COVID-19 Bulletin: March 16

Today marks the second anniversary of our COVID-19 Bulletin, edition number 501.

We have followed the pandemic, historic supply chain disruption, extreme weather events, and now a war on Europe, tracing their impact on the economy and plastics industry. Our surveys suggest the Bulletin has delivered value to subscribers, many of whom have asked that we continue the publication when COVID-19 subsides. We intend to do so and will soon introduce a new name and look as we constantly seek to provide more value to customers, suppliers, business partners and friends.

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil futures tumbled another 6% to below $100/bbl Tuesday, the lowest in two weeks, on fears of demand impacts in COVID-hit China.

- The Energy Information Agency reported a 4.3 million barrel build in crude inventories last week, sending crude prices lower in mid-morning trading today. WTI futures were off 0.5% at $95.99/bbl, Brent was down 1.2% at $98.76/bbl and U.S. natural gas was up 1.9% at $4.65/MMBtu.

- In its monthly market report, OPEC held off on revising supply and demand forecasts due to the fast-changing situation in Ukraine but cautioned that global demand could decline sharply as inflation rises.

- More oil news related to the war in Europe:

- Sanctions on Russia could cut 3 million barrels of crude per day from the global market starting next month, the International Energy Agency warned.

- European nations should start immediately stockpiling gas stores to prepare for next winter and as a buffer against further supply shocks, EU lawmakers urged Tuesday.

- Trafigura Group, one of the world’s top oil and metals traders, is in talks with private equity groups to secure additional financing as soaring prices trigger massive margin calls across the commodities industry.

- Gazprom’s natural gas exports to nations outside former Soviet states fell almost 30% year over year from Jan. 1 to March 15, the firm said, despite rising export volumes so far this month.

- The Yamal-Europe gas pipeline from Russia to Germany is back flowing westward after a brief eastward flow on Tuesday.

- Greece’s largest refiner is boosting orders for Saudi Arabian crude as it works to transition away from Russian imports, which accounted for 18% of its total crude supplies last year.

- The world’s nuclear energy regulators have been blocked from what is happening inside the Russian-occupied Chernobyl nuclear complex, as reports swirl of staff forced to work around the clock at gunpoint.

- The average price for a gallon of gas in Hawaii hit $5 yesterday, according to AAA, a first for any U.S. state outside California.

- Michigan lawmakers sent a bill to the governor to temporarily suspend the state gas tax, which is expected to be vetoed.

- Lyft joined Uber in imposing a new gas surcharge on fares amid rising fuel costs.

- Airlines say they will be able to absorb higher fuel costs on an unexpected pickup in travel demand following the U.S.’s Omicron wave.

- Aggressive dealmaking in the U.S. shale industry has created a group of so-called “mini-majors” including Devon Energy Corp., EQT Corp., Continental Resources, Pioneer Natural Resources and Diamondback Energy.

- U.S. energy firm Sempra Infrastructure plans to increase LNG production by 60% over the next five years.

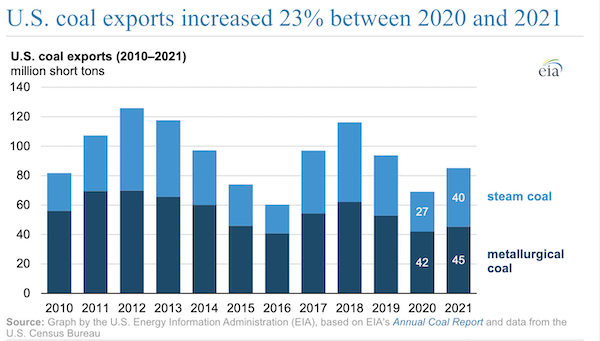

- U.S. coal exports rose 23% last year, new data shows:

- Saudi Arabia is in talks with Beijing to price some of its oil sales to China in yuan, a move that could dent the U.S. dollar’s dominance of the global petroleum market and marks another shift by the world’s top crude exporter toward Asia. Some analysts see the move as largely symbolic.

- OMV, Austria’s largest industrial group, will focus on plastics and biofuels in its transition away from oil and gas, a contrast to other producers shifting to renewables.

- EU lawmakers reached an agreement on proposed trade rules that would raise tariffs on goods made in countries with weak CO2 emissions standards.

Supply Chain

- More supply chain news related to the war in Europe:

- Rates for the largest capesize bulk ships jumped 20% in a day last week as more Australian coal started moving toward Europe.

- Tanker owners willing to take the risk of sailing into the Black Sea can fetch more than $200,000 per day, but most are steering clear, reports show.

- War-induced demand slowdowns for vehicles in Europe could have an outsized impact on Volkswagen, which gets 39% of its sales from the continent while accounting for one in every four car sales there. The central European car industry, as a whole, will see the largest impact, as supply shortages shift from semiconductors to even more fundamental car parts like wire harnesses.

- Some firms have pulled business out of Russia but are still sending shipments on the nation’s rail lines between Europe and Asia.

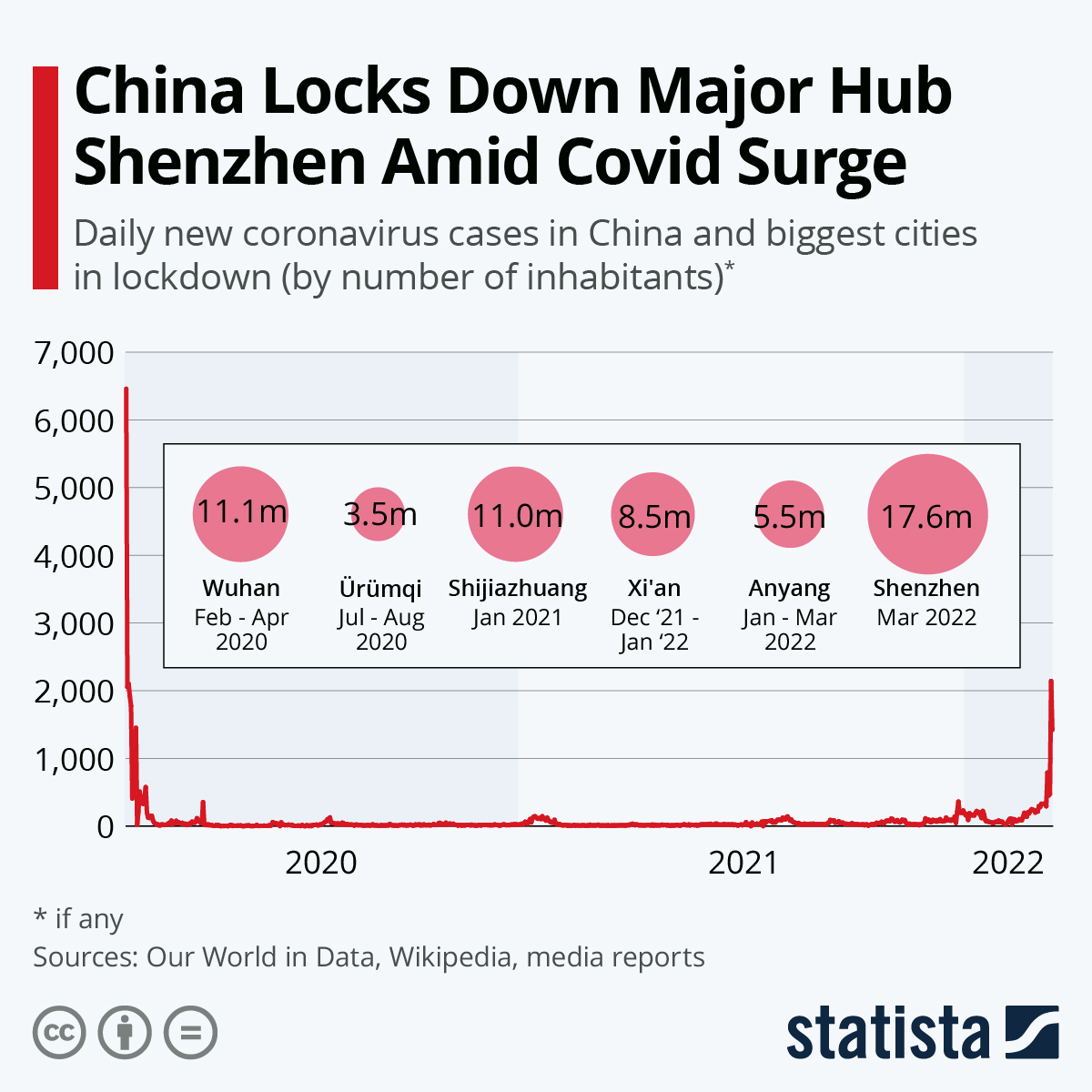

- Chinese authorities tightened anti-virus controls at the nation’s ports Tuesday, raising the risk of more trade disruptions on top of production shutdowns at auto and electronics manufacturing hubs. Makers of everything from flash drives to glass for Apple’s iPhone screens are warning of new shipment delays.

- A year after a giant container ship got stuck in the Suez Canal and disrupted ocean trade for months, another Evergreen Marine Corp. boxship has run aground, this time in the Chesapeake Bay outside the Port of Baltimore.

- Total U.S. rail traffic for the first nine weeks of 2022 was 4.35 million carloads and intermodal units, down 2.3% from the same time last year, led by a 7% drop in intermodal.

- Thousands of employees at Canadian Pacific Railway, the nation’s second largest rail line, are threatening to strike this week in a pay dispute.

- Tesla raised prices on all vehicles sold in the U.S. and China by 3%-5% due to rising raw material costs.

- Southwest predicts a 7% decline in second-quarter flight capacity due primarily to a shortage of workers.

- FedEx Ground contractor-drivers say the company financially hobbled them last holiday season with poor forecasting and tough demands.

- Intel is investing $36 billion in chip production and research across Europe, including a new complex in Germany, the firm’s second multibillion-dollar plant investment announced in 2022.

- Startup companies that promise to make computer chips for artificial intelligence applications pulled in almost $10 billion in venture capital last year, triple the total funding from 2020.

- Another container of unlawfully loaded lithium battery waste caught fire at the Port of Los Angeles and Long Beach yesterday, the second such fire in the past two weeks, prompting the U.S. Coast Guard to put all containers from the unnamed shipper on hold.

- Hapag-Lloyd acquired the container line unit of regional operator Deutsche Afrika-Linien.

- Miami-based cargo airline Amerijet will add six 757 freighters by mid-April to expand its network in Latin America.

- Maersk became the first major shipping line to join an environmental pact pledging full decarbonization of operations by 2040, a full decade ahead of the Paris Agreement.

- Extreme weather events caused by climate change could pose a $25 billion annual cost on the global shipping industry by the end of the century, researchers predict.

- California approved a plan to remake the Port of Humboldt Bay into the West Coast’s first port partially dedicated to offshore wind activities.

- Maersk signed six supply deals to buy 730,000 tonnes a year of bio and e-methanol by 2025 for its methanol-powered vessels.

Domestic Markets

- The U.S. reported 24,442 new COVID-19 infections and 1,281 virus fatalities Tuesday.

- The BA.2 “stealth” subvariant of Omicron is thought to account for 23% of current COVID-19 cases in the U.S.

- New COVID-19 cases in Texas rose almost 25% last week.

- The Los Angeles school district, the nation’s second largest, will keep its mask mandate despite falling cases and hospitalizations across California.

- Uninsured Americans will no longer be able to submit claims for tests or COVID-19 treatments starting next week, the first of several upcoming program cuts as federal funding for the pandemic response winds down and Congress stalls on providing more. The White House warned it would soon be forced to cut purchases of antibody treatments and won’t be able to provide a fourth COVID-19 vaccine dose for all Americans, if needed.

- New data suggests the single-dose COVID-19 vaccine made by Johnson & Johnson could be as effective as Pfizer and Moderna’s two-dose regimen.

- Pfizer is seeking approval for a second COVID-19 booster dose for people over age 65, citing immunity that wanes after a few months from the first booster.

- The Federal Reserve is expected to raise interest rates by a quarter percentage point at the conclusion of its policy meeting today, the first rate hike since 2018.

- New York state manufacturing activity showed a surprise contraction in early March as orders fell and delivery times lengthened, according to a New York Federal Reserve index.

- The average worker in Houston — one of the fastest cities to scrap remote work measures — shows up at the office about 10.7 days per month compared to 17 before the pandemic, signaling a potential permanent shift to hybrid work structures.

- Revenue in the travel nursing industry tripled between 2015 and 2021, new data shows.

- Single-family rents rose a record 12.6% year over year in January, new data shows, compared to an annual increase of just 3.9% in January of 2021. Miami, Orlando and Phoenix led the rise.

- First-time home buyers accounted for just 27% of U.S. home sales in January, the lowest in eight years amid continued tight supplies and rising mortgage rates.

- S&P 500 firms have committed to a combined $238 billion in share buybacks through the first two months of 2022, a record for this time of year. Buybacks for the full year could top $1 trillion, Goldman Sachs predicts.

- AMC is venturing away from its core movie-theater operations with the purchase of a 22% stake in a Nevada-based miner of gold and silver.

- Mercedes’ first battery assembly plant began operations yesterday in Alabama.

- Starbucks is boosting efforts to eliminate its use of single-use plastic cups, with customers at every location in the U.S. and Canada able to use their own reusable cups by the end of next year.

International Markets

- More news related to the war in Europe:

- A round of Russian bond payments due today could kickstart the nation’s first foreign-currency default since the 1917 revolution, prompting Russian bonds to trade at prices near the low-water mark set by Venezuela, which collapsed into famine five years ago, and Argentina, which has taken 15 years to repay creditors.

- The EU has approved its fourth round of economic sanctions against Russia, including a broad ban on investment in the nation’s energy sector, a ban on selling some luxury goods to the country and new sanctions against Russian executives and oligarchs.

- The U.K. severed normal trade links with Russia and Belarus.

- Eli Lilly, Novartis and AbbVie said they would continue supplying Russia with drugs for urgent medical conditions while halting all new investments in the country.

- Business communication platform Slack shut down all accounts in Russia.

- New Western sanctions on Russia effectively bar the top three global ratings agencies — S&P Global, Moody’s and Fitch — from rating Russian companies and the nation’s sovereign debt.

- The Ukrainian refugee exodus surpassed 3 million people Tuesday.

- Global COVID-19 fatalities were down 17% last week, but new cases rose 8%, reversing a recent declining trend.

- Germany continues to mark record high daily COVID-19 cases above 250,000, while infections pick up in other European nations including France, Switzerland, Italy and the Netherlands. In the U.K., infections were up almost 50% and hospitalizations were up almost 17% week-over-week.

- China modified its hospitalization mandates for some COVID-infected people as it seeks to avoid strains on its healthcare system amid its worst virus wave since early 2020, which saw 5,154 new cases Monday.

- South Korea surpassed 400,000 daily COVID-19 infections Tuesday, a record.

- Demand for flights leaving Hong Kong is up over 300% from the same time last year as residents seek to flee the island’s on-and-off talks of mass testing and lockdowns. Hong Kong crematoriums are at capacity.

- Vietnam dropped quarantine requirements for international travelers.

- The U.S., EU, India and South Africa reached an agreement on an IP-sharing framework for COVID-19 vaccines, potentially leading to more doses for middle- and low-income nations.

- Chinese industrial output in the first two months of 2022 was up 7.5% from a year earlier, quicker than December’s 4.3% pace and more than double the 3.5% pace expected by many economists.

- New home construction in Canada picked up sharply to start the year.

- Walmart’s technology unit, Walmart Global Tech, aims to hire 5,000 associates globally this fiscal year and open new hubs in Toronto and Atlanta as part of its aggressive expansion plans, the retailer said.

- EU advisers are proposing a new “amber” climate rating for investments in projects that are not fully renewable but still play a significant role in transitioning to cleaner power, such as natural gas.

- Swedish battery maker Northvolt expects to start production of lithium-ion batteries at a new gigafactory in northern Germany by 2025.

- Luxury carmaker Bentley plans to manufacture one new electric-vehicle model per year for five years starting in 2025.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.