COVID-19 Bulletin: May 14

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices slid more than 3% yesterday on news of the Colonial Pipeline reopening and concerns about the COVID-19 surge in India. Crude futures were higher in mid-day trading today, with WTI up 2.1% at $65.14/bbl and Brent up 2.1% at $68.47/bbl. Natural gas was 0.8% lower at $2.95/MMBtu.

- The Colonial Pipeline resumed operation following a six-day shutdown, but a gas shortage across the southeastern United States is expected to linger for several days.

- Colonial Pipeline paid a $5 million ransom in untraceable cryptocurrency to Eastern European hackers to get its system back online.

- The White House granted a second waiver from the Jones Act, allowing a foreign shipper to move fuels among U.S. ports to help fill a supply gap.

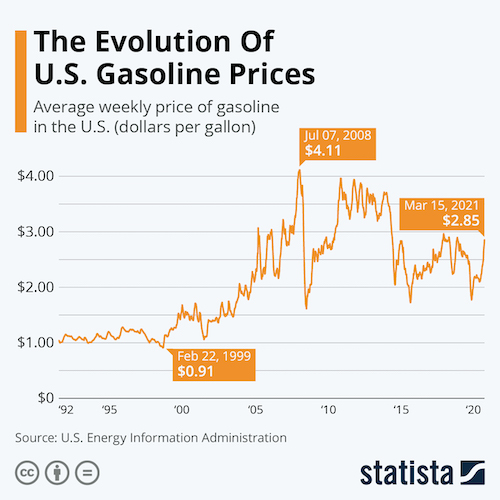

- Gasoline demand is up by more than 11% week-to-date, with the average price for a gallon of gas now at $3.02, up $0.08 from last week.

- The White House is urging Americans not to “panic buy” gas in the wake of the attack while also warning gas stations not to price gouge.

- China will start taxing imports of light-cycle oil, mixed aromatics and diluted bitumen as the nation increases its scrutiny of high-emission fuels.

- Goldman Sachs cut its ratings on Dow, Huntsman and LyondellBasell on concerns that petrochemicals margins have peaked.

- JPMorgan, the world’s largest financier of fossil fuel companies, is pledging to cut “operational carbon intensity” by 35% from its portfolio by 2030.

- BP is partnering with global building supply leader CEMEX to develop net-zero carbon cement.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- COVID-19 disruptions at major ports in India threaten to have global reverberations for the shipping industry.

- American semiconductor companies have teamed up with large U.S. businesses to form the Semiconductors in America Coalition, part of an effort to get Congress to provide $50 billion for semiconductor research and manufacturing.

- U.S. car dealers had fewer than 2 million vehicles on the ground or in route to stores at the end of April, roughly half the normal number and the lowest level in more than three decades as the global chip shortage hurts supply.

- Lost auto sales from the chip shortage could be as high as $110 billion, caused by a production hit of nearly 4 million vehicles across the globe.

- South Korea plans to invest $450 billion into its semiconductor industry over the next decade, joining China and the U.S. in a global race to dominate the market.

- More than 770 barges containing oil and dry products were backed up on the Mississippi River after a crack was discovered in a bridge. Officials hope to restore the movement of river traffic within 48 hours.

- Canadian National Railway’s $30 billion takeover proposal has taken the lead in a race to acquire Kansas City Southern (KCS), a price that includes a nearly $700 million breakup fee that KCS would owe a rival bidder for walking away from an existing agreement.

- PayPal announced plans to acquire returns solution provider Happy Returns, providing online shoppers a way to return unwanted goods without needing to package and ship the items themselves.

- Seventy percent of California is officially under drought conditions.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- Newly reported U.S. COVID-19 cases fell below 40,000 for the fifth straight day yesterday, with 38,087 infections and 802 deaths. Over 266 million vaccine doses have been administered with 36.3% of the population fully vaccinated.

- Most states that experienced recent COVID-19 outbreaks have reported major declines in both new cases and deaths over the last two weeks.

- The CDC lifted mask-wearing guidance for fully vaccinated individuals in most settings.

- Exceptions include when masks are required by federal and local officials, as well as in hospitals, doctor’s offices, airports, train stations, prisons and homeless shelters.

- The CDC also updated mask-wearing guidance for cruise ship passengers, allowing those who are fully vaccinated to remove their masks outdoors if they are not among crowds.

- At least eight states lifted mask mandates following the new guidance.

- The White House will stop shipping Johnson & Johnson’s single-shot COVID-19 vaccine to states next week due to a production freeze after a large-batch contamination at a Baltimore plant two months ago. Emergent BioSolutions executives will talk to lawmakers next week as part of an investigation into the contamination.

- Drugmakers CureVac and GlaxoSmithKline released positive data regarding their second generation COVID-19 vaccine, suggesting the shots could also provide protection against virus variants.

- Following the approval of the Pfizer/BioNTech COVID-19 vaccine for adolescents aged 12-15, the U.S. plans to launch a new family-oriented campaign to help inoculate the demographic.

- New York City’s mayor is offering hamburger and sandwich vouchers for Shake Shack to help increase vaccinations in the city.

- An Oxford study showed that people who received mixed doses of the Pfizer/BioNTech COVID-19 and AstraZeneca shots were more likely to experience adverse reactions than those who received two doses of the same vaccine.

- New research shows that those still experiencing a loss of smell from COVID-19 can train themselves into smelling again.

- The nation’s second-largest teachers union is calling for all schools to reopen fully for the next academic school year.

- With more states lifting COVID-19 restrictions, new unemployment claims in the U.S. fell to 473,000 last week, the lowest since March 2020.

- After hiring more than 500,000 people last year as it bulked up to meet increased demand, Amazon is looking to hire an additional 75,000 fulfillment and logistics workers to help boost its North American operations. The company also is hiring 10,000 workers in the U.K.

- Major U.S. companies, including Amazon and many fast-food chains, are raising pay for low-wage jobs to fill a glut of available positions amid labor shortages.

- At least 16 states have announced plans to end $300 federal supplemental unemployment payments that are not scheduled to expire until Sept. 6.

- Retail sales were flat in April, disappointing economists who expected a 0.8% increase.

- Despite incurring a first-quarter net loss of more than $1.1 billion, Airbnb said its travel stay bookings are increasing.

- Fisker and manufacturing partner Foxconn announced plans to build an electric vehicle manufacturing factory in the U.S., aiming to begin production in 2023.

- Hyundai plans to invest $7.4 billion in U.S. facilities through 2025, with special focus on electric vehicles.

International

- India reported 343,144 new COVID-19 cases Friday, alongside 4,000 virus deaths, as total reported infections topped 24 million.

- The crisis is spreading rapidly in rural areas of the country, where an acute lack of access to medical resources prevents diagnosis and treatment.

- The nation is set to receive more than 2 billion additional doses of COVID-19 vaccines in the second half of the year.

- As the pandemic eases in Europe and the U.S., earlier epicenters of the coronavirus, it is surging across Southeast Asia.

- The government of Taiwan, which has largely controlled the coronavirus, ordered virus testing as the island nation experienced a record 29 new COVID-19 infections from community spread today.

- A cluster of COVID-19 cases originating in a Singapore airport grew to 24 Thursday.

- The seven-day average of new COVID-19 infections in Germany has fallen below 100 per 100,000 people, a key threshold for lifting restrictions.

- The number of new COVID-19 cases in France rose at the slowest pace since last June, with 19,791 new infections over the past week.

- As it reopens its economy, the U.K. has formed a rapid response team and is warily watching for a new spike related to the Indian variant of COVID-19.

- Spain’s prime minister says the country is on track to achieve herd immunity by mid-August.

- Australia will purchase 25 million doses of Moderna’s COVID-19 vaccine, hoping to boost its lagging vaccination numbers, while also negotiating with the drugmaker to manufacture the vaccine locally.

- Turkey and Serbia have reached a travel agreement allowing for quarantine-free travel for fully vaccinated people.

- While higher commodity prices have added to fears of inflation, they have been a boom to commodity exporting nations such as Australia, Brazil and Chile.

- Economists slashed their estimates for second-quarter growth in Japan to 1.7% due to renewed COVID-19 restrictions.

- Toyota beat analyst estimates for the first quarter, reporting that profits more than doubled on an 11% rise in revenue.

- BMW announced plans to produce a limited number of hydrogen fuel cell crossover vehicles in 2022, a bid to offer alternatives in the growing electric vehicle market.

- Volkswagen is developing an electric version of its microbus, the ID.Buzz, for commercial introduction by 2025.

- Safety perceptions of car buyers have changed during the pandemic, with many showing an increased desire for new hygiene features in their vehicles.

- Canada officially labeled plastic as a “toxic substance,” paving the way for a ban on certain single-use items.

- China aims to recycle 60% of its urban waste by 2025 by reducing the use of single-use plastics, mandating the separation of trash and investing in recycling.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.