COVID-19 Bulletin: October 15

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose Thursday after the International Energy Agency forecast surging natural gas prices would boost oil demand by up to 500,000 bpd globally, outweighing the effect of larger-than-expected U.S. inventory levels for the week ending Oct. 8.

- Crude futures were higher in late morning trading, with WTI up 1.2% at $82.32/bbl and Brent up 1.0% at $84.86/bbl. Natural gas was 1.1% lower at $5.62/MMBtu.

- Coal India has temporarily stopped supplying non-power customers as it tries to overcome a severe shortage of the fuel.

- Fuel oil shipments from Europe to Asia have picked up over the past month, as natural gas and coal shortages cause an uptick in demand for the low-value, low-quality oil.

- Britain’s Freightliner announced it will switch back to using diesel-operated trains due to high electricity prices, which are making the cost of running electric locomotives too expensive.

- Germany will cut surcharges for renewable energy investments by 43% next year in a bid to ease rising energy bills for consumers.

- French public bank Banque Postale pledged to cease doing business in the oil and gas industry by 2030.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- La Niña, a weather event in the Pacific that breaks with normal trade wind patterns, has strengthened over the past month and is projected to continue through winter in the Northern Hemisphere, causing drier conditions in places like California and Brazil, and also an increased risk of late-season Atlantic hurricanes.

- California’s Alisal Fire grew to more than 16,800 acres Thursday with just 11% containment.

- Louisiana’s Port Fourchon is operating at just 60% of normal levels more than a month after Hurricane Ida decimated the area.

- Texas’ Port of Houston has awarded a $95 million contract to Great Lakes Dredge & Dock Company for the expansion of the Houston Ship Channel.

- There are more than 13 loads for every truck at the ports of Los Angeles and Long Beach, a backlog expected to ease following the ports’ switch to 24/7 operations earlier this week.

- The rules on the number of deliveries truck drivers can make in the U.K. are set to be relaxed in a bid to tackle supply chain disruptions in the run-up to Christmas.

- Spot rates for LNG carriers have jumped 87% in October, significantly outpacing the last two years’ seasonal rises.

- A key index of base metals rallied to a record high Thursday, as energy shortages cause manufacturers to curtail output despite growing demand for raw materials.

- GM’s China deliveries dropped 19% to 623,000 in the third quarter, as the ongoing chip shortage continues to rattle automakers.

- European automakers logged their worst September in more than 25 years due to production cuts caused by the global chip shortage, with new-car registrations dropping 25%.

- The aviation industry paid up to 44% more for raw materials in the first half of this year compared to last year, making it harder for corporate plane makers and suppliers to meet resurgent demand.

- Over 10% of IKEA’s products are absent from shelves in the U.K., as the company expects supply chain disruptions to continue well into 2022.

- Argentina’s government has reached an agreement with retailers in the country to freeze prices on many food and household products for 90 days in a bid to offset rising inflation.

- The U.K. is issuing more than 800 temporary work visas for foreign butchers to remedy a severe labor shortage in the pork industry.

- Roughly 10,000 members of the United Auto Workers union went on strike Thursday against equipment maker John Deere, the U.S.’s largest private-sector strike in two years.

- U.S. same-store sales at Domino’s Pizza dropped 1.9% in the last quarter, the company’s first drop in more than 10 years, crimped by a shortage in delivery drivers as the company tries to steer more customers to its carryout business.

- Farm machinery maker CNH Industrial will temporarily shut some of its European manufacturing facilities due to supply chain disruptions.

- A growing number of Americans are calling for increased transparency from retailers regarding supply chain disruptions amid long-term fears of higher prices, a new survey shows.

- Kansas City Southern is partnering with technology platform Commtrex to enhance the visibility and connectivity of its network across 100 transload facilities in the U.S. and Mexico.

- Last-mile deliverer LaserShip and logistics firm OnTrac announced merger plans in a bid to provide shippers with new alternatives for U.S. e-commerce deliveries across multiple regions.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, clickhere.

- Our Logistics team reports the following:Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply

Domestic Markets

- The U.S. reported 83,756 new COVID-19 infections and 2,005 virus fatalities Thursday.

- The U.S. administration is ramping up calls for states and businesses to support COVID-19 vaccine mandates in the hope of preventing a winter virus surge.

- An FDA panel preliminarily recommended a half-dose booster shot of Moderna’s COVID-19 vaccine for people over 65 and high-risk adults. The panel will meet today to discuss booster doses of Johnson & Johnson’s vaccine.

- September saw 1.1 million American children infected with COVID-19, the worst month of the pandemic, as the government prepares to approve vaccines for those aged 5 to 11.

- More than 50% of people still had at least one COVID-19 symptom six months or more after initial diagnosis with the virus, new research shows.

- More than 25% of Pennsylvania’s COVID-19 hospital patients in the past month were vaccinated against the virus, as the rate of breakthrough infections in the state increases.

- Washington state will require proof of COVID-19 vaccination to attend indoor events with more than 1,000 people starting Nov. 15.

- Nearly 85% of eligible New York City residents have received at least one dose of a COVID-19 vaccine, equating to roughly 6 million people.

- A federal judge allowed Maine to bar religious exemptions to its COVID-19 vaccine mandate for healthcare workers. Separately, state officials said healthcare workers who are fired for refusing to get a mandated vaccine would lose state unemployment benefits.

- Big businesses in Texas are lining up against the governor’s ban on vaccine mandates in the state.

- The U.S. Navy unveiled plans to discharge any soldiers who refuse to comply with a mandatory COVID-19 vaccine policy by Nov. 14.

- Roughly 1,900 San Francisco city employees are facing termination over failure to comply with the city’s COVID-19 vaccine mandate.

- The Chicago police union is telling its members to resist the city’s requirement to report their COVID-19 vaccination status by Friday’s deadline or be placed on unpaid leave, setting up a potential legal showdown with the city’s mayor.

- A U.S. judge issued a temporary restraining order blocking a COVID-19 vaccine mandate for California prison employees. The state’s Los Angeles and San Diego school districts are also being sued over student COVID-19 vaccine mandates.

- Honeywell will mandate COVID-19 vaccines for all employees at U.S. offices and some of its manufacturing locations.

- U.S. retail sales in September climbed a better-than-expected 0.7% from the prior month and 13.9% from the prior year period.

- Nearly 40% of American households say they faced serious financial difficulties in recent months, while about one-fifth have depleted all their savings.

- Thirty-year fixed mortgage rates rose to 3.05%, the highest in six months and up from 2.99% last week.

- U.S. home foreclosures are rising with the end of certain pandemic bailout measures, with foreclosure starts jumping 32% in the third quarter compared to the second and 67% compared to the same time last year.

- Roughly one-third of jobless Americans have been out of work for at least six months, with 1.6 million more long-term unemployed Americans compared to pre-pandemic levels.

- Walgreens reported strong quarterly earnings on a surge in COVID-19 vaccinations as more employers mandate shots.

- Wells Fargo reported a 59% rise in third-quarter profits after releasing funds it set aside for potential pandemic losses. Citigroup saw a 48% third-quarter profit increase after reversing loss reserves.

- Morgan Stanley topped expectations for third-quarter earnings, which rose 36% on higher revenues from mergers and acquisitions advising.

- Boeing is dealing with a new defect on its 787 Dreamliner, the latest in a series of production slip-ups that have delayed aircraft deliveries and drawn increased U.S. government scrutiny.

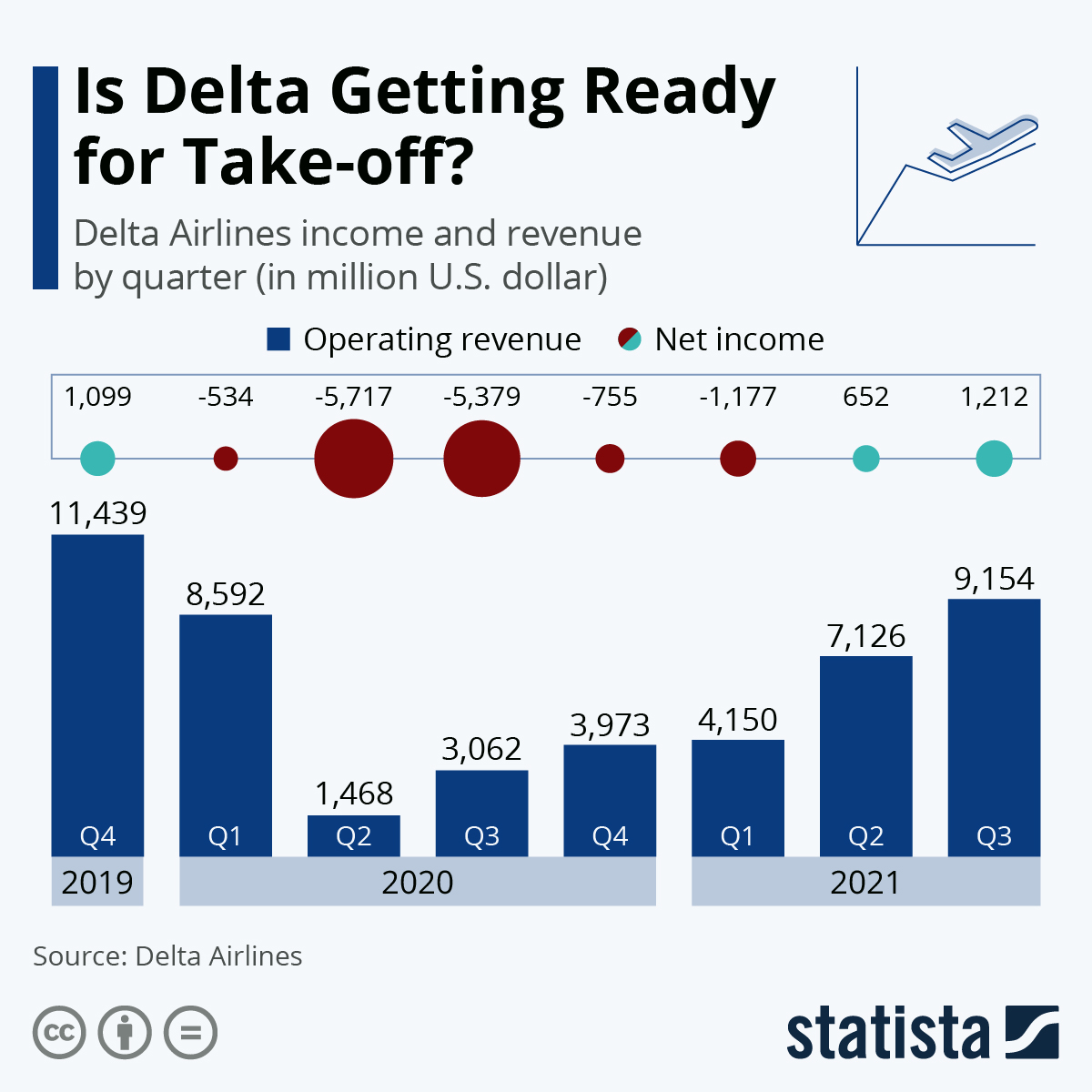

- United Airlines plans to add five new international destinations and 10 new routes next spring to meet expected pent-up travel demand. Separately, Delta Air Lines’ third-quarter results surpassed expectations, highlighting a broader trend of increasing revenues throughout 2021.

- The White House is looking to revise federal procurement rules for government contracts, seeking to consider risks posed by climate change before contracts are signed.

International Markets

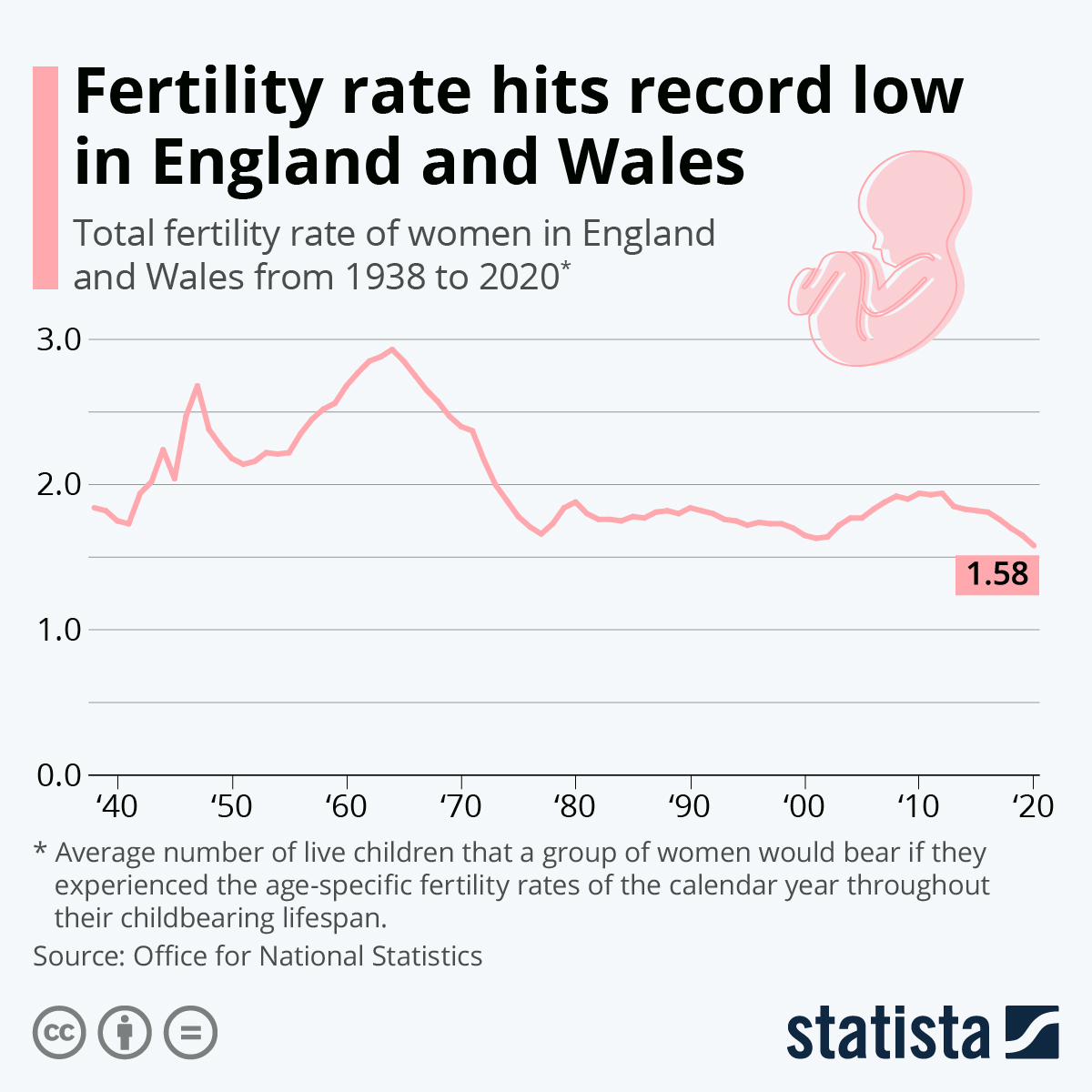

- The U.K. reported 45,066 new COVID-19 cases Thursday, the most since July, along with 157 virus fatalities. New data shows the country’s fertility rate has fallen to an all-time low since data tracking began before WWII.

- Italy began mandating proof of COVID-19 vaccination or a negative test within the previous 48 hours for all public- and private-sector employers.

- France ended free COVID-19 testing in a bid to encourage vaccinations.

- Russia reported 31,299 new COVID-19 cases and 986 virus fatalities Thursday, the most since the start of the pandemic.

- High-tech computer models predict Auckland, New Zealand’s largest city, will see up to 5,300 COVID-19 cases per week next year, a harrowing forecast after more than a year of some of the world’s strictest lockdowns.

- COVID-19 deaths among those under 60 years old in Mexico surpassed those of older Mexicans in the first half of the year, rising to nearly 60% of total deaths in June, a trend seen throughout Latin America.

- The U.S. announced it would donate more than 17 million Johnson & Johnson COVID-19 vaccine doses to the African continent.

- Japan will set up a $4.4 billion fund to support companies developing vaccines for infectious diseases under a new economic package that aims to strengthen the government’s pandemic response.

- Stellantis, GM and Ford will require all employees, contractors and visitors at their Canadian plants to show proof of a COVID-19 vaccine by the end of the year.

- A new global survey shows that an increasing number of scientists are receiving death threats or threats of violence for talking publicly about COVID-19.

- India’s trade deficit widened to $22.6 billion in September, a record, amid surging imports of crude oil and gold.

- Porsche’s electric Taycan has outsold the brand’s iconic 911 so far this year.

- BMW plans to build only electric vehicles starting in 2030, ahead of the EU’s 2035 ban on fossil-fuel cars.

- A growing number of businesses in India are asking the government for support to meet a target for at least 65% of all new vehicle sales to be electric by 2030.

- Vietnamese automaker VinFast will start taking preorders in the U.S. for its VF e35 and e36 electric utility vehicles in the first half of 2022, hoping to begin deliveries by the end of next year.

- McDonald’s is scrapping the use of plastic utensils at its Canadian restaurants by December, swapping them with wooden cutlery and stir sticks, as well as paper straws.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.