COVID-19 Bulletin: October 5

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The price of oil hit a seven-year high Monday after OPEC and allied oil producers stuck with a plan to cautiously raise production, even as global demand for crude oil surges. Saudi Aramco alone has seen a 500,000-bpd demand boost, more than the combined monthly output increases planned for all of OPEC, as a shortage of gas sends prices soaring in Europe and Asia and forces many businesses to switch to crude products for power.

- Goldman Sachs forecasts an additional 650,000 bpd of crude oil will be needed to meet demand this year, with Brent possibly reaching $90/bbl by 2022.

- Crude futures continued their rise in morning trading, with WTI up 2.2% at $79.36/bbl and Brent up 2.1% at $82.99/bbl. Natural gas was 7.2% higher at $6.18/MMBtu.

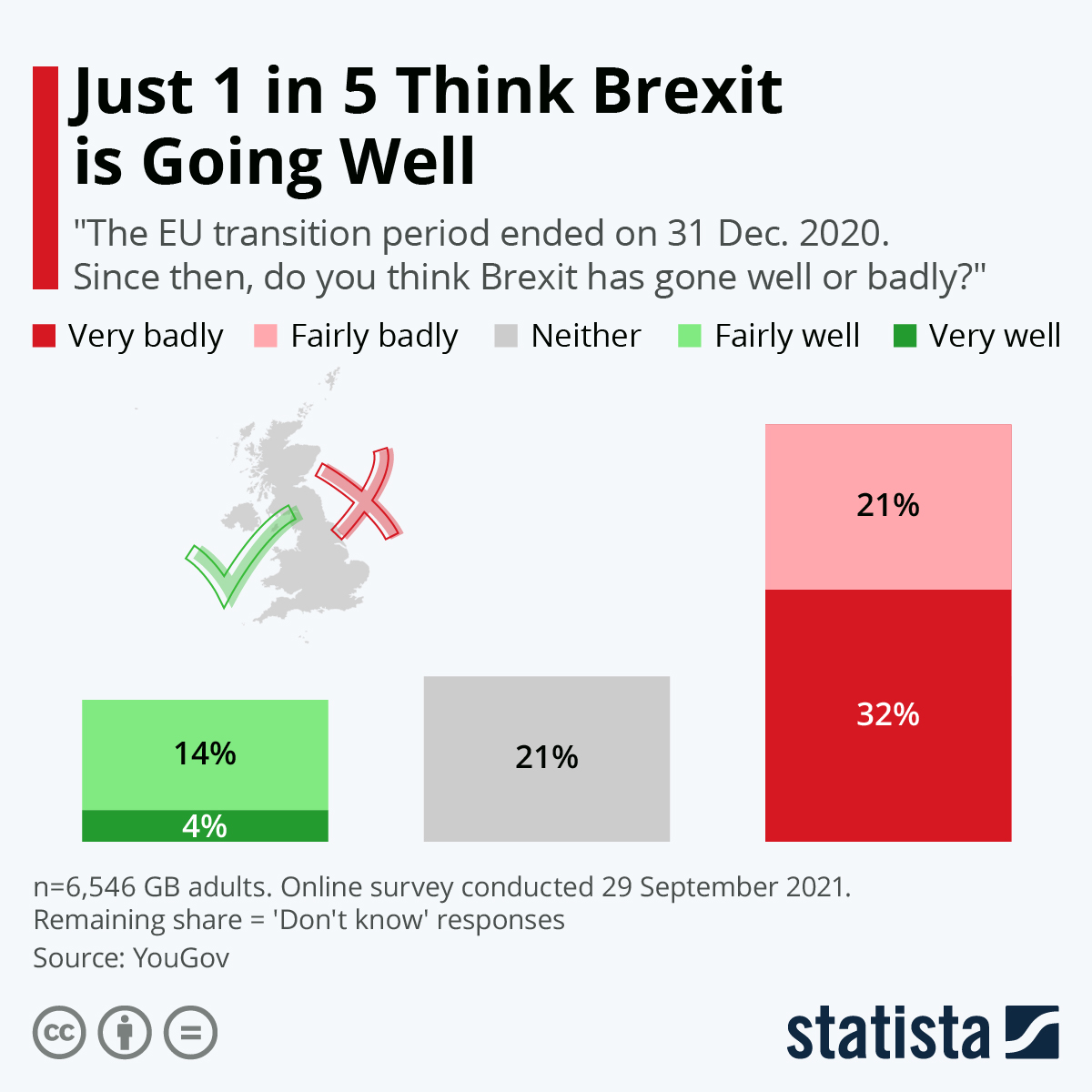

- The U.K. deployed its military to a BP storage depot Monday to help deliver fuel amid an acute shortage of truckers, now estimated to be at 100,000. Analysts point to Brexit as a major driver of the shortage:

- A pipelinIndia’s coal ministry has asked Coal India to boost investments in electric vehicles and charging stations as part of a plan to diversify the state-run business.

- Southern California’s 13-square-mile oil pipeline spill is expected to keep beaches closed for months, as aid and environmental groups work frantically to clean up and protect the affected ecosystem.

- A group of 60 companies has pledged to make sustainable aviation fuels comprise 10% of global jet fuel supply by 2030.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Wait times are stretching up to four weeks for ships to dock at some California ports, an unprecedented backlog stemming from a combination of factors including strong consumer demand, labor shortages, supply chain disruptions, and clogged rail yards and trucking routes.

- Containership leaser Seaspan has received the first vessel in its massive 70-ship order made in response to pandemic shipping disruptions.

- The White House is leaving in place the steep tariffs on Chinese imports first imposed under the previous administration while it seeks new trade talks with the country.

- The value of U.S. goods exports in the first seven months of the year hit a record $990 billion.

- Appliance makers are beginning to prioritize higher-priced product models as part of an effort to recoup rising production and shipping costs.

- Coca-Cola has opted to ship cargo on bulk carriers rather than containerships in the face of increasing port congestion and rising freight costs.

- Wisconsin-based freight carrier Marten Transport had its operating system knocked out Sunday by a cyberattack.

- Volvo’s monthly sales fell 30.2% in September from a year earlier amid production hits caused by component shortages.

- Marvell Technologies CEO said the global semiconductor shortage could last through 2022, with new capacity not expected to come onstream until 2023 and 2024.

- The book publishing industry is emerging as the latest victim of global supply chain disruptions.

- With rubber prices up 70% in the past year, fleet managers are scrambling to find ways to extend tire life.

- British meat prices are soaring due to labor shortages at slaughterhouses and butcheries, while pharmacies run low on medicines due to a shortage of truckers.

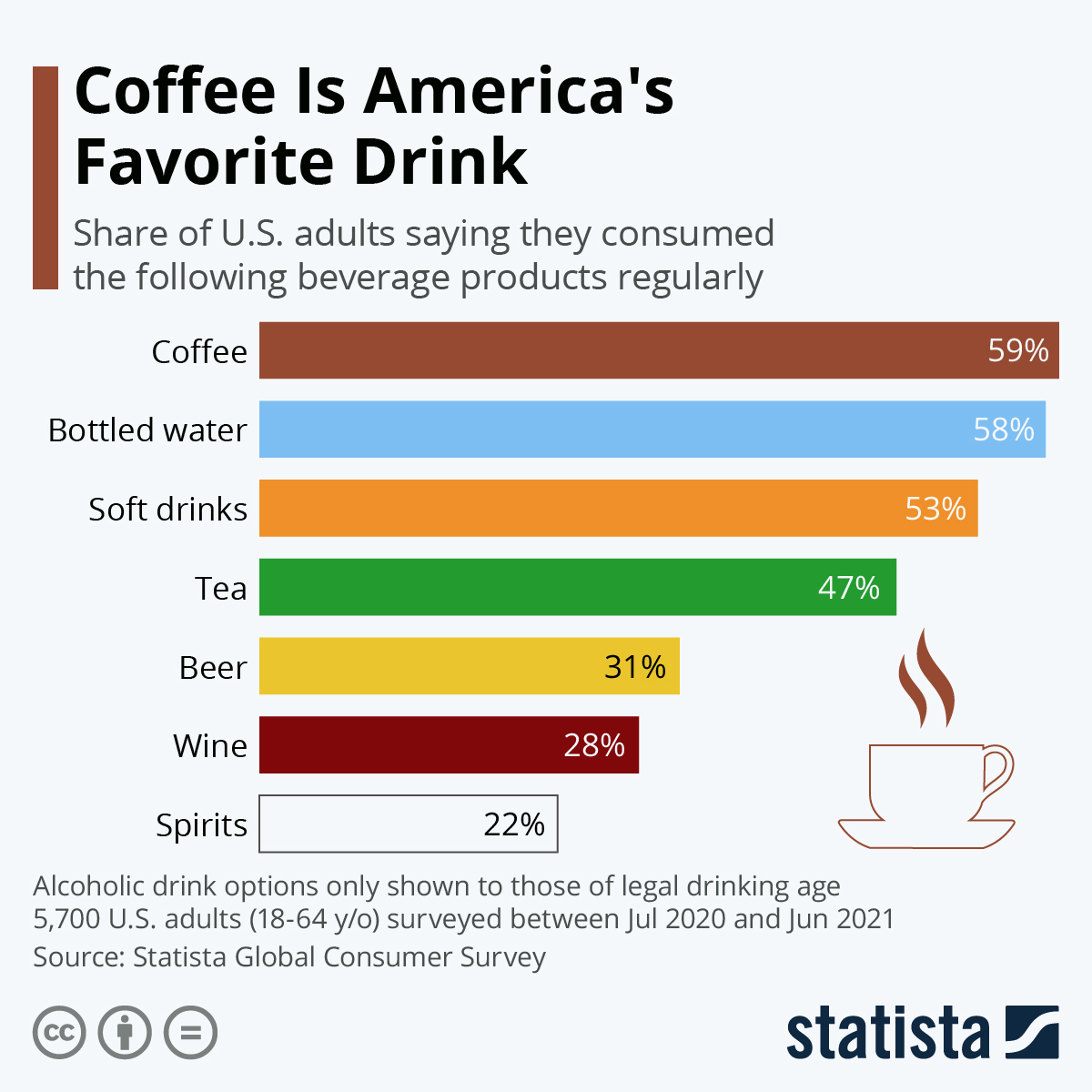

- Prices for commodity-grade Arabica coffee has nearly doubled in the past year, largely a result of a series of environmental disruptions in Brazil.

- Target is adding 30,000 non-seasonal supply chain employees.

- Cotton prices have surged to their highest levels in a decade, with rising Chinese demand being met in part by growing U.S. exports.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 169,207 new COVID-19 infections and 2,109 new virus fatalities Monday.

- Total virus hospitalizations in the nation have dropped 12.7% week over week to roughly 71,325 patients.

- Arizona became the 11th U.S. state to surpass 20,000 COVID-19 fatalities since the start of the pandemic.

- COVID-19 hospitalizations in Oklahoma dipped below 1,000 for the first time in eight weeks.

- New COVID-19 cases in New Jersey have dropped 9% from a week ago.

- Total COVID-19 hospitalizations in Florida have continued a steady decline, dropping below 5,000 Sunday.

- The number of COVID-19 patients in Los Angeles hospitals hit a three-month low.

- COVID-19 was the leading cause of death for police officers last year, nearly doubling the number killed by gun violence and vehicle crashes combined.

- More than 4,000 public school employees in New York City have been placed on unpaid leave after failing to meet a deadline for COVID-19 vaccination.

- The CDC is encouraging Americans to host events outdoors, wear masks and use fans by open windows to prevent the spread of COVID-19 at gatherings this holiday season.

- Johnson & Johnson will ask U.S. federal regulators to authorize a booster dose of its COVID-19 vaccine this week.

- New research suggests Pfizer/BioNTech’s COVID-19 vaccine remains 90% effective six months after the first shot. However, BioNTech’s CEO expects a new vaccine formula to be required by the middle of next year to protect against mutated virus strains.

- AstraZeneca has submitted a preventative COVID-19 antibody treatment for approval from the FDA, saying the drug could be an effective alternative for people whose immune systems make vaccines ineffective.

- COVID-19 can have long-term detrimental effects on all five senses, not just taste and smell.

- The U.S. Supreme Court returned to hearing in-person oral arguments Monday for the first time since the start of the pandemic.

- Nearly 20% of 1,000 health care workers polled had quit their jobs during the pandemic, citing poor pay, safety concerns and burnout.

- With more than 200,000 COVID-19 cases reported weekly among children for the past month, a majority of parents now believe schools should have comprehensive COVID-19 mask mandates.

- JPMorgan will ban non-vaccinated employees from business travel and deduct from their pay for COVID-19 testing.

- Southwest Airlines became the latest U.S. airline to require its employees to be vaccinated against COVID-19. The number of remaining unvaccinated employees at United, meanwhile, has dropped significantly after the airline began making good on threats to terminate employees who did not comply with the mandate.

- A cooling of travel demand during the current COVID-19 surge has prompted United Airlines to reassign aircraft to cargo-only flights.

- Nine years of airline industry earnings, around $201 billion, is set to be lost due to the pandemic, top industry officials said.

- Hotel owners are bracing for another sluggish holiday season as the continued spread of COVID-19 cuts down on leisure travel this fall and winter.

- Facebook, Instagram and WhatsApp shut down for more than six hours Monday, the worst outage for the Facebook-owned companies since 2008. The outage was caused by a network configuration issue and did not compromise user data, Facebook says.

- McDonald’s announced a new target of achieving net-zero global greenhouse emissions by 2050.

- Amazon unveiled a slew of new products at its latest fall product event, including an Alexa-controlled autonomous robot that can set and deliver reminders, control smart home devices and integrate with smart home security devices.

- GM-backed autonomous vehicle startup Cruise expects to begin putting vehicles on the road by 2023.

- Amazon- and Ford-backed electric vehicle maker Rivian announced plans to manufacture battery cells in-house, a shift from current production sourcing in South Korea.

International Markets

- Japan will require proof of COVID-19 vaccination to enter restaurants and other indoor facilities in 13 prefectures starting this month.

- Europe’s drug regulator approved third COVID-19 booster shots for everyone over the age of 18.

- The government of India will pay families of COVID-19 victims $674 per death suffered.

- Indonesia reported just 922 new COVID-19 cases yesterday, the fewest since June of 2020.

- Taiwan began easing pandemic restrictions after zero new cases of COVID-19 were reported for the fourth consecutive day.

- The U.K. began loosening international travel restrictions for 45 countries, as it reported 35,077 new infections and 33 virus fatalities Monday.

- Thailand began administering COVID-19 vaccines to high school students Monday.

- New COVID-19 cases in Mexico fell 38% in September from August, though deaths were higher. Only one of Mexico’s 32 states, Baja, remains in the “high risk” rating for COVID-19.

- Roughly 30% of immunocompromised people do not develop protection against COVID-19 even after getting vaccinated, a new Italian study shows.

- Air New Zealand will mandate COVID-19 vaccines for all international travelers beginning next year.

- The number of tourists in Spain doubled in August compared to a year ago to 5.19 million people, still around half of pre-pandemic levels.

- The World Trade Organization raised its forecast for global trade growth in 2021 and 2022 to 10.8% and 4.7%, respectively, as global economic activity continues to rebound from the pandemic.

- A new study suggests China’s population could significantly decline in the next 45 years, with researchers thought to have severely underestimated the pace of demographic decline.

- Nestlé Mexico inked a deal with U.K.-based Greenback Recycling Technologies to build a Mexico recycling plant capable of processing flexible plastic packaging.

- British officials stepped up calls for the nation to transition to complete clean energy production by 2035, having already committed to cutting carbon emissions 78% by that date.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.