COVID-19 Bulletin: March 24

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices jumped over 5% Wednesday on the potential loss of 1.2% of daily global capacity after a storm damaged Black Sea pipelines owned by the Caspian Pipeline Consortium. Officials said the group’s oil supplies could be completely stopped for up to two months.

- In mid-morning trading today, WTI futures were down 1.4% at $113.40/bbl, Brent was off 1.6% at $119.70/bbl and U.S. natural gas was up 0.1% at $5.24/bbl.

- U.S. crude stocks fell a surprise 2.5 million barrels last week on higher demand, government data showed, with production remaining flat at 11.6 million bpd for the seventh straight week.

- A Federal Reserve index of oil and gas activity in Texas, Louisiana and New Mexico rose to 56 in the first quarter from 42.6 the previous quarter, marking the highest reading since the survey began six years ago.

- Canada, which has the world’s third-largest oil reserves, will unveil new plans today to boost oil exports and help alleviate the tight global market.

- California’s governor is proposing to send direct payments of $400 per vehicle to state residents to help offset higher fuel prices. Calls for similar measures are rising in Congress.

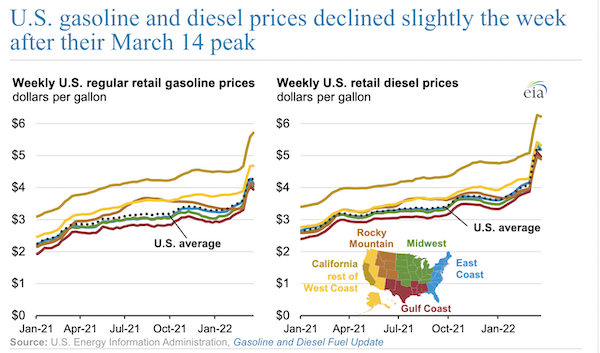

- U.S. gasoline prices averaged $4.24 a gallon last week, an 8 cent decline from the previous week’s record:

- More oil news related to the war in Europe:

- An agreement to ensure supplies of American natural gas and hydrogen for Europe will be announced tomorrow, officials said.

- Russia is attempting to make “unfriendly” nations buy its gas in rubles rather than euros, although it is unclear if the country has unilateral power to make the switch.

- TotalEnergies said it would stop buying Russian oil and petroleum products by the end of the year, but that it won’t sell off assets in the country.

- Germany’s third-largest energy company said it would avoid any new supply deals with Russia until there is a change in the country’s administration.

- EU officials proposed legislation yesterday that would require natural-gas reservoirs to be filled to a minimum 90% before next winter.

- China is restarting two shuttered coal plants as power shortages mount.

- Shell has reserved a substantial part of a proposed LNG terminal to be built in Germany by 2026.

- Pressure to reduce reliance on Russian gas has Bulgaria speeding up its plans for completing a new pipeline with Greece.

- JPMorgan lowered its growth estimates for Italy and Spain this year after predicting the countries will see the harshest effects from surging European energy prices.

- Some 1.5 million Russians who work in the oil and gas industry may lose their jobs by next year, analysts say.

- China is aiming to boost green hydrogen production and have 50,000 hydrogen-fueled vehicles on its roads by 2025, officials said.

Supply Chain

- A strike among Spanish truck drivers is growing, tying up food distribution and other supply chains.

- French logistics conglomerate Bolloré is pulling all operations from Africa.

- Container spot rates fell 4%-5% last week from Asia to North European and Mediterranean markets, leading some shipping lines to cancel sailings.

- DHL closed a $1.65 billion deal yesterday to acquire J.F. Hillebrand Group, an international ocean logistics provider specializing in beverage and bulk liquid shipments.

- General Mills raised its full-year guidance on projections of higher demand for packaged goods including cereal, snack bars and pet foods.

- Global lithium-ion battery production capacity will remain tight this year but could rise as much as fivefold by the end of the decade on high demand from automakers, Wood Mackenzie predicts.

- Nvidia’s pipeline of deals with auto customers jumped by more than one-third over the past year to $11 billion, suggesting booming demand for automation in cars.

- Amazon is opening a $100 million logistics site in Turkey later this year to meet rising demand. Separately, workers at Amazon’s largest warehouse in Staten Island, New York, will begin voting Friday on whether to become the firm’s first U.S. employees to join a union.

- Nike’s revenue jumped 5% in the quarter ending Feb. 28 to $10.87 billion, surpassing market expectations with all its Vietnam factories reopened and fully operational.

- More supply chain news related to the war in Europe:

- Cargo-ship departures from Russian ports are down 35% since late February, largely from lost grain shipments.

- Japan’s Ocean Network Express suspended container service to Russia.

- LG Electronics halted all shipments to Russia, citing logistical difficulties.

- Trading giant Trafigura Group doubled the size of its credit facility with banks to over $2 billion, as volatile moves in oil, natural gas and metals continue tying up huge amounts of cash.

- Steel giant Severstal PAO is verging on being the first major Russian issuer to default on its debt. Similar concerns are rising for Russian competitor Evraz.

- Farmers in some of the world’s richest coffee producing regions are struggling to find alternatives to counter soaring fertilizer costs, threatening lower yields and a global rise in prices.

- China is expanding its purchases of U.S. corn to replace shipments from Ukraine.

- Nebraska will cull over a half a million chickens due to an outbreak of bird flu.

Domestic Markets

- The U.S. reported 40,987 new COVID-19 infections and 1,617 virus fatalities Wednesday.

- Moderna will seek authorization for its COVID-19 vaccine in children as young as six months old following positive results from a recent clinical trial, the firm said.

- Nearly three-quarters of U.S. counties suffered more deaths than births in 2021.

- Leading airlines are requesting the U.S. administration drop masking requirements for air travel.

- New York City is scrapping the rule today that allows out-of-town, unvaccinated professional athletes to play in its venues but not New York-based unvaccinated athletes.

- More than $20 billion in federal pandemic rental assistance had been allocated at the end of January, new data shows.

- First-time jobless claims last week fell by 28,000 to 187,000, the lowest level since 1969.

- Americans over age 65 have been the slowest to increase spending habits during the pandemic, a trend expected to reverse sharply in the coming months.

- U.S. auto sales could fall as much as 28% this month from a year ago on the combined effects of inflation and production shortfalls, J.D. Power predicts.

- U.S. new home sales fell 2% in February, the second consecutive month of decline, as high prices and rising mortgage rates took more buyers out of the market.

- The U.S. administration said it would renew tariff waivers for over 350 categories of goods from China, applying to bicycle parts, electric motors, machinery, chemicals, seafood, and duffel bags, among other items.

- Searches about electric vehicles on Edmunds.com jumped 84% in early March from the same time last month, as rising fuel costs lead more Americans to electric vehicles.

- Apple has held preliminary discussions about potential joint projects with sports-car maker Porsche.

- A Colorado biofuel supplier inked a deal with Delta Air Lines to provide 75 million gallons of sustainable aviation fuel for the next seven years.

- Current U.S. recycling rates will be unable to match projected demand for recycled resins over the next several years, according to industry speakers at yesterday’s Plastics Recycling Conference.

International Markets

- More news related to the war in Europe:

- The U.S., U.K. and Canada withdrew all credit support to protect exporters of products to Russia and Belarus against the risk of non-payment, while maintaining support for exports to Ukraine.

- Russia’s stock market began limited trading for the first time in a month.

- Nestlé bowed to pressure and will suspend production and sales of most products in Russia, the consumer goods giant said Wednesday. In a similar move, French automaker Renault reversed course and said it would suspend operations at its Moscow plant.

- Mexico’s administration ruled out imposing economic sanctions against Russia for its invasion of Ukraine.

- France has an outsized presence of big foreign firms in Russia, with many continuing operations there despite a wide retreat by Western companies. The nation’s second-largest bank said it would halt operations in Russia yesterday.

- Russia has transferred over 50% of foreign-leased aircraft to its own registry in contravention of international regulations, with the bill rising for the U.S. Export-Import Bank that covers lessors for expropriated aircraft.

- Over 6.5 million Ukrainians have been displaced on top of the 3.5 million who left the country since the end of February.

- France reported 189,777 new COVID-19 cases Tuesday, its largest daily rise in a month.

- Over 200,000 British children were out sick with COVID-19 last week, almost quadruple the level from two weeks prior.

- COVID-19 hospitalizations in Scotland are at pandemic highs.

- Austria reimposed a blanket mask mandate after infections soared following the nation’s lifting of all pandemic restrictions.

- South Korean COVID-19 fatalities rose to a daily record this week, prompting a scramble for morgue space.

- Hong Kong is ending a ban on flights from certain countries, halving hotel quarantine requirements for arriving travelers, and reducing social distancing measures. The island also put its universal testing plans on indefinite hold.

- Singapore will ease most COVID-19 restrictions, among the world’s strictest, at the end of this month.

- South Africa began loosening some pandemic restrictions, including an outdoor mask mandate and some capacity restrictions for indoor venues.

- Europe’s drug regulator is likely to greenlight AstraZeneca’s COVID-19 antibody shot later this week, following the shot’s approval in both the U.S. and U.K.

- An Italian study suggests proper building ventilation can reduce the transmission of COVID-19 in schools by as much as 82%.

- British inflation is up to a 30-year high of 6.2% so far in March, prompting officials to reduce income taxes, double energy subsidies for households and implement the nation’s largest ever tax cut on auto fuel.

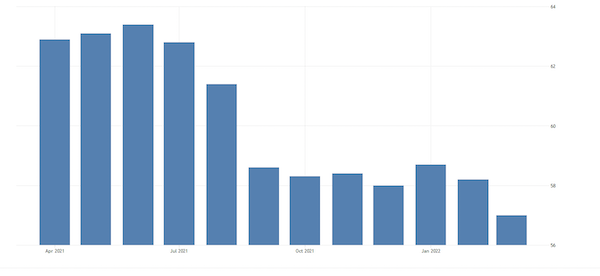

- An index of European manufacturing activity is at its lowest level in 14 months:

- Japanese consumer prices rose a smaller-than-expected 0.2% in February, the fifth straight monthly rise, as lawmakers assemble a new stimulus package to help ease food and fuel costs.

- Mexico’s federal budget deficit was up over tenfold in January from the year-ago period.

- Brazil suspended import tariffs for ethanol and six food products to the end of this year, a bid to help reduce soaring inflation.

- LG Energy Solution will invest $1.5 billion in a joint venture with Stellantis to start producing electric vehicle batteries in Canada by 2024. Separately, Stellantis is pairing up with Mercedes-Benz and TotalEnergies on a new battery plant in Italy.

- Volkswagen plans to put $7 billion into expanding electric-vehicle battery production in Spain, including possible construction of a new plant outside Valencia that could include Ford as a partner.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.