COVID-19 Bulletin: June 24

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- A surge in oil prices continued Wednesday on news of a tight market for U.S. crude, with Brent rising to $75.91/bbl and WTI hitting $74.07/bbl, their highest levels since October 2018. U.S. crude inventories fell by 7.6 million barrels last week to the lowest level since March of last year.

- Energy futures were higher in mid-day trading today, with WTI up 0.2% to $73.24/bbl and Brent up 0.3% to $75.42/bbl. Natural gas was 1.3% higher at $3.38/MMBtu.

- The average U.S. price of diesel gas increased for the eighth consecutive week last week, rising to $3.29 per gallon.

- The Middle East’s share of India’s crude imports dropped to 52.7% in April, the lowest level since April 2019.

- U.S. liquefied natural gas (LNG) company Venture Global has plans to build a new carbon capture and storage facility for its LNG plants in Louisiana.

- Construction on the Trans Mountain oil pipeline from Alberta, Canada, to British Columbia will resume after a four-month environmental shutdown, with the expanded line expected to triple capacity to 890,000 bpd by 2022.

- BP successfully launched a new oil project in the U.S. Gulf of Mexico expected to boost gross production by an estimated 20,100 bpd.

- Norway is expanding its oil exploration in frontier Arctic areas.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A record-breaking heat wave is set to move through the Pacific Northwest this weekend, straining power grids in several states as residents crank up air conditioners. Temperatures in the region are expected to be the hottest in all of North America for several days.

- At least 50 large wildfires have burned more than half a million acres across 11 western states, mostly a result of last week’s intense heat wave paired with drought conditions. Several states are closing forests to visitors to prevent further fires.

- China’s Yantian port, which ran at 30% below capacity last week due to a regional COVID-19 outbreak, will reopen fully today, although shipping disruptions from the partial shutdown will ripple globally for weeks.

- A COVID-19 outbreak in Taiwan continues to grow, prompting lockdowns at a time when Taiwanese suppliers are rushing to expand production of semiconductor chips.

- Container dwell times at Southern California ports rose slightly from April to May.

- U.S. engineering and construction costs rose for the eighth consecutive month in June, according to an index from IHS Markit.

- Natural rubber prices fell in the first half of June due to the economic impact of COVID-19 outbreaks in Asia and constrained automobile production due to the global chip shortage and supply chain disruptions.

- The U.S. will likely need an additional 330 million square feet of warehouse space dedicated to e-commerce by 2025 in order to keep up with expected demand.

- Supply constraints and shipping backlogs have pushed lead times for La-Z-Boy products to 4-9 months, eight times higher than before the pandemic and 16 times higher than at the close of fiscal year 2020.

- The U.S. retail inventory-to-sales ratio fell to an all-time low of 1.25 in April, spurred largely by shortages at motor vehicle and parts dealers, which account for 36% of all retail inventories.

- Prices for used freight trucks rose 11.9% from April to May as new truck production suffers from chip shortages and higher commodity prices.

- Despite a weakened supply chain, early estimates show sales on Amazon’s Prime Day potentially reached $12 billion, a record.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The highly transmissible Delta variant of COVID-19 now accounts for 20% of current infections in the U.S., up from 3% just a few weeks ago. The country reported 12,436 new COVID-19 cases and 375 deaths for Wednesday.

- The U.S. is falling behind on promised COVID-19 vaccine exports to other countries, shipping just 20% of the 20 million doses planned to be donated by the end of the month.

- New York will automatically lift more pandemic restrictions when its COVID-19 state of emergency, imposed last year, expires today.

- Maryland joined Vermont and South Dakota as the only three “green zone” states, with reported COVID-19 cases under 1 per 100,000 people.

- California has inoculated 70% of its residents with at least one dose of a COVID-19 vaccine, a milestone.

- The U.S. territory of Guam is now offering COVID-19 vaccinations to visitors from any country, hoping to boost the island’s tourism industry.

- Top health officials warn that the Delta variant of COVID-19 could infect more children in the U.S.

- A preliminary announcement from the CDC suggests that COVID-19 booster shots will not be needed for vaccinated people.

- U.S. authorities seized unauthorized versions of COVID-19 treatments being sent from India and Bangladesh to Mexico.

- The White House is expected to extend the June 30 expiration date for a national moratorium on evictions, allowing more time to distribute billions of dollars in pandemic housing aid.

- As U.S. COVID-19 cases continue to decrease, makers of virus antibody treatments are being forced to find new customers for their products, particularly people with compromised immune systems.

- The CDC has reported roughly 1,200 cases of a rare inflammatory heart condition in adolescents and young adults who received their second dose of a COVID-19 vaccine. Following the announcement, top health officials emphasized that the risk of such a condition is extremely low.

- San Francisco’s 37,000 municipal employees are required to be vaccinated within 10 weeks after a COVID-19 vaccine is fully approved by the FDA or face losing their jobs.

- First-time jobless claims of 411,000 last week were higher than expected, down just 7,000 from the prior week and still well above pre-pandemic levels.

- Nearly half of American workers are reconsidering their career options because of the pandemic.

- Shares of big hospital operators have rebounded faster than the broader stock market this year, reflecting improved financial conditions as a year-long rush of COVID-19 patients recedes.

- Carnival will resume sailing with 42 ships, just over half its total fleet, in the Caribbean and Europe by November 30, while Celebrity Cruises will no longer require passengers to show proof of COVID-19 vaccination in order to travel.

- Boeing will not increase production of its 737 MAX jet until it clears regulatory hurdles to resume operations in China, with experts predicting it could take months for the company to gain approval.

- Tesla’s Model 3 became the first all-electric vehicle to reach the top of Cars.com’s 2021 American-made index.

- New York City will install its first curbside electric-vehicle charging stations this year.

- General Motors is partnering with Shell to provide some Texas electric vehicle (EV) owners with fixed-rate renewable energy plans and free charging in a bid to make EVs more affordable.

- Honda announced that it will phase out sales of gas-powered cars completely by 2040.

International

- Despite India’s recent decline in COVID-19 cases, government officials are warning that a third wave of the virus is inevitable, as the country reported 54,069 new COVID-19 infections and 1,321 deaths Thursday, bringing its total number of cases above 30 million.

- Brazil recorded 115,228 new COVID-19 cases in the past 24 hours, a record, along with 2,392 deaths.

- Argentina posted 792 COVID-19 deaths in the past 24 hours, a record.

- The Delta variant of COVID-19 is continuing to take hold across Europe, accounting for 20% of new cases in Ireland and parts of Germany and 25% of cases in Italy. By late August, health officials expect the variant to make up 90% of cases across the bloc.

- The Delta variant of COVID-19 currently accounts for 90% of new infections in Moscow, and 70% of new infections in Israel.

- Sydney, Australia, will bar roughly 1 million people from leaving the city to help contain an outbreak of the COVID-19 Delta variant.

- South Africa reported 17,493 new COVID-19 infections Wednesday, the most since January.

- Portugal reported 1,497 new COVID-19 infections Wednesday, its largest one-day increase since February.

- Japan has exceeded its target of administering 1 million COVID-19 vaccine doses per day as the country prepares for the Tokyo Olympics next month.

- Only 22.3% of Asians have received at least one dose of a COVID-19 vaccine, compared to 53.0% in the U.S. and 63.6% in the U.K.

- Switzerland will further ease COVID-19 restrictions Saturday as the nation adopts broader use of digital vaccination certificates.

- Johnson & Johnson’s COVID-19 vaccine is the least used approved vaccine across Europe, a result of safety concerns and supply shortages.

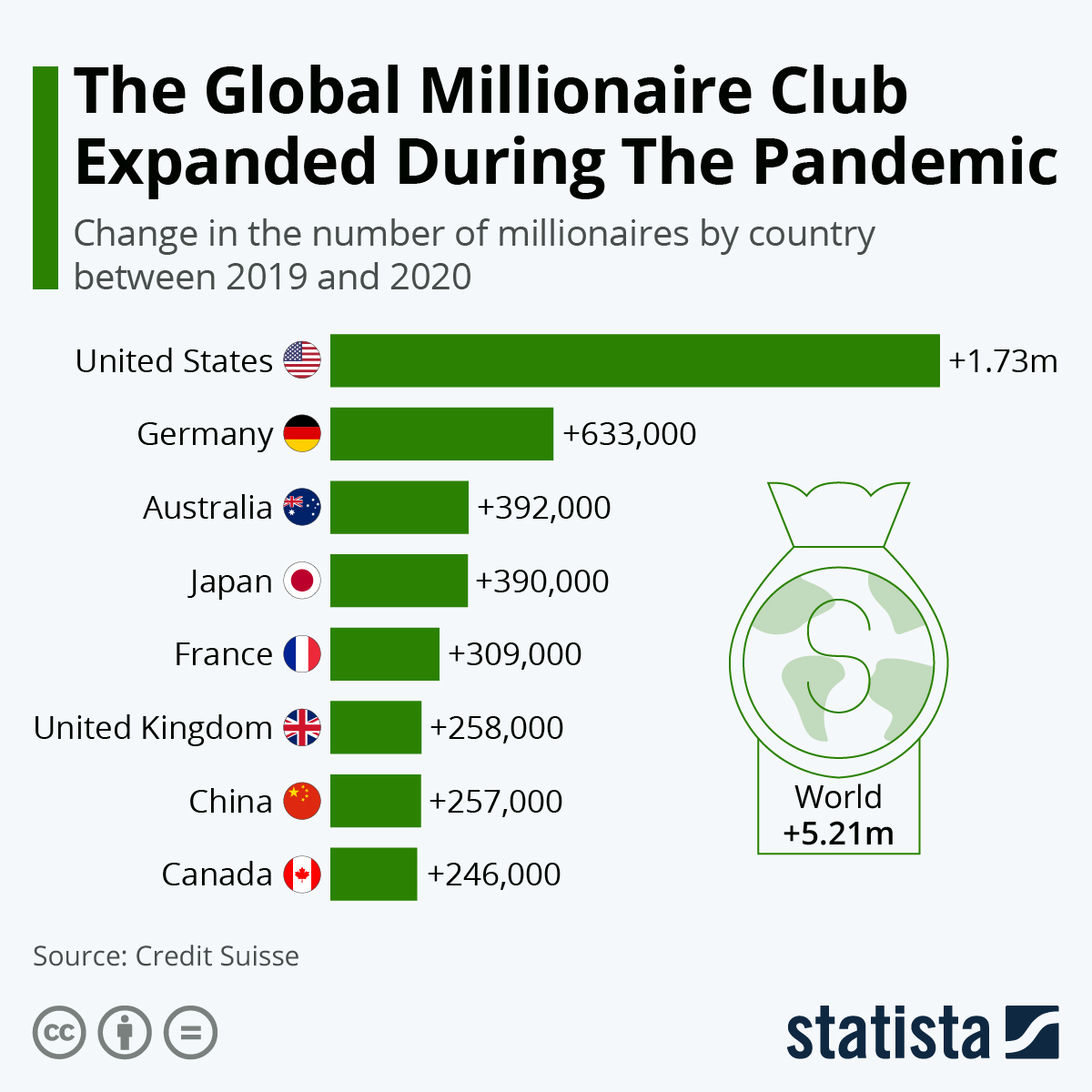

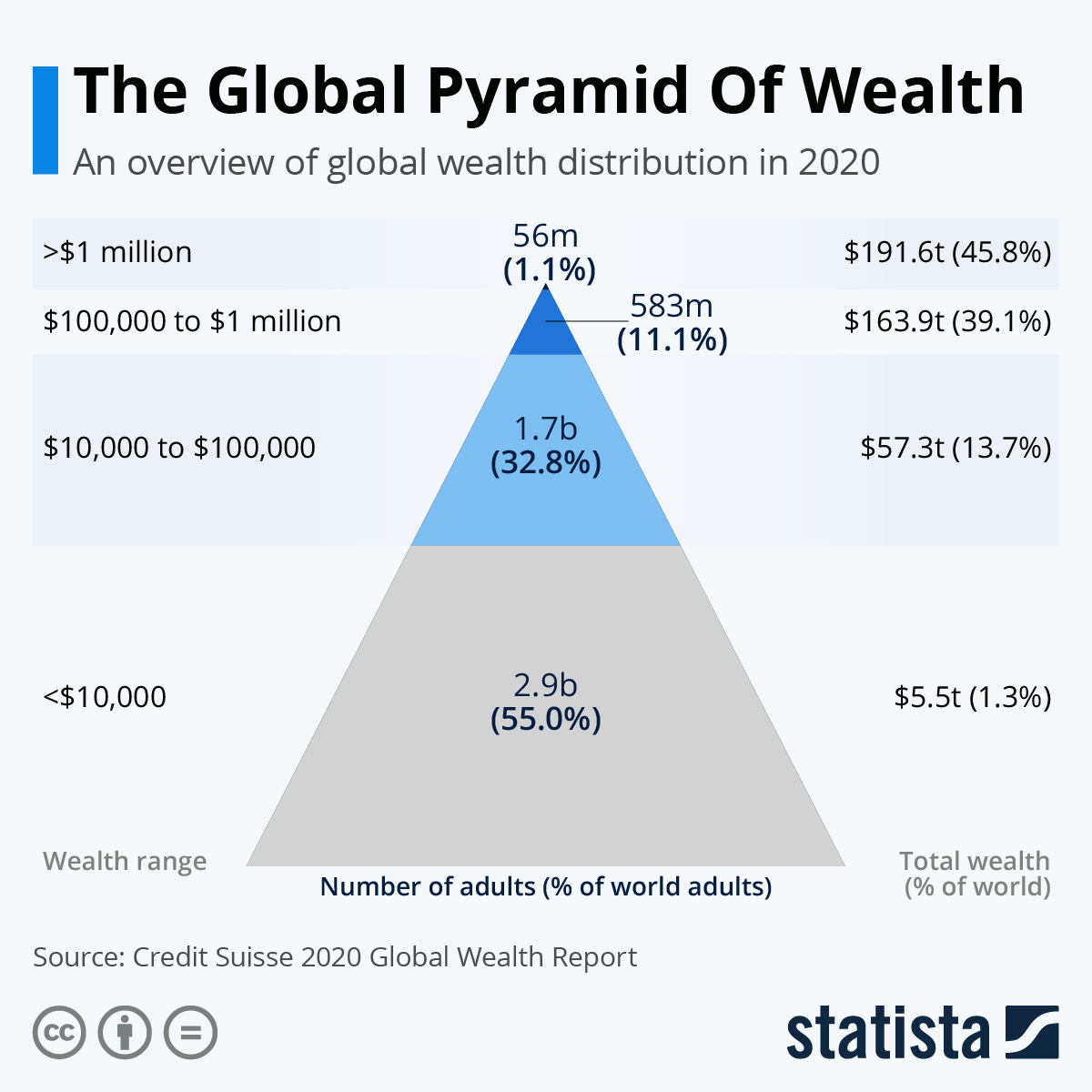

- Soaring prices for stocks, housing and other assets created 5.2 million more millionaires globally during the pandemic.

- The German government approved a draft budget for next year that adds $119 billion in debt to finance additional COVID-19 measures, bringing the country’s total borrowing since 2020 to over $561 billion.

- Tens of thousands of U.K. workers protested yesterday over the country’s continued travel restrictions.

- Canadian retail trade fell 5.7% in April, its steepest decline in a year, with a 3.2% decline expected in May.

- Irish budget airline Ryanair is seeing increased bookings to Portugal, Germany, Scandinavia and the Benelux countries as travel picks up despite continued pandemic restrictions.

- Lego plans to sell toy sets made from recycled beverage plastics in Europe and the U.S. within the next two years.

- U.K.-based startup Ellipsis Earth is using drones to help identify locations of plastic pollution throughout the world.

- Singapore’s minister for sustainability and the environment is pushing for a global standard for green finance markets, hoping to provide better guidance as companies work to reduce their carbon emissions.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.