COVID-19 Bulletin: September 9

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose roughly 1% Wednesday as Gulf Coast producers struggle to restart operations after Hurricane Ida, with nearly-three quarters of regional production (1.4 million bpd) remaining offline, totaling about 12.5% of the nation’s output.

- Some 17.5 million bpd of oil has been lost to the market since Hurricane Ida struck more than a week ago, one of the costliest disasters to U.S. offshore energy since Katrina in 2005.

- Diesel fuel hit its highest price level in three years in the wake of Hurricane Ida.

- Energy prices were mixed in mid-day trading today, with WTI down 0.3% to $69.11 bbl, Brent down 0.4% to $72.34/bbl and natural gas higher by 0.8% to $4.95/MMBtu.

- Mexico cut its forecast for oil production at state-owned Pemex to 1.83 million bpd next year while reducing its profit-sharing duty with the government from 54% to 40%, the latest fallout following two recent offshore accidents that knocked out a quarter of the company’s output.

- Oil demand in China, the world’s top energy consumer, is expected to be 13% higher in the fourth quarter than in the same period in 2019, as demand also surpasses pre-pandemic levels in several other nations.

- Russian oil shipments to the U.S. are rising in the wake of Hurricane Ida, pushing prices higher for medium sour grades like those produced in the Gulf of Mexico.

- Royal Dutch Shell is considering mandating COVID-19 vaccines for employees and firing those who do not comply.

- LyondellBasell plans to sell its 263,776/bpd refinery along the Houston ship channel.

- The U.S. now gets 3% of its power from solar sources, a share that could increase to 44% by 2050 with the help of more than $550 billion in needed investment, officials say.

- Plastic “nurdles,” pellets likely lost during transfer or transit, are a growing problem for the Great Lakes and their surrounding lakes and tributaries.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Powerful aftershocks from Tuesday’s 7.0-magnitude earthquake in Mexico rippled through the nation yesterday, triggering more landslides, gas leaks and infrastructure damage.

- High-level talks are set to begin today between the U.S. and Mexico over boosting investment in trade infrastructure along the border.

- Vessel operations at the Port of New Orleans have been fully restored following shutdowns caused by Hurricane Ida.

- New cranes and a plan to deepen the Port of Boston’s ship channel could draw larger ships to the eastern U.S. gateway, helping ease a global backlog of vessels and containers.

- Business activity in the logistics industry continued its historic growth stretch in August, new data shows.

- Shipyards are raising prices for new and used vehicle carriers, with at least $4.4 billion spent so far this year on newbuilds.

- Transportation capacity shrank in August for the 15th consecutive month, even as demand and utilization hit new highs.

- Ninety percent of supply chain companies responding to a recent survey are recruiting more employees for the holiday season, while nearly half of respondents are raising wages to attract and retain workers, even as warehouse and storage hourly earnings are at an all-time high.

- “Athleisure” maker Lululemon reported better-than-expected quarterly financials yesterday, as COVID-19 closures at major Vietnamese retail factories have yet to hit the company’s bottom line.

- Nvidia, the world’s largest graphics and AI chip maker, is seeking European antitrust approval for its $54 billion takeover of British chipmaker Arm, whose customers include Qualcomm, Samsung and Apple.

- Revenue in Old Dominion Freight Line’s less-than-truckload unit rose nearly 30% in August on the back of a 10.9% rise in daily volumes.

- Proposed legislation to lower the minimum age for driving big rigs on interstates to 18 is generating controversy within the trucking industry.

- A&R Logistics rebranded itself as “Quantix” to unite its various logistics brands from a spate of acquisitions.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Domestic Markets

- The U.S. reported 176,710 new COVID-19 cases and 2,146 fatalities yesterday.

- More than 95% of U.S. counties are experiencing “high” rates of COVID-19 transmission, signifying there were at least 100 infections per 100,000 of population.

- Nearly 252,000 children tested positive for COVID-19 in the past week as schools reopened, compared to a weekly infection rate of 8,400 in June.

- A record-high 2,396 children were hospitalized with COVID-19 across the U.S. as of Wednesday. Children now make up roughly a quarter of all new weekly infections in the nation.

- The President plans to issue an executive order requiring all federal workers and contractors to be vaccinated for COVID-19.

- COVID-19 cases appear to have crested and begun declining in several of the most recent hard-hit states including Arkansas, Mississippi, Missouri, Alabama and Florida.

- Hospitals in Kentucky are at or near capacity, with COVID-19 occupancy at an all-time high and hospitalizations among children reaching critical levels.

- COVID-19 hospitalizations in New York are up 206% since Aug. 1 as virus fatalities reach a four-month high.

- Hundreds of National Guard soldiers were sent to Tennessee to assist overburdened hospitals with a flood of COVID-19 patients.

- Breakthrough COVID-19 infections among fully vaccinated people account for roughly 40% of new cases in Massachusetts, while unvaccinated people still make up most of the state’s virus hospitalizations.

- Soon after a circuit court judge allowed Florida school districts to enforce mask mandates, the state’s governor filed an appeal to overturn the decision and reinstate his executive order barring mask mandates in the state.

- Several South Carolina cities are defying a state ban on local mask mandates by requiring masks for indoor activities.

- Louisiana hospital workers are experiencing unprecedented stress as they grapple with the surge in COVID-19 infections and recent trauma from Hurricane Ida.

- The Department of Agriculture will distribute $700 million in grants to farm and food workers to defray pandemic-related costs.

- The Seattle Seahawks will require all home-game attendees over the age of 12 to be vaccinated against COVID-19.

- Tulane University will require proof of vaccination or a negative test for admittance to its upcoming football home opener.

- The 2021 Macy’s Thanksgiving Day parade will return in-person with full crowds, organizers said.

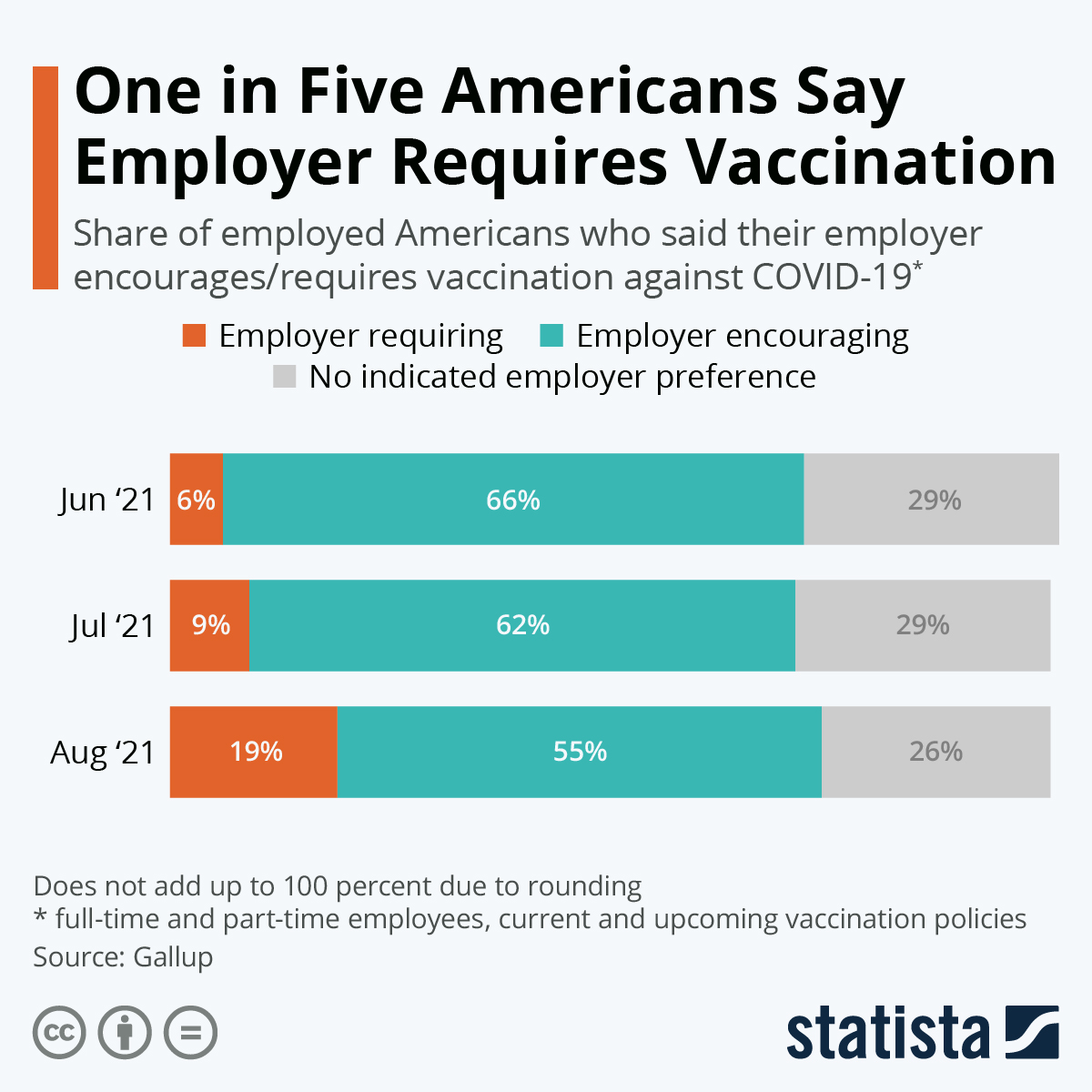

- Twenty percent of Americans say their employers now require vaccines:

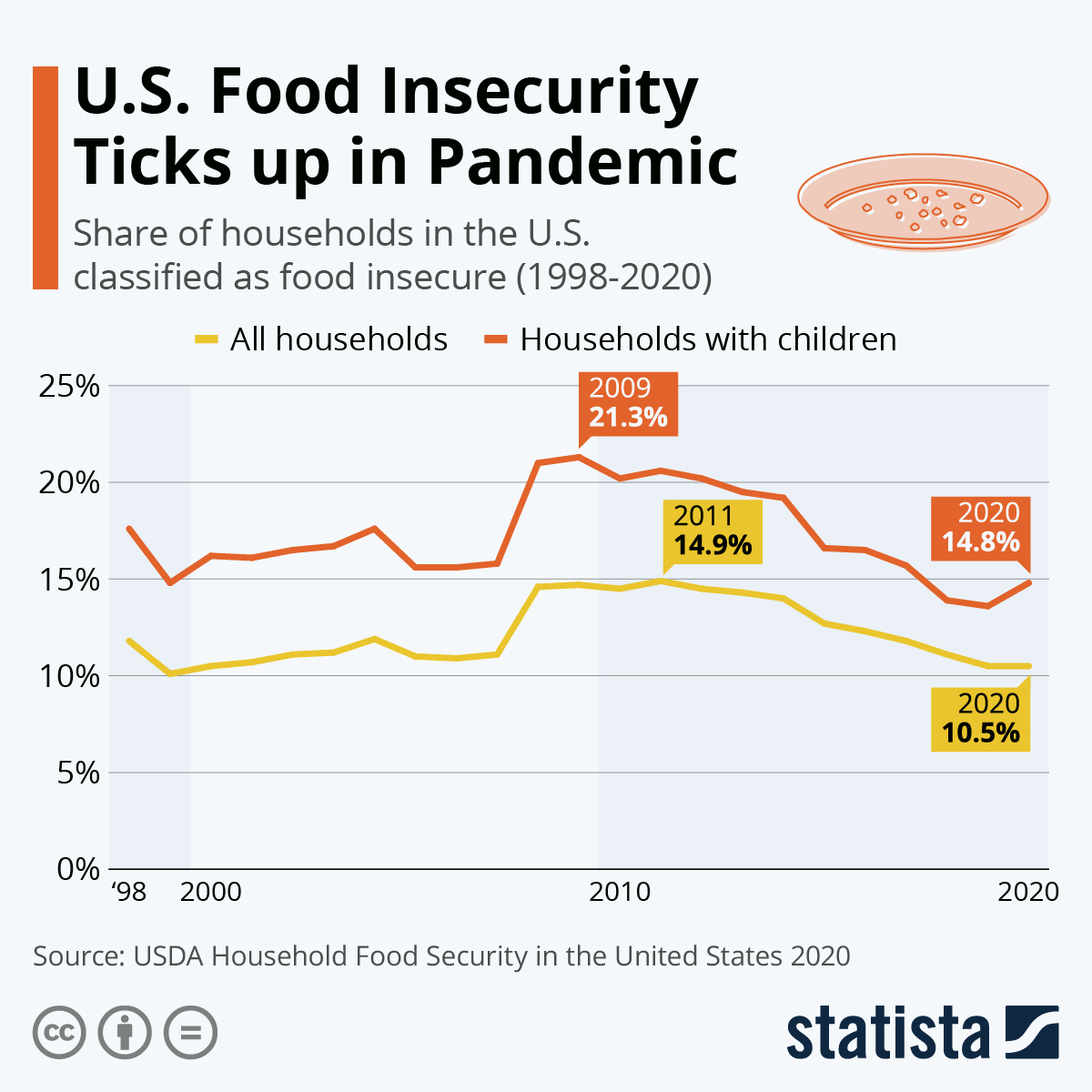

- Food insecurity among American families increased during the pandemic:

- United Airlines extended its COVID-19 vaccination mandate deadline by five weeks, while at the same time increasing consequences for not getting vaccinated, including temporary unpaid leave for those who refuse shots under certain exemptions.

- American Airlines cut its revenue forecast for the third quarter due to the rise in COVID-19 infections, now expecting to be down as much as 28% from the comparable period in 2019. Delta, JetBlue, Southwest and United also indicated bookings are slowing and cancellations are increasing.

- U.S. economic growth slowed over the summer due to spreading COVID-19 cases, Federal Reserve anecdotal evidence suggests, with losses largely concentrated in dining, travel and tourism. The nation faces further slowdowns in September, with businesses and consumers adjusting to renewed mask mandates, travel restrictions and delayed office openings.

- First-time jobless claims fell to 310,000 last week, a pandemic low, from 345,000 the week prior.

- U.S. job openings jumped to a record high of 10.9 million at the end of July, suggesting last month’s slowdown in hiring was mostly the result of a severe labor shortage.

- U.S. bank profits slipped 8.3% in the second quarter from the third as firms slowed the rate of reversing loan-loss reserves built up during the pandemic. Profits were still up 281% from the same time last year.

- Home mortgage applications fell to a two-month low last week while interest rates remained largely unchanged.

- Several Federal Reserve officials suggested the bank could start trimming large monthly asset purchases by year’s end, despite disappointing job growth in August amid rising COVID-19 cases.

- The White House is funneling $1.4 billion to small meat producers and workers to reduce industry concentration and bring down domestic food prices.

- Amazon is developing a new point-of-sale system to be sold to third parties, the tech giant’s latest entry into a new market dominated by established players including Shopify and PayPal.

- Li-Cycle Holdings announced plans to build a lithium battery recycling facility in the U.S. Southeast, a bid to boost circular economies in the domestic EV market.

- Energy storage startup Energy Vault is going public in a roughly $1.6 billion deal, enabling the company to boost investment in technology to store renewable energy electricity during off-times.

- Ford announced the hiring of a top Apple executive to oversee its advanced electric-vehicle technology.

- California is pursuing legislation outlawing the use of recycling symbols on products that are not recycled.

International Markets

- The White House plans to call a global summit on COVID-19 later this month to better calibrate the world’s response to the pandemic.

- Canada’s Atlantic Nova Scotia province will require proof of COVID-19 vaccination for non-essential activities.

- Switzerland will require proof of COVID-19 vaccination for people to enter bars, restaurants and gyms.

- Canada’s WestJet Airlines announced plans to fire employees who do not meet the company’s upcoming deadlines for receiving COVID-19 vaccines.

- Australia’s Qantas Airlines will ban persons unvaccinated against COVID-19 from international flights.

- The European Central Bank announced it will pare back bond purchases despite rising COVID-19 infections and growing economic uncertainty.

- Japan’s 1.9% GDP growth in the second quarter beat expectations, reflecting the nation’s gradual recovery from a COVID-induced slump.

- Germany is extending pandemic economic aid for businesses until the end of the year.

- Mexico raised its full-year economic growth forecast to 4.1% after suffering the largest recession in almost a century last year, when GDP shrank 8.5%. Officials also proposed a slight loosening of the president’s austere fiscal policies imposed during the pandemic.

- Chinese producer prices rose to a 13-year high in August, a 9.5% increase from the same time last year.

- Philippine Airlines filed for bankruptcy yesterday, the result of prolonged travel restrictions and significant declines in tourism to the airline’s home country.

- A Russian autonomous vehicle firm will begin testing driverless taxis in Moscow later this year.

At M. Holland

- During our latest Plastics Reflections Web Series event, panelists from M. Holland, BPI, LyondellBasell and MTS Logistics discussed how global supply chain complexities are impacting the plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.