COVID-19 Bulletin: March 30

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices dropped 7% Tuesday before climbing back to end the session only slightly lower, as peace talks between Russia and Ukraine appeared to gain momentum.

- In mid-morning trading today, WTI futures were up 3.8% at $108.20/bbl, Brent was up 3.8% at $114.40/bbl and U.S. natural gas was up 3.9% at $5.54/MMBtu.

- Some Chinese refiners are trying to resell purchased crude as lockdowns dampen consumption of transportation fuels. Weakness in global oil demand is expected to persist through April and May, according to Rystad Energy.

- Saudi Arabia is expected to raise prices for Asia-bound cargoes of its key light crude by $5/bbl next month to a new all-time high.

- Kazakhstan is set to lose at least one-fifth of its oil production for a month following recent storm damage to the Caspian Pipeline Consortium’s export facilities, officials said.

- Analysts say natural gas output in the U.K., one of western Europe’s largest producers, will likely remain flat this year and fail to provide relief to the tight European market.

- The U.S. administration likely won’t sell offshore drilling rights in the Gulf of Mexico through at least October 2023, stretching the inactivity into its third straight year.

- More oil news related to the war in Europe:

- Russia is demanding Europe start paying for Russian gas in rubles by tomorrow, setting up a potential supply crisis if nations hold firm in rejecting the demand. Germany has already triggered a contingency plan that aims to insulate the country against a sudden drop in deliveries.

- Poland is banning all coal imports from Russia.

- Saudi Arabia and the United Arab Emirates rejected calls to expel Russia from the OPEC+ oil alliance.

- The U.S. administration will unveil stricter fuel economy requirements for new vehicles this Friday, officials said.

- New Jersey is shutting down its last two coal power plants in May.

- Spurred by planned investment in carbon-capture projects, Canada is calling for a 42% reduction in emissions from the oil and gas sector by the end of the decade.

- European lawmakers are considering an “amber” environmental label on gas-fired power plants, indicating that the natural gas is not yet sustainable but could become so as it helps bridge a transition to renewables.

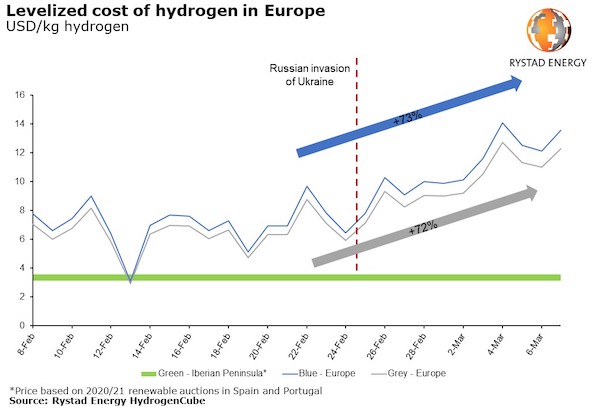

- Germany’s largest energy group is pairing up with an Australian miner to ship 5 million tonnes of green hydrogen to Europe by the end of the decade. Rising prices for the fuel make it more feasible as a vehicle for weaning Europe off Russian gas:

- U.S. renewables firm Heliogen is partnering with Australia’s Woodside Petroleum to build a 5-megawatt concentrated solar farm in Mojave, California.

Supply Chain

- Two major auto suppliers joined Tesla in suspending production in Shanghai during the city’s COVID-19 lockdown, with GM reportedly staying open by asking workers to sleep on factory floors. A growing number of airlines are canceling cargo service to the city, where inspections have been halted and roads to a main airfreight hub shut down.

- The Pharr-Reynosa bridge between the U.S. and Mexico carried a record $150 million in goods each day last year, a 26% rise over 2020. Volumes could skyrocket after a second commercial bridge is built alongside the existing one.

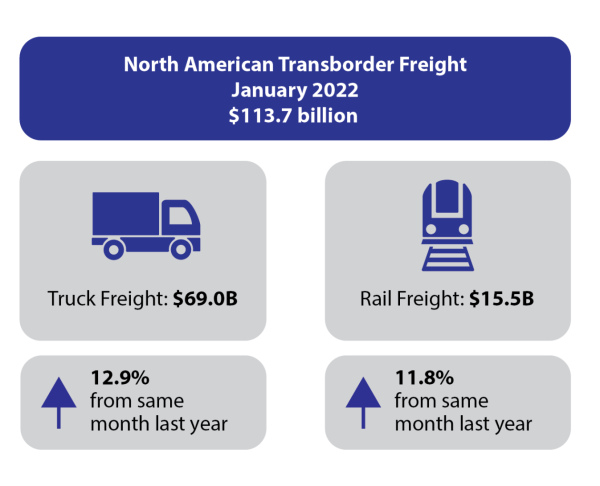

- North American trans-border freight values surpassed $113 billion in January, up 20.6% from the year before and 17.1% higher than in January 2020.

- South Carolina’s Port of Charleston stopped forecasting when it will be able to clear a backlog of more than two dozen vessels.

- Ocean Network Express plans to invest $20 billion to boost container shipping capacity by a third and acquire more terminals by 2030.

- The U.S. Senate is considering new legislation to overhaul and strengthen U.S. maritime regulation for the first time in over two decades.

- Over 28,500 Norwegian shipyard, oil and manufacturing workers plan to strike Friday over a wage dispute.

- Old Dominion Freight Line plans to add 10 terminals across the U.S. this year on top of the seven it added or expanded over the last two quarters.

- Indiana’s JCB Trucking filed for bankruptcy protection just one month after it was ordered to suspend interstate routes due to poor regulatory performance.

- UPS is expanding a deal with Alphabet’s Google Cloud to provide better data collection and artificial-intelligence and machine-learning tools.

- Businesses are focusing more on “fourth-party” risk management due to increasing rates of disruption caused further down the supply chain from their direct third-party providers.

- More supply chain news related to the war in Europe:

- Buyers seeking replacements for commodities that are restricted in Russia are increasingly looking at Canada, which shares similar climate and geographical features and produces many of the same commodities as Russia.

- Russian steel maker Severstal PAO is edging closer to becoming the first major Russian debt defaulter since the invasion.

- The number of ships leaving Russian ports for international destinations has declined 35% since late February.

- International concern is rising over dwindling food supplies for the 100 foreign-flagged ships and 1,000 seafarers that remain stranded in Ukrainian ports.

- Ukraine will need to rely on a flood of international aid to restore typically large agriculture exports once Russia’s invasion is over.

- U.S. officials predict American farmers will rapidly adjust their planting to export more and take advantage of higher global food prices.

Domestic Markets

- The U.S. reported 23,643 new COVID-19 infections and 961 virus fatalities Tuesday. Total fatalities since the start of the pandemic are verging on 1 million, the highest in the world.

- The BA.2 subvariant of Omicron now represents over half of new infections in the U.S., the CDC says, including about 70% of infections in New York and New Jersey, where cases are rising.

- The FDA authorized a second COVID-19 booster shot for everyone over age 50 and for immunocompromised people over age 12, and suggested a second booster could be particularly helpful for those who received Johnson & Johnson’s initial shot.

- Researchers at Cornell University are close to developing a nasal spray they say can block COVID-19 infection.

- The White House will launch a new website today — COVID.gov — where Americans can identify virus risks in their areas and recommendations for threat mitigation.

- Twenty-one states are suing the federal government over mask mandates in airports and on other forms of public transportation.

- The White House’s proposed budget for next year would increase FDA funding by 34% to $2.1 billion, an effort to help the agency prepare for future pandemics.

- An index of U.S. consumer confidence rose to 107.2 in March, up from a year-low reading in February, even as consumers expect prices to rise by the most on record this year.

- The Treasury bond yield curve briefly inverted yesterday, with short-term rates topping long-term rates, indicating investor uncertainty about the near term and signaling increased risk of recession.

- A widely tracked index of metro home prices rose 19.2% in the 12 months ending in January, a faster rise than the previous month as the supply of homes fell to a new low.

- Brand loyalty for many of the most common grocery items is being tested as shortages and stockpiling drive U.S. consumers to lower-cost items. Pandemic shortages also prompted consumers to gravitate to alternative products, such as recycled toilet paper.

- Vietnamese auto startup VinFast will invest over $4 billion to build an assembly plant in North Carolina capable of producing 200,000 vehicles per year by 2027.

International Markets

- Global COVID-19 fatalities surged over 40% last week, although the number of new infections went down.

- Asian countries long considered the most successful against COVID-19 are now facing the world’s worst virus surges.

- China reported nearly 6,000 new COVID-19 cases in Shanghai alone yesterday, up by one-third from the day before as panic-buying spreads across the nation.

- More than 20,000 workers in Shanghai’s financial district are sleeping in offices among other extreme measures to keep the nation’s finance center running through lockdowns. Economists say the nation is on track to lose $46 billion per month in economic output, equating to some 3.1% of GDP.

- South Korea’s daily COVID-19 cases rose to over 420,000 yesterday, a sharp upturn from the previous five days.

- More news related to the war in Europe:Ukrainian and Russian negotiators met in Turkey for the first face-to-face discussions in nearly three weeks, with Russia promising to reduce its military operations around Kyiv and northern Ukraine, while Ukraine proposed adoption of neutral status but with international guarantees it would be protected from attack.

- Russia is offering to buy back dollar bonds maturing next week in rubles, raising fears of default if investors reject the plan.

- Johnson & Johnson is suspending sales of personal-care products in Russia while continuing to sell medicine and medical devices there.

- Aluminum-can maker Ball Corp. plans to sell its three manufacturing sites in Russia.

- Renault may transfer ownership of its Russian venture AvtoVaz to a local investor to exit the nation, reports say.

- A new air route from Hong Kong to New York will become the world’s longest commercial passenger flight after being recalibrated to avoid Russian airspace.

- The White House could soon release an additional $500 million in aid for Ukraine, officials said.

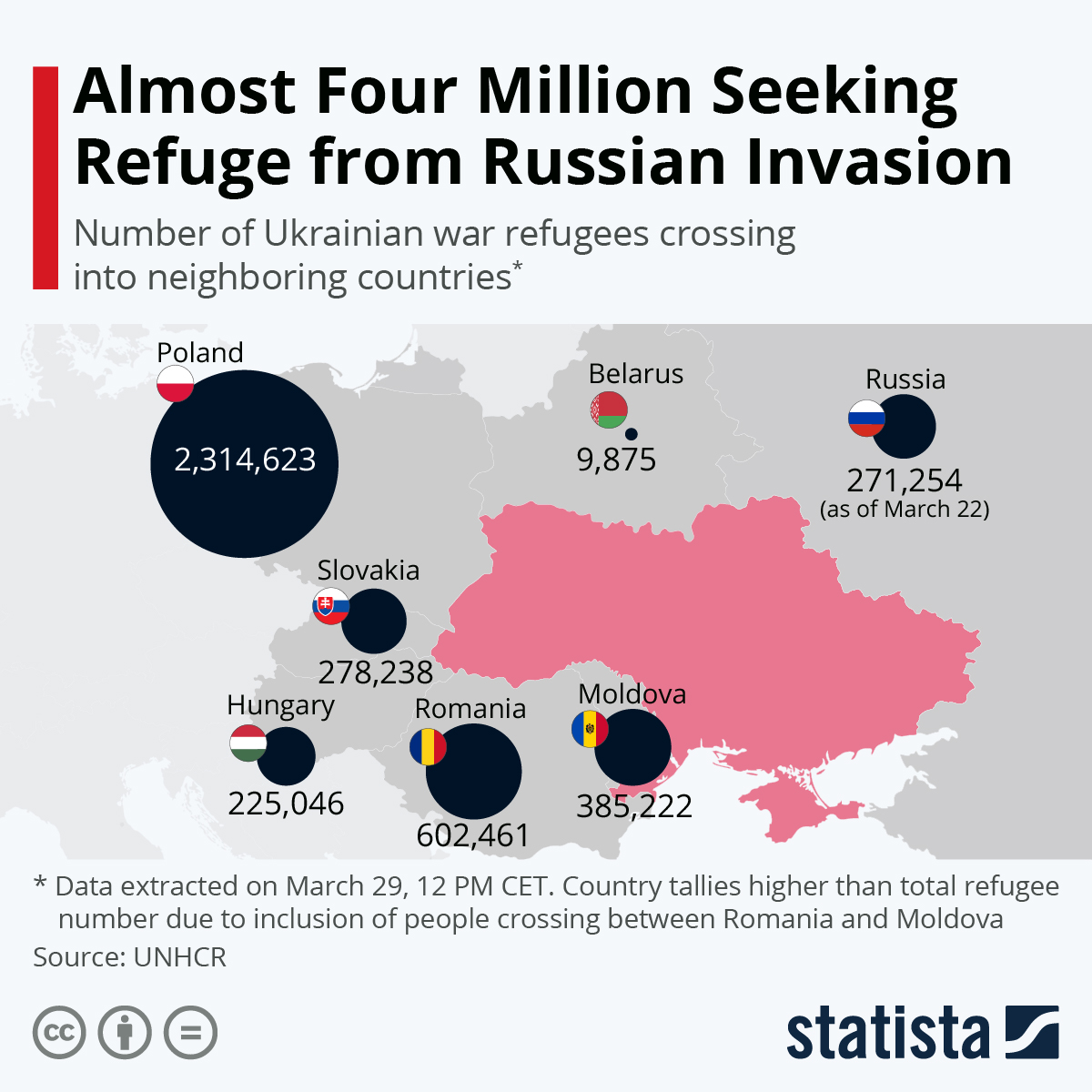

- Nearly 4 million people have fled Ukraine since late February:

- Hong Kong professional wages are rising by over 30% in some instances as firms look to keep workers on the island amid strict virus controls.

- Consumer confidence in France and Germany dropped sharply in recent weeks on fears of inflation and the fallout of Russia’s invasion. Sentiment among businesses and households is down across Europe.

- Italy slashed its economic growth target from 4.7% this year to 2.8%.

- Corporate travel budgets are only about one-third of pre-pandemic levels and may never fully recover, according to the Global Business Travel Association.

At M. Holland

- Our next Plastics Reflections Web Series is today at 1:00 pm CT. This event focused on the current and future state of the North American plastics industry will feature panelists from Business Publishing International, Jabil (Inc), LyondellBasell and M. Holland. Click here to learn more and register.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.