COVID-19 Bulletin: July 16

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell roughly 2% Thursday on expectations of OPEC increasing its production quotas. Futures were higher in mid-day trading, with WTI up 0.5% at $72.00/bbl and Brent up 0.4% at $73.73/bbl. Natural gas was 1.2% higher at $3.66/MMBtu.

- OPEC expects oil demand to grow by 3.4% this year, led by higher consumption in the U.S., China and India, ultimately surpassing pre-pandemic levels in the second half of 2022. The demand increases could spur increased global inflation, OPEC warned.

- A new report from the International Energy Agency shows that global electricity demand will surge by 5% this year, outpacing renewable energy growth and increasing energy generation derived from fossil fuels.

- The U.S. Energy Department announced a new goal of lowering the cost of grid-scale, long-duration energy storage by 90% by 2030.

- Energy companies including oil producers, pipeline operators and refineries have issued a record $34 billion in debt this year, primarily using the cash to mend pandemic-hit balance sheets rather than increase production.

- Greenland will ban all future oil exploration over growing environmental concerns.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The U.S. West and western Canada are bracing for their fourth heat wave in five weeks, with triple-digit temperatures expected for at least 17 million people this weekend.

- A new wildfire has broken out in California just 10 miles away from the deadly Camp Fire of 2018, prompting evacuation warnings for the county’s residents.

- At least 100 people in Germany and Belgium have died from the most severe flooding and storms in the last century, while hundreds of thousands lost power Thursday.

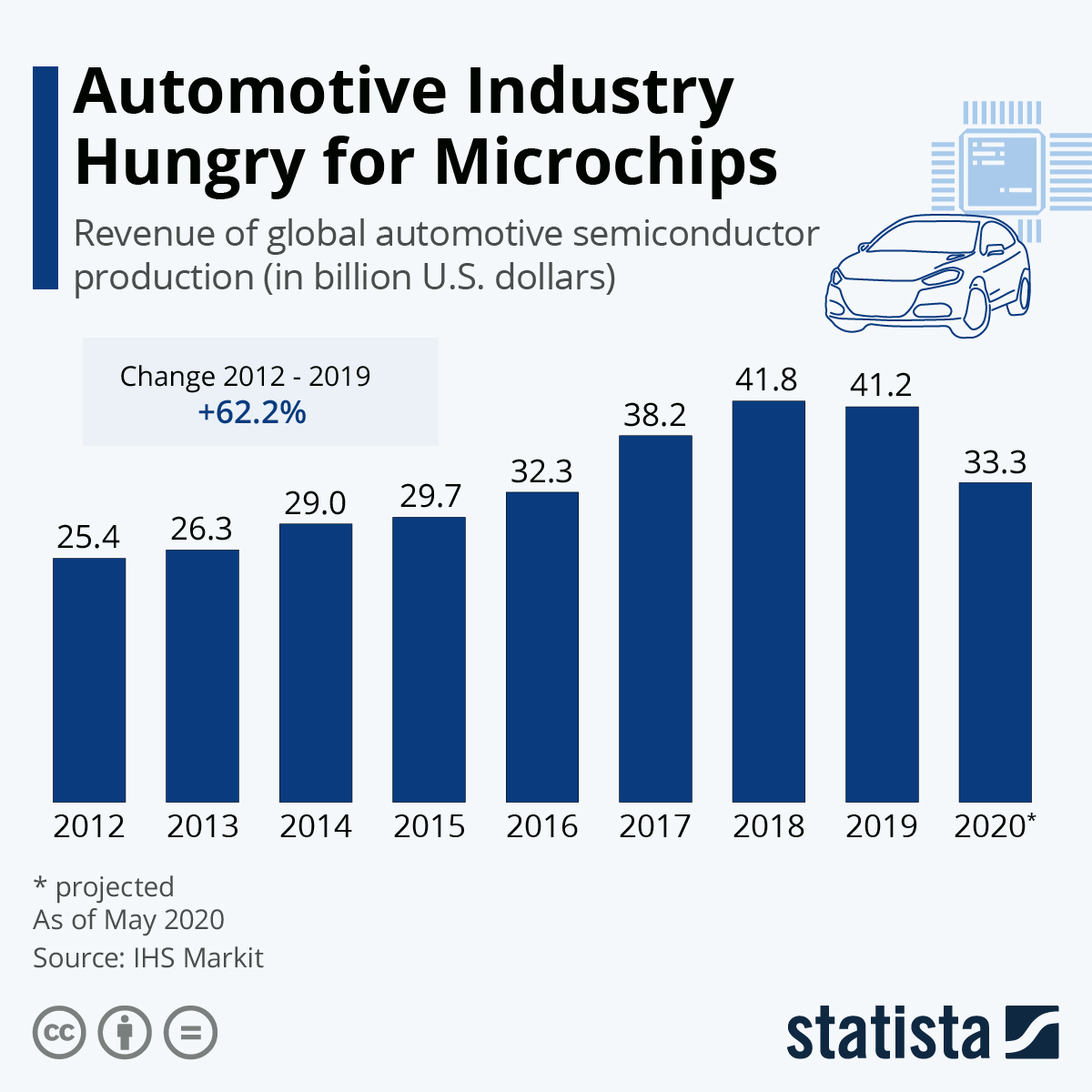

- TSMC, the world’s largest contract chip manufacturer, expects the effects of the global chip shortage on the auto industry to start easing in the coming months, adding that it is on track to increase the output of microcontrollers used in cars by roughly 60% compared to last year. Volkswagen also predicts the chip supply shortage to ease in the coming months.

- Intel is eyeing a $30 billion acquisition of semiconductor manufacturer GlobalFoundries, as the company seeks to expand its chipmaking capacity and become a key supplier for other companies.

- Global chipmaking revenue had been rapidly increasing in the past decade until pandemic-induced supply disruptions:

- The Port of Los Angeles closed out fiscal year 2021 with 10.9 million TEUs of volume, a new record for the Western Hemisphere.

- Shipping company Maersk is redesigning its network in west and central Asia, launching two new services and upgrading an existing one to help accelerate cargo delivery.

- U.S. manufacturing output dipped slightly in June, dropping by 0.1% compared to an increase of 0.9% in May.

- Manufacturing in New York state is expanding at a record pace, with the Federal Reserve Bank of New York’s general business conditions index climbing to 43 in June from just 17.4 in May.

- An MIT study shows that despite the pandemic triggering global lockdowns as well as a shortage of consumer products, supply-chain sustainability goals were mostly maintained by companies in 2020.

- Shortages of PPE during the pandemic led to fraudulent supply chain activity, ranging from counterfeit and ineffective products to large unpaid orders.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- Daily COVID-19 infection numbers have increased by at least 15% across 49 U.S. states in the past two weeks, fueled by the highly contagious Delta variant infecting mostly unvaccinated people. Thirty-five states have seen increases of at least 50%.

- The U.S. reported 28,412 new COVID-19 cases and 283 deaths Thursday.

- Los Angeles County, the nation’s largest, reimposed an indoor mask mandate regardless of a person’s COVID-19 vaccination status. Sacramento is nearing a similar order.

- Health officials in Missouri have issued a COVID-19 hotspot advisory for a number of southwestern counties where vaccination rates are lower than 40%.

- Connecticut reported its highest COVID-19 positivity rate since May, with the seven-day average of new infections doubling since mid-June.

- COVID-19 cases continue to rise in Louisiana, with the state reporting more than 1,300 new infections Wednesday, the highest since February.

- Pennsylvania’s seven-day moving average for new COVID-19 infections rose 28% from last week.

- Police in parts of Massachusetts are now using sniffing dogs to help detect COVID-19 among residents.

- The U.S. surgeon general warned that misinformation on the COVID-19 virus and vaccines pose a serious threat to public health.

- Even with the rise of highly infectious COVID-19 variants in the U.S., the majority of vaccinated Americans are unlikely to need booster shots for several months or possibly years.

- Alabama’s Fort Rucker is the first U.S. military base to require COVID-19 vaccinations in some iteration.

- Norwegian Cruise Line is threatening to abandon Florida if the state does not reverse its ban on requiring passengers to provide proof of a COVID-19 vaccination.

- The U.S. budget deficit narrowed to $2.2 trillion in the first nine months of the fiscal year following higher tax revenues as the nation’s economy rebounded.

- U.S. jobless claims fell to a new pandemic low of 360,000 last week, still significantly elevated over a pre-pandemic average of 218,000.

- The chairman of the Federal Reserve expressed growing concern at the U.S. inflation rate staying above 2%, but maintained the central bank’s plan to keep interest rates low and continue monthly asset purchases.

- U.S. existing home sales decreased for a fourth straight month in May, while the number of new listings grew 11%, reflecting a cooldown in recent frenzied housing market activity.

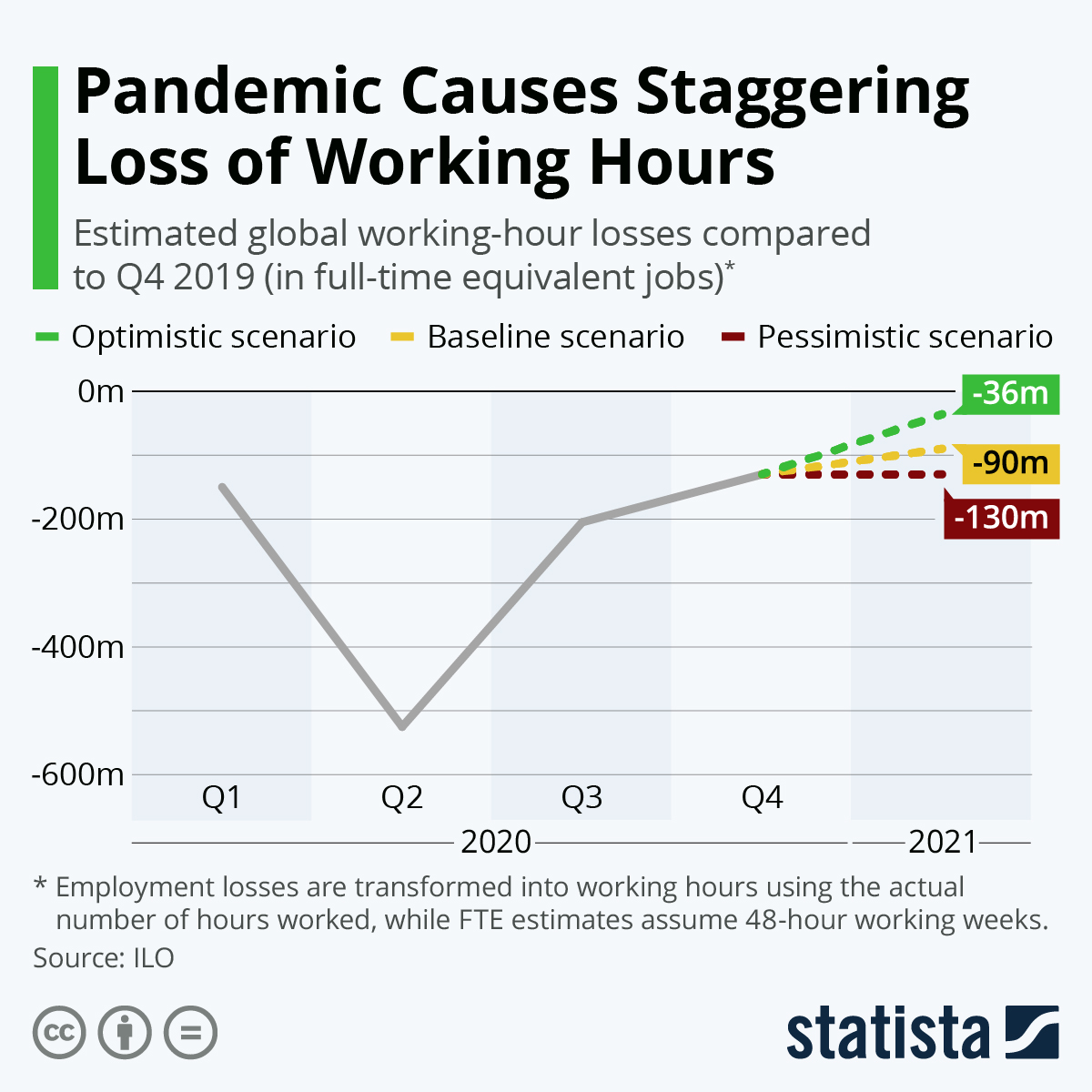

- U.S. economic output nearly recovered to pre-pandemic levels in the first quarter of 2021 despite employees putting in 4.3% fewer hours, showcasing how companies learned to do more with less over the past year.

- The pandemic-induced loss of working hours was not limited to the U.S.:

- Siemens Gamesa warned of profit hits caused by its wind-turbine unit in the latest quarter, sending the company’s stock plummeting more than 16% Thursday.

- A new study on U.S. infrastructure shows how tall buildings and sparse green areas in urban centers contribute to exceedingly hot conditions.

International

- Indonesian hospitals are setting up overflow tents to deal with an overwhelming number of COVID-19 patients. The nation reported 56,757 new COVID-19 cases and 982 deaths Thursday, while making attempts to rapidly scale up vaccination efforts.

- India reported 38,949 new COVID-19 cases and 542 deaths Thursday.

- The U.K. reported 48,553 new COVID-19 cases Thursday alongside a 42.8% increase in hospitalizations, with officials warning that pandemic curbs could be reimposed in the near future.

- New COVID-19 cases in Tokyo climbed to 1,308, the city’s highest daily total since January, with the Olympic Games scheduled to begin next week.

- COVID-19 infections are spreading across Africa at a record pace, with the continent reporting 1 million infections in the last month, bringing its total caseload to 6 million since the start of the pandemic.

- Russia reported more than 25,000 new COVID-19 infections Thursday and a record 791 deaths.

- Vietnam reported 3,416 new COVID-19 infections Thursday, a record.

- Thailand reported an average of 7,600 new COVID-19 cases per day the past week, stoking fears of a new virus wave as the nation prepares to reopen its borders.

- Germany reported 1,548 new COVID-19 cases Wednesday, up by more than 500 from the same time last week, with the nation’s retailers expressing support for a new indoor mask mandate.

- COVID-19 cases in Italy rose by 2,455 Thursday, up from 2,153 the previous day.

- The U.S. CDC issued a new travel advisory for Mexico, warning against travel to the country amid a third wave of COVID-19, while the country reported more than 11,000 new cases Tuesday, up 23% from a week earlier.

- Canada is eyeing reopening its border to fully vaccinated Americans in mid-August.

- The U.S. is expected to change pandemic restrictions on travel from Europe in the coming days, following a year where 80% of travel between the regions was lost.

- The World Health Organization is warning South Africa to brace for a new surge in COVID-19 infections following days of widespread civil unrest in Johannesburg and Durban.

- Protests broke out in France after the country’s president mandated a COVID-19 vaccine certificate or a negative PCR test in order to go to bars, restaurants or cinemas.

- The World Health Organization reiterated its support against requiring proof of COVID-19 vaccines for international travel.

- Alcohol-related deaths in the U.K. surged by 21% last year alongside a 24% increase in liquor store sales, highlighting the pandemic’s severe effects on individual well-being.

- European car registrations surged 13.3% in June from the same time a year ago, the fourth straight months of gains.

- Mercedes-Benz parent Daimler posted strong earnings for the second quarter with revenue jumping to $6.14 billion, fueled by higher sales despite the global chip shortage.

- European car leaser LeasePlan ordered 3,000 vehicles from U.K.-based electric van-maker Arrival, part of a plan to achieve net-zero emissions by 2030.

- The global issuance of sustainable debt is likely to cross $1 trillion by the end of this year, the Institute of International Finance predicts.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.