores are looking to unionize.

International Markets

- China’s COVID-19 troubles are far from over, with a new outbreak cropping up in Beijing Saturday and virus fatalities more than tripling to a new record in Shanghai, where authorities began putting metal fences outside residential buildings to enforce lockdowns. New data shows Shanghai’s economy grew at a substantially slower pace than China’s overall GDP in the first quarter and less than half the rate of last year.

- New COVID-19 cases hit a record 4,126 in Taiwan on Saturday.

- Hong Kong will allow international travelers into the island for the first time in two years.

- The G-20 industrialized nations agreed last week to build a fund for pandemic preparedness, likely to be housed in the World Bank.

- Romania is seeking EU help in selling or donating COVID-19 vaccine doses, as demand stays low and millions more doses are set to arrive this year.

- More news related to the war in Europe:

- Russian authorities stopped publishing data on government debt, trade statistics and oil production, likely an effort to hide the cost of Western sanctions.

- The IMF further downgraded global growth forecasts if Western nations expand sanctions against Russia. Germany cut its projected GDP growth this year from 3.6% to 2.2%.

- Over 8,000 luxury vehicles destined for Russia are trapped at Belgium’s Port of Zeebrugge due to sanctions.

- Europe’s next round of sanctions could include removing one of Russia’s largest banks from the Swift global payment network.

- Big auditing firms are struggling to disengage with Russia, facing the conundrum of condemning the nation’s invasion of Ukraine while forced to serve companies still doing business there.

- Renault plans to separate its electric vehicle (EV) unit into a publicly listed firm by the second half of 2023. The French automaker is also considering a sale of its 43% stake in Nissan to help fund the transition to EVs.

- Honda plans to create three new platforms for electric vehicles by 2030, including one developed with GM.

- Audi’s chief executive said global automakers should stop producing gas-powered vehicles by 2040.

- Luxury electric vehicle startup Lucid is putting desk employees on the factory floor and ordering parts from Amazon in a scramble to meet early production targets, former employees say.

- India is considering rules to mandate swappable batteries for scooters, motorcycles and rickshaws.

- Last summer was Europe’s hottest on record, with temperatures about 1°C above the average for the past three decades.

- Taiwan expects to reach its 2050 zero-carbon goals with a mixture of 60% renewables, 20% thermal and 10% hydrogen.

Some sources linked are subscription services.