COVID-19 Bulletin: October 6

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose for the fourth straight session Tuesday to their highest close since October of 2014, a day after OPEC decided not to accelerate its plan for gradually relaxing production cuts. Prices have climbed 63% so far this year, amplifying inflationary pressures weighing on the world economy.

- Natural gas futures rallied Tuesday, jumping 9.5% to the highest level since 2008 amid tight global supplies heading into the winter heating season. The squeeze has hit Europe particularly hard, where the benchmark gas price reached $36/MMBtu for the first time ever (equivalent to roughly $205/bbl of oil), while gas prices in the U.K. surged 23% to around $42/MMBtu.

- Crude futures were lower in morning trading, with WTI down 2.1% at $77.31/bbl and Brent down 2.0% at $80.95/bbl. Natural gas was 7.1% lower at $5.89/MMBtu.

- The national average for a gallon of regular gas rose to $3.20 Tuesday, AAA reported, the highest since 2014 and a 47% rise from the same time last year. Analysts predict gasoline prices to rise faster in the coming weeks following the recent surge in oil.

- The American Petroleum Institute reported a second consecutive surprise crude build last week. The news had little effect on soaring prices of oil and gas.

- Operators of Nord Stream 2, the controversial gas pipeline between Russia and Europe, started filling the first string of the pipeline with gas in preparation for Germany’s pending approval of an operational license.

- Russian producer Rosneft entered a long-term agreement to supply oil to Dutch trader Vitol, restoring a relationship that ended when their last contract expired in 2018.

- India’s power industry is beginning to run short of coal, threatening a power crunch in the country that relies on the fuel for around 70% of electricity generation. Inventories hit the lowest level since November of 2017 last week.

- A new British program aimed at recruiting migrant drivers to deliver fuel supplies has attracted only 127 applications so far out of roughly 5,000 estimated to be needed.

- France lost more than 5% of its nuclear production capacity Tuesday following employee strikes.

- Hundreds more people will be deployed to help clean up coastal California’s 13-acre oil spill, state and local officials announced, as a 13-inch split in a sea bottom pipeline was identified as a likely source of the leak.

- Spanish major Repsol upped its 2030 capacity target for renewable energy generation by 60%, along with making new pledges to cut emissions in its oil and gas unit.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The 13-acre oil spill off the coast of California is not expected to affect operations at Los Angeles ports, authorities said.

- Available capacity in the logistics industry shrank from August to September, data from the latest Logistics Managers’ Index shows.

- Holiday demand could be up as much as 9% this year, according to Deloitte, but supply chain disruptions and empty store shelves could become the Grinch that stole Christmas.

- U.S. and Asian port congestion prompted a greater number of shippers to switch from sea transport to air cargo to stock retail shelves in time for the holiday season.

- Vietnam, Malaysia and Thailand all reported rising factory shutdowns in recent weeks caused by COVID-19 outbreaks, spelling more trouble for global supply chains that depend on the nations as a production hub for the world’s largest consumer brands.

- Capesize bulker rates rose 5% to $80,000 Tuesday, the highest level since 2008.

- The average long-term contract price to ship a 40-foot container from Asia to the U.S. rose to $4,979 Tuesday, more than double the contract rates from a year ago.

- DHL is raising U.S. shipping rates by 5.9% in January, matching FedEx’s recent rate hike.

- The Bloomberg Commodity Spot Index soared to an all-time high Tuesday as a global resurgence in demand for raw materials collides with supply constraints.

- More companies have begun charging the same amount for less of a product, hoping to offset increased labor and material costs as inflation rises.

- Pepsi expects to raise product prices early next year to offset rising supply chain costs, while the company raised guidance for 2021 following strong sales in its snacks and Mountain Dew beverage segments.

- Amazon has already started rolling out Black Friday deals with the hope of staving off delivery disruptions several weeks out.

- Some 90% of home builders report shortages of plywood, strand board, framing lumber, windows and doors, and major appliances.

- Third-quarter deliveries from heavy-duty truck maker Paccar are expected to be down 7,000 compared to the second quarter, a result of production hits caused by the global chip shortage. Daimler Trucks also lowered its 2022 sales forecast for the same reason.

- Micron’s CEO expects the global chip shortage to bottom in the second half of this year, with a full recovery one to two years off.

- All 155,000 members of the National Union of Metalworkers of South Africa, the nation’s largest metalworkers union, have gone on strike.

- The unexpected thawing of Russia’s frozen permafrost is threatening national infrastructure, causing corrosion leaks at mines and plants, and permanently damaging residential buildings.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Due to port congestion and other factors, we are seeing inventory buildups at our sites near ports.

Domestic Markets

- The U.S. reported 95,756 new COVID-19 infections and 1,916 virus fatalities Tuesday.

- The number of COVID-19 cases in the U.S. dropped 29% the last two weeks of September.

- Florida passed New York for the third-most COVID-19 deaths in the U.S. at 55,000, behind only Texas and California. It is also the only state not to have submitted a plan for spending emergency pandemic dollars distributed by the U.S. Education Department.

- Nearly 1,400 employees of New York’s largest healthcare provider were fired or resigned for failing to meet a COVID-19 vaccine mandate.

- Louisiana’s largest healthcare provider will increase monthly insurance costs by $200 for employees whose spouses are not vaccinated against COVID-19.

- Due to its low seven-day COVID-19 infection rate, California is currently the only state to fall under the CDC’s “moderate” virus transmission warning.

- The FDA authorized a new at-home rapid COVID-19 test developed by ACON as demand for tests surges and supply runs short.

- COVID-19 vaccines are estimated to have prevented more than 250,000 infections and nearly 40,000 deaths among seniors.

- There is growing suspicion that COVID-19 can harm the pancreas and cause new-onset diabetes.

- Generation X, comprising people aged 41 to 56, has enjoyed a financial windfall during the pandemic, adding $13 trillion in assets over the last 15 months, a 50% increase. Generation Xers’ share of the nation’s wealth rose to nearly 30%, while the shares of Baby Boomers and the Silent Generation fell.

- Nearly 20% of U.S. workers could remain fully remote after the pandemic, new data suggests.

- Private jobs grew by a higher-than-expected 568,000 in September, according to ADP.

- Washington, D.C., and New York City lead the nation in the amount of office space ditched by companies during the pandemic.

- Manhattan apartment sales rose to 4,523 in the third quarter, the most in three decades as New York City’s housing market continues to recover from the pandemic.

- The U.S. trade deficit rose 4.2% in August to $73.3 billion, a record high, as a small gain in exports was swamped by a much larger gain in imports.

- GM announced plans to open a battery-cell development center in Michigan to help lower costs and increase the driving range of electric vehicles with lithium-ion and solid-state batteries.

- Single-use food containers made from Styrofoam are more environmentally friendly compared to reusable containers due to the low amounts of raw material and electricity needed to produce them, new research shows.

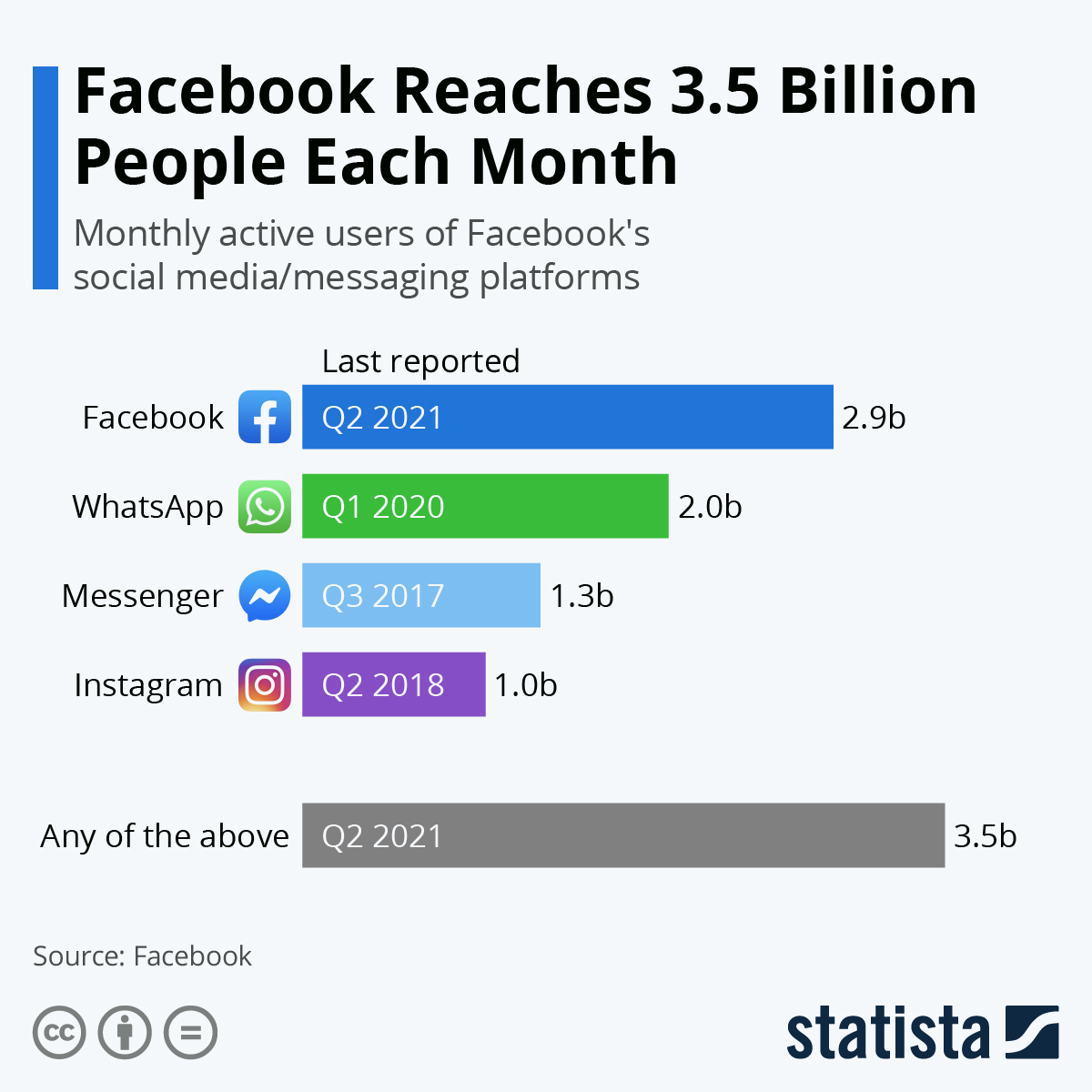

- Facebook’s six-hour outage Monday left more than 2.9 billion users unable to access its services, including Instagram and WhatsApp, the result of cascading failures after a simple technical mistake.

International Markets

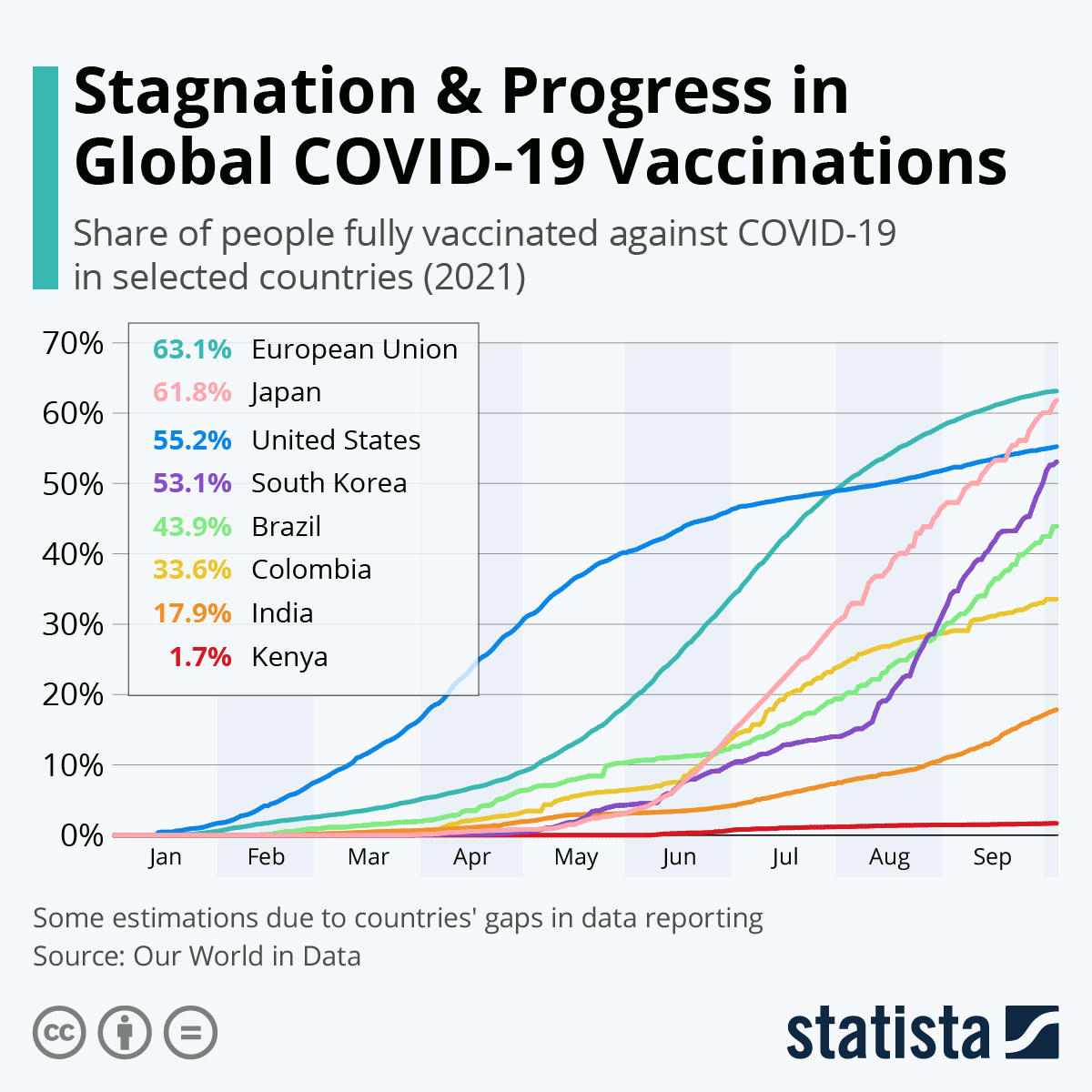

- Global COVID-19 vaccination rates are picking up in Asia and Latin America while slowing down in the U.S. and Europe, new data shows.

- The U.K. reported 33,869 new COVID-19 cases Tuesday, with weekly cases down 2.3% compared to the week prior.

- Australia’s Victoria state reported 1,763 new COVID-19 cases Tuesday, a record, as the nation and New Zealand continue making plans to reopen their economies in the next several months.

- Russia reported 895 COVID-19 deaths Tuesday, a record.

- Daily COVID-19 cases in Poland are up 70% over the past week as the country’s fourth virus wave intensifies.

- New COVID-19 infections in Romania rose to more than 15,000 Tuesday, the most since the start of the pandemic.

- Normally frenzied travel activity during China’s “Golden Week” is more than 30% below 2019 levels, as the nation remains the last major country to seek the complete eradication of COVID-19 with strict lockdowns and other restrictions.

- COVID-19 hospitalizations in Israel hit a two-month low following the nation’s recent focus on administering booster vaccines.

- The Philippines pushed back its goal of fully vaccinating 70% of its population against COVID-19 by several months to February 2022.

- Multiple research groups around the world are working to develop pan-coronavirus vaccines that would protect people from multiple strains of the virus, including those yet to emerge.

- The International Monetary Fund forecasts global economic growth in 2021 will dip slightly below earlier predictions of 6% due to risks linked to debt, inflation and supply chain disruption.

- Euro zone retail sales were weaker in August as consumers reined in spending on food, drinks and tobacco.

- German industrial orders fell more than expected in August on weaker export demand cause by supply chain disruptions, including a massive 12% drop-off in orders for cars and automotive parts.

- New Zealand’s central bank hiked interest rates Wednesday for the third time in seven years and signaled further tightening to come, as it looks to stay ahead of rising inflation and a red-hot housing market.

- A shortage of skilled research and engineering specialists could hamper global goals to swiftly transition to battery-powered electric vehicles.

- Japan reaffirmed its pledge to reduce emissions 46% by 2030, likely to come from increased adoption of nuclear production. Meanwhile, one of the nation’s state-run energy firms is working on creating a global standard for measuring greenhouse gas emissions in the LNG industry.

- Sweden’s Volvo received an order for 100 electric trucks for short- and long-haul shipping firm DFDS, the biggest commercial electric-truck order to date.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.