COVID-19 Bulletin: January 17

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose Friday, notching a fourth straight week of gains to two-and-a-half-month highs and Brent trading at its highest since 2014. Crude futures were higher in late morning trading, with WTI up 0.3% at $84.10/bbl and Brent up 0.3% at $86.33/bbl. U.S. natural gas was marginally higher at $4.26/MMBtu.

- Crude futures were mixed in morning trading, with WTI up .2% at $83.97/bbl and Brent down .1% at $85.97/bbl. U.S. natural gas was .2% higher at $4.27/MMBtu.

- Active U.S. oil and gas rigs rose by 13 last week to 601, while production hit 11.7 million bpd, up from 11 million bpd the same time last year.

- Trade in oil futures is picking up rapidly to start 2022 from December lows.

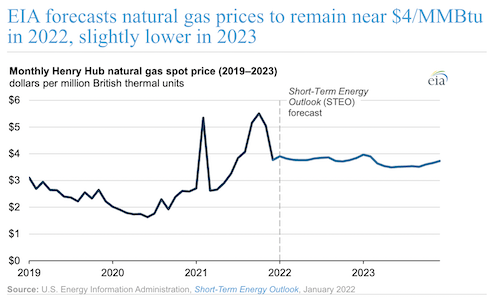

- The U.S. government expects natural gas prices to remain relatively flat around $4/MMBtu throughout 2022:

- China is expected to release an unspecified amount of crude from strategic reserves on Feb. 1 as global benchmarks tick above $85/bbl. The nation’s crude imports fell 5.4% last year, the first decline in two decades.

- Europe’s ongoing energy shortage could steal 1% of the continent’s GDP this year, analysts warn.

- European imports of U.S. natural gas are five times higher than Russian deliveries this month, the first time in history that American LNG has surpassed Russian pipeline flows to the continent.

- The U.S. Senate rejected new sanctions against Russia’s completed—but not yet flowing—Nord Stream 2 gas pipeline to Germany, saying the measure would harm relations with Germany.

- Germany is expected to become a net importer of electricity by 2023 for the first time in two decades, underscoring the impact of recent phase-outs of coal and nuclear plants.

- France’s largest utility is expected to lose almost $9 billion after the government’s recent order to discount power to tamp down rising costs among households.

Supply Chain

- A major winter storm struck the U.S. Southeast over the weekend, working its way up the East Coast Sunday while leaving more than a foot of snow and a quarter inch of ice in some areas. Widespread air and road disruptions were reported, along with power outages for more than 200,000 homes and businesses in the Carolinas and Georgia. Airlines canceled at least 2,800 flights Sunday.

- Dry bulk rates ended last week at their lowest levels since March 2021.

- Some trucking and air cargo links between China and Europe are being threatened by rising political turmoil in Kazakhstan.

- Idled and delayed containers have been the target of rising theft incidents near main U.S. ports, notably in Southern California.

- Union Pacific Railroad has threatened to cease operating in Los Angeles County due to rampant cargo theft after experiencing a 160% year-over-year increase, which it blames on lax law enforcement.

- Amtrak is suspending about 8% of its Northeast Regional weekly schedule through March due to COVID-19-related staffing shortages.

- Air freight demand is expected to grow this year despite overall capacity being down 7% from pre-pandemic levels, according to freight forwarder Flexport.

- British road freight prices reached a two-year high last month.

- North American heavy-duty truck orders totaled 365,000 units last year, a number unreflective of true demand as production backlogs stretched manufacturers thin.

- Paccar’s Kenworth Trucks unit reported a tripling of orders for its heavy- and medium-duty battery electric trucks over the past three months.

- A benchmark lithium price in China rose over 500% last year, pushing electric vehicle (EV) battery prices higher for the first time and threatening the EV boom.

- Investors directed a record $24 billion into North American and European supply chain firms through the third quarter of last year, pushing up valuations for startups.

- More than 8,000 Colorado Kroger employees went on strike Friday over pay and benefits.

- U.S. homebuilder KB Home overcame supply chain disruptions for a 64% rise in quarterly earnings from the previous year, as demand for new home construction surges.

- The parent company of third-party food deliverer Grubhub lost almost half of its market value last year on stiffer competition from large U.S. rivals.

- Starbucks plans to spend $1.5 billion with diverse suppliers by the end of the decade.

- The FAA will allow more planes to fly within new 5G network zones, reducing the risk of schedule disruptions for most U.S. carriers.

- FedEx requested FAA approval to equip cargo planes with anti-missile systems for protection in hostile regions.

M. Holland’s 2022 Plastics Industry Trends & Predictions

M. Holland’s market experts weigh in on what we can expect for the plastics industry in 2022. View the infographic and read more on current trends and predictions.

Domestic Markets

- The U.S. reported 254,550 new COVID-19 infections and 545 virus fatalities Sunday. The nation has seen a large increase in the number of COVID-19-related deaths over the past month, with total virus fatalities surpassing 850,000 over the weekend, just one month after surpassing 800,000.

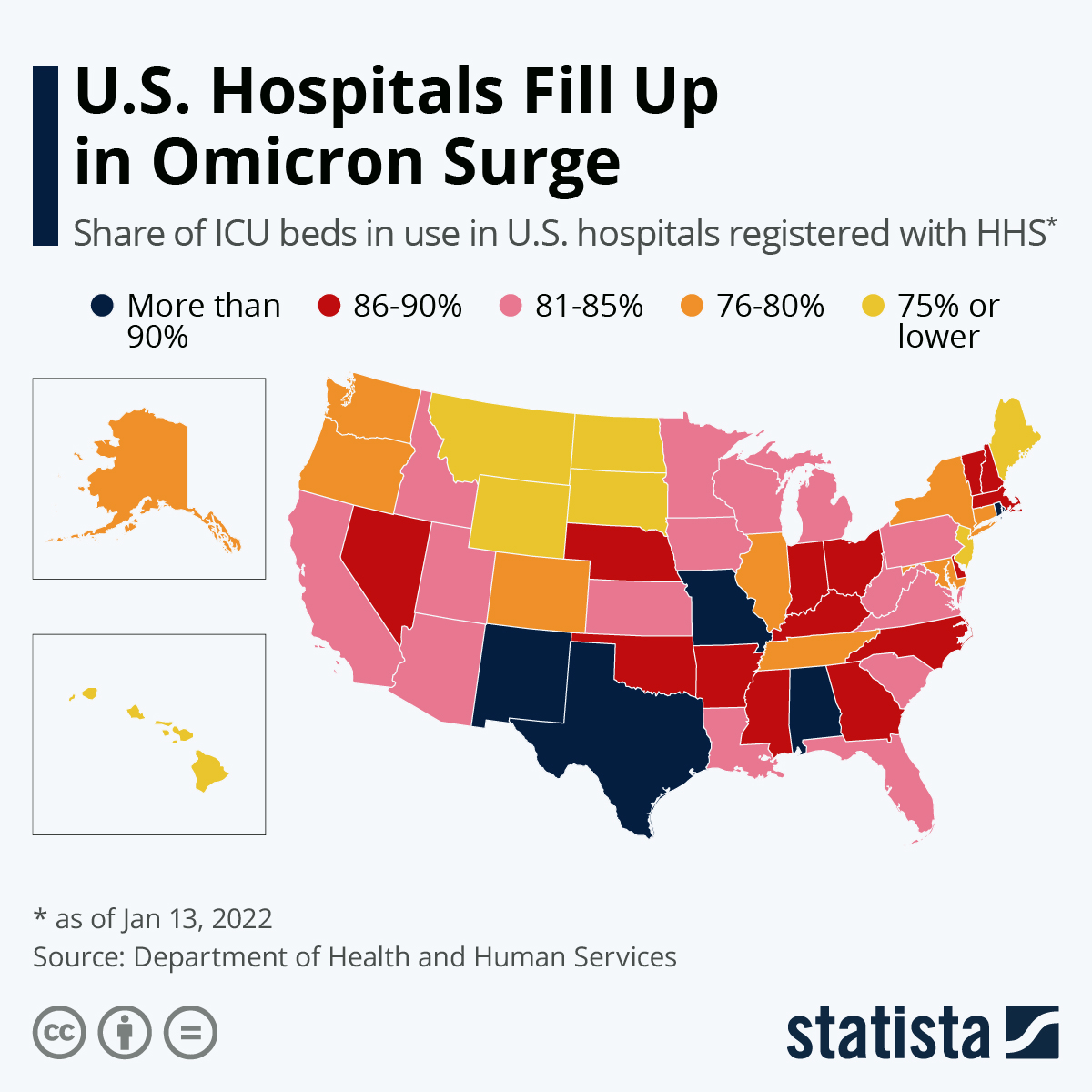

- The seven-day average for COVID-19 hospitalizations hit 155,958 Sunday, the most ever, with the largest rise concentrated in the South and Midwest:

- The number of new people getting a COVID-19 vaccine is at one of the lowest points of the pandemic, while West Virginia, Mississippi and Alabama continue to have the fewest overall vaccinations in the nation.

- Florida’s COVID-19 case count topped 5 million, with 1 million infections added in less than three weeks.

- COVID-19 deaths in Los Angeles County hit their highest level since April 2021.

- New York is seeing a steep drop in COVID-19 infections throughout the state, reporting roughly 48,000 cases Friday, a near 47% drop from its recent peak on Jan. 7.

- New York City is committed to keeping its strict COVID-19 vaccine mandate for all private employees despite the U.S. Supreme Court’s overturning of a federal mandate on large businesses last week. Nationwide, private firms are divided on whether to keep company mandates.

- Illinois’ Cook County is reopening three mass COVID-19 vaccination sites it closed last July.

- Hawaii may change its definition of fully vaccinated to include booster shots, which would require travelers without a booster to quarantine at their own expense.

- U.S. pharmacy chains CVS and Walgreens were forced to temporarily close some of their stores across the country over the weekend due to staffing shortages caused by COVID-19.

- Apple will require corporate and store employees to have a COVID-19 booster vaccine dose beginning Jan. 24.

- U.S. retail food chains including Starbucks and Chipotle have returned to limiting hours and dining-room access amid labor shortages and rising COVID-19 cases.

- Americans can begin ordering free at-home rapid COVID-19 tests through a new government website on Jan. 19, the U.S. administration said.

- The CDC is encouraging wider use of medical-grade face masks by the public now that months-long supply shortages have been eased.

- The White House announced new funding for states that send National Guard troops to hospitals overwhelmed by COVID-19 patients.

- The U.S. administration could withdraw pandemic aid from Arizona over the state’s use of the funds to discourage face masks in schools.

- Early data suggests unvaccinated pregnant women could experience harsher effects from COVID-19 infection than their vaccinated counterparts.

- Hotels, fitness clubs, tour bus companies and minor league ball clubs are among the many businesses lobbying Congress for a new round of targeted pandemic aid after being left out of previous funding.

- U.S. consumer sentiment fell to its second-lowest level in a decade during the first half of January over concerns about the fast-spreading COVID-19 Omicron variant, according to a University of Michigan index.

- U.S. business inventories grew in November, while import prices fell slightly.

- Remote work coupled with the Omicron variant’s generally less severe symptoms have blurred the shape of COVID-19 sick days for many infected employees.

- U.S. home listings declined 19% year over year in December to an all-time low, contributing to a sharp fall in sales despite continued high demand, real estate firm Redfin reported.

International Markets

- Germany registered 92,223 new COVID-19 infections Friday, a record.

- The Netherlands reported 35,000 new COVID-19 cases Friday, a record.

- France’s parliament passed a new law Sunday requiring individuals to have proof of COVID-19 vaccination to enter public places such as restaurants, cafes, cinemas, and long-distance trains.

- Hong Kong suspended flights from 150 countries and territories, including the U.S., for the next month over fears of importing COVID-19.

- South Korea is extending COVID-19 restrictions for an additional three weeks to prepare for an expected surge ahead of the Lunar New Year.

- New cases of the COVID-19 Omicron variant have been reported in Beijing, Shanghai and China’s Guangdong province, adding pressure on the nation’s containment efforts just weeks before the Winter Olympics. Americans wishing to visit for the Olympics may have no way to get there as China restricts more incoming flights.

- The U.K. saw sharp declines in new COVID-19 cases last week, with under 82,000 reported Sunday, the lowest in several weeks.

- France opened travel to vaccinated British nationals for the first time in a month last Friday, while Paris lifted its outdoor mask mandate.

- Japan is reducing mandatory quarantine periods after new data showed 90% of COVID-19 cases in Okinawa were mild or had no symptoms. Meanwhile, Tokyo is looking to introduce tighter pandemic restrictions throughout the region and its three surrounding prefectures after the capital’s daily infections tripled in the last week to 4,172 Sunday.

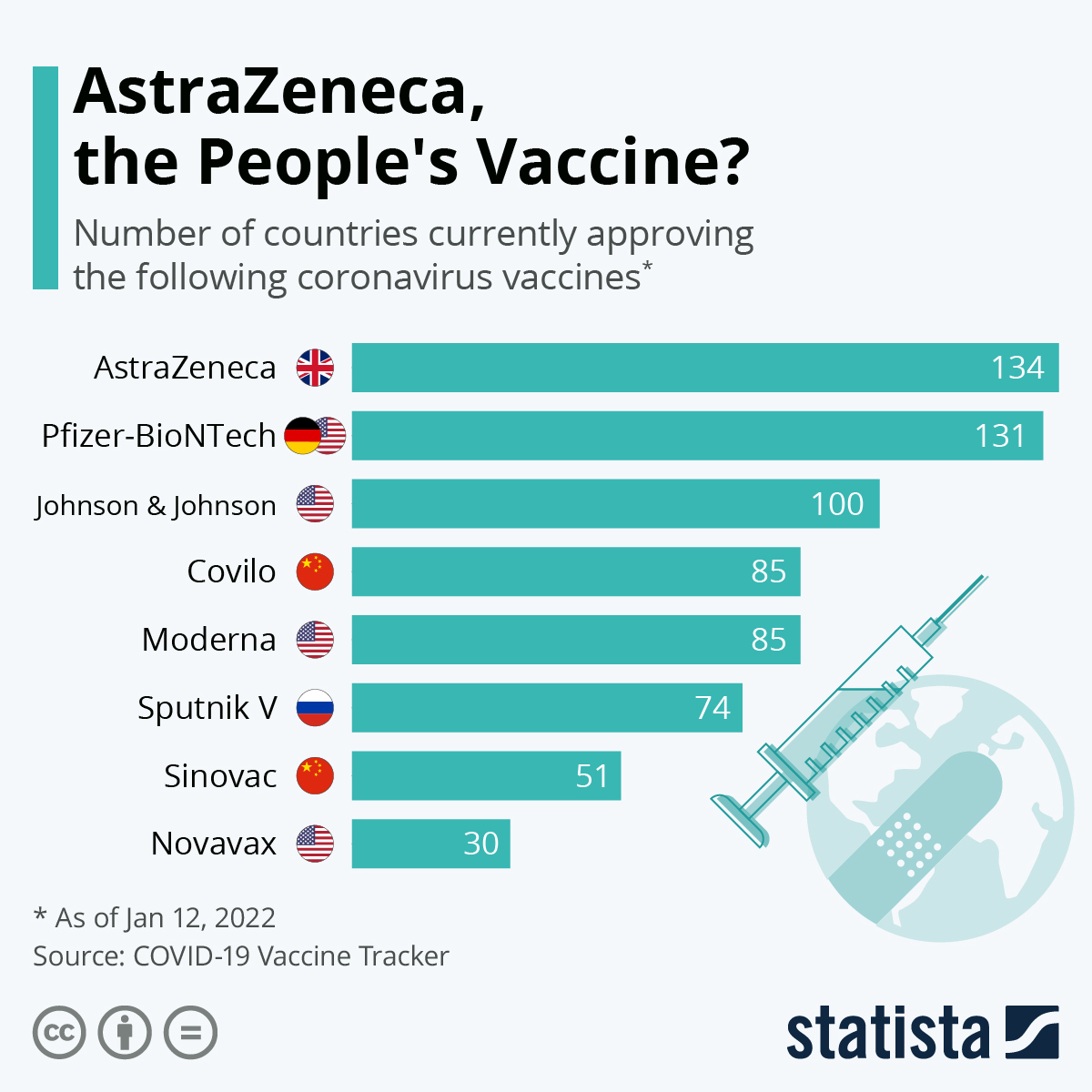

- The U.K.’s AstraZeneca COVID-19 vaccine is the most approved shot across the world:

- The World Health Organization issued recommendations for COVID-19 antibody treatments made by the U.S.’s Eli Lilly and Britain’s GlaxoSmithKline.

- South Africa’s COVID-19 Omicron death rate peaked at just 15% of the previous Delta wave’s rate, new data shows.

- New research from the U.K. suggests the COVID-19 Omicron variant is more likely than other strains to send children to the hospital, a phenomenon likely due to generally higher case numbers rather than harsher symptoms.

- Germany’s economy grew just 2.7% in 2021 after shrinking almost 5% the year before, primarily a result of supply chain disruptions and energy and materials inflation.

- China’s central bank cut its key interest rate for the first time in almost two years after new data showed GDP grew an annual 4% in the final quarter of 2021, slower than the previous three months due to a property-market slump and repeated virus outbreaks. The nation’s trade surplus rose sharply to a record $676.43 billion in 2021, up more than $150 billion from the previous year.

- Births in China last year barely outnumbered deaths, falling for the fifth year in a row.

- Loop, a Canadian recycling startup, is pitching large consumer-goods makers including Danone, L’Oréal and L’Occitane to use recycled plastic resin from its new facility under construction in Normandy, France.

- A Maersk subsidiary is building a geothermal plant that will provide heat for one-fifth of residents in Denmark’s second-largest city, as the shipping line expands further into renewables.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.