COVID-19 Bulletin: June 17

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices edged slightly higher on Wednesday, again setting two-year highs, as U.S. crude inventories dropped by 7.4 million barrels last week, the fourth consecutive weekly decline.

- Energy futures were lower in mid-day trading today, with WTI down 1.4% to $71.15/bbl and Brent down 1.6% to $73.17/bbl. Natural gas was 0.2% higher at $3.26/MMBtu.

- Oil refineries in Asia are racing to meet demand as premiums for Middle East and Russian crude reached their highest levels in almost a year.

- Russia’s natural gas exports increased 26.7% year over year in January.

- U.S. consumption of renewable energy grew for the fifth consecutive year in 2020, topping 11.6 quadrillion Btu, equivalent to 12% of total U.S. energy consumption.

- Norway’s Lundin Energy is certifying oil it sells from fields in Norway and the North Sea as carbon neutral.

- As more companies take action to limit the effects of climate change, commodities traders predict carbon could become a larger market than oil in coming years.

- To encourage carbon capture and storage and cut emissions, Australia is asking companies to suggest offshore locations as potential sites to bury carbon dioxide.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

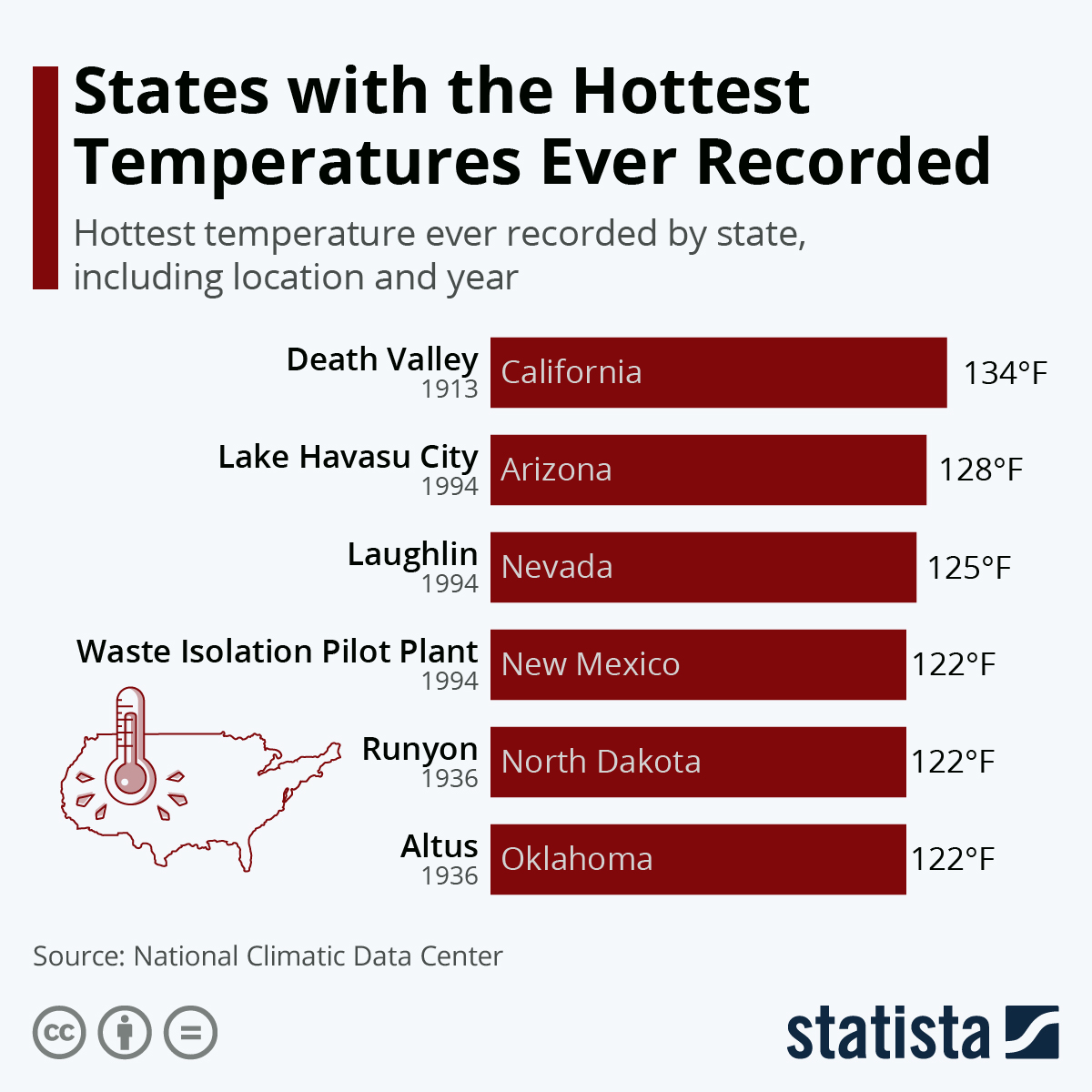

- Record temperatures spread to more Western regions Wednesday, affecting 50 million people as wildfires broke out in parts of Montana, Wyoming, Colorado and Arizona. Salt Lake City hit 107 degrees Fahrenheit, tying a record from 1874, while Tucson set an all-time high of 115 degrees.

- Many all-time temperature highs could be broken this week:

- Tropical storm Claudette is expected to hit the U.S. Gulf Coast in the coming week, potentially delivering a foot of rainfall in Texas and Louisiana.

- General Motors expects the chip shortage to increase its expenses by up to $3 billion in the second half of the year, leading the company to relax profit forecasts.

- Volvo will halt production at a Belgian plant next week due to the computer chip shortage.

- China’s semiconductor chip output reached a record monthly high in May, up 37.6% from a year ago amid soaring global demand.

- Billions in U.S.-China tariffs have set back the world’s value chains by 3-5 years but have had little effect on the trade imbalance between the nations. The shocks of the tariffs and pandemic have conspired to force companies to diversify their supply chains to reduce risks.

- U.S. poultry prices rose for the eighth consecutive month in May, rising 2.1% to a record high.

- Japan’s exports rose at their fastest pace in over 40 years in May, rising 49.6% year on year after a 38% jump in April.

- The Panama Canal has expanded the size of its locks, providing shipping lines greater flexibility in the transport, deployment and construction of vessels.

- French shipping start-up Neoline has confirmed plans to build two sail-powered cargo ships scheduled for delivery in the first half of 2024.

- Our logistics team reports that bulk trucking firms are refusing to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. reported 12,430 new infections and 368 deaths on Wednesday, with the Delta variant’s share of cases rising to roughly 10%.

- Official U.S. COVID-19 fatalities roughly equal the number of Americans who died from cancer in 2019.

- Public health officials are warning that herd immunity to COVID-19 could be a long way off, highlighting the need for close surveillance and rapid responses to outbreaks despite shrinking infections.

- New data shows Pfizer’s COVID-19 vaccine to be effective against resilient virus mutations.

- The U.S. purchased an additional 200 million doses of Moderna’s COVID-19 vaccine, bringing its total to 500 million.

- The U.S. has authorized an additional 14 million doses of Johnson & Johnson’s single-shot COVID-19 vaccine manufactured at a beleaguered Baltimore plant, with plans to export the doses to other countries.

- The NFL has eliminated mask mandates and daily testing for players and staff.

- After falling for six straight weeks, first-time unemployment claims rose to 412,000 last week, illustrating the fragile state of the jobs recovery.

- More than 400,000 people will lose $300 in extra federal unemployment benefits Saturday as eight states — Alabama, Idaho, Indiana, Nebraska, New Hampshire, North Dakota, West Virginia and Wyoming — opt out of the pandemic relief program.

- After concluding a much-anticipated meeting Wednesday, the Federal Reserve indicated it would hold interest rates near zero in the short term while speeding up its timeline for rate hikes in the next two years.

- U.S. mortgage applications rose 4.2% last week following three weeks of decline, while refinancings rose 6%.

- A comprehensive report on U.S. housing conditions identifies a split in the housing market, with one group of households quickly purchasing homes with money saved during the pandemic, while others are struggling to buy homes as prices surge.

- Big banks report that stock and fixed income trading has slowed from the torrid pace of 2020, with trading revenue down 38% at JPMorgan and 30% at Citigroup.

- Only about 30% of employees in 10 large cities have returned to offices, leaving business districts behind in the recovery lifting retail, dining, and travel and leisure sectors.

- Multiple airlines have experienced website outages and other connectivity problems this week, with Southwest Airlines forced to cancel more than 500 flights.

- General Motors is doubling down on its electrical vehicle transition, raising investment plans for the second time in eight months, budgeting to spend $35 billion to introduce 30 plug-in models by 2025.

- Ford’s luxury Lincoln brand expects half its vehicle sales to be all-electric models by 2026, while Mazda will introduce 13 electric car models by 2025.

- Despite ousting its CEO and CFO earlier this week, electric-truck startup Lordstown Motors says it is on track to begin production in September.

- Habitat for Humanity is making progress on a single-story home in Arizona built with up to 80% 3D-printed materials, hoping to pave the way for more affordable housing across the U.S.

- U.S. mixed plastic exports were up nearly 15% year over year in the first quarter, with Canada taking nearly two-thirds of the scrap.

International

- Weekly COVID-19 cases in Africa jumped 44% over the previous week, along with a 20% rise in virus fatalities.

- The U.K. reported 9,055 new COVID-19 cases Wednesday, its highest one-day case count since February.

- Brazil reported more than 80,000 new cases of COVID-19 and nearly 2,500 deaths over a 24-hour period, as hospitals warn of a new fungal infection in some virus patients with lethal consequences.

- Indonesian health authorities say that the recent surge of COVID-19 infections in the country is likely due to the highly transmissible Delta variant of the virus.

- India reported 67,208 new COVID-19 cases and 2,330 deaths on Wednesday as the country’s infection numbers continue to decline. The Taj Mahal was reopened to the public on Wednesday amid a broader easing of pandemic restrictions.

- Amid declining COVID-19 infections, Germany will end its work-from-home mandate June 30, six months after it was imposed.

- France will end a nationwide curfew on June 20, 10 days earlier than planned.

- Japan announced that it will lift its state of emergency for nine prefectures beginning June 20, while instating “quasi-emergency” measures in seven prefectures. The country plans to allow up to 10,000 spectators at major events in prefectures where the state of emergency has been lifted, which would apply to the upcoming Tokyo Olympics in July.

- German vaccine maker CureVac reported a disappointing efficacy rate of just 47% for its COVID-19 vaccine, citing the increased prevalence of resilient virus mutations.

- The EU could approve Russia’s Sputnik V COVID-19 vaccine by September.

- Italy is mulling mixing doses of COVID-19 vaccines to finish vaccinating those who received a first shot of AstraZeneca’s jab.

- Portugal’s recovery plan is the first to be approved by the EU, garnering $16.9 billion in grants from the bloc’s COVID-19 recovery fund. The nation dropped travel restrictions on passengers from the U.S.

- Malaysia is hoping to lift its travel ban and reopen its economy by the end of October, with plans to begin easing curbs starting in July. The government estimates the national lockdown is costing the nation $242 million per day.

- The EU dropped remaining travel restrictions on U.S. tourists, a boon for several tourism-dependent economies including Italy and Greece.

- Despite vaccinating 44% of its population with at least one dose of a COVID-19 vaccine, health officials in China are warning against reopening the nation’s borders to travel.

- The U.K. announced it will further extend a ban on evictions for businesses that can’t pay their rent due to the pandemic, extending the moratorium through March 2022 after it was set to expire at the end of this month.

- Momentum in China’s factory output slowed for its third consecutive month, rising by 8.8% in May from a year ago, down from a 9.8% increase in April.

- Euro zone inflation rose 0.3% month over month in May, in line with expectations of higher energy prices and more expensive services.

- Taiwanese exports — a leading indicator of demand for hi-tech gadgets and Asia’s exports — are expected to have risen in May for the 15th month in a row.

- The founder of Chinese electric car manufacturer BYD expects that new energy vehicles will account for 70% of China’s new car sales by 2030, up from 11.4% currently.

- Six companies including Ford, Nissan, LG and Samsung are in talks to build U.K. gigafactories to produce electric-vehicle batteries.

- The European Federation for Transport and Environment says tougher emission standards are needed in the EU and the U.K. to accelerate the move to electric vehicles and ensure that $32 billion in planned battery investments are justified by demand.

- The European Central Bank says that no major euro zone banks meet the necessary criteria in measuring climate-related risk and that it will increase pressure on the industry.

- A pair of environmental groups have asked a German court to revoke provisional building permits for a Tesla factory in Berlin, saying that the company has not said how it plans to prevent highly poisonous gas from escaping the factory.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.