COVID-19 Bulletin: January 28

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices eased slightly from seven-year highs Thursday, reversing course in late morning trading today as they head for a sixth straight week of gains. In late morning trading, WTI was up 1.2% at $87.74/bbl and Brent was up 1.5% at $90.70/bbl. U.S. natural gas was 10.7% higher at $4.74/MMBtu.

- Los Angeles council members voted unanimously to suspend oil drilling in the city, which had one of the highest concentrations of urban oil wells in the 20th century.

- A federal judge invalidated a lease sale of 80 million acres slated for oil and gas drilling in the Gulf of Mexico — the largest sale in the nation’s history — citing flawed environmental-impact determinations.

- Saudi Arabia is expected to lift selling prices for all crude grades sold in Asia next month on continued high demand.

- Saudi Arabian officials are calling for increased investment in oil and gas production until low-carbon energy grows enough to meet rising global energy demand.

- The U.S. administration said logistics challenges would make it difficult to secure extra gas supply for Europe if a crisis unfolds in the continent’s easternmost region.

- U.S. refiner Valero posted quarterly earnings well above Wall Street expectations Thursday, with margins tripling on the back of higher demand and fuel prices.

- Indonesia is selectively allowing some firms to resume exports of coal.

- Oil-wealthy Norway’s sovereign wealth fund, the world’s largest, posted its second-best return in history last year.

- Dow Chemical Company reported a 34.2% rise in sales last quarter, beating Wall Street expectations.

- Italian oil field servicer Saipem, formerly a subsidiary of the nation’s Eni oil major, is in the early stages of constructing a new domestic CO2 capture project.

- The U.S. administration authorized $25 million in funding for wave power generation off the coast of Oregon.

Supply Chain

- A severe winter storm is expected to sweep across parts of the U.S. East Coast this weekend and could develop into a major nor’easter with the potential to drop more than a foot of snow in some places, forecasters say.

- The average spot rate per 40-foot container from Shanghai to Los Angeles rose to $11,197 for the week ending Jan. 20, up 6.4% from the first week of the year and 168% higher than the same time a year ago.

- The backlog of container ships at South Carolina’s Port of Charleston could take six weeks to clear, port officials say.

- In the largest disaster mobilization in its history, the U.S. Postal Service has added thousands of temporary employees and converted more than 40 facilities to deliver the 500 million COVID-19 test kits promised to citizens by the White House.

- The U.S. Transportation Department is increasing funding for highway safety in a bid to reduce fatalities from heavy-duty truck crashes.

- U.S. truck shipments declined in the fourth quarter due to restrained capacity, a U.S. Bank report said.

- J.B. Hunt said it would boost investments in rail equipment as intermodal was the source of some of the firm’s worst congestion last year.

- Britain’s critical shortage of truck drivers is easing, U.K. logistics firms report.

- Eastern European factories are withering under high energy bills, which have more than doubled in the past year in some cases.

- United Airlines became the first U.S. carrier to open its own flight school, with plans to train 500 new pilots a year as the industry faces a severe pilot shortage caused by the pandemic, with a projected 12,000-pilot shortfall by next year.

- Taiwan-based China Airlines is ordering 10 more Boeing freighters on surging export demand.

- Texas-based parcel deliverer Lone Star Overnight plans to expand into the Chicago-Milwaukee area by next year.

- Procter & Gamble and snack food maker Mondelez are set to further raise product prices due to higher input costs.

- PPG Industries has diversified resin sourcing and saw a 30% jump in raw material costs year-over-year in the fourth quarter, as some facilities experienced 40% absenteeism due to COVID-19 call offs.

- Supply chain snarls forced Tesla to delay its long-awaited “Cybertruck” until at least 2023, the company said.

- Supply snags will keep private-jet-maker Textron’s revenues down this year despite soaring demand for business flying, the manufacturer said.

- FedEx is expanding a partnership with Microsoft to improve supply chain visibility and logistics tracking products for businesses.

- Maersk is releasing the full spectrum of its historical weather data in a bid to help researchers study the effects of climate change.

- Maritime shipping emissions rose 4.9% last year on rising trade activity.

Domestic Markets

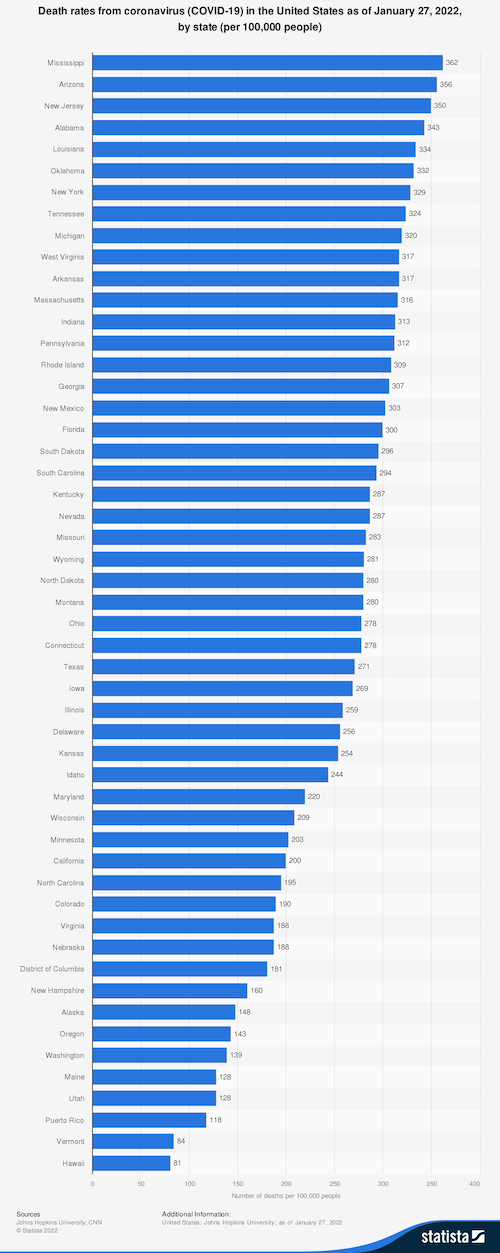

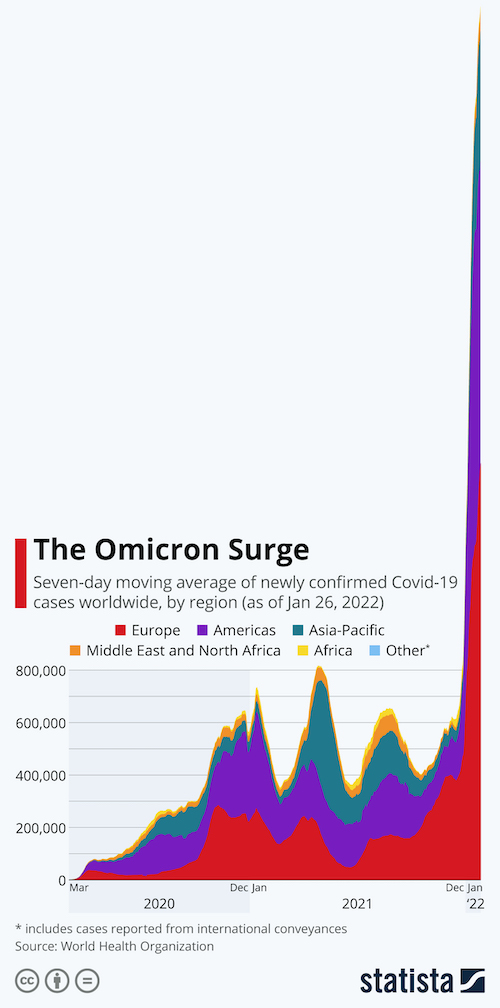

- The U.S. reported 517,199 new COVID-19 infections and 2,359 virus fatalities Thursday.

- New data shows U.S. COVID-19 hospitalizations leveling off the past week, a promising sign even as single-day fatalities approach records.

- California surpassed 8 million COVID-19 cases since the start of the pandemic, with 2.5 million of those added in January alone. One in five Californians has been infected.

- COVID-19 fatalities in Maryland have doubled from December to a new record.

- Texas is running out of ICU bed capacity due to a surge of COVID-19 patients.

- Virus hospitalizations hit a record in Oklahoma, and dropped to one-month lows in Illinois.

- Florida’s seven-day average of COVID-19 fatalities was at its highest since mid-October yesterday.

- Just 229,000 people were added to the U.S. population in the first year of the pandemic as deaths exceeded births in about half of states.

- 10 million U.S. healthcare workers were required to be vaccinated against COVID-19 as of yesterday, as the White House’s mandate took effect across a patchwork of states.

- U.S. labor costs were up 4.0% year over year in the fourth quarter and are rising at the fastest rate in two decades, new data shows.

- U.S. labor costs are rising at the fastest rate in two decades, new data shows.

- New capital goods orders in the U.S. were flat in December.

- Most new electric vehicle (EV) owners would not switch back to gas cars despite the lack of charging infrastructure, new surveys show. Production facilities continue to see the bulk of EV funding in the U.S.

- Southwest Airlines reported its first quarterly profit of the pandemic in the final three months of 2021.

- Apple shattered previous quarterly sales and earnings records in the final three months of 2021, despite widespread supply constraints.

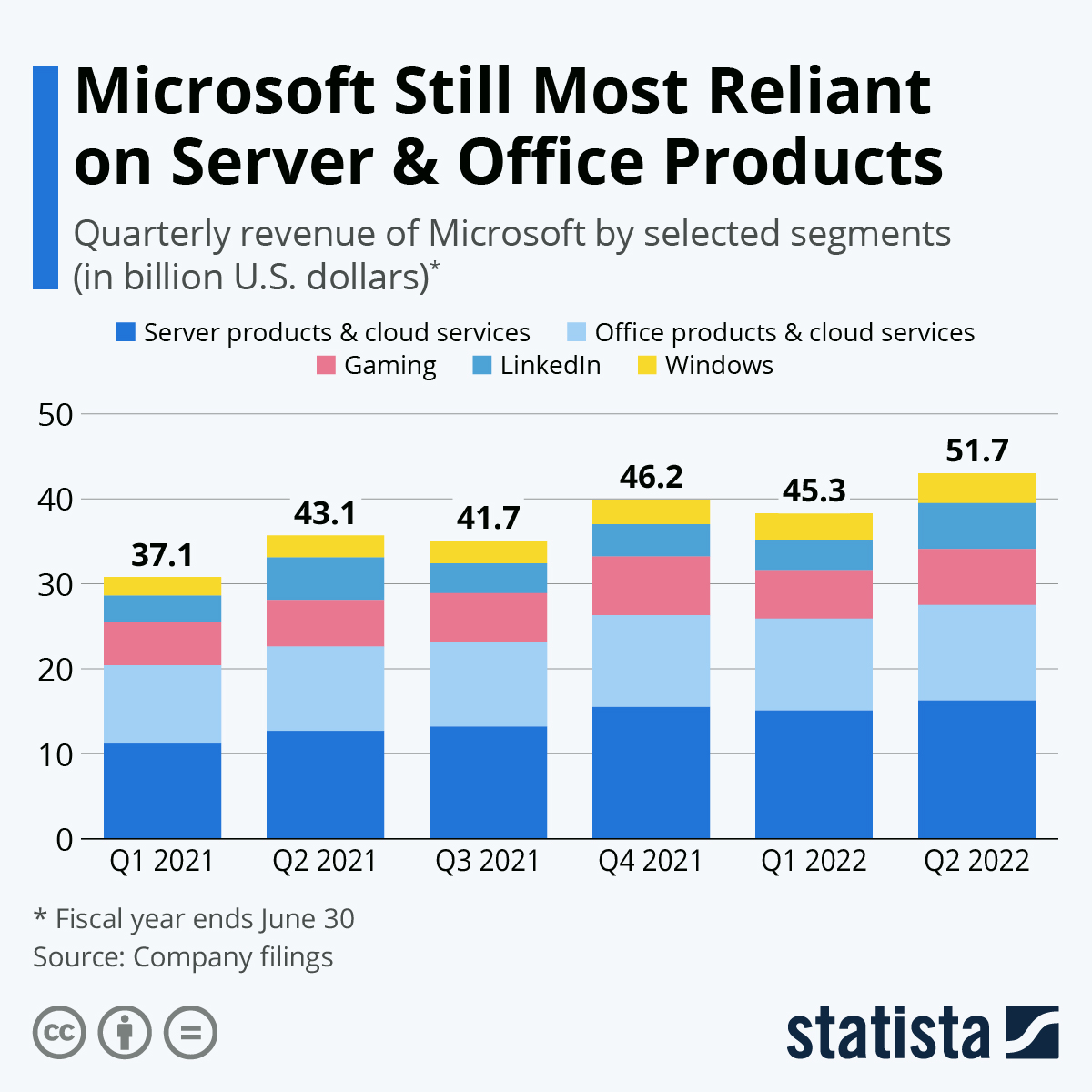

- Microsoft’s record revenues in 2021 came on the shoulders of higher demand for cloud-based corporate IT and traditional software offerings, the firm’s largest revenue streams:

- Sears Auto Centers shuttered the last of its 15 stores in the U.S. and Puerto Rico.

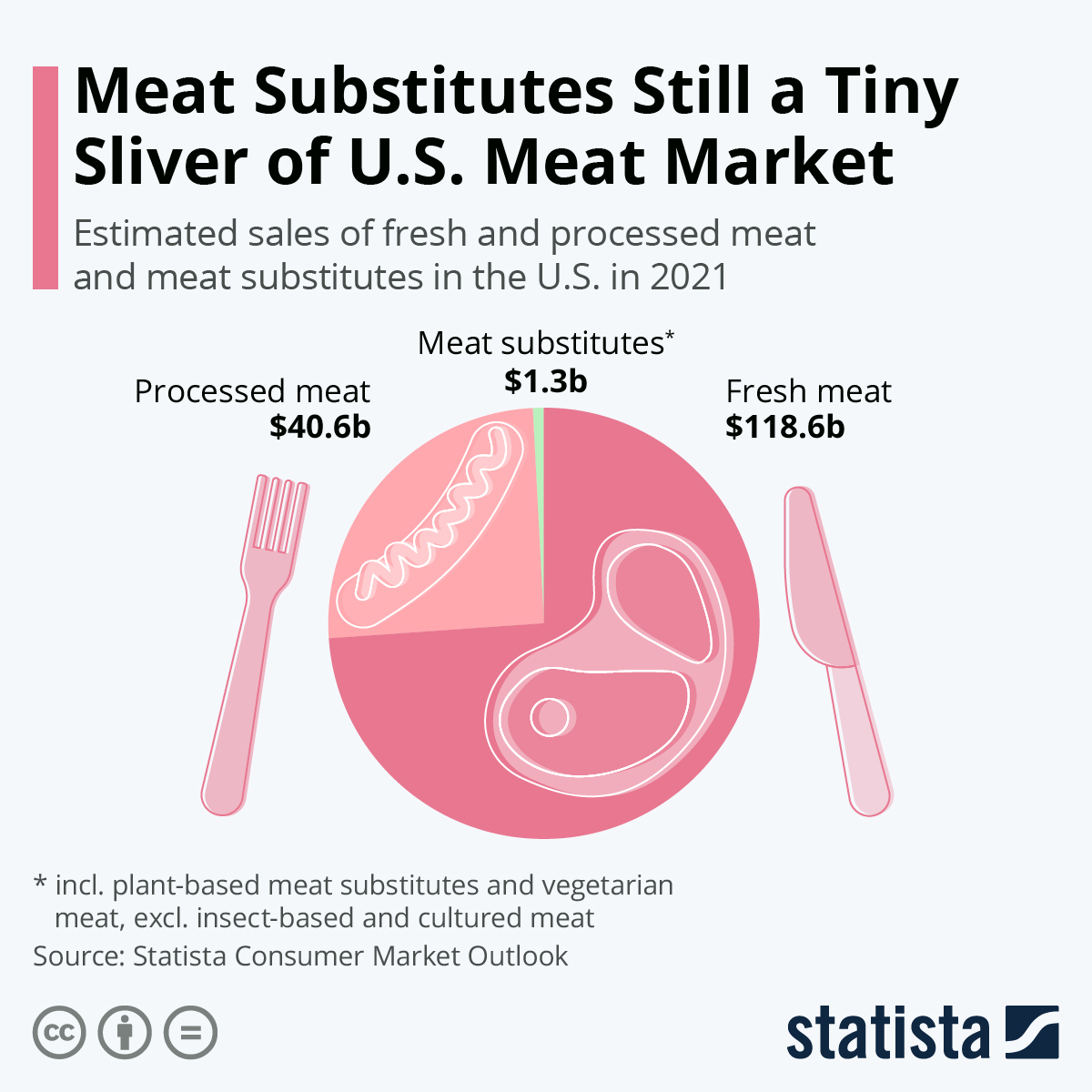

- McDonald’s reported a better-than-expected 7.5% increase in U.S. same-store sales last quarter, largely a result of higher menu prices. The chain will expand its offering of the McPlant, a meatless burger developed in partnership with Beyond Meat, to 600 new locations throughout Texas and California on surging demand.

- Insurance payments to U.S. farmers have increased threefold over the past 25 years, the result of rising periods of drought and other adverse weather events.

International Markets

- More than 8 million COVID-19 cases were reported in the Americas last week, 32% higher than the prior week, crushing the previous record.

- New COVID-19 cases in Japan topped 80,000 Thursday, the third straight record high.

- South Korea’s new COVID-19 cases hit 15,894 yesterday, the second straight record.

- The BA.2 “stealth” subvariant of Omicron has been detected in Australia.

- More European nations are relaxing pandemic restrictions, citing milder symptoms associated with the COVID-19 Omicron variant.

- COVID-19 deaths in Mexico are at their highest since October, a week after virus infections topped 60,000, a single-day record.

- A member of Germany’s Olympic delegation tested positive for COVID-19 in Beijing, one of the first infections linked to an athletic team. The city reported 19 new infections Thursday, as authorities expanded lockdowns to more neighborhoods around Olympic Village.

- European regulators approved Pfizer’s COVID-19 antiviral pill yesterday.

- COVID-19 boosters cut the risk of death from the virus by 95%, according to a U.K. study.

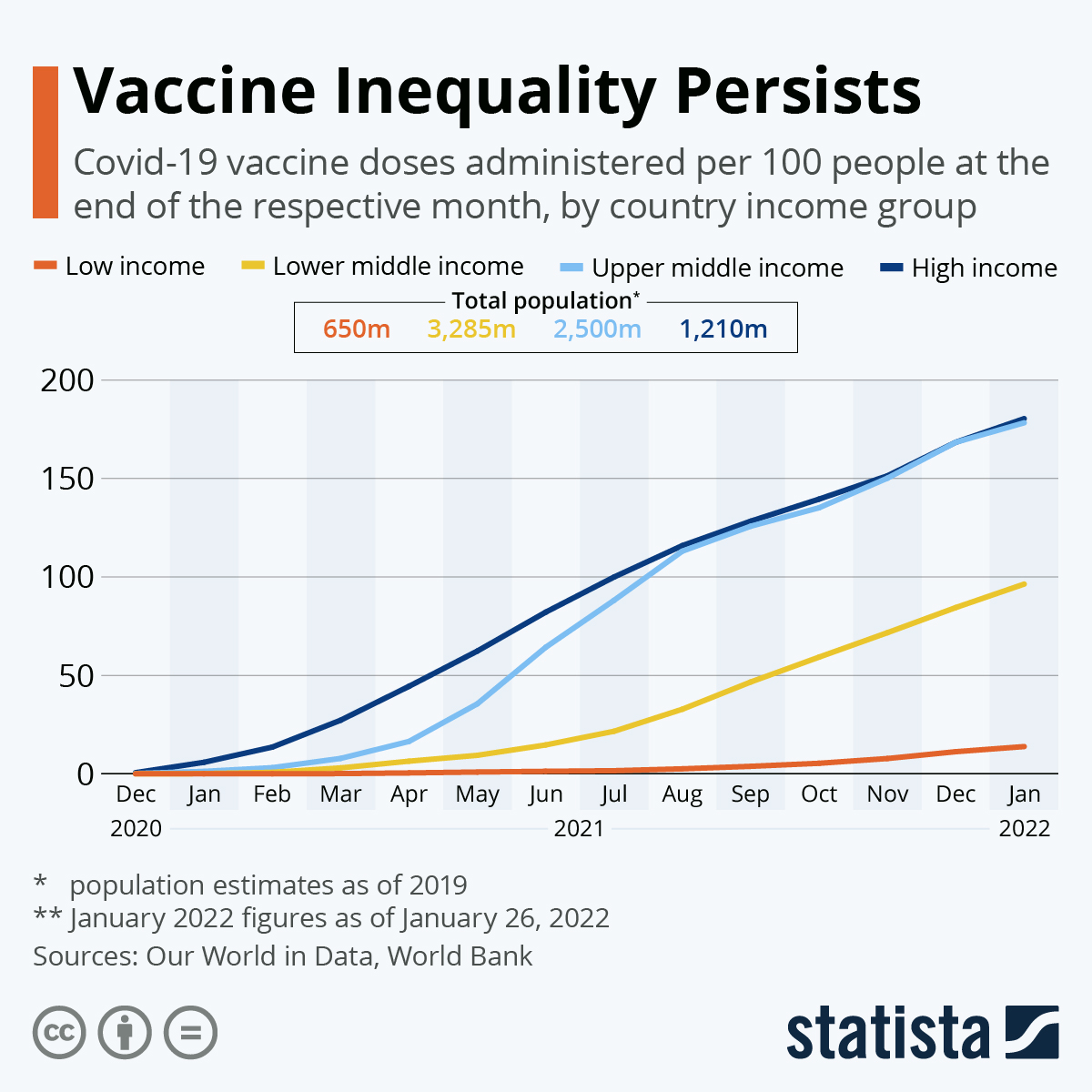

- Global inequality could prolong the pandemic, with fewer than 10% of people vaccinated in most low-income countries.

- More than 102,000 U.K. businesses shut down last quarter, 14% more than a year ago as the COVID-19 Omicron variant delivered an outsize impact on small firms.

- Germany risks falling into its second recession of the pandemic after the government reported a disappointing 0.7% GDP shrink last quarter.

- Turkey’s inflation rate could surpass 23% this year as the nation’s monetary crisis worsens, economists say.

- Already America’s second-biggest employer, Amazon has invested nearly $90 billion in Europe and the U.K. since 2010, revitalizing small towns where it builds facilities as it prepares for even more expansion.

- British car output fell 6.7% to 860,000 units last year, the lowest since 1956.

- Hyundai predicts vehicle production will rebound in the first half of this year on improved computer chip inventories.

At M. Holland

- Our Healthcare team has published a revised Medical Resin Selector Guide containing additional resins, new focus grades and new 3D printing resins.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.