COVID-19 Bulletin: October 8

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices climbed Thursday, reclaiming some of the losses suffered in the previous session as the U.S. administration backtracked on plans to release supply from strategic reserves.

- Natural gas ended Thursday mostly flat following news that Russia would raise gas exports to Europe.

- Oil prices are headed for their seventh weekly gain, the longest run since December, with WTI up 1.3% in mid-day trading today at $79.35/bbl and Brent up 0.6% at $82.43/bbl. Natural gas was 1.2% lower at $5.61/MMBtu.

- U.S. diesel inventories are at a two-decade low for this time of year, largely a result of February’s Texas freeze that took down 18 refineries, knocked out 5.5 million bpd of processing capacity, and caused a large emergency drawdown of gas and diesel inventories.

- As the winter heating season approaches, the global energy crisis is worsening, with natural gas futures in Europe trading at the equivalent of $230/bbl of oil, up 130% from early September, and prices in East Asia up 85%.

- Roughly 12% of filling stations in London and the U.K.’s southeast were still dry as of Thursday, 15 days into the nation’s gas supply crisis. Separately, calls are increasing for the nation’s energy regulator to take emergency action on surging power prices.

- A British judge upheld the government’s decision to grant a 30-million-barrel North Sea drilling permit to BP, as the nation’s crisis-level energy crunch reinforces a continuing need for diverse fuel sources.

- Exxon Mobil raised its resource estimate by 1 billion oil barrels following a new discovery at the company’s Stabroek Block in offshore Guyana.

- Major U.S. producer Occidental is looking to re-establish dividend payments for shareholders rather than boost production over the next decade, a move that also will allow for increased investment in other businesses such as carbon capture, the company said.

- Shell warned that third-quarter losses from damage caused by Hurricane Ida could reach $400 million.

- Marathon is emptying tanks at its 593,000-bpd Texas City refinery as quickly as possible following a storage tank leak first discovered Wednesday.

- U.S.-based Nikola and Canadian pipeline operator TC Energy announced a new partnership to develop large-scale hydrogen production plants in the U.S. and Canada to produce the fuel needed to operate Nikola’s electric heavy-duty trucks.

- The United Arab Emirates became the first of the Persian Gulf petrostates to set a net-zero carbon emissions goal by 2050.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- With demand surging in the U.S., shipping a parcel from Shanghai to Los Angeles is currently six times more expensive than shipping from L.A. to Shanghai.

- The price to ship a single container has risen from roughly $2,500 before the pandemic to more than $25,000.

- Some cargo ships are waiting a month to dock and unload at Southern California ports. Up to 25% of goods stuck on ships won’t make it to shelves in time for Black Friday on Nov. 26, retail analysts predict.

- Maritime research firm Drewry and shipper MSI expect current supply-chain disruptions to continue through 2022.

- Taiwanese and South Korean chipmakers are resisting calls from the White House to share their supply chain data, thwarting U.S. efforts to mitigate the ongoing shortage and prompting demands for increased American production.

- Semiconductor giant Samsung said its operating profit was up 28% in the latest quarter from a year ago, the best in three years.

- Used car prices in the U.S. rose 5.3% to all-time highs in September as supply chain disruptions continue to hamper new vehicle production.

- Volkswagen’s Skoda Auto, the Czech Republic’s largest exporter, will significantly reduce or even halt vehicle production through the rest of the year due to the global chip shortage.

- Greece transferred a 16% stake in the Piraeus Port Authority to Chinese shipper COSCO, which plans to boost investments in the port over the next five years.

- Union Pacific has purchased five autonomous cranes for its Chicago terminal in a bid to reduce greenhouse gases and streamline its loading and unloading process.

- Home Depot is the first retail client for Walmart’s new delivery service, which will begin offering same-day and next-day deliveries to locations in Texas, New Mexico and Northwest Arkansas.

- Packaged food maker Conagra will raise prices again on frozen meals and snacks to help recoup higher inflation and shipping costs, the company said.

- An index of British construction activity fell to an eight-month low of 52.6 in September following the continued rise in material prices, supply-chain disruptions and labor shortages.

- Germany’s Deutsche Post raised its 2021 guidance for the sixth time, fueled by the surge in e-commerce spurred by the pandemic.

- In a growing movement, hackers are attacking companies over social grievances rather than for financial gain.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Due to port congestion and other factors, we are seeing inventory buildups at our sites near ports.

Domestic Markets

- The U.S. The U.S. reported 100,083 new COVID-19 cases and 2,392 virus fatalities Thursday.

- Total COVID-19 hospitalizations in the U.S. have declined from 104,000 to 69,000 over the past five weeks.

- Roughly 3,500 U.S. organizations, including many large firms, have introduced COVID-19 vaccine mandates.

- Florida reported 782 deaths from COVID-19 Thursday, as data stretching back several weeks was finally reported.

- Pfizer/BioNTech formally asked U.S. regulators for emergency-use authorization of its COVID-19 vaccine in children aged 5 to 11, with the White House expecting approval as early as November.

- Studies suggest the Pfizer COVID-19 vaccine’s immunity protection diminishes after two months, but the vaccine remains 96% effective in preventing hospitalizations and deaths.

- The cost of a recently approved over-the-counter rapid COVID-19 test developed by ACON will be under $10.

- The U.S. is administering roughly 385,000 booster COVID-19 vaccine doses per day, compared to around 281,000 first doses.

- More than 92% of active-duty troops have received at least one dose of a COVID-19 vaccine.

- Nearly 40% of Los Angeles police officers are yet to be vaccinated against COVID-19 ahead of the city’s Oct. 20 vaccine mandate deadline.

- The CDC is encouraging everyone to get vaccinated against the flu this year to avoid further strain on the nation’s hospitals dealing with recent overloads of COVID-19 patients.

- American Airlines joined other major airlines in requiring all employees to be fully vaccinated against COVID-19 by Nov. 24.

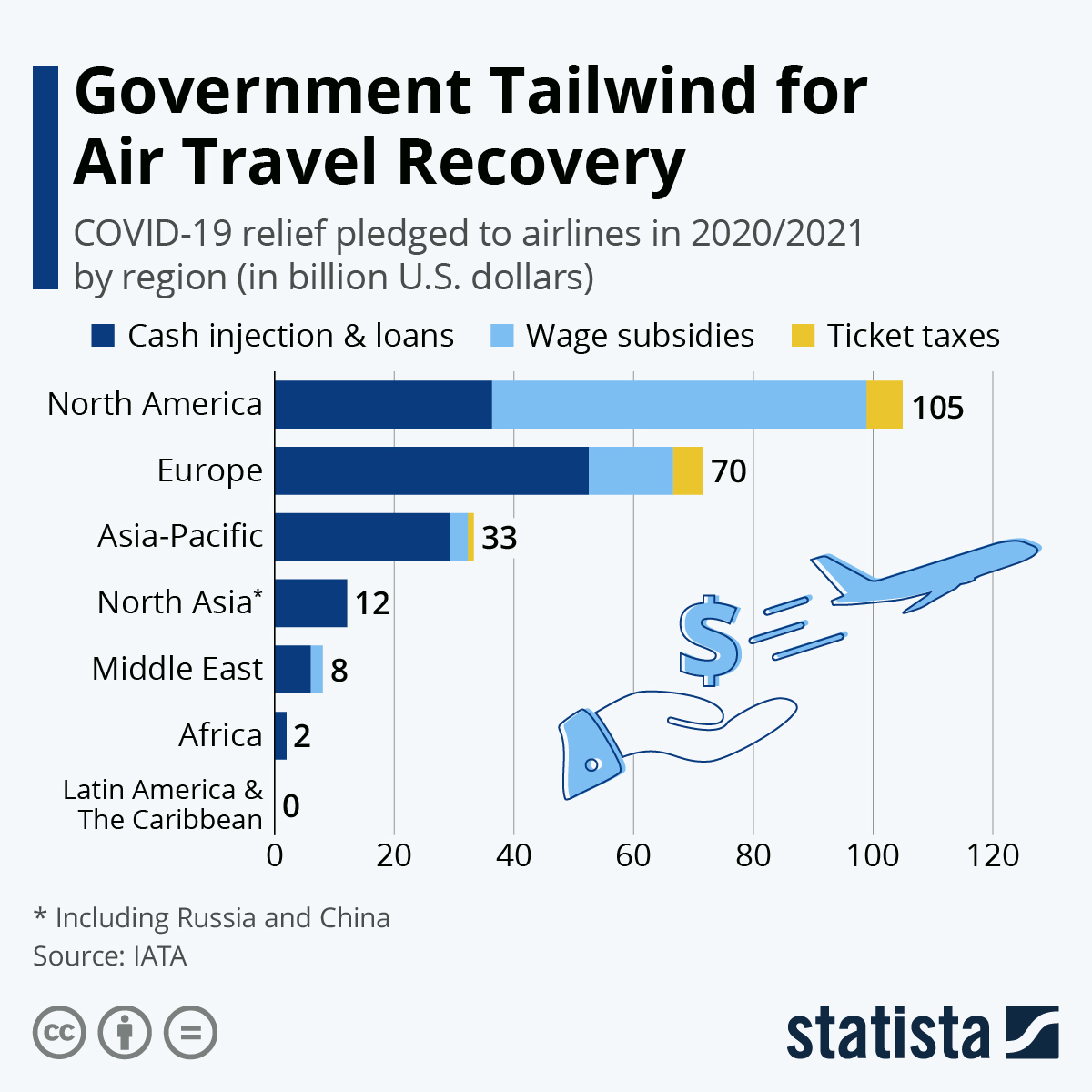

- United Airlines is planning to fly 3,500 domestic flights per day in December, the most since the start of the pandemic, as more airlines bank on a holiday travel uptick and government stimulus payments to rebuild momentum lost by the COVID-19 Delta variant.

- A disappointing 194,000 new jobs were created in September, well below the 500,000 expected, but unemployment dipped to 4.8%.

- The market value for New York City office space declined by almost $30 billion during the pandemic, costing the city more than $850 million in lost property tax revenue.

- Roughly 1 in 5 U.S. employers say they have plans to offer remote-work perks such as subsidized furniture and food-delivery costs.

- Office-sharing firm WeWork reported $228 million in sales for September, the most this year, despite a recent wave of companies pushing back their return-to-office dates.

- The average 30-year fixed mortgage rate has risen from 3.10% to 3.14%, causing a 10% decline in refinancings week over week toward a three-month low.

- California’s median home price is set to rise more than 5% next year to $834,000, as the state becomes increasingly unaffordable for the average household.

- Americans have been taking fewer trips to the store but spending more when they do venture out, new data shows, a trend expected to outlast the pandemic.

- Starting salaries and temporary staff wages have risen at the sharpest rate in more than two decades, financial firm surveys suggest.

- A growing number of U.S. restaurants are upgrading their locations for outdoor dining ahead of the winter season, adding heaters, blankets, new structures, and altered menus following rapid adoption of the trend last winter.

- JPMorgan will begin sharing patents related to how it efficiently cools and ventilates its massive data centers, part of a joint effort by Microsoft, Facebook and HP to spread carbon-mitigation technology.

- Tesla is moving its headquarters to Austin, Texas, from California’s San Francisco Bay Area, the latest in a growing number of large enterprises moving operations to the Lone Star State.

- Mazda is adding five new crossover models to its vehicle fleet by 2023, with plans to manufacture at least one of the vehicles in Alabama.

International Markets

- The U.K. reported 40,701 new COVID-19 infections Thursday, the most in a month. The country announced plans to remove 47 destinations from strict quarantine requirements in a bid to boost air travel and revive tourism.

- New COVID-19 cases in South Korea remained above 2,000 for the third straight day Friday.

- France will begin charging unvaccinated people for COVID-19 tests beginning Oct. 15.

- Greece will begin lifting restrictions for vaccinated people in areas with high levels of COVID-19 infections.

- COVID-19 rates in Spain dipped below 50 cases per 100,000 people Thursday, putting the nation in Europe’s “low risk” category for the first time in 15 months.

- Italy is slowly loosening its COVID-19 restrictions, allowing for full capacity at cinemas, theaters and concert venues starting Oct. 11 while increasing capacity at sports stadiums from 35% to 60%.

- Facing a syringe shortage, India is curbing exports of syringes, which could hamper global inoculation efforts.

- Moderna is investing upwards of $500 million for a new vaccine manufacturing plant in Africa.

- Singapore and South Korea will open a quarantine-free travel corridor in November for people fully vaccinated against COVID-19.

- The European Central Bank predicts the pandemic will permanently change how people spend their money after a substantial number of households reported not missing certain products or services when lockdowns began in spring of 2020.

- The Geneva Motor Show, a major international auto show scheduled to take place in March 2022, has been canceled for the third year in a row due to the pandemic.

- British Airways will move ahead with plans to operate short-haul service at London’s Gatwick airport following widespread pilot support.

- Card spending in the U.K. returned to 100% of pre-pandemic levels this week.

- Tesco, the U.K.’s biggest retailer, raised its full-year earnings forecast following a 16.6% year over year profit increase in the first half of 2021.

- German auto supplier ZF will take a 5% stake in British autonomous vehicle firm Oxbotica to jointly develop software for pod-like shuttles capable of transporting people and goods.

- A Chinese battery manufacturer backed by Mercedes claims to have developed lithium-silicon batteries capable of holding up to 25% more energy than their lithium-ion counterparts.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.