COVID-19 Bulletin: March 28

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose 1.5% with Brent topping $120/bbl Friday and both WTI and Brent logging their first weekly gain in three weeks. In mid-day trading today, WTI futures were down 5.9% at $107.10/bbl, Brent was down 6.0% at $113.40/bbl and U.S. natural gas was down 1.3% at $5.50/MMBtu.

- A Saudi Aramco fuel depot in Jeddah went up in flames Friday amid retaliatory skirmishes with an armed group in Yemen.

- More oil news related to the war in Europe:

- The U.S. aims to ship 50 billion cubic meters of LNG to Europe each year through at least 2030, officials said Friday, more than double last year’s record amount and equating to roughly a third of typical shipments from Russia. Analysts say the move will reorder the global supply system so that the U.S. ships more gas across the Atlantic while Australia and Qatar supply more to Asia.

- Russia is looking at leveraging high oil prices to ship larger amounts of its flagship Urals crude every month, even as the nation’s seaborne exports fell to the lowest level in eight months last week and will likely drop further.

- Chinese refineries are reported to be discreetly buying Russian crude at discounted prices.

- Russia is stepping up efforts to cut associations with the U.S. dollar, including asking India to pay for gas in euros and reaffirming its stance that Europe must pay for the commodity in rubles or face action.

- German imports of Russian energy are already down by double-digit percentages over the past month and declining, in spite of the nation’s earlier pledges to refuse a ban on Russian fuel commodities.

- Europe could face further pressure on GDP growth as prospects grow for the rationing of diesel fuel, the primary fuel for moving goods to market.

- British lawmakers are reportedly considering another multi-billion-dollar package to help shield households from even higher energy prices later this year.

- The trading arm of Gazprom, one of Europe’s top gas and power traders, is facing liquidity problems as banks delay its transactions and peers refuse to deal with it.

- China’s Sinopec plans to boost capital investment by almost 20% this year amid record-high profits and as officials call for raising production.

- High oil prices delivered the biggest budget surplus in nearly 20 years to Alaska.

- The U.S. administration revealed plans to sell another batch of leases for wind development offshore the Carolinas, coming on the heels of a record sale in New York last month that drew over $4.3 billion in bids.

- Australia’s Northern Territory has introduced new legislation that will allow for a high-voltage cable to export power from a giant solar and battery complex in the region to Singapore, aiming to meet 15% of the city-state’s demand with a target start date in 2026.

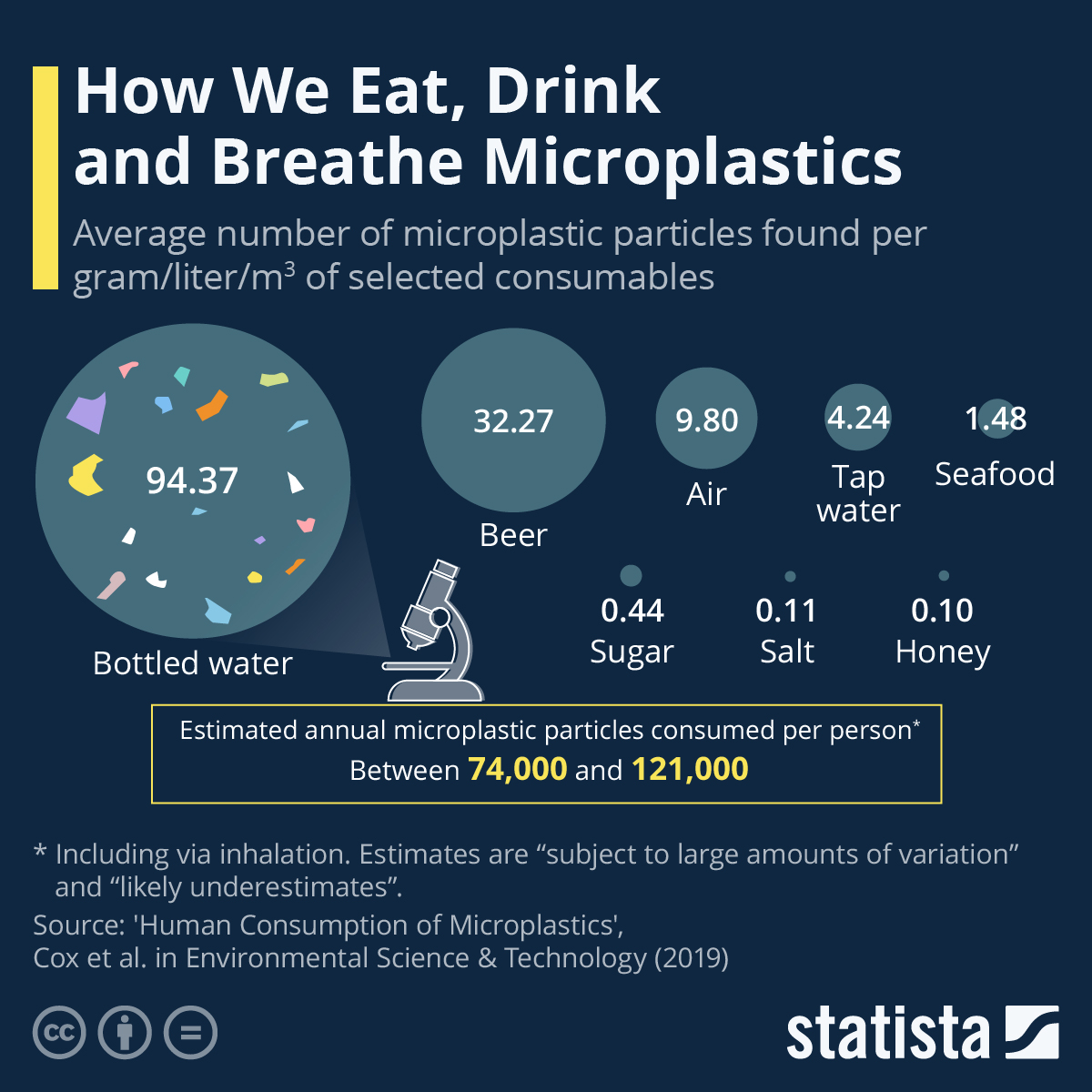

- For the first time, scientists have found microplastics in human blood.

Supply Chain

- Suspension of commercial activity in locked-down Shanghai will have global ripple effects on manufacturing and goods trade, economists warn. The measure has already forced Tesla to shut down factory operations in the city for four days.

- Maersk cancelled more sailings to Shenzhen as supply chain constraints persist even after the city lifted some lockdown measures.

- Companies, including Volkswagen, are reversing decades of supply chain globalization in favor of building resiliency and safeguarding access to key goods at home.

- XPO Logistics sold its North American intermodal segment for about $710 million to STG Logistics, furthering XPO’s strategy to become a standalone provider of less-than-truckload services.

- Independent freight operators and small trucking firms are struggling to keep pace with rising diesel costs, forcing maintenance delays among other deferred expenses.

- France issued over $440 million in state aid to truckers to mitigate rising fuel costs.

- The American Trucking Associations’ for-hire truck tonnage index hit 115.3 in February, up 2.4% from the prior-year period, the sixth straight month of year-over-year increases, though it remains below its pre-pandemic level.

- The average capesize spot rate across five key routes dropped over $2,400 last week to around $18,000 per day.

- Venture investment into supply-chain tech startups based in North America and Europe jumped 104% to $41 billion last year, according to PitchBook Data.

- A U.S. audit of container line operations has been expanded to include export trade, specifically massive cargoes of empty containers allegedly rushed to Asia at the expense of U.S. shipments.

- GM will idle production for two weeks at a truck assembly plant in Indiana due to a shortage of semiconductors.

- Around 47,000 grocery workers in central and Southern California voted to authorize a strike against several major grocery store chains if an agreement over wage increases cannot be met.

- More supply chain news related to the war in Europe:

- At least 11 of the world’s top 25 cargo airlines have curtailed flights through Russian airspace.

- A U.S. Customs and Border Protection bulletin warns that hackers and ransomware groups are targeting American logistics and shipping companies, as the White House warns of possible cyber-attacks by Russia.

- Prices for hot-rolled coil steel are up 40% in Europe and roughly 8% in North America and China over the past three weeks and will likely continue rising.

- The threat of disrupted supply of aluminum from Russia has been driving prices for the metal higher as well as providing momentum for more scrap-based production in the U.S.

- Commodity markets could grow even more volatile as trading houses are forced to reduce activity or tie up liquidity to meet margin calls on whipsawing prices.

- Funding is growing for efforts to evacuate Ukrainian seafarers and their families from the besieged port city of Odessa.

- Traders have exported the first supplies of Ukrainian corn to Europe by train as the nation’s seaports remain blocked by the Russian military.

Domestic Markets

- The U.S. reported 8,321 new COVID-19 infections and 50 virus fatalities Sunday.

- Florida has seen a decrease in COVID-19 fatalities over the past two weeks, reporting 1,167 new virus-related deaths, down from more than 2,000 recorded the two weeks prior.

- The FDA could authorize as soon as next week a second COVID-19 booster dose for people over age 50.

- Moderna raised its COVID-19 vaccine sales forecast for the year from $19 billion to around $21 billion.

- Big U.S. banks including Goldman Sachs and Citigroup are betting the Federal Reserve will raise interest rates more aggressively than planned this year, with the benchmark rate possibly reaching 3.75% in 2023.

- Some 57% of Americans did not pay federal income taxes last year due to a combination of pandemic aid programs and stimulus, up from 44% in 2019.

- A new survey shows that almost half of millennials are living paycheck to paycheck, a 6% increase from last year.

- Employers are waiting as much as 10 months for the IRS to process claims for a widely used pandemic wage subsidy, forcing businesses to dig deeper into reserves and slowing their recovery.

- U.S. pending home sales dropped 4.1% in February, the fourth straight month of declines approaching the usually busy spring season. With inflation rising, new home builders are adding escalator clauses in contracts, while many prospective buyers are stepping back from the market due to high prices and rising interest rates.

- American business investment grew 7.4% last year, the fastest pace in almost a decade, led by 14% more spending on software and computers.

- Third-party deliverer Instacart cut its valuation by nearly 40% as it prepares for an initial public offering, highlighting the difficulties of competing in delivery services marked by rapid innovation and changing demand.

- Federal officials are warning that Boeing may not meet its deadline for certifying a new version of its 737 MAX jet, potentially forcing a costly redesign.

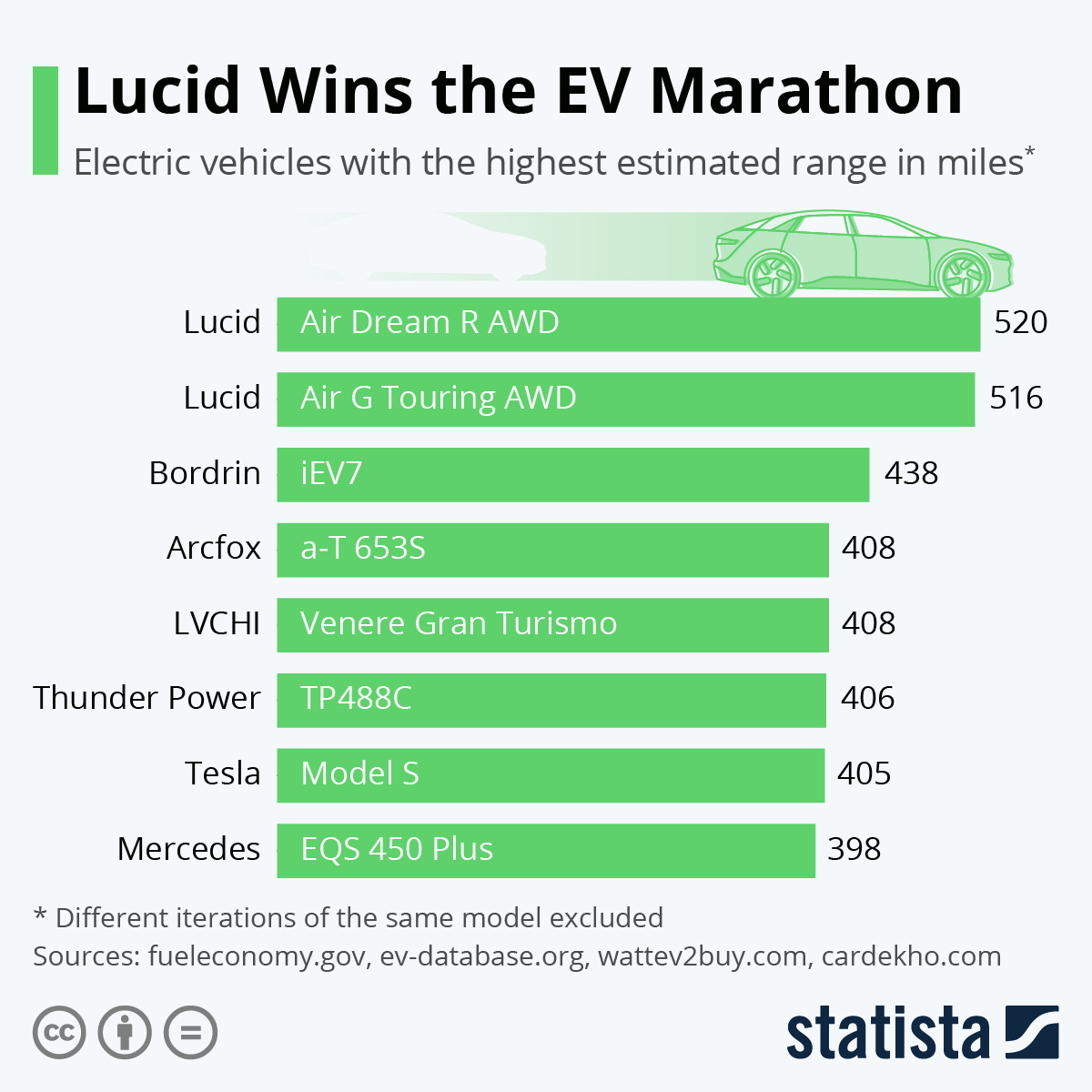

- Cars made by American electric-vehicle startup Lucid have the best battery life on the market by a long shot, new data shows:

- The U.S. National Highway Traffic Safety Administration has reinstated increased penalties for automakers whose cars do not meet fuel efficiency requirements, starting with vehicles manufactured in 2019.

- An SEC proposal to mandate strict climate reporting from public companies could dramatically increase the exposure of firms to securities fraud litigation, analysts say.

International Markets

- China started locking down its largest city of Shanghai as citywide COVID-19 testing gets underway for roughly 25 million people, officials said. More than 6,000 cases were reported across the nation on Sunday.

- Hong Kong is shortening a ban on airlines that are found to have carried COVID-19 positive passengers as the island’s latest virus wave shows signs of easing.

- The Omicron “stealth” subvariant is spreading rapidly across the U.K., with around 4.2 million infections reported in the nation over the last week, including record case numbers reported in both Scotland and Wales.

- Poland will end all pandemic restrictions starting today.

- El Salvador joined Australia in making plans to provide a fourth COVID-19 vaccine dose to some people.

- Ghana’s economy is expected to grow 5.8% this year as the nation lifted the bulk of its pandemic restrictions earlier today, including the reopening of its land and sea borders.

- The U.K. is ordering its public sector organizations to review their contracts with Russian companies to ensure they are not benefiting Russia’s government and helping fund the nation’s invasion of Ukraine.

- Initial public offerings across the globe are down about 70% year over year due to unstable markets and soaring inflation.

- Canada’s booming housing market is showing early signs of a slowdown amidst higher interest rates and inflation.

- China Evergrande New Energy Vehicle Group announced plans to soon start accepting orders for its inaugural electric car and will open new sales centers in 15 major cities across China.

At M. Holland

- Our next Plastics Reflections Web Series is Wednesday, March 30 at 1:00 pm CT. This event focused on the current and future state of the North American plastics industry will feature panelists from Business Publishing International, Jabil (Inc), LyondellBasell and M. Holland. Click here to learn more and register.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.