COVID-19 Bulletin: March 29

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices slid 7% Monday over fears of rising COVID-19 cases in China, which could dent demand up to 800,000 bpd next month, according to traders. In mid-morning trading today, WTI futures were down 3.7% at $102.00/bbl, Brent was down 3.7% at $108.40/bbl and U.S. natural gas was down 1.8% at $5.41/MMBtu.

- OPEC+ is expected to stick to a modest 432,000-bpd output increase for May when the group convenes this Thursday.

- Crude supplies in Cushing, Oklahoma, are at a four-year low as American producers send more oil to the Gulf Coast for export.

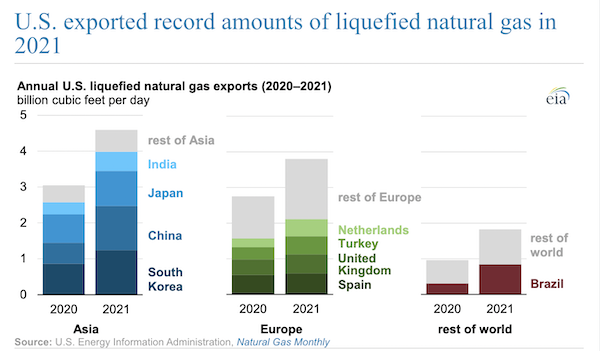

- U.S. LNG exports rose to a record 9.7 billion cubic feet per day last year, driven by demand in Europe and China:

- Houston-based Tellurian greenlighted construction on a $12 billion Louisiana export complex that will expand U.S. LNG export capacity by about 15% in four years, the firm said.

- More oil news related to the war in Europe:

- With most of Russia’s March crude shipments contracted before the invasion, April could be the first month the world sees significant crude supply shortages, analysts warn. Russian oil exports were already down over 25% last week.

- A supply crisis could be imminent after leaders of the G7 nations firmly stood against Russia’s continuing demand that they start paying for Russian gas in rubles by week’s end, a measure that would help the invading nation prop up its currency but goes against contractual terms and Western efforts to punish the nation economically.

- Following India and China, Indonesia became the latest nation to say it would consider buying war-discounted Russian oil.

- Indian energy firms with a stake in Russian oil projects are struggling to sell discounted crude to all but India’s own refiners.

- Europe’s gas storage capabilities are struggling to keep up with a surge in demand for non-Russian LNG.

- Russian tankers are turning off identification systems to avoid being spotted breaching Western sanctions.

- Spain approved $17.5 billion in financial aid yesterday to help companies and households manage energy prices.

- A nuclear plant under construction in the U.K. could face months or years of delays over fallout from the invasion of Ukraine.

- Exxon Mobil’s latest exploration efforts off the Brazilian coast have come up dry, a rare setback.

- A new software platform from Xpansiv will provide rig emissions data for oil extraction.

- The price for R-PET clear flake and food grade pellets soared in February to the highest premium over virgin PET on record due to strong demand and limited supply.

Supply Chain

- The U.S. is set for a volatile few days of weather, which could see flooding, mudslides and snow in California alongside severe thunderstorms and tornados in the central and eastern U.S. Meanwhile, a heat wave brought record March temperatures to the southwest last weekend.

- While Shanghai’s port remains open, exporters are bracing for delays as the city’s lockdowns hit warehouses, transport and staffing, a pattern experienced during recent lockdowns in Shenzhen. Bridges and tunnels are closed while highway traffic is restricted, although some firms are able to keep factories open with tightly controlled isolation and testing regimens.

- Maersk said some depots serving local ports in Shanghai have closed indefinitely, and trucking to and from terminals will be “severely impacted” due to COVID lockdowns.

- Labor negotiations will soon begin for the more than 22,000 dockworkers at 29 West Coast ports whose contracts end in June, heightening anxiety about further logistics disruption.

- A seven-year deepening of the Port of Savannah has been completed, officials said Monday, which will ease the passage of megaships and help the port handle an expected record number of calls as more cargo is diverted from the congested Pacific Gateway.

- Construction and business groups are lobbying to stall a wave of state and federal gas-tax decreases that could jeopardize infrastructure funding, including projects tied to last year’s $1 trillion aid package.

- The U.S. Surface Transportation Board is working through feedback from logistics providers on a proposal to expand reciprocal switching, which would compel rail companies to open their tracks for use by competitors.

- Economic and educational advances in Mexico are boosting the nation’s appeal to U.S. manufacturers looking to nearshore supply chains.

- Almost 100,000 vehicles across the globe were removed from planned production last week due to semiconductor shortages.

- Apple is reportedly cutting production of iPhone SEs by about 20% next quarter on signs that consumer-electronics demand is being hurt by the war in Ukraine and rising inflation.

- Crews are still working to free the Ever Forward container ship stuck in the Chesapeake Bay for the past two weeks.

- WestJet, Canada’s second-largest passenger airline, will launch a standalone freighter division this summer with two converted Boeing 737s.

- Truck maker Navistar is recalling more than 2,800 of its flagship tractors due to fire risks caused by faulty wiring.

- FedEx’s supply chain unit is ending operations at four facilities in California, Pennsylvania and Tennessee this year as customers shift locations and gravitate to other providers as their contracts expire.

- Grain shipments from major exporter Ukraine have fallen from 5 million tonnes per month to just a few hundred thousand due to the war with Russia. A reprieve could come next month if enough crops are sowed, officials say.

- Higher food prices are rippling through global markets, changing the way consumers eat and reducing or shrinking the menu items offered by the world’s most recognizable brands.

Domestic Markets

- The U.S. reported 42,967 new COVID-19 infections and 985 virus fatalities Monday. Fatalities are at their lowest level since before the Omicron variant took hold last fall.

- Led by the BA.2 Omicron subvariant, COVID-19 cases are up the past two weeks in several northeastern and southern states, including New York, Connecticut and Arkansas.

- A COVID-19 outbreak in the Alaskan statehouse is spreading, prompting a new mask mandate.

- Just 30% of Los Angeles children have been vaccinated against COVID-19 compared to 80% of teens and adults, reflecting broader trends across the nation.

- The risk of COVID-19 outbreaks on U.S. cruise ships is far from over, even where all passengers are vaccinated.

- Uninsured Americans may have to pay up to $195 for individual COVID tests as congressional funding begins drying up. Hospitals are bracing for the financial impact from lost reimbursements.

- Up to 10%, or $80 billion, of the Paycheck Protection Program may have been fraudulently claimed, prosecutors say.

- U.S. healthcare spending rose 4.2% in 2021, less than half the growth rate of the record-setting first year of the pandemic.

- Four of New York City’s five counties lost comparatively more people last year than any other major county in the U.S., led by a 6.9% decline in Manhattan.

- The EPA recently codified best practices for ventilation, air filtration and air disinfection, as reducing indoor transmission of COVID-19 becomes a primary focus of the next pandemic phase.

- The White House unveiled its $5.8 trillion budget proposal for next year, slightly smaller than initial projections, but still projecting an estimated $1.15 trillion deficit.

- The U.S. trade deficit in goods fell 0.9% in February, the first decline in three months after a record-setting January, led by a gain in export values rather than export volumes.

- Job openings declined slightly in February from January, continuing to dwarf the number of people looking for work.

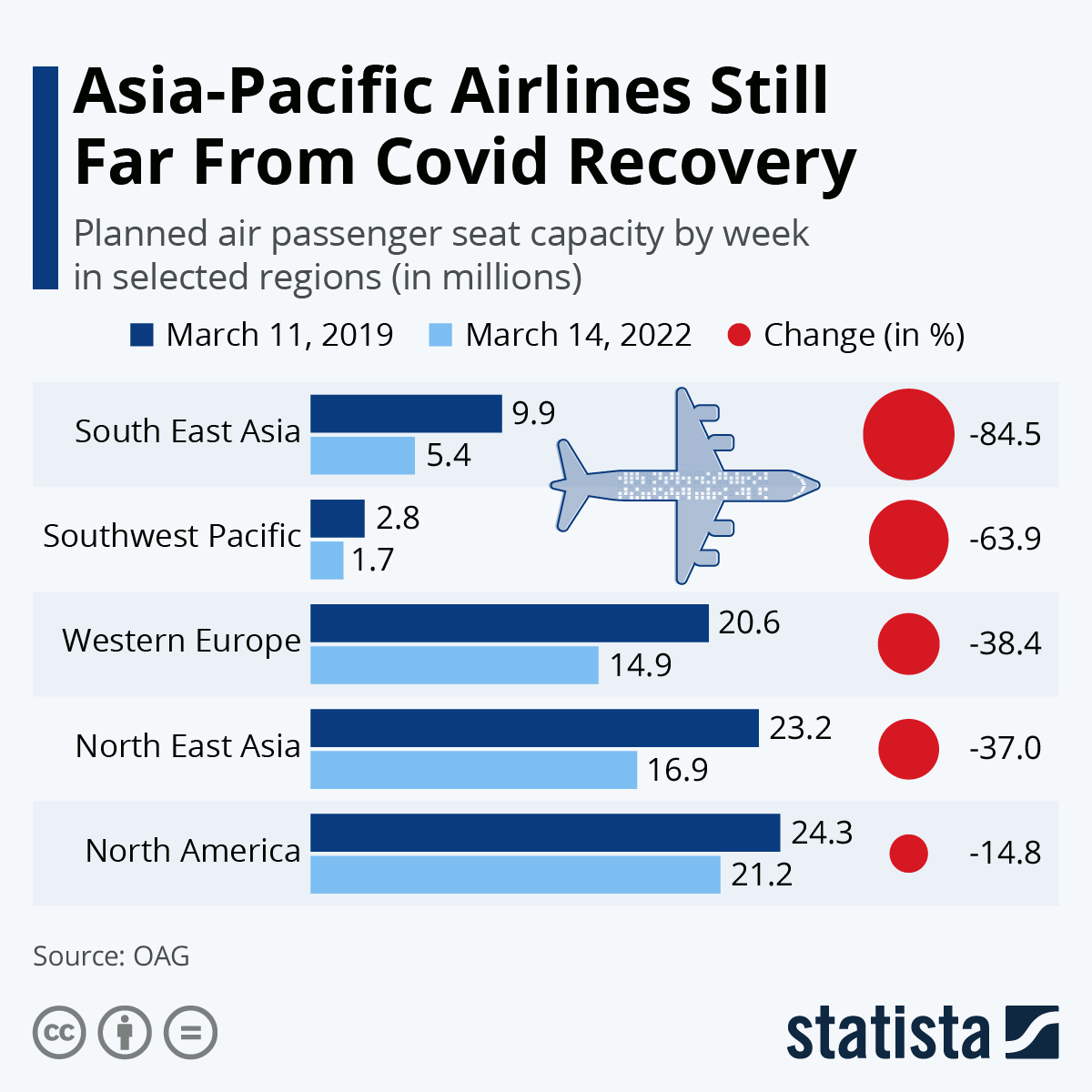

- The Austin-Bergstrom International Airport is running out of jet fuel as passenger air travel rebounds well above pre-pandemic levels. Business travel is picking up faster in the U.S. compared to other regions of the world.

- Consumer dollars usually spent on new vehicles are more frequently being spent on vehicle maintenance and upgrades, boosting the auto parts industry.

- Vehicle sales per dealership rose last year while the number of dealerships fell, the latest data shows.

- U.S. electric scooter sales are surging as urban commuters look for more convenient and less expensive modes of transportation.

- Real estate investors are targeting unconventional properties occupied by small businesses, as low interest rates have pushed up the price of apartments, warehouses and other more traditional holdings.

- HP is looking to capitalize on remote working trends with the $3.3 billion acquisition of a maker of phone headsets and audio/video accessories.

- The Justice Department endorsed antitrust legislation yesterday that would forbid large platforms such as Amazon and Google from favoring their own products and services.

- Wildfires have become three times more likely to occur in some parts of the U.S. over the last two decades.

International Markets

- The BA.2 subvariant of Omicron now accounts for 86% of all new cases across the globe, the World Health Organization said.

- COVID-19 vaccine supply is exceeding demand in much of the world, even with countries rolling out booster shots.

- Germany will remove most remaining pandemic restrictions at the beginning of April, officials said.

- China reported almost 7,000 new COVID-19 cases Monday, including a record 4,477 in Shanghai, where strict stay-at-home lockdowns were tightened. Officials in the nation’s northeast province of Jilin are apologizing for food shortages.

- South Korea’s weekly COVID-19 infections dropped for the first time in 11 weeks, suggesting its most recent virus wave has peaked.

- Funeral homes in Hong Kong have introduced eco-friendly, cardboard coffins to help deal with a surge in COVID-19 deaths and corresponding shortage of traditional caskets.

- Older Israelis who received a second COVID-19 vaccine booster were 78% less likely to die than those with only one booster, a new study shows.

- International airlines are increasingly scrapping mask mandates.

- More news related to the war in Europe:

- The Moscow Exchange fell after reopening trading for the first time in a month yesterday. The exchange is still banning foreigners from selling shares.

- Switzerland’s Credit Suisse is halting new business in Russia and further cutting its exposure there.

- Global beer giants Heineken and Carlsberg have committed to exiting the Russian market.

- U.S. trade officials are launching a probe into Chinese solar equipment makers that circumvent tariffs by routing operations through Cambodia, Malaysia, Thailand and Vietnam.

- Overcoming component shortages and supply chain challenges, Mexico’s heavy truck makers increased production 41% in February compared with the year-ago month, with most destined for export.

- The White House is lobbying Congress to authorize $11 billion to support foreign clean energy projects this year, over 10 times the level from last year.

- Canadian e-commerce company Shopify is putting over $13 million into carbon removal startups, the firm said.

- A heat wave in Antarctica coincided with the collapse of an ice shelf the size of Manhattan, a first for the continent.

At M. Holland

- Our next Plastics Reflections Web Series is tomorrow, March 30 at 1:00 pm CT. This event focused on the current and future state of the North American plastics industry will feature panelists from Business Publishing International, Jabil (Inc), LyondellBasell and M. Holland. Click here to learn more and register.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.