COVID-19 Bulletin: September 7

More news relevant to the plastics industry:

Some sources linked are subscription services.

Hurricane Ida

- At least 52 people have died from Hurricane Ida’s destruction in the U.S. Northeast. The storm’s historic rainfall caused more than $50 million in damage in New York, as the White House approved a disaster declaration for New Jersey, unlocking federal aid for emergency assistance and cleanup efforts. Power remained out for dozens of thousands of residents over the weekend.

- Southeastern Louisiana and southern Mississippi are under extreme heat advisories and flash flood watches in the wake of Ida, while more than 500,000 Louisianans remain without power a week after the storm. The death toll in Louisiana, Mississippi and Alabama rose to a combined 16.

- Power has been restored to roughly half of New Orleans residents, as commercial flights resumed from the city’s main airport.

- Nearly 350 oil spills have been reported in the U.S. Gulf of Mexico, a result of old pipelines damaged by the storm.

- Hurricane Larry, which strengthened into a Category 3 over the weekend, is expected to miss the U.S. as it moves up the Atlantic this week, while still causing major swells to hit the East Coast.

- Falling oil prices on Friday were limited by significant remaining production shutdowns across the U.S. Gulf Coast. As of Monday, over 80% (1.5 million bpd) of regional output was still offline, a larger initial hit to the industry than Hurricane Katrina in 2005.

- New York’s Financial Services Department announced it would quicken its process of approving independent insurance adjusters from outside the state to help with an expected increase in claims stemming from Hurricane Ida.

Supply

- Oil prices closed 2% higher Thursday on rebounding optimism in the U.S. economy and a larger-than-expected drop in crude inventories.

- Oil prices fell roughly 40 cents Monday after Saudi Aramco announced it would cut October selling prices for all crude grades sold to Asia, its largest buying region, by at least $1 per barrel.

- In mid-day trading today, WTI was down 1.4% to $68.34/bbl, Brent was off 0.6% to $71.76/bbl and natural gas was down 2.6% to $4.59/MMBtu.

- The Nord Stream 2 gas pipeline from Russia to Germany will start operations in the next few days, a Russian official said, after the final piece of pipe was attached over the weekend. The line is expected to double Russian supplier Gazprom’s export capacity to Europe.

- Several LNG buyers with long-term contracts are asking for more volume from their suppliers in a bid to avoid a roughly 25% premium on spot market prices.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Thousands of evacuees began returning to California’s South Lake Tahoe as firefighters gained control over the 216,000-acre Caldor Fire, now 44% contained. The state’s Monument Fire surpassed 183,000 acres Sunday with 37% containment, while the Dixie Fire topped 900,000 acres with 57% containment. Blazes in the state’s northern region now cover more than 1.4 million acres.

- After a four-year hiatus, the U.S. and Mexico will resume formal discussions on a range of topics, including strengthening supply chains between the two nations.

- In the latest news about the global semiconductor shortage:

- BMW’s CEO publicly shared forecasts that supply chains, particularly for semiconductors, will remain tight well into 2022.

- Daimler’s CEO extended projections for a shortage of semiconductor chips into 2023.

- Honda, Nissan and Toyota reported plunging sales for August in China, the world’s largest car market, due to the chip shortage.

- New car sales in the U.K. fell by 22% in August.

- Volvo suffered a 10.6% sales drop in August compared to a year ago, as the company warned of further production hits in the second half of the year.

- Intel plans to invest $95 billion in new chipmaking capacity in Europe.

- China’s Semiconductor Manufacturing International announced plans to invest $8.87 billion into a new plant in Shanghai.

- Major U.S. ports handled the equivalent of 2.37 million imported containers in August, the most for any month since records dating back to 2002, as the nation approaches a new yearly all-time high.

- U.S. port leaders expect the congestion at ports to extend well into 2022.

- South Korea’s HMM reached an agreement with seafarers and office staff over contract wages, averting a potentially disruptive employee strike at the nation’s largest shipping line.

- Two major international shipping groups jointly proposed a global levy on carbon emissions from ships in a bid to boost the industry’s shift toward cleaner fuels.

- A pair of Russian firms are building the country’s first duel-fuel LNG and diesel icebreaker vessel in preparation for greater shipping volumes on the under-utilized Arctic trade route.

- Hong Kong’s Orient Overseas Container Line submitted orders for the construction of 10 16,000-TEU container ships.

- A shortage of beer at U.K. pubs is the latest result of a severe post-Brexit shortage of truck drivers.

- Warehousing and courier jobs accounted for 17.1% of the U.S.’s overall job gains from July to August, an increase of roughly 40,000 positions.

- Aluminum prices rose to their highest levels in 10 years following a military coup in mineral-rich Guinea Monday. Prices also shot up for lithium, a key component of electric vehicle batteries, amid expansion in global electric vehicle markets.

- BMW launched a new sports car production line at its central Mexico plant, with plans to export the vehicles across North America and Europe by the beginning of next year.

- Worker shortages are hampering global food production, an inherently labor-intensive industry.

- U.S. grocery stores are prepping for a shortage of snack foods following a weeks-long and expanding strike among employees at Mondelez International.

Domestic Markets

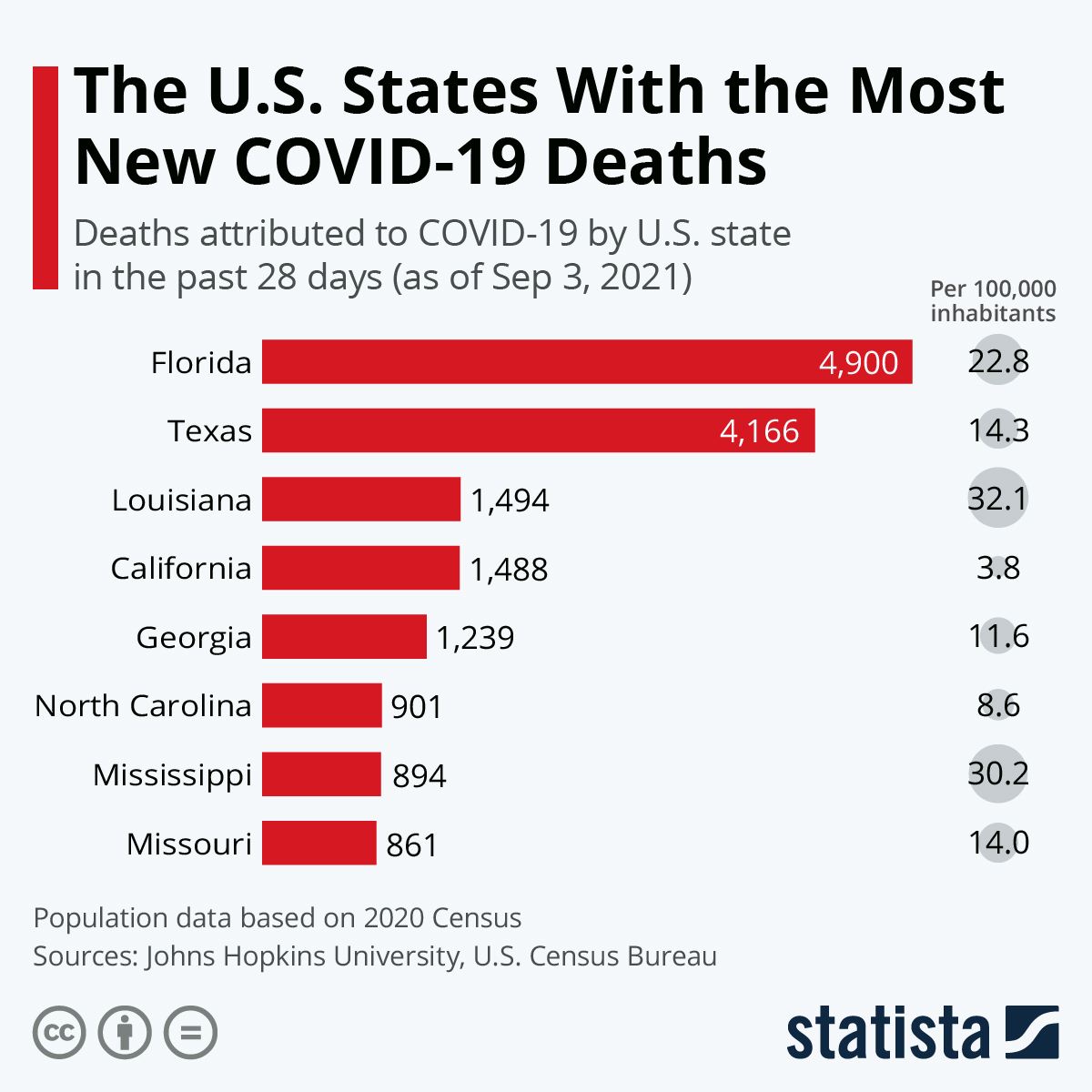

- The U.S. has surpassed 40 million COVID-19 cases since the start of the pandemic, the most in the world, with 73,331 new infections and 530 virus fatalities added Monday.

- Daily COVID-19 infections are running 316% higher and hospitalizations are up 158% from Labor Day weekend last year.

- Daily U.S. COVID-19 deaths jumped 131% over the last month.

- Federal health officials have asked the White House to scale back its plan to offer COVID-19 boosters to the general public later this month, saying not enough data has been collected on who should get the shots. Officials suggest booster doses of Pfizer’s vaccine will be approved by the FDA by Sept. 20, while approval of Moderna’s vaccine booster may come later.

- With at least 10 states reaching new highs for COVID-19 hospitalizations last week, a growing number of hospitals have been forced to employ the last-resort measure of rationing care.

- More than 1,000 schools in 35 states have been shut down due to COVID-19 outbreaks so far this school year.

- Texas doctors are asking the state’s governor to reverse a decision banning vaccine and mask mandates in schools, as 282 children remain hospitalized with COVID-19 throughout the state. Meanwhile, an 11-county region that includes Austin has completely run out of staffed ICU beds due to surging virus patients.

- Alabama hospitals had a negative 92 ICU beds Sunday, with more than half of ICU beds occupied by COVID-19 patients.

- California faces a shortage of more than 40,000 nurses, a years-long trend exacerbated by the stresses of the pandemic and fresh vaccine requirements.

- COVID-19 hospitalizations in Florida dropped nearly 10% from a week prior to 14,886 patients, the state’s first positive virus trend in weeks.

- Pediatric COVID-19 cases are rising in Missouri, with between 10 and 14 infected per day compared to just 11 per day in early June.

- Roughly 1,900 of Hawaii’s 19,000 COVID-19 cases over the past month were among fully vaccinated people.

- The “Mu” variant of COVID-19 first discovered in Colombia, which appears more infectious and vaccine resistant than Delta, has been detected in 49 U.S. states and some 48 countries.

- A widespread fear of needles among Americans may further hinder the nation’s ability to reach herd immunity from COVID-19, new research suggests.

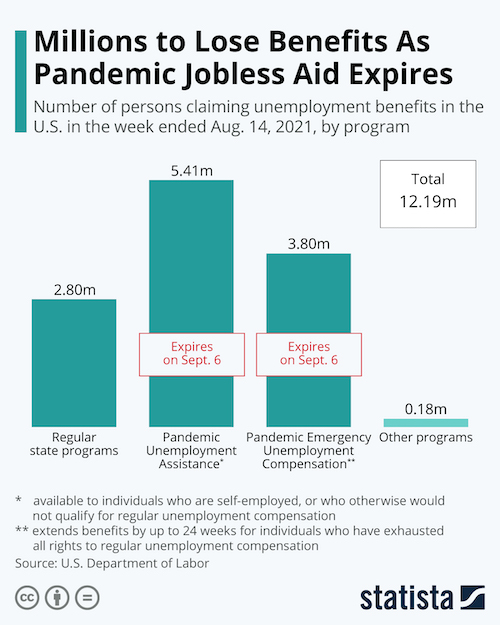

- The last of federal pandemic unemployment support expired, impacting 11 million Americans.

- Increased labor costs and worker shortages caused by the pandemic is spurring new investments in automation in the service sector, threatening some less-skilled jobs that many low-income workers depend on.

- U.S. imports fell 0.2% from June to July, led by a 3.4% decline in consumer goods imports and a 22% decline in shipments of toys, games and sporting goods.

- U.S. hotels and airlines are downgrading forecasts of a rebound in business travel this fall, as surging COVID-19 cases push back many return-to-office plans.

- Deliveries of Boeing’s 787 Dreamliner will remain halted until late October following a rejected proposal to provide in-house inspections of the aircraft. Ongoing safety problems with the aircraft have given many customers the opportunity to back out of deals — most recently Ryanair, the company’s largest buyer outside the U.S.

International Markets

- New COVID-19 cases in the U.K. rose 12% week over week, with the nation reporting 41,192 new infections and 45 fatalities Monday.

- The U.K. is sending 4 million doses of Pfizer’s COVID-19 vaccine to Australia, where infections are expected to peak in the nation within two weeks.

- New Zealand extended strict stay-at-home orders in its largest city of Auckland for one more week while lifting restrictions for the rest of the nation amid declining cases of COVID-19. The nation reported its first COVID-19 death in more than six months over the weekend.

- Japan is extending emergency curbs in and around Tokyo until the end of September after reporting more than 16,000 new COVID-19 cases Friday, as the nation’s fifth virus wave continues unabated.

- The Philippines recorded an all-time high of 22,415 new COVID-19 infections Monday.

- With one of the world’s best COVID-19 vaccination rates, Singapore will maintain loose pandemic restrictions despite a recent rise in cases as part of its new “living with COVID” strategy.

- Vietnam is prepping to loosen restrictions in Ho Chi Minh City next week.

- Guatemala is increasing pandemic restrictions following a recent surge in COVID-19, as less than 10% of the nation’s population is vaccinated.

- Brazil’s health regulator suspended the use of China’s Sinovac COVID-19 vaccine over production concerns.

- A new law in Brazil would break certain medical patents during times of public emergency, a controversial measure aimed at boosting COVID-19 vaccine production.

- The end is in sight for a legal battle over delayed vaccine deliveries from AstraZeneca to the EU, with the bloc expected to receive 300 million more COVID-19 shots by March 2022.

- German industrial orders surged 3.4% in July, the largest monthly gain since 1990.

- Economists expect Chinese export growth slowed in August amid port congestion caused by small but frequent COVID-19 clusters.

- Australia’s economy has reentered a recession as ultrastrict COVID-19 lockdowns hamper economic activity in several states. The nation is expected to post one of its largest GDP contractions on record in the third quarter.

- Latin American central bankers in Brazil, Chile, Mexico, Peru, Paraguay and Uruguay have raised interest rates to counter rising inflation, with Colombia expected to follow soon.

At M. Holland

- During our latest Plastics Reflections Web Series event, panelists from M. Holland, BPI, LyondellBasell and MTS Logistics discussed how global supply chain complexities are impacting the plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.