COVID-19 Bulletin: September 28

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose for a fifth straight session Monday amid concerns over tight global fuel supplies. Crude futures were lower in morning trading today, with the WTI off 1.0% at $74.69/bbl and Brent down 1.2% to $78.59/bbl. Natural gas futures jumped 2.5% to $5.85/MMBtu.

- Natural gas and power prices are surging to all-time highs in the EU, a result of limited natural gas imports from Norway and Russia and higher costs associated with a government-driven shift toward cleaner fuel sources.

- The U.K. took emergency steps to allow oil companies to help each other stock up on gasoline and diesel, as panic buying the past week left up to 90% of fuel pumps dry in some of the nation’s largest cities. The shortages are beginning to materially impact small businesses, key workers and taxi drivers, as military personnel were put on standby to potentially help prop up the nation’s supply chains.

- In its 2021 Energy Outlook, French oil major Total forecast global oil demand will peak before the end of the decade as more nations crack down on fossil fuels and promote cleaner power in transport and industry.

- Coal stockpiles in India, one of the world’s largest consumers of the fuel, have fallen to their lowest levels since 2017 amid surging natural gas prices that have required more coal-powered plants to be fired up.

- Local Chinese officials are asking people to consume less electricity amid a shortage of coal and gas rippling through the nation’s economy. As much as 44% of the nation’s industrial output has been affected, including dozens of semiconductor-related firms and several key suppliers to Apple and Tesla.

- The plastics industry is opposing a proposal in the Senate Finance Committee that would impose up to a 20-cent-per-pound excise tax on virgin resin to encourage recycling and help pay for the $3.5 trillion spending bill pending in Congress.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A wave of COVID-19 Delta-variant cases in Malaysia, Vietnam and the Philippines is causing production delays at factories that cut and package semiconductors, exacerbating the global shortage.

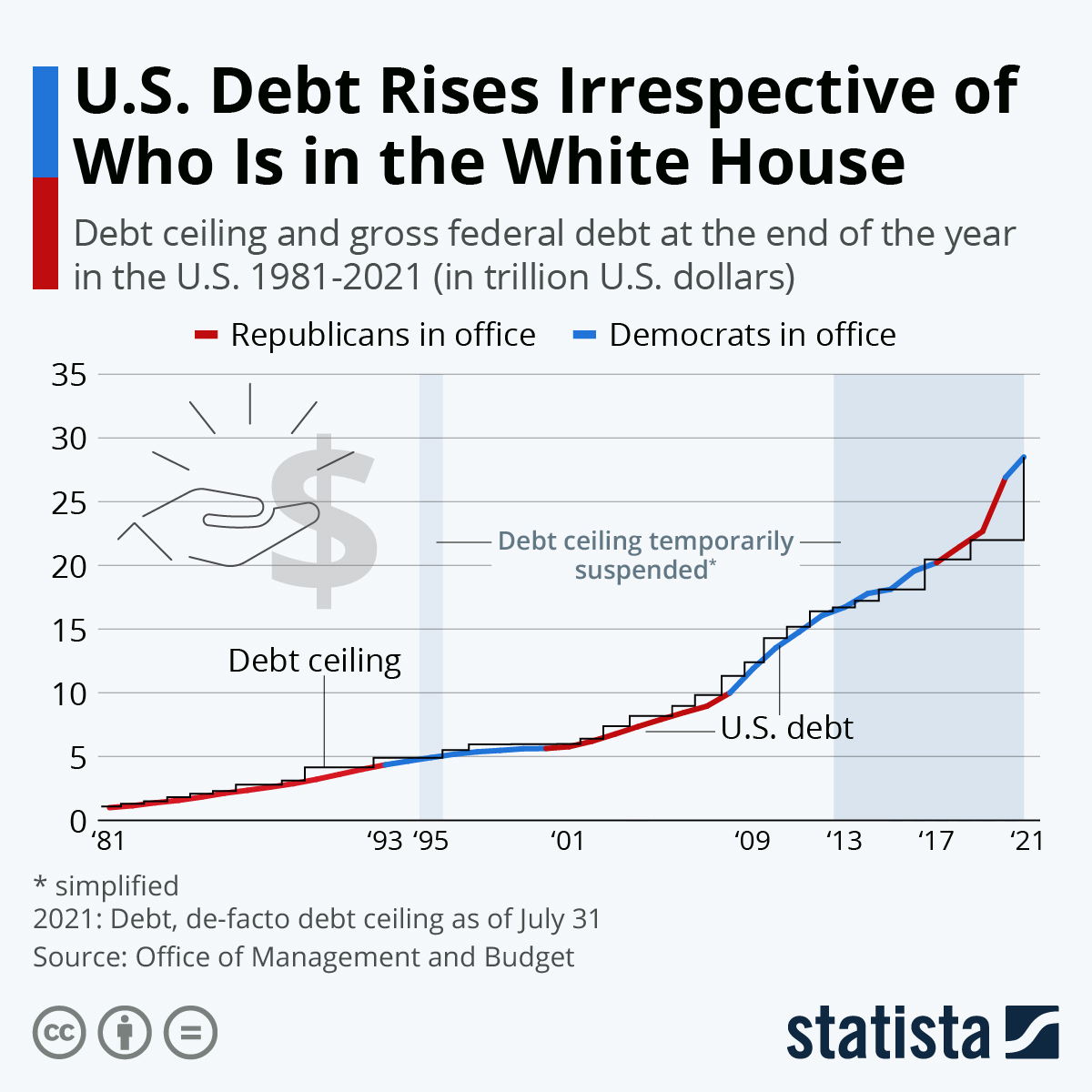

- With an emergency bill failing to advance out of the U.S. Senate Monday evening, the stakes are rising for congressional lawmakers ahead of Thursday’s deadline to fund the government and raise the country’s borrowing limit.

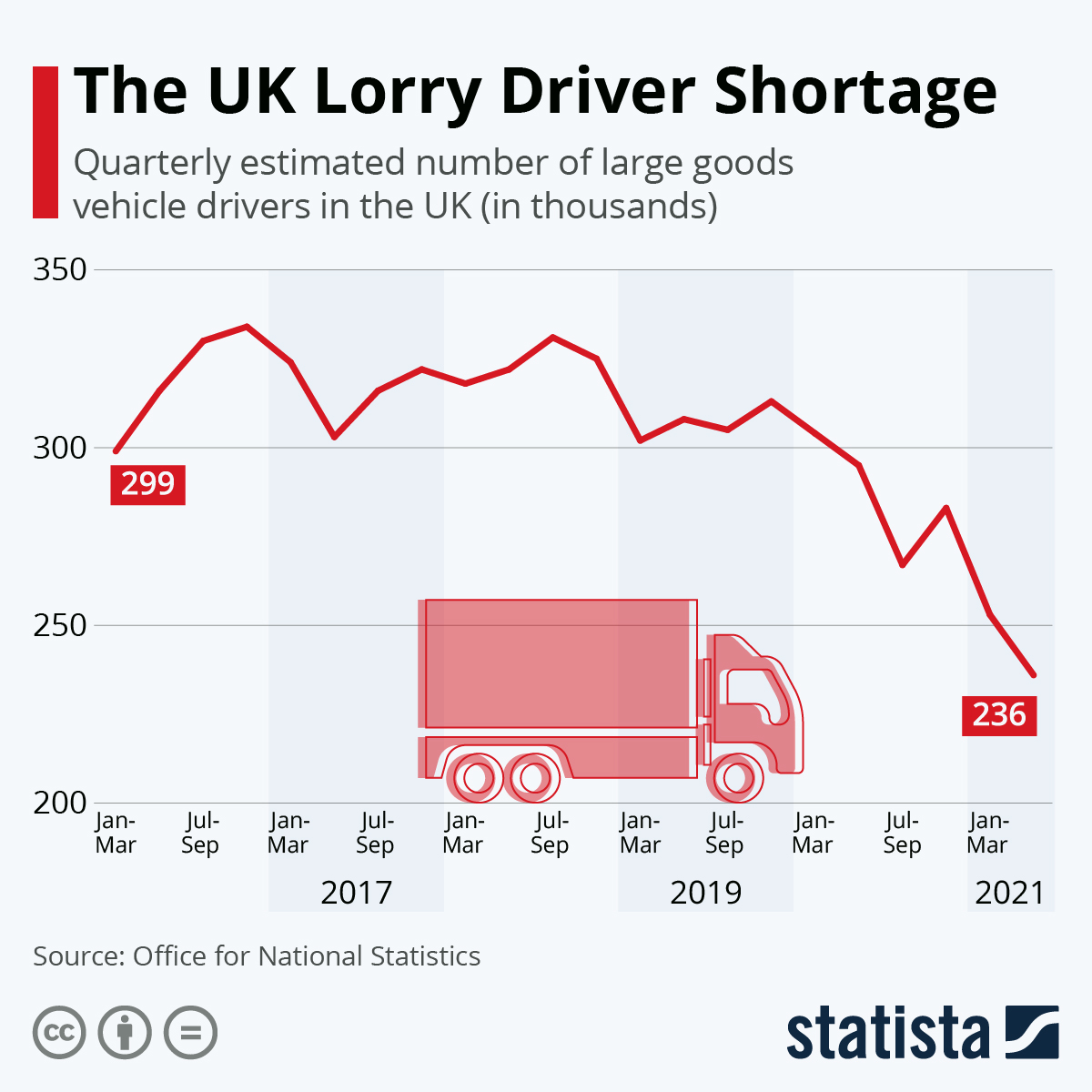

- Over 98% of drivers for British logistics provider Yodel voted to strike, completely halting the firm’s deliveries to retailers, supermarkets and numerous other businesses. The news followed an announcement by the British prime minister to authorize temporary visas for foreign truck drivers to ease a shortage affecting key products.

- A shortage of British warehouse workers is pushing up average wages more than 30% as logistics firms broaden recruitment incentives.

- For the second week, spot container freight rates to both the U.S. East and West coasts eased from recent record highs on the Freightos Baltic Index, a positive sign for beleaguered U.S. shippers.

- Congestion near southern California ports is straining nearby warehouse capacity to the limits, prompting freight to be sent inland earlier and pushing up spot rates faster than expected out of the Los Angeles region.

- Bulk carrier Genco Shipping has requested approval to carry containers on vessel decks and inside cargo holds.

- Supply chain delays and strong demand have pushed back expected deliveries of Apple’s newest iPhone by several weeks.

- Average annual salaries for independent truck owner operators surpassed $70,000, a record.

- China’s pork prices have fallen 56% since January following two years of sustained growth.

- U.S. soybean exports rose to a six-month high last week while corn shipments rose to their highest in a month, as agricultural exports continue to recover following disruption caused by Hurricane Ida.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Here are updates from our Logistics team:

- Port congestion continues to be very problematic, delaying the delivery of imported containers.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand is exceeding supply.

- Bulk trucking capacity is very tight as demand is exceeding supply.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- The nation recorded 185,088 new COVID-19 infections and 2,394 deaths yesterday.

- COVID-19 vaccinations in the U.S. are slowing, with the seven-day average dropping to 231,695, 31% less than last week and the lowest rate on record.

- The U.S. president and senate minority leader got COVID-19 booster shots yesterday.

- Reported COVID-19 cases in children eased to 206,864 last week but rose to nearly 27% of total infections. Fifty-five percent of parents of children under age 12 say they will get their kids inoculated when a vaccine is available.

- Schools nationwide are grappling with bus driver shortages, prompting districts in Ohio to request help from the National Guard to fill in for COVID-19-infected or quarantined bus drivers and a superintendent in one Minnesota district to get a bus driver’s license to fill in.

- Texas surpassed 4 million COVID-19 cases since the start of the pandemic, second only to California, as the state currently averages the highest daily case and hospitalization numbers in the U.S.

- Cold weather could deliver a COVID-19 surge in the Northeast rivaling that gripping the South, the nation’s leading infection disease official warned.

- Hospitals and nursing homes are bracing for deepening staff shortages as deadlines loom for vaccine mandates.

- Numerous states in the U.S. South are reporting upticks in stillbirths linked to COVID-19 infections.

- Nearly 75% of New York City municipal workers have received at least one dose of a COVID-19 vaccine, with the lowest rate among first responders such as firefighters and police.

- Pfizer has begun clinical testing of a COVID-19 pill that would prevent infection for those potentially exposed to the virus.

- The Harvard Business School moved all first-year and some second-year MBA students to full remote learning following a steady rise in COVID-19 cases.

- The U.S. treasury secretary said the government could run out of funds on Oct. 18 after the Senate failed to raise the debt ceiling this morning.

- New orders for U.S. durable goods rose 1.8% to a record $263.5 billion from July to August, with a 5.5% increase in orders for transportation equipment leading the rise. Core capital goods orders increased 0.5% for the same period, a positive trend.

- The U.S. secretary of commerce indicated she will attempt to strengthen business ties between the U.S. and China despite ongoing problems with Chinese subsidized exports and intellectual property theft.

- U.S. home construction rose 3.9% from July to August but was down from the same time last year due to continued supply chain disruptions for key building materials.

- On average, would-be U.S. homebuyers now must save up for eight years for the typical down payment on a home, up from seven years before the pandemic.

- Roughly 3.5 million mothers with school-age children have lost their jobs, taken leave or left the labor market since the start of the pandemic, prompting more U.S. businesses to boost flexibility and child-support measures. In a McKinsey study, one-third of professional women say they have considered leaving or downshifting their careers over the past year.

- The Federal Housing Finance Agency extended for the fourth time its forbearance programs for multifamily properties, which were scheduled to expire at the end of this month.

- U.S. homicides rose nearly 30% in 2020 from the prior year to 21,570, the largest single-year increase ever.

- Airlines are demanding virus-fighting fabrics for seats to reduce the time and cost of cleaning aircraft.

- United Airlines was fined $1.9 million by the U.S. Transportation Department for excessive tarmac delays.

- GM threw its support behind proposed emissions reduction goals through 2026 outlined by the U.S. EPA last month.

- Ford recalled more than 30,000 2021 electric Mustang sport utility vehicles over inadequate windshield bonding with the vehicles’ panoramic glass roof.

- Ford announced a joint venture with South Korea’s SK Innovation to build an $11.4 billion electric-truck assembly plant and three battery plants in the U.S., the largest investment in Ford’s history.

- The SEC is asking more companies to document their impact on climate change while the staff prepares recommendations for mandatory climate disclosures in annual 10K reports.

International Markets

- Russia reported 852 COVID-19 deaths yesterday, a pandemic high.

- With more than 500 COVID-19 infections per 100,000 population, Norway’s and Bulgaria’s COVID-19 status was raised to “Level 4: Very High“, the CDC’s highest. The CDC also elevated its advisory status for Singapore from Level 2 to Level 3 and Hong Kong from Level 1 to Level 2.

- Japan is lifting its COVID-19 state of emergency nationwide this week amid falling infection rates.

- More than 1 million children globally have been orphaned by COVID-19 deaths of parents.

- Deaths from unknown causes increased 30% in Brazil last year, evidence of a severe underreporting of COVID-19 fatalities for the nation with the world’s second-largest virus death count behind the U.S.

- Australian authorities unveiled plans to gradually reopen locked-down Sydney starting Oct. 11, with plans for some form of proof of COVID-19 vaccination required to access most activities.

- With nearly 85% of its residents inoculated, Portugal is winding down its military-led team set up eight months ago to lead the nation’s vaccination program, with most pandemic restrictions to be lifted Friday.

- Lending to euro zone companies slowed last month, extending a downtrend and raising concerns among policymakers about a bloc-wide reluctance to extend credit.

- Europe’s advancing shift to electric vehicles is expected to require large investments in “reskilling” programs in the auto industry.

- U.S. officials will tour Latin America this week to scout infrastructure projects slated for possible investment in coming years.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.