COVID-19 Bulletin: March 17

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

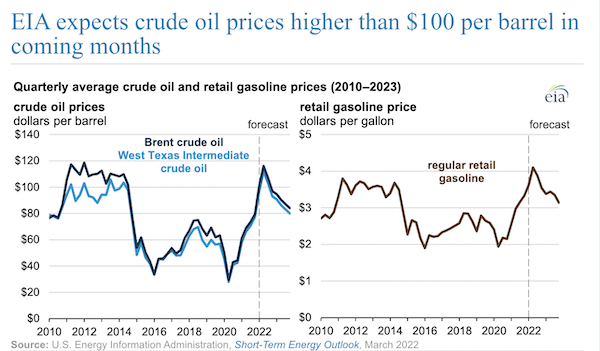

- Oil prices fell over 1.5% Wednesday on a surprise build in U.S. crude inventories last week and possible progress in peace talks between Russia and Ukraine. In mid-morning trading today, WTI futures were up 7.8% at $102.50/bbl, Brent was up 8.4% at $106.30/bbl and U.S. natural gas was up 4.6% at $4.97/MMBtu.

- The U.S. government expects Brent crude to average $116/bbl and WTI to average $112/bbl in the second quarter before declining.

- More oil news related to the war in Europe:

- The U.S. will see a surge in Russian energy imports this month as vessels carrying pre-ban cargoes rush to its shores before an April 22 cutoff.

- The U.S. federal government is permitting two Cheniere-owned LNG export terminals on the Gulf Coast to ship to countries that do not have free trade agreements with the U.S., including all of Europe.

- Chevron is readying to take greater operational control of its Venezuelan joint ventures if the U.S. lifts sanctions and begins importing fuel from the nation.

- France unveiled a spate of new measures designed to mitigate supply shocks for oil-dependent industries, including covering more than half the cost of their increased energy bills, delaying taxes and payroll charges and boosting state-guaranteed loans. The nation plans to end Russian energy imports by 2027.

- Norway and its largest producer, Equinor, are working to expand gas output in the normally slower summer season to help make up for lost European supplies from Russia.

- Germany’s top power supplier echoed the government’s warnings of dire economic consequences if the nation were to immediately halt Russian energy imports. Household utility bills are already at record highs.

- The U.K. ruled out lifting its 2019 moratorium on fracking to boost energy supplies from shortages caused by Russia.

- It could take three years for Italy to fully replace energy imports from Russia, government officials said.

- With Russian crude offered at around 20% below global benchmark prices, some nations, notably India, are preparing to buy more in the coming weeks.

- The U.S. oil and gas rig count rose by 13 to 663 last week, the highest since April 2020 and the ninth gain in the last 10 weeks.

- The average U.S. gasoline price fell by one cent to $4.32 per gallon Tuesday.

- DoorDash broke with the fuel-surcharge strategy of Uber and Lyft and will start a new gas rewards program for drivers to offset rising prices at the pump to avoid raising costs for customers.

- Jet fuel prices are at their highest levels in almost 15 years.

- Portugal will hold its first auction for offshore windfarms this summer with the goal of producing up to 4 GW of electricity from new projects by 2026.

Supply Chain

- A magnitude 7.4 earthquake hit northeastern Japan late Wednesday, triggering small tsunamis, shutting off power for more than 2 million in Tokyo and killing at least four.

- More supply chain news related to the war in Europe:

- Container ship spot rates on Asia-North Europe routes have fallen steadily from a peak of around $15,000 per FEU at the end of January to between $12,500 and $13,500 per FEU last week due to softening demand.

- Maersk said it would return to Russia to pick up empty containers despite a NATO warning that Russia is likely to attack commercial ships.

- At least 500 commercial leased aircraft owned by Western companies are stranded in Russia.

- Over half of Ukraine’s 80,000 seafarers are currently on ships, with many fearing arrests or worse if their vessels enter Russian ports.

- Insurance premiums have leapt 400% for ships looking to pick up oil from the Black Sea. High premiums have also held back many agricultural shipments.

- Maersk is selling its 30% stake in Russian port terminal operator Global Ports.

- Global auto production could drop by 5 million vehicles over the next two years due to supply chain fallout from Russia’s invasion of Ukraine, S&P Global Mobility says.

- Germany’s Thyssenkrupp downplayed the possibility of spinning off its steel unit and suspended several financial forecasts over the fast-changing situation in Eastern Europe.

- BMW and Volkswagen announced new production shutdowns at European factories this week due to parts shortages from Eastern Europe. BMW lowered profit projections by as much as 9% this year.

- The London Metal Exchange briefly reopened trading in nickel on Wednesday before the metal dropped 5%, reaching its new limit on daily trade swings and prompting another suspension. Volatility is worsened by the growing exodus of Western directors from Russian metal giant MMC Norilsk Nickel PJSC.

- Czech-based Draslovka, the world’s largest maker of gold and silver mining material, suspended production in Europe due to soaring energy prices.

- Key Apple supplier Foxconn has restarted some production in the Chinese tech hub of Shenzhen, a week after announcing suspensions due to COVID-19 lockdowns.

- UPS suspended all pickup, delivery and self-pickup services in Shenzhen and neighboring Dongguan due to COVID restrictions.

- Tesla is halting some production in China over the next few days.

- Toyota said it would cut more production this month due to shortages of computer chips, just days after the automaker lowered output projections for the April-June quarter by 20%.

- Canadian Pacific Railway threatened to lock out employees in three days if there is no agreement with their union, a move that could strand large volumes of commodities and manufacturing shipments.

- U.S. consumer spending on e-commerce could hit a record $1 trillion this year, Adobe Analytics predicts, some 13% higher than 2021.

- The Georgia Ports Authority will spend $150 million to grow capacity at the Port of Brunswick’s flagship auto port and breakbulk terminal for forest products.

- Container ships skipped calls at the world’s smaller ports at a quickening pace in 2021, with the hardest-hit ports in Sri Lanka and Greece losing up to 40% of expected capacity.

- Following a string of carrier acquisitions, Costco now delivers 85% of its less-than-truckload shipments for U.S. e-commerce through Costco Logistics, its in-house, in-home delivery unit.

- To shorten lead times, Party City will start directly chartering vessels, leasing containers and using less popular ports along the U.S. East Coast.

- Trucker Yellow saw an annual 33.8% rise in revenue per hundredweight in February despite a 27.4% decline in tonnage.

- Amazon’s air cargo unit now makes an average of 187 flights per day, up from just 85 in May 2020, making it the world’s fastest growing air cargo business as it seeks to compete with market leaders UPS and FedEx.

- Pennsylvania logistics operator A. Duie Pyle is expanding operations in Virginia, the firm announced.

- XPO Logistics reached an agreement to raise U.K. driver pay by 8% and warehouse pay by 13% over the next 15 months.

- A new White House proposal would update the century-old rules governing pay for construction workers on federally funded projects, potentially bringing wages more in line with what local workers would get for similar types of work. Construction wages were 6% higher in February from the same time a year ago, the fastest growth in four decades.

- Eighteen companies — a mix of ocean carriers, retailers and freight forwarders — will begin sharing supply chain data under a U.S. federal pilot program launched yesterday aimed at improving the flow of goods.

- The British government approved a $5.26 billion package to fund expansion and improvements in the nation’s shipbuilding sector.

- Denmark approved $185 million yesterday for expanding green hydrogen production capacity aimed at fueling a new generation of cleaner vessels in the shipping sector.

Domestic Markets

- The U.S. reported 45,014 new COVID-19 infections and 1,943 virus fatalities Wednesday.

- Newly admitted COVID-19 hospital patients are nearing their lowest recorded level after any prior surge, with the seven-day average sliding to 6,406 Wednesday, down from a peak above 28,000 in January.

- U.S. hospitalizations of young children rose fivefold during the Omicron surge of COVID-19, new data shows.

- One of the two 9/11 museums in Manhattan will permanently close after an 83% decline in attendance during the pandemic.

- The White House will announce new ventilation standards for buildings today as part of its fight against COVID-19.

- First-time unemployment claims fell by 15,000 last week to 214,000, a two-and-a-half month low.

- The Federal Reserve raised its benchmark interest rate by a quarter percentage point to a range between 0.25% and 0.5% yesterday, the first time in four years, with at least six more rate hikes planned for this year. The central bank also signaled it would begin to shrink its $9 trillion asset portfolio built up during the pandemic as soon as its next meeting in May.

- Federal Reserve officials see core U.S. inflation hitting 4.1% this year, higher than market expectations of 3.5%.

- U.S. retail sales rose 0.3% in February from the previous month, led by higher spending at gas stations and bars and restaurants. Although slower than January’s 4.9% pace, the number is a promising sign that American consumers are still willing to absorb higher prices.

- The average U.S. 30-year mortgage rate jumped to 4.27% from 4.09% last week, while applications to purchase a home fell 8% from the year-ago period.

- More than 90% of employers are planning to adopt a hybrid work model this year, according to tech consulting firm Gartner, while a smaller number will insist on a full return to the office.

- Walmart is seeking around 50,000 new hires in the U.S. by the end of April, during a time of year when many retailers pull back on hiring following the holiday shopping season.

- The used-car market is booming amid supply chain problems for new vehicles, with used-car prices up 41% in February from the same time last year compared to a 12% rise for new cars.

- Corporate venture funds invested $23.2 billion in climate-technology businesses including renewables and energy storage last year, more than double the amount from 2020.

International Markets

- More news related to the war in Europe:

- The White House has announced over $1 billion in new security assistance to Ukraine over the past week.

- France abandoned its economic growth forecasts for the second quarter due to uncertainty caused by the war in Eastern Europe.

- Russia’s president acknowledged Wednesday that the country’s economy had taken a profound blow from recently imposed Western sanctions and warned of deep structural changes, higher inflation and rising unemployment.

- Russian officials indicated that over $100 million of interest payments made Wednesday may not go through, which would set the country on a path toward almost certain default by April 15.

- In a decade-long slide, foreign direct investment in Russia has fallen to just $9 billion in 2020 from a $75 billion peak in 2008 and will undoubtedly fall more due to the war.

- The World Health Organization is suspending testing of Russia’s COVID-19 vaccine.

- The BA.2 “stealth” variant of Omicron now accounts for three-fourths of sequenced cases globally.

- Germany’s seven-day COVID-19 infection rate reached a record high this week. Lawmakers are debating a possible vaccine mandate for the country at the same time others are advocating for the planned lifting of restrictions.

- Hong Kong’s government is mulling easing its tight pandemic restrictions due to growing public impatience with the measures, even as it runs out of coffins in the midst of its fifth and worst COVID-19 wave.

- China reported 1,226 new COVID-19 cases yesterday, the second day of declines but high enough to keep the nation’s ultrastrict pandemic lockdowns on millions of citizens. Jing province will roll out mass testing for all residents, as health authorities begin using Pfizer’s antiviral pill to treat severe disease.

- New COVID-19 cases in South Korea surged past 600,000 on Thursday, 55% higher than the previous day’s record.

- New Zealand will end some of its ultra-strict pandemic travel restrictions starting next month, officials said.

- London’s Heathrow Airport dropped its facemask rules.

- The U.S. and U.K. have agreed to start talks to deepen trade and investment ties, their first such effort since negotiations to forge a free-trade agreement were suspended last year.

- Euro-area inflation surged a larger-than-expected 5.9% last month, with energy prices up 32% from the previous year.

- China made a surprise cut to lending rates this week amid concerns that a slowdown in the nation’s property sector could dent economic growth.

- Japan will likely take longer than most nations to raise interest rates after the most recent data showed inflation slowing in January.

- A major index tracking Chinese makers of cars and components is down 46% this year, as sluggish sales and supply chain disruptions make investors more pessimistic about the world’s largest car market. The nation’s electric vehicle sales fell at a double-digit pace for the second straight month in February.

- Boeing’s long-grounded 737 MAX jet is closer to flying commercial routes again in China.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.