COVID-19 Bulletin: January 27

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Brent crude surged above $90/bbl for the first time in seven years Wednesday over concerns of tight supply arising from political tensions in Europe and the Middle East. Oil prices ended the day about 2% higher, staying essentially flat in late morning trading today with WTI at $87.36/bbl and Brent at $89.93/bbl.

- U.S. natural gas prices surged Wednesday on higher heating demand in regions hit by frigid weather. Futures were 3.9% higher in late morning trading at $4.45/MMBtu.

- The American Petroleum Institute reported a 400,000-barrel crude draw last week, more than double analysts’ expectations. Meanwhile, U.S. crude inventories rose by 2.4 million barrels.

- The White House approved releasing another 13.4 million barrels of crude from strategic reserves to seven companies, bringing the total released since last November to 40 million barrels.

- OPEC+ will likely continue unwinding pandemic production cuts by 400,000 bpd in March, as global demand remains resilient despite record COVID-19 cases in major oil-consuming countries. The group will meet next week to decide.

- Qatar, one of the world’s largest LNG exporters, says it does not have enough capacity to make up for potential lost Russian flows into Europe. U.S. leverage may be required to reroute some exports in the event of emergency, officials said.

- Shell will shut down a key processing unit at its Pernis refinery in Rotterdam as it prepares for seasonal maintenance at Europe’s biggest refinery, likely causing a temporary spike in already high energy prices.

- European utilities have raised more than $10 billion through bond offerings this month, the most since 2014, as energy prices remain high and borrowing costs are expected to rise.

- Striking energy workers in France lowered the nation’s nuclear and hydro power generation by 2.5 GW Wednesday.

- Oil production is set to triple next month in Guyana, the resource-rich South American nation that’s been a primary focus of new capacity investment by oil majors during the pandemic.

- High-impact drilling activity in the U.S. returned to growth in 2021 after a decade-low the previous year, as the early-pandemic crash in demand forced producers to slash drilling budgets and defer exploration.

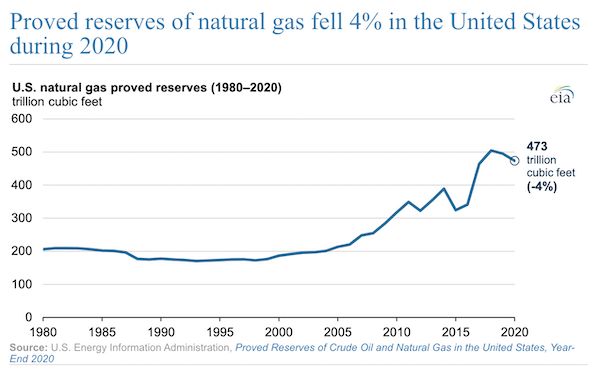

- Low natural gas prices in 2020 caused many U.S. operators to lower proved reserve estimates and scale back development plans for new wells, leading to a 4% decline in proved reserves:

- U.S. independent energy company Hess saw $265 million in fourth-quarter profit compared to a $176 million loss the same time in 2020.

- Six people were injured yesterday when an empty Ethylene Dichloride tank exploded at a Westlake Chemical plant near Lake Charles, LA, causing a brief shelter-in-place warning in the area.

Supply Chain

- An out-of-season wildfire in California’s central coastal region is now 55% contained after forcing hundreds to evacuate the past week.

- Container ship charter rates are continuing to hit record highs, with prices for 3,500-teu vessels shooting up to $60,000/day on three-year contracts compared to $45,000/day just a few weeks ago. Meanwhile, spot rates for the largest dry bulk ships are down 56% since the start of the year in a traditionally weak quarter.

- The Port of Savannah saw 12 straight months of record container growth in 2021, totaling a 20% annual rise to 5.6 million TEUs.

- Some freight forwarders claim they are being shut out by shipping lines in favor of only the very largest forwarders.

- Container lines ordered 555 new ships last year, a record and four times the number of ships ordered in 2020.

- The White House suspended 44 Chinese airline flights from the U.S. to China until March in retaliation for the nation’s strict inbound flight restrictions. The decision will remove critical widebody belly capacity for cargo shipments.

- Global air cargo demand grew 6.9% in 2021 from pre-pandemic levels of 2019, according to the International Air Transport Association.

- United Airlines is maintaining its cargo-only service after freight revenue doubled last year to $2.3 billion. Cargo revenue at American Airlines rose an annual 19.6% in the fourth quarter.

- The American Trucking Association’s for-hire truck tonnage index hit 114.7 in December, up 1% from the month before and the highest level for the index since April 2021.

- Total freight truck mileage on U.S. roads hit a record for the 12 months ending last September and is expected to grow even more in 2022, leading state officials to look for ways to ramp up spending on road and bridge maintenance.

- Union Pacific reported fewer on-time trips and other deteriorating performance measures in the fourth quarter amid high levels of COVID-19 infections among workers.

- Class I freight railroad CSX saw quarterly profit rise 23% to $934 million as strong pricing gains offset a 28% increase in expenses.

- High demand for cardboard and lumber is lifting southern timber prices, raising hopes of a more consistent path forward for the sector that has seen some of the greatest volatility of the pandemic. Saw timber prices are up 18% from their 50-year lows of 2020 but remain well below levels of two decades ago.

- U.S. consumers are sometimes waiting months and even years for delivery of home furnishings after sudden lockdowns at the start of the pandemic sent demand for desks and other furniture soaring, with supply chains unable to keep up.

- U.S. lawmakers introduced new legislation Tuesday that would subsidize $52 billion of American semiconductor research and development.

- U.S. semiconductor chip maker Micron Technology is shutting down some Shanghai operations by the end of the year with plans to relocate them to the U.S. and India.

- Computer maker ASUS continued a production halt of some operations in Taiwan as COVID-19 cases on the island rise.

- The White House approved $246 million to build a 3,000-mile freight and passenger rail line between New York and Mississippi, expected to go live in 2040.

- Nike credits a direct rail link from Southern California to its Tennessee facilities for allowing the apparel maker to avoid many of the major supply chain snags seen by other large importers.

- BJ’s Wholesale Club became the latest U.S. retailer to acquire a transportation provider to help reduce supply chain snarls.

- California-based warehouse giant Prologis plans to generate more revenue from renting out equipment and providing other add-on services as it benefits from higher industrial rents and more leases.

- Hillwood Investment Properties, one of the largest commercial real estate developers in the nation, is working with autonomous trucking firm TuSimple to create procedures for driverless truck stops at warehouses.

- Danish ports are making strides toward cleaner operations with the upcoming construction of Europe’s largest wind turbines and a new system to link green power sources to offshore drilling rigs.

3D Printing: M. Holland’s 2022 Market Trends & Predictions

M. Holland’s 3D Printing Market Manager, Haleyanne Freedman, shares her insights on the growth and momentum in the 3D printing market and how it will continue to evolve.

Domestic Markets

- The U.S. reported 653,120 new COVID-19 infections and 4,040 virus fatalities Wednesday.

- The U.S. seven-day average for new COVID-19 fatalities reached 2,258 per day Tuesday, up from about 1,000 two months ago and eclipsing early 2021’s wave of the Delta variant. The CDC expects the nation to record 62,000 more virus fatalities over the next month.

- Total COVID-19 hospitalizations in West Virginia rose to a record 1,043 Wednesday.

- COVID-19 hospitalizations are rising in Utah, with a record 776 new patients admitted Wednesday.

- Michigan recorded more deaths than births in 2020, largely the result of COVID-19, officials say.

- Health officials and scientists are closely tracking the BA.2 “stealth” subvariant of Omicron, which is rapidly spreading in Europe and Asia, though only 96 cases have been confirmed in the U.S. so far. In mid-January, it comprised 45% of COVID-19 cases in Denmark, up from 20% two weeks earlier.

- It could take years for vaccine makers to develop a shot that works against all COVID-19 variants, federal health officials say.

- The U.S. Navy discharged 23 sailors Wednesday for failing to get vaccinated against COVID-19.

- Moderna has started human trials of a COVID-19 vaccine tailored for the Omicron variant.

- Abbot Laboratories, one of America’s largest producers of COVID-19 rapid tests, reported $2.3 billion in testing-related sales in the final three months of 2021 but warned that demand will slow this year.

- The Federal Reserve publicly indicated it would begin raising interest rates in mid-March and could continue to lift them faster than it did during the past decade. Most Americans expect inflation will continue rising this year.

- U.S. GDP grew at a robust 6.9% in the fourth quarter of 2021, better than the 5.5% that analysts expected.

- First-time jobless claims fell by 30,000 last week to 260,000.

- The U.S. trade deficit surpassed $1 trillion for the first time in 2021, up from $893.5 billion in 2020, on elevated levels of consumer imports.

- New U.S. home sales rose 12% in December but dropped sharply from December 2020 due to a lack of inventory.

- U.S. auto sales are expected to drop 8.3% in January as component shortages continue to hamper production.

- Record auto lending was a bright spot last year for big lenders as businesses and customers flush with cash were slow to take out loans.

- More than one-third of active airline pilots before the pandemic have yet to resume flying.

- Boeing said production problems and delivery delays with its 787 Dreamliner jet would cost it another $5.5 billion as the plane maker reported its third consecutive annual loss.

- More than 90% of the U.S. airline fleet can now operate in 5G network zones as the FAA expands authorizations.

- Intel saw a decline in fourth-quarter earnings following increased spending on new facilities and products, leading the chip maker to issue a weak profit forecast for the first three months of this year.

- Amazon-backed Rivian Automotive is ramping up output of its debut electric pick-up truck toward almost 200 delivery-ready units per week, a fourfold output rise from late last year.

- Tesla reported record earnings and profit last year and said it would spend 2022 focused on increasing output to meet rising demand rather than unveiling new models.

International Markets

- Germany reported a record 164,000 new COVID-19 cases Wednesday, up from 126,955 the day before.

- Single-day COVID-19 cases in France surpassed 500,000 for the first time.

- Poland, Hungary, Bulgaria, Romania and the Czech Republic each logged single-day COVID-19 records yesterday, as outbreaks grow in Eastern Europe.

- Denmark is ending pandemic restrictions next week and reclassifying COVID-19 as a disease that no longer poses a threat to society, even as infections in the nation are at a record high.

- Sweden reported a record 44,944 new COVID-19 infections Tuesday. The nation is tightening restrictions as officials expect 1 in 10 Swedes to become infected within the next two weeks.

- Austria will end its monthslong lockdown for unvaccinated people next week as the latest wave of COVID-19 has not overwhelmed hospitals.

- About two-thirds of participants in a large U.K. study who tested positive this month for COVID-19 had already reported a previous infection with the virus.

- South Korea logged a record 13,012 new COVID-19 infections Wednesday.

- Hong Kong’s zero-tolerance approach to COVID-19 could keep the Asian financial hub cut off from most of the world until 2024, according to a report. The island shortened quarantine protocols but kept most flight bans yesterday.

- The world surpassed 10 billion administered COVID-19 vaccine doses, the equivalent of around 30.8 million per day.

- The U.S. has shared more than 400 million COVID-19 vaccine doses with lower-income nations, a world record.

- BioNTech plans a 50% boost in staff at its biggest German factory this year as the COVID-19 Omicron variant drives demand for boosters of the vaccine it developed with Pfizer.

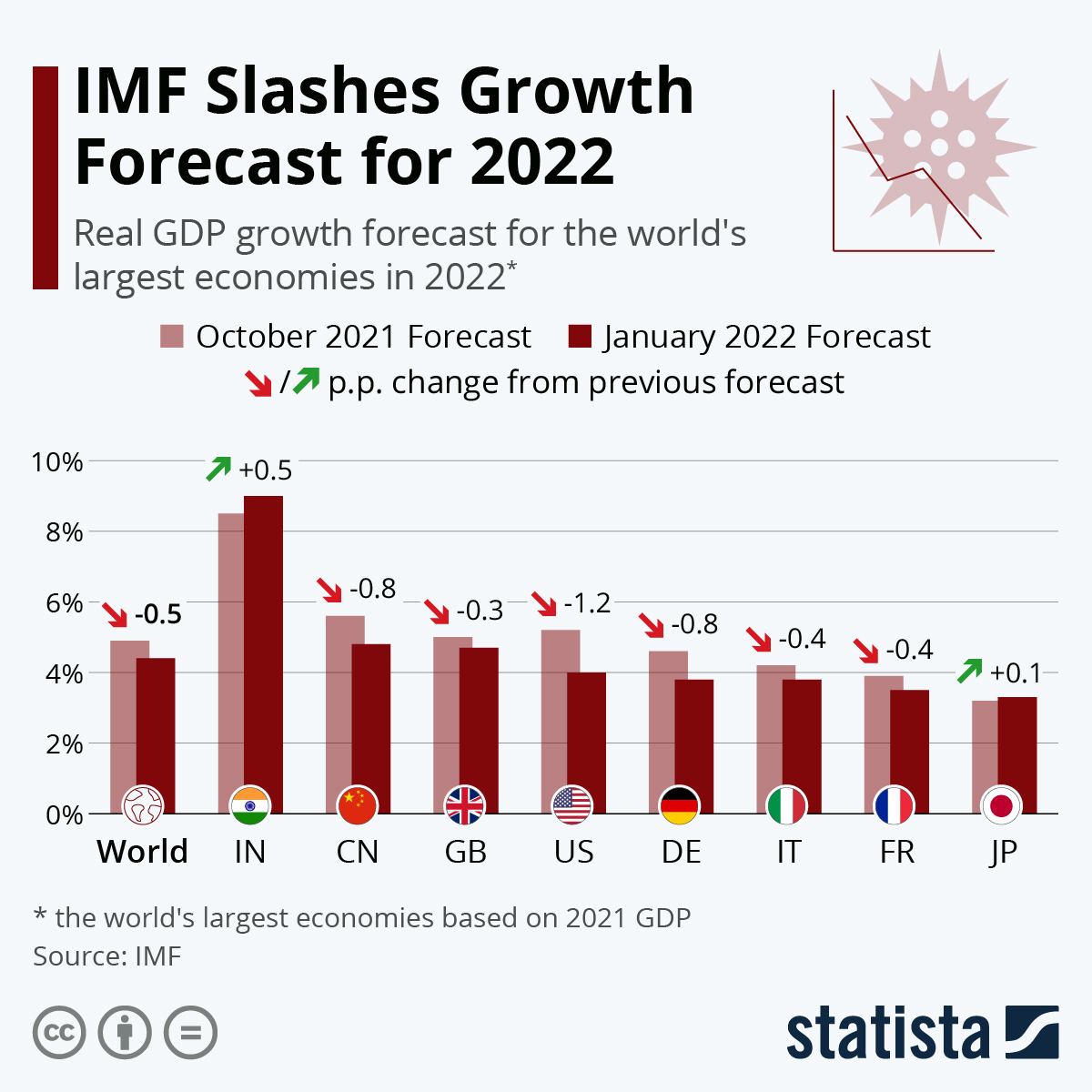

- India and Japan were the only major world economies to have their economic growth forecasts for this year revised upward, according to the International Monetary Fund:

- Germany expects GDP growth this year to be weaker than previously forecast after output contracted as much as 1% in the final quarter of last year on supply chain constraints.

- Canada’s central bank left interest rates unchanged at its meeting yesterday but signaled it would tighten monetary policy in the coming weeks to contain three-decade high inflation.

- Japan’s exports rose 17.5% in December, their 10th straight month of gains, with shipments to the U.S. increasing 22.1%.

- Samsung logged its biggest ever quarterly revenue alongside a 64% rise in net profit as it surpassed Intel to become the world’s largest chip maker.

- Royal Caribbean is prepping to relocate its cruise ships to Singapore due to stringent anti-COVID measures in Hong Kong.

- Luxury British carmaker Bentley plans to produce its first fully electric car in 2025, with the goal of transitioning its entire lineup to electric vehicles by the end of the decade.

At M. Holland

- M. Holland’s 2021 EcoVadis rating improved year over year, reflecting a continued commitment to sustainability and corporate social responsibility initiatives. See the press release.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.