COVID-19 Bulletin: March 2

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

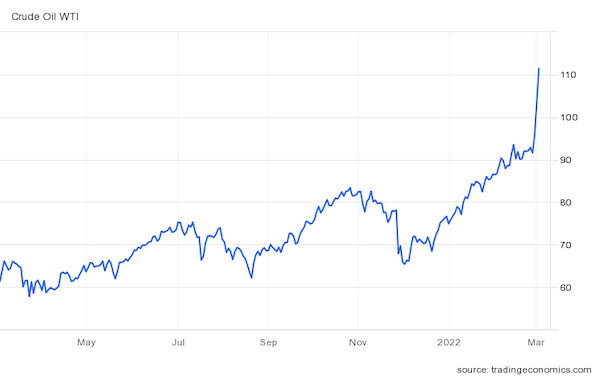

- Global oil markets are reeling from war in Eastern Europe:

- WTI surged over 8% Tuesday to settle at $103.41/bbl, while Brent rose 7% before closing at $104.97/bbl, the biggest one-day gains in almost two years. Futures continued climbing in early morning trading today, with WTI up 5.6% at $109.00/bbl, Brent up 5.8% at $111.00/bbl and U.S. natural gas 3.6% higher at $4.73/MMBtu.

- The International Energy Agency agreed to a coordinated release of 60 million barrels of oil from global reserves, including 30 million from the U.S., amid warnings that global energy security is under threat. The release is the largest since the first Gulf War in 1991 and only the fourth in the IEA’s 47-year history.

- Morgan Stanley sees Brent averaging $110/bbl in the second quarter, up from a prior forecast of $100/bbl.

- Nord Stream 2 AG, the operator behind the controversial gas pipeline under the Baltic Sea from Russia to Germany, fired all its staff and filed for bankruptcy yesterday.

- Canada became the first nation to directly ban Russian oil imports.

- Russia’s Urals crude traded at a steep $18/bbl discount to Brent yesterday, and even then could not find buyers, suggesting refiners in Japan, South Korea and China have joined Europe and the U.S. in slowing purchases.

- China is scaling back imports of Russian coal as traders struggle to secure letters of credit from sanction-wary banks. Prices for coal from other exporters — including Indonesia, South Africa and Australia — are sharply rising.

- The Russian government issued an emergency decree to block foreign companies — notably several energy giants including BP and Shell — from exiting investments in the nation, although it is unclear what the decision entailed and how it would be enforced.

- Italy is attempting to make up for lost Russian oil imports with higher flows from Algeria.

- The U.S. national average for a gallon of gas stood at $3.62 Tuesday, up 24 cents from a month ago. Gas prices are sharply rising in the U.K. and Netherlands.

- U.S. crude inventories are set for a sharp drawdown this week.

- A crude pipeline from Alberta to Canada’s Pacific Coast is set to triple capacity to 890,000 bpd by the third quarter of 2023, boosting the nation’s ability to export.

- U.S.-based Occidental Petroleum is buying back $2.5 billion in debt after beating market expectations on a swing to profit in the fourth quarter.

Supply Chain

- The U.S. South and Midwest will see severe weather this weekend, including strong wind gusts and torrential rain. More severe weather is expected to continue throughout March, forecasters say.

- Global logistics stakeholders continue to react to new sanctions on Russia:

- Maersk will temporarily suspend all shipments to and from Russia by ocean, air and rail, apart from food and medicine. Ocean Network Express, Hapag-Lloyd, MSC and CMA CGM have announced similar suspensions.

- Cargo flights along major trade routes through the region have slowed, according to an analysis by logistics firm Flexport. Flights between New Delhi and London, for example, were about 8% longer on average between Wednesday and Sunday, according to data from Flightradar24.

- Boeing halted major operations in Moscow and suspended all parts and maintenance support for Russian airlines, which fly roughly 700 Western-made aircraft.

- Trucker Landstar says the fallout from fighting in Ukraine could cost the company $100 million in lost revenue.

- Automakers, computer chip manufacturers and farmers expect imminent shortages of key supplies from Russia and Ukraine.

- Volkswagen will idle some production lines at the world’s largest car plant in Wolfsburg, Germany, next week before a broader shutdown the following week, citing shortages from Russian suppliers.

- BMW said it would temporarily suspend vehicle exports and shut down regional production in Eastern Europe.

- Ford suspended all joint ventures in Russia.

- Apple and Dell halted all product sales in Russia.

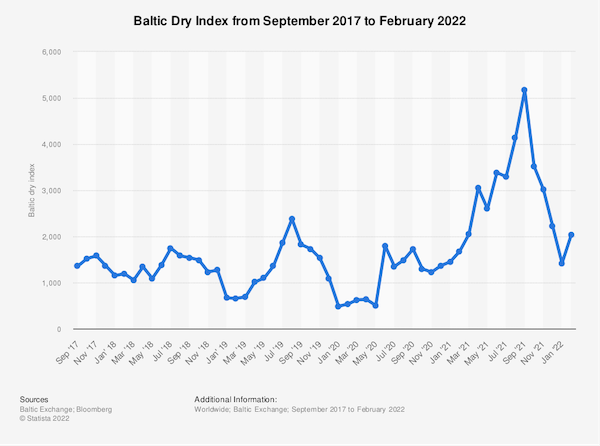

- The Baltic Dry Index, a bellwether of the general shipping market, reversed months of declines and rose to 2,040 this week:

- A gauge of U.S. manufacturing order backlogs rose by 8.6 points from January to February, the largest jump in 11 years, while supplier delivery times slowed further.

- Operators of the Ports of Savannah, Wilmington and Jacksonville agreed to transition away from a multi-contributor chassis pool to a single provider over the next 18 months, an effort to update and expand chassis fleets.

- Toyota will restart production in Japan today after a cyberattack took down one of its suppliers, sparking concerns over the automaker’s supply chain vulnerabilities.

- The Felicity Ace, which caught fire offshore Portugal in mid-February with hundreds of luxury vehicles on board, sank to the bottom of the Atlantic Ocean.

- A Philadelphia real estate firm is partnering with self-driving truck maker Embark Trucks to buy land near metro areas where autonomous trucks can move trailers to human-driven delivery vehicles.

Domestic Markets

- The U.S. reported 47,017 new COVID-19 infections and 1,691 virus fatalities Tuesday. Average daily cases have dropped to 66,000 per day, down from more than 800,000 per day in mid-January.

- Hawaii plans to lift COVID-19 quarantine requirements for incoming travelers this month, putting an end to the only such remaining program among states.

- The White House announced plans to provide antiviral pills through pharmacies to those who test positive for COVID-19.

- The Federal Emergency Management Agency will extend its COVID-19 emergency aid program for states through July.

- A growing number of U.S. companies are recalling workers back to the office this month as virus cases fall and officials loosen mask requirements.

- Health officials are renewing efforts to get COVID-19 vaccines to low-income and rural populations, two of the nation’s least vaccinated demographics.

- New surveys show Americans are much less worried about getting infected with COVID-19 and much less supportive of mask mandates than they were six months ago.

- Up to 23 million Americans may have experienced long COVID, a catchall term for roughly 200 persistent symptoms including memory issues, chest pain and dizziness upon standing.

- Up to a quarter of American children missed more than a week of in-person school in January due to the raging Omicron variant, new survey results show.

- The average 30-year fixed mortgage rate is down to 3.9% from 4.18% last Friday, the largest two-day drop since the start of the pandemic. For-sale home inventory remains at the lowest in a generation, while home prices are at record highs, up nearly 20% from the same time last year.

- Inflation has forced companies to become more creative in offering perks to attract and retain employees, with special emphasis on college graduates, who are stepping into one of the best hiring seasons in generations.

- Auto lenders extended $734 billion in loans last year, a record high in data going back to 2004, as dealerships took advantage of high demand to grab more fees from financing services.

- Electric vehicles accounted for 4.5% of all U.S. car sales in the fourth quarter, an all-time high, according to Kelley Blue Book.

- GM sold its 7.5 million shares in struggling electric-truck startup Lordstown Motors for a loss last quarter, as the Ohio-based electric vehicle maker underwhelms on production estimates.

- Target’s annual revenue crossed $100 billion last year, a first, as the retailer warns of slowing sales in 2022. Kohl’s saw the opposite, posting lower-than-expected quarterly results alongside a higher sales forecast for this year.

- The SEC is set to unveil a batch of standardized measurements for corporate sustainability disclosures, a bid to combat so-called “greenwashing.”

- Sixteen states and a consortium of agriculture and petrochemical associations are challenging the EPA’s new rule requiring a 28.3% reduction in vehicle emissions between 2023 and 2026.

International Markets

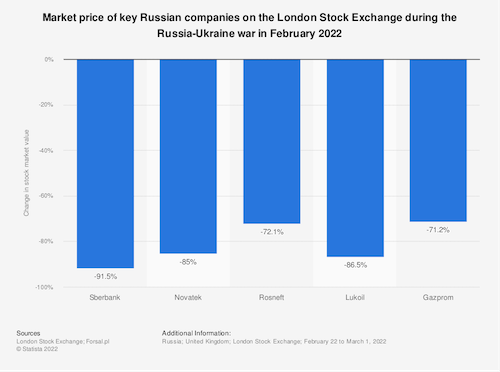

- The financial consequences of Russia’s invasion of Ukraine continue to spread:

- In just under a week, Russia’s invasion of Ukraine has reversed three decades of investment in the country by Western and other foreign businesses following the collapse of the Soviet Union.

- Western countries agreed to remove seven Russian banks — including the second-largest bank and several smaller ones — from the SWIFT global payment system. Notably absent are Russia’s Sberbank and Gazprombank, both key conduits for Russia’s energy transactions.

- Large financial institutions — including European exchange operators, the largest U.S. and foreign banks, and possibly the world’s giant commodity traders — are freezing funds with exposure to Russian equities amid a plunge in markets.

- Meanwhile, Russian government bonds are disappearing from top bond-trading platforms, while the Moscow Exchange halted trading for a third consecutive day today.

- Visa and Mastercard have cut Russian financial institutions from their payment networks to comply with sanctions against the country.

- Russia’s currency crisis is spreading to nations that are economically and geographically linked to Ukraine and Russia, such as Poland.

- The U.S. will ban all Russian flights from American airspace, in keeping with moves by most other Western nations.

- New COVID-19 cases globally fell 16% last week, while virus fatalities fell 10%.

- New COVID-19 cases in mainland China are up 171% over the past two weeks to more than 300 per day. The nation’s postal service will start testing all overseas mail for presence of the virus.

- Hong Kong will lock down all 7.4 million residents for several days later this month to perform a rapid round of compulsory COVID-19 testing. The island reported over 30,000 virus cases for the second day in a row on Tuesday, and now has one of the highest virus fatality rates in the developed world.

- London’s subway, one of the largest transit systems in the world, shut down on Tuesday as 10,000 workers went on strike over pay and working conditions.

- Toyota claims its new battery-electric vehicles will retain more than 90% of their battery capacity after a decade.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.