COVID-19 Bulletin: March 8

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- More oil news related to the war in Europe:

- U.S. benchmark WTI rose 3.2% to settle at $119.40/bbl yesterday after earlier surpassing $130/bbl. Brent rose 4.3% to close at $123.21/bbl.

- In mid-morning trading today, WTI futures were up 7.4% at $128.30/bbl, Brent was up 7.1% at $131.90/bbl and U.S. natural gas was 4.0% lower at $4.64/MMBtu.

- Gathered at a Houston conference on Monday, chief executives of the world’s largest oil companies widely agreed there is no immediate relief in sight for surging oil prices. OPEC+ indicated it has no plans to boost output either.

- The average U.S. gasoline price reached an all-time high this morning of $4.17 a gallon, according to AAA.

- The White House is expected to announce a ban on Russian energy imports, including oil, today.

- Spare pipeline capacity in Alberta, Canada, could help move more oil to the domestic market if the U.S. blocks Russian imports, officials say.

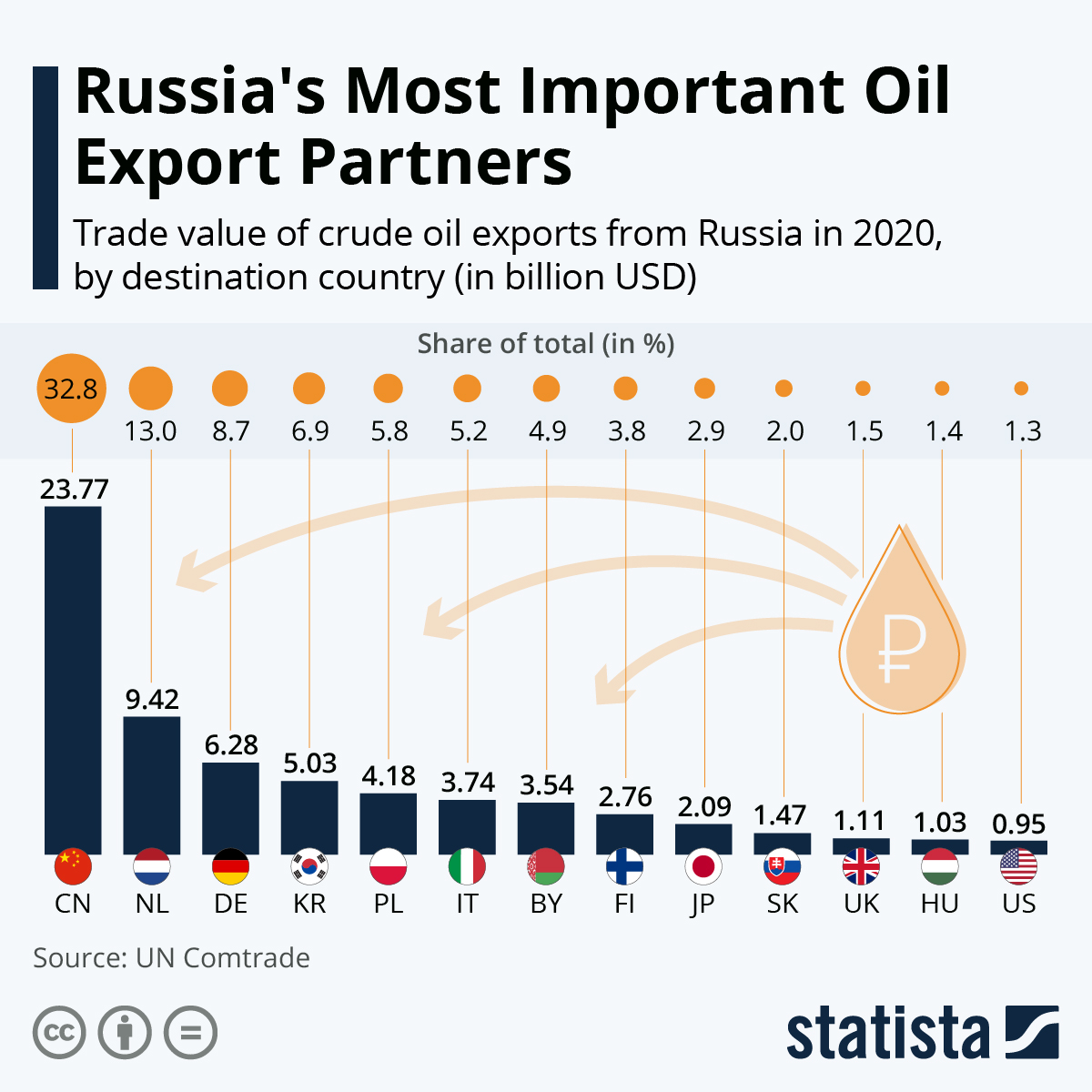

- Russian oil made up about 3% of all crude shipments that arrived in the U.S. last year, government data shows.

- British, Dutch and German officials oppose a ban on Russian oil imports, as European gas prices climb to record highs some 20 times higher than U.S. benchmarks.

- British economists predict the nation will fall into recession by the second half of the year if energy prices stay at current levels.

- Only one of Russia’s two biggest state-controlled energy companies made scheduled bond repayments due on Monday, adding to uncertainty facing investors holding Russian assets.

- European leaders are laying out an ambitious plan today to cut the bloc’s reliance on Russian gas imports by 80% by the end of the year, as Russian officials threaten pipeline closures to the bloc.

- Shell said it would halt all spot purchases of Russian crude and shut its gas stations, aviation-fuel and lubricant operations in the country.

- TotalEnergies reportedly told traders to halt purchases of Russian oil as all but one of the firm’s refineries are moving to replace Russian supplies.

- The U.S.’s largest producer of natural gas reported more frequent attempted cyberattacks after Russia invaded Ukraine.

- U.S. natural gas prices have doubled over the past year, sending the typical household’s electricity payments skyrocketing.

- The recently announced merger of North Dakota shale rivals Oasis Petroleum and Whiting Petroleum will form a company valued at $6 billion, executives say.

Supply Chain

- More supply chain news related to the war in Europe:

- An estimated 50,000 Russian and Ukrainian sailors are stuck waiting to be replaced at sea or at ports around the world as shipowners scramble to find replacement crews.

- Port workers from locations in the U.S., Canada and Australia are calling for more bans on Russian ships, moves that could potentially blacklist over 1,700 vessels connected to the country.

- The World Container Index compiled by London-based Drewry has ticked down since the conflict started, with the largest rate drop measuring 5% on the Shanghai-Rotterdam route.

- Sanctions are prompting large American air cargo operators, including UPS and FedEx, to completely avoid Russian airspace.

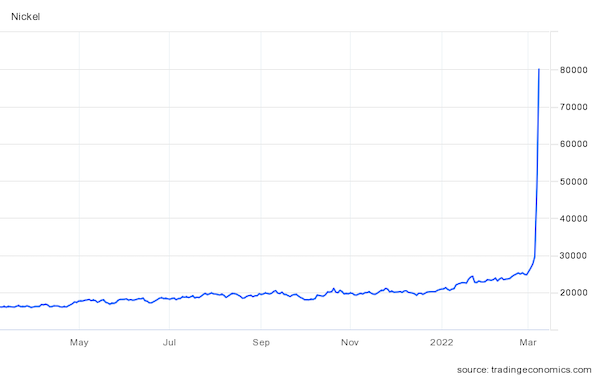

- The London Metal Exchange suspended trading in its nickel market after prices for the metal surged as much as 250% from Monday to early Tuesday, briefly trading above $100,000 a ton before easing.

- Boeing halted all titanium purchases from Russia, the source of about one-third of its supply.

- Airbus no longer provides support services to its customers in Russia and halted deliveries of spare aircraft parts to the nation’s airlines.

- Nissan will idle production at a St. Petersburg plant starting sometime this week.

- Chicago wheat prices racked up their seventh straight maximum daily increase Monday to a new all-time high, breaking a record from 1975.

- The index for inventory levels in the Logistics Managers’ Index rose 9.1 points to 80.2 in February, the highest level in the index’s five-year history.

- U.S. coal carloads rose 21.3% in February from the same time last year, the Association of American Railroads said.

- Container volumes at Germany’s Port of Hamburg rose 2.2% last year following a 7.9% decline in 2020.

- A 19-day sit-in at the headquarters of South Korea’s largest parcel delivery firm ended last week.

- Freight forwarder Kuehne+Nagel saw a threefold jump in fourth-quarter operating earnings to about $1.2 billion, while revenue doubled to more than $6 billion.

- The chairman of the Federal Maritime Commission said he does not see collusion among container lines amid soaring freight rates during the pandemic.

- Hapag-Lloyd and other shipping operators reported attempted cyberattacks Monday.

- The ports of Seattle and Tacoma are the latest to join the Northwest Seaport Alliance, a new data-sharing project spearheaded by the Port of Long Beach.

- Southern California pipeline operator Amplify Energy is suing Mediterranean Shipping Co. and Cosco Shipping over alleged anchor drags that ruptured the firm’s pipeline last year.

- 48forty Solutions, North America’s largest pallet management firm, expanded its network with the acquisition of rival Nazareth Pallet.

- The EPA unveiled tighter standards for engine makers to lower nitrogen-oxide emissions from big rigs, cement mixers, trash trucks and other commercial vehicles starting in 2027.

Domestic Markets

- The U.S. reported 67,516 new COVID-19 infections and 1,686 virus fatalities Monday.

- New COVID-19 cases in Los Angeles County are down over 60% the past two weeks.

- New York City ended all mask mandates for school students yesterday.

- Puerto Rico, among the last U.S. holdouts with a mask mandate, dropped the requirement Monday.

- Florida is recommending healthy children not get COVID-19 vaccinations, putting the state at odds with widely accepted guidance from the CDC and health experts at home and abroad.

- A new study reveals that even minor cases of COVID-19 can accelerate aging of the brain by up to a decade.

- The White House is asking lawmakers to approve another $22.5 billion to purchase COVID-19 antibody treatments, with existing inventory set to run out by May.

- Wall Street saw its largest drop in more than a year Monday as surging oil prices heightened inflationary pressures. Still, U.S. firms are on track for a record number of share buybacks in February, signaling optimism despite the market volatility.

- New York rent prices were up 33% in January from a year ago, nearly double the national rate. Survey results show more Americans believe their rents will rise sharply this year.

- Used car prices in the U.S. fell 2.1% in February, the first monthly decline since August.

- Gross bookings for Uber rides to and from airports were up 50% at the end of February compared to a month earlier, suggesting passenger plane travel is quickly picking up after Omicron.

- Intel’s self-driving car unit Mobileye is set to go public and could be valued as high as $50 billion, traders say.

- Construction began on the U.S.’s first major vessel devoted to offshore wind farm operations and maintenance.

- The U.S. will give $2.2 billion in COVID-19 relief money to public transit agencies in 18 states, with another $1.5 billion released for purchases of low-emissions, U.S.-made buses.

International Markets

- More news related to the war in Europe:

- JPMorgan Chase removed Russian debt from its most widely tracked fixed-income indexes.

- The world’s four largest accounting firms are cutting ties to Russia.

- Central banks across the globe are delaying or softening rate increases in the wake of economic fallout from the crisis.

- South Korea joined the U.S. and EU in banning transactions with Russia’s central bank.

- Procter & Gamble halted all investment, advertising and promotion in Russia and sales of everything but basic health care products, while Siemens AG halted all new business and deliveries to the nation.

- Estee Lauder and the parent of Tommy Hilfiger and Calvin Klein are suspending Russian operations, the source of over 2% of each firm’s revenue.

- Lego, the world’s largest toymaker, ceased toy shipments to its 81 independent stores in Russia.

- Over 2 million people have left Ukraine since Feb. 24, while more than a million have been internally displaced, the United Nations said.

- In a sharp reversal of fortune, Hong Kong now has the highest COVID-19 death rate in the world. More people are fleeing the island over its strict virus controls, while consumer activity is down precipitously.

- Moderna will invest $500 million to build its first African site for manufacturing COVID-19 vaccines in Kenya, the firm said. The company pledged not to enforce its COVID-19 patents in 92 low- and middle-income countries.

- More than one-third of foreign companies surveyed said they plan to reduce investment in China due to its uncertain policy environment and continued strict COVID-19 controls.

- Sony and Honda will pair up to manufacture new electric-vehicle models by 2025, the firms said.

- Stellantis is in early plans to make a new type of hybrid vehicle powered by batteries and ethanol by 2025. The car maker is ramping up joint ventures to produce more fully electric vehicles by the end of the decade.

- GM is partnering with a South Korean firm on a $393-million plant in Quebec to produce electric vehicle battery materials.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.