COVID-19 Bulletin: March 10

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- More oil news related to the war in Europe:

- Oil prices fell roughly 13% Wednesday, the biggest one-day slide in two years, after Iraq and the UAE signaled support for higher production from OPEC. Prices also were pressured after the International Energy Agency said it could release more oil from strategic reserves.

- Energy futures were higher in late-morning trading today, with WTI up 1.1% at $109.90/bbl, Brent up 2.0% at $113.30/bbl and U.S. natural gas up 1.8% at $4.61/MMBtu.

- The U.S. government raised its forecast for the average price of Brent crude this year from $82.87/bbl to $105.22/bbl.

- Oil futures contracts for longer-term delivery have not risen nearly as much as short-term contracts.

- The average price for a gallon of gas in the U.S. rose to $4.25 Wednesday, topping the previous day’s all-time high of $4.17. Gas prices are up 15% since last week and 21% since last month.

- European gas futures plunged 43% Wednesday, tracking a widespread drop in prices for commodities.

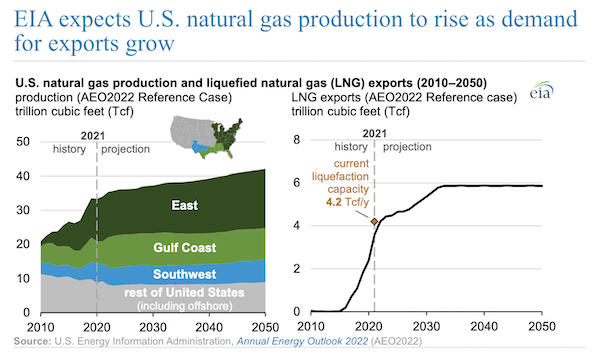

- European gas prices have surged to new heights between $50-60/MMBtu just as LNG exporters in the U.S. complete several projects to deliver more supplies internationally. Over 160 cargoes were sent to Europe in the first two months of 2022, topping the previous record of 125 in 2020, as the U.S. government predicts exports to continue rising in the years ahead:

- Germany is accelerating plans to build its first LNG terminals to reduce reliance on Russian gas imports.

- European governments are scrambling to source thermal coal shipments from around the world to replace Russian gas, sending benchmark prices to all-time highs as countries reconsider policies that phased out the fuel.

- The White House is considering sanctions on Rosatom Corp., Russia’s state-owned atomic energy company and a major supplier of fuel and technology to power plants around the world.

- A Russian attack disconnected the Chernobyl nuclear power plant from the Ukrainian electricity grid, which could potentially cause radiation leakage, officials say.

- The Dutch prime minister said he was not in favor of banning Russian energy imports and would not bar Russian ships from the Port of Rotterdam until the measure is decided on a bloc-wide level.

- Norway cast doubts on the idea that new pipeline capacity in Poland later this year will lead to higher gas exports from the nation.

- U.S. shale giant Pioneer Natural Resources says domestic producers won’t be able to replace crude supplies from Russia this year.

- A Russian oil tanker that Britain turned away a week ago has still not found a port to discharge its cargo, a problem becoming more frequent for the sanctioned vessels.

- Union Pacific will start testing higher biodiesel fuel blends on some trains in a strategic bid to reduce emissions 26% by the end of the decade.

- Canada is putting off a blueprint to reduce emissions in the oil and gas sector from this month to early next year, officials said.

Supply Chain

- More supply chain news related to the war in Europe:

- Amazon has suspended shipments of all retail orders to customers in Russia and Belarus.

- Russia’s government moved forward with a plan to take over the factories of Western firms that have fled the nation due to sanctions.

- Bunker prices at two of the world’s largest hubs in Singapore and the UAE shot past $900 per tonne late last week, the highest ever.

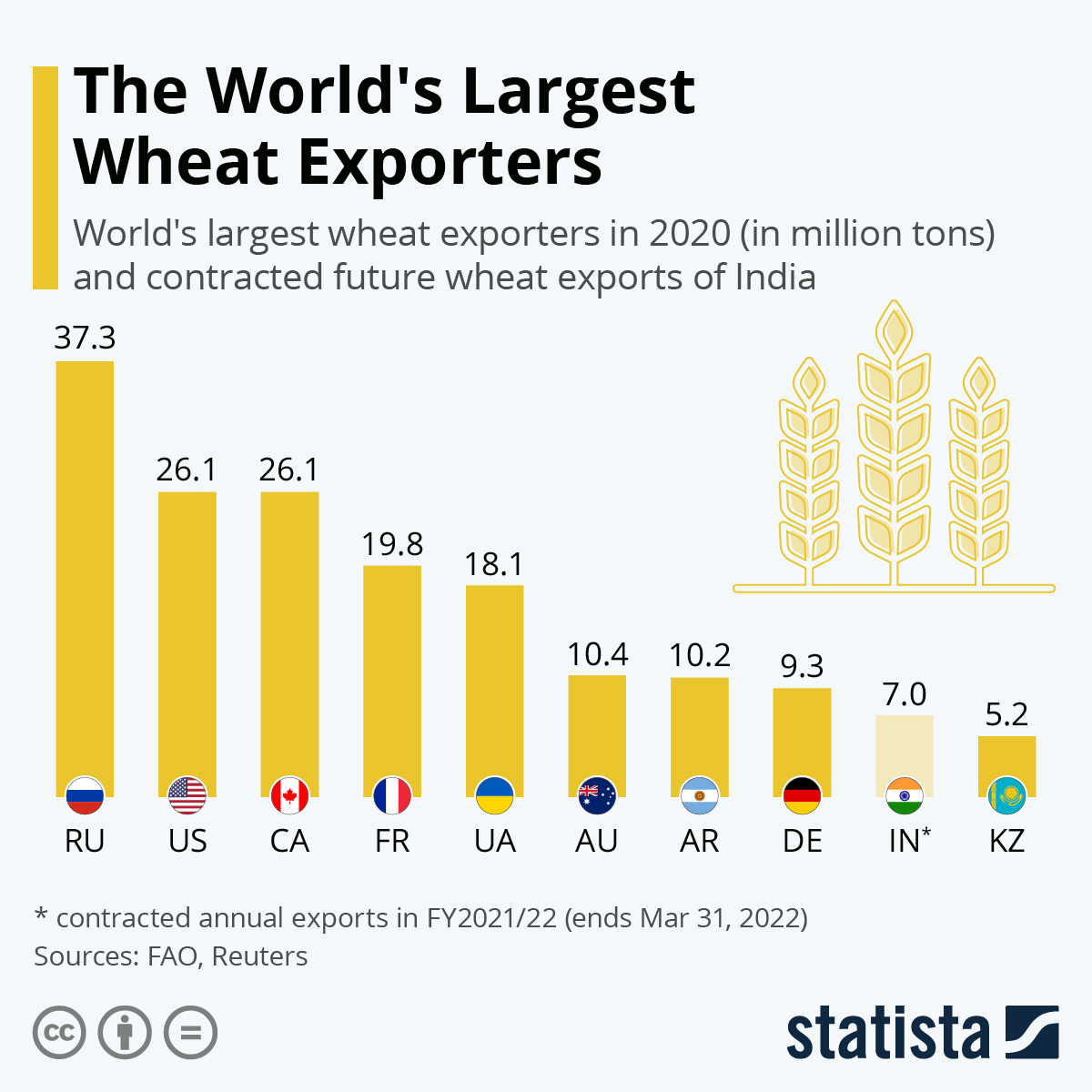

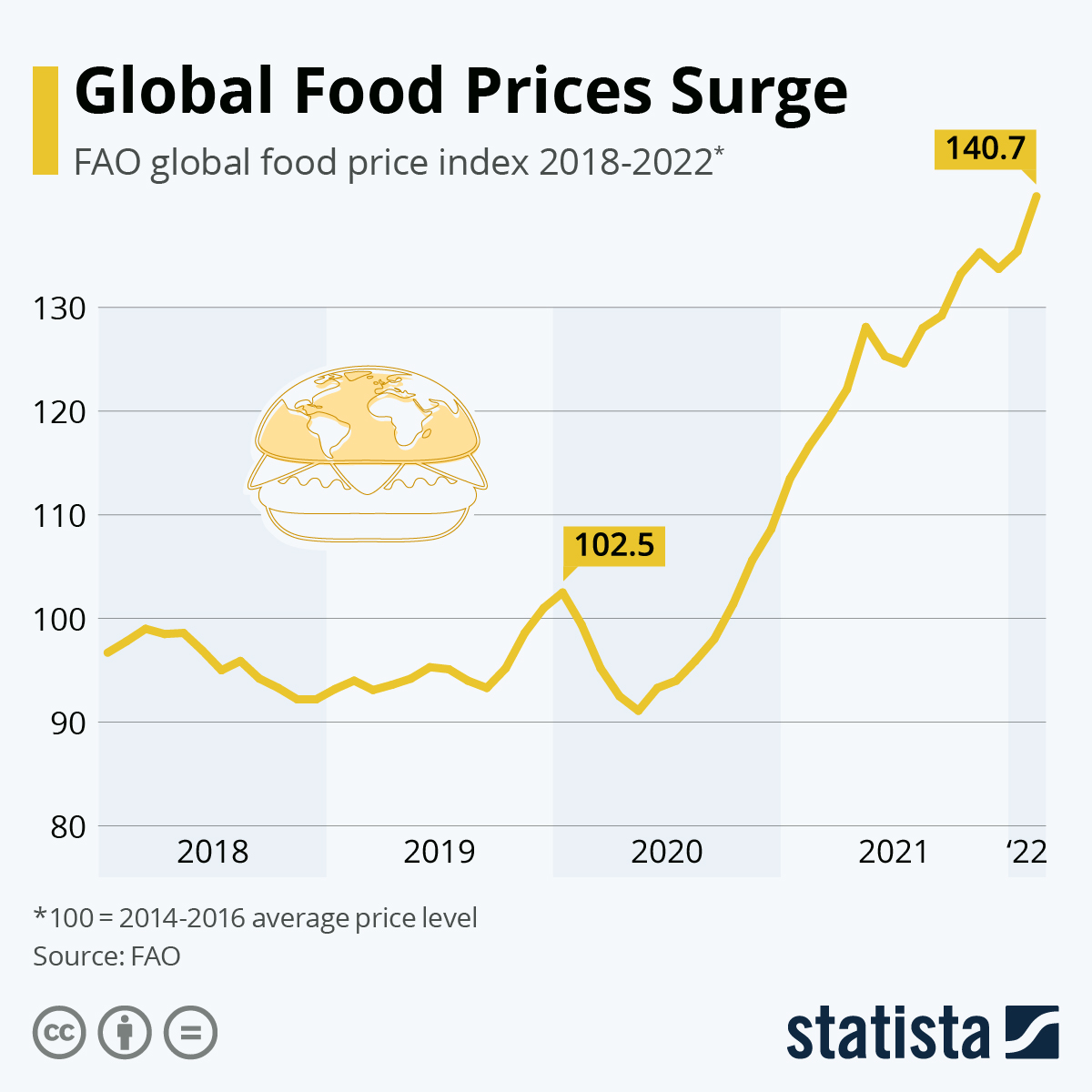

- Ukraine banned its normally plentiful exports of wheat, oats and other food staples to feed its people, a move expected to raise global food prices. Despite the news, wheat futures eased from 14-year highs yesterday on forecasts of larger global stockpiles.

- A wildfire in the Florida Panhandle ballooned to 33,000 acres Wednesday in dry areas destroyed by Hurricane Michael in 2018.

- South Carolina’s Port of Charleston is opening Sunday truck gates and expanding operating hours to reduce a heavy backlog of queued container ships.

- About 420,000 jobs have been added to U.S. warehousing and storage companies since February 2020, according to the Bureau of Labor Statistics.

- Canada is adding a new container examination facility at the Port of Halifax, an effort to speed up inspection turnaround times.

- An influential House committee is seeking information from the world’s largest shipping lines to explain exorbitant rate hikes over the last two years.

- The Federal Motor Carrier Safety Administration scrapped a rule requiring truck drivers to provide employers with a list of traffic violations each year.

- Kodiak Robotics and third-party logistics firm Ceva added a second fully autonomous truck route from Dallas to Oklahoma City. Its first route started last November from Dallas to Austin.

- AFS Logistics acquired Canada’s DTA Services, creating the largest freight audit and payment company in Canada.

- Singapore’s Pacific International Lines ordered four 14,000-box container ships with LNG fueling capability.

- Indonesia is raising domestic-sales quotas for palm oil producers due to the surging cost of home cooking oil.

Domestic Markets

- The U.S. reported 37,595 new COVID-19 infections and 1,976 virus fatalities Wednesday. Daily cases are down over 50% the past two weeks, while fatalities are down by one-third.

- Hawaii will let its indoor mask mandate expire March 25, the last state to do so.

- San Francisco dropped a proof-of-vaccine requirement for restaurants and other businesses.

- United Airlines is calling back employees on unpaid leave who had received exemptions from COVID-19 vaccination requirements.

- The head of the CDC says COVID-19 will likely never go away but turn into a seasonal virus like influenza.

- Florida is prepping for a threefold rise in the number of Spring Break visitors this year.

- Ride-hailing firm Lyft will permanently allow employees to work from home.

- The year-over-year inflation rate hit a 40-year high of 7.9% last month.

- First-time jobless claims rose by 11,000 to 227,000 last week.

- U.S. lawmakers yesterday evening passed a $1.5 trillion package to fund the federal government after billions of dollars of COVID-19 aid were stripped from the bill.

- The budget bill passed by the House includes a provision to ensure the orderly transition of LIBOR-based contracts that extend beyond the expiration date for the discredited interest-rate benchmark in the summer of 2023.

- There were 1.7 job openings in January for each of the nation’s 6.5 million active job seekers, according to the latest data.

- A Pew Research survey suggests 1 in 5 U.S. adults quit their jobs in 2021 for a variety of pandemic-induced reasons. Over half of the job jumpers switched careers.

- A record 1 in 12 U.S. homes are now worth more than $1 million, a proportion nearly doubling since February 2020.

- Some retailers on Twitter will be able to advertise a 50-product digital catalog on the site, part of the social media giant’s new effort to expand into shopping and e-commerce.

- Michigan van maker Shyft Group is launching its first electric commercial vehicle as a direct challenge to GM’s BrightDrop EV600 electric utility van. The firm expects electric vehicle sales to top $150 million by 2025.

- The U.S. administration reinstated California’s authority to impose the toughest emissions and electric vehicle-sales requirements in the country, with the state indicating it will soon tighten those standards.

International Markets

- More news related to the war in Europe:

- Consumer prices for things like cars (+17%), TVs (+15%), and medicines and vegetables (+5-7%) are soaring in Russia since last week.

- Russia’s central bank continued to tighten capital controls yesterday, putting limits on foreign-currency withdrawals and barring banks from selling foreign currencies for the next six months.

- Citigroup, with the largest presence of any U.S. bank in Russia, is finding it difficult to sell its consumer-banking unit there.

- The latest firms to curtail business in Russia include Heineken, the parent of KFC and Pizza Hut, Papa John’s, Sony, Nintendo, 3M, Deere, Skechers, S&P Global and the world’s second-largest miner.

- Despite Russia’s attack, Ukraine continues to gather COVID-19 data, reporting 40,265 infections and 758 deaths last week, down significantly from the prior week. Health officials worry the mass migration from the invasion could prompt a spike in infections.

- Confirmed COVID-19 cases across the globe surpassed 450 million yesterday, even as new cases fall in most parts of the world, the World Health Organization said.

- Austria scrapped Europe’s first population-wide COVID-19 vaccine mandate just a week before it was set to be imposed.

- China’s 5.5% economic growth target for this year is the lowest in more than a quarter century.

- The world’s seven wealthiest nations will meet tomorrow to discuss the state of global food markets.

- Shell and Scottish Power are putting a combined $99 million into infrastructure and facilities to help boost offshore wind development in Scotland.

- Colombia signed an agreement to develop its first offshore wind project and expects the industry to bring in nearly $30 billion of investment by 2050.

- Global CO2 emissions rebounded 6% last year to the highest level in history, new data shows.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.