COVID-19 Bulletin: January 3

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose slightly last Thursday for their seventh straight day of gains. Futures were higher in morning trading, with WTI up 0.8% at $75.81/bbl and Brent up 0.9% at $78.67/bbl, as Omicron clouds the outlook for demand and pricing.

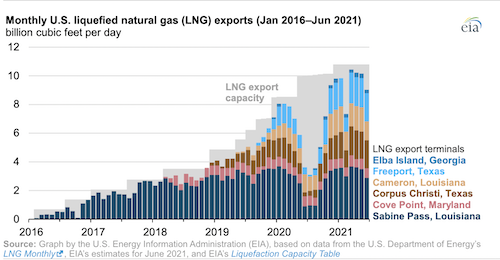

- U.S. natural gas prices dropped more than 7% last Thursday to a six-month low on steady output increases. Sharp price declines were also reported in Europe and Asia late last week, a trend reflected in falling LNG exports:

- U.S. gas futures were 1.0% lower in morning trading at $3.69/MMBtu.

- The U.S. active rig count remained unchanged last week at 586, over double the same time last year.

- OPEC+ will meet tomorrow to decide whether to continue increasing output in February. Analysts predict the oil-producing cartel will stick to its 400,000-bpd monthly increases, despite several countries, including Russia, failing to boost output last month.

- Russia delivered less gas to Europe last year than in 2018 and 2019, a major contributor to the continent’s severe energy crisis, year-end data shows.

- Aluminum prices rose late last week after two major European smelters cut production due to high power prices.

- Milder weather is expected to avert a French power crisis this month after more than a dozen of the nation’s nuclear plants recently suffered maintenance and technical problems.

- China’s crude oil imports are set to slow early this year, a result of crackdowns on independent refiners and the nation’s commitment to eradicating every COVID-19 outbreak. The nation already lowered its first batch of 2022 import quotas to independent refiners by 11%.

- Germany permanently closed three of its six remaining nuclear power stations last week after more than three decades of operation.

- Construction will start within three years on solar fields in Virginia capable of powering 30,000 homes.

- The White House is lobbying to extend federal authority over power line projects that often face regional opposition, a bid to speed up the nation’s 2035 emissions goals.

- With resin supply improving and most 2021 force majeures lifted, we are ending our force majeure link. Please contact your M. Holland account manager if you have questions concerning availability of specific products.

Supply Chain

- A severe winter storm is forecasted to bring heavy winds and up to a foot of snow to parts of the South and mid-Atlantic today.

- Thousands of Colorado homes were damaged or destroyed late last week after wildfires broke out Thursday, while two people remain missing.

- The eastern Chinese city of Ningbo, which houses the largest port in the world, reported 10 new COVID-19 cases at a clothing factory over the weekend, prompting new worker testing throughout most of the city and causing parts of the area to go into lockdown. Vietnam is urging the nation to ease certain pandemic measures at key border crossings, saying that its restrictions are hampering trade between the two nations.

- Labor shortages in the global semiconductor industry are growing, with the U.S. forecast to need 90,000 additional workers by 2025, while Taiwan is facing its largest recruitment gap in six years.

- Over 50,000 Finnish industrial workers are threatening to go on strike midway through January over wage disputes.

- Venture funding for supply-chain tech startups was up 58% year over year the first three quarters of 2021, matching investment trends seen across the board in the U.S. last year.

- Large U.S. retailers are facing more pressure to spin off e-commerce business units, with proponents saying the split would allow greater focus on both in-store and online sales.

- IKEA will soon raise prices by an average of 9% across all global markets due to higher transport and raw material costs.

Domestic Markets

- The U.S. reported 248,632 new COVID-19 infections and 244 virus fatalities Sunday.

- The seven-day average for new COVID-19 cases across the U.S. rose to 405,470 Sunday, more than tripling over the past two weeks and well above last January’s record of 251,232, while the seven-day average of virus hospitalizations rose above 93,000, a 35% spike over the past two weeks.

- Daily COVID-19 hospitalizations among U.S. children rose 58% between Dec. 21 and 27, the fastest rise of any age group and following trends of sharply rising cases in teens and young adults.

- New York reported 85,476 new COVID-19 infections Saturday, shattering its previous record. Almost one-third of the state’s emergency workers and 17% of firefighters were out sick last week, officials said, prompting New York City’s mayor to consider mandating COVID-19 booster doses for all city employees,

- Florida recorded 75,900 new COVID-19 cases Dec. 31, a pandemic record.

- COVID-19 infections in Los Angeles County nearly tripled last week from the week earlier.

- Texas’s governor requested federal aid for more testing sites, medical personnel and therapeutics to help fight a surge in COVID-19 in the state.

- Ohio recorded over 20,000 COVID-19 infections Friday, a daily record, as hospitalizations rose 19% in the past week, with 1 in 3 hospital patients infected with the virus and 1 in 3 ICU beds occupied by virus victims.

- Utah reported over 3,300 new COVID-19 cases late last week, the most since January, with the Omicron strain accounting for 70% of infections.

- New COVID-19 cases in Puerto Rico increased 46-fold in recent weeks, a staggering rise despite high levels of vaccination.

- Chicago requires proof of vaccination to enter indoor venues beginning today, and the Illinois Secretary of State closed offices for in-person services through mid-month to protect staff and visitors from risk of COVID-19 infection.

- As of today, children aged 5 to 11 must show proof of COVID-19 vaccination to enter public indoor businesses in New Orleans.

- Urgent care centers across the country, overwhelmed with COVID-19 testing demand, are being forced to temporarily close due to soaring infections among workers.

- A COVID-19 outbreak at a U.S. military base in Japan surged to a record 235 cases Saturday.

- More than 2,400 flights into and out of the U.S. were canceled on New Year’s Day amid bad weather and continued staff shortages caused by the COVID-19 Omicron variant. Total flight cancelations over the weekend topped 6,000, while budget carrier JetBlue is preemptively removing more than 1,200 flights from its schedule the next two weeks.

- The U.S. National Institutes of Health, the nation’s largest hospital for clinical research, will postpone elective surgeries following a rise in COVID-19 infections among staff.

- Many of the U.S.’s largest financial firms are returning to remote work for the first several weeks of 2022.

- American support for keeping schools open for in-person classes after winter break is stronger than last year despite concerns over the availability of rapid at-home tests used to track outbreaks.

- The U.S. administration could add a testing requirement to last week’s move to shorten quarantine periods for people who test positive for COVID-19. The news comes as more states reject the latest federal guidance in favor of their own alternatives.

- The FDA could expand COVID-19 booster access for Pfizer’s COVID-19 vaccine to children as young as age 12 Monday.

- Economists expect improved U.S. monthly job gains when official numbers are released this Friday, while filling jobs will remain the primary barrier to economic growth in the months ahead.

- Revenues and profit margins for most public U.S. companies have surpassed late-2019 levels, a stark turnaround from early pandemic forecasts of a severe economic crisis.

- U.S. mortgage lenders issued $1.61 trillion in 2021 in loans, topping the previous record set in 2005.

- Tesla’s annual deliveries surged 87% in 2021 to more than 936,000 vehicles, a surprise rate of growth amid widespread component shortages in the auto industry. The automaker also issued a recall of nearly half a million vehicles over rearview camera and trunk malfunctions.

- AT&T and Verizon refused the federal government’s request to delay 5G network launches this month over fears of disruption to airplane cockpits.

- At-home workers seeking larger screens than their laptops provide prompted an estimated 7% jump in personal computer sales last year, a growth trend expected to continue with the rise of the COVID-19 Omicron variant.

- The U.S.’s first new paperboard production line in decades will fire up this month, a bid to capitalize on a shift away from foam cups, plastic containers and six-pack rings.

International Markets

- COVID-19 infections across the globe rose 59% last week to more than 9 million, a record. The highly contagious Omicron COVID-19 variant caused global cases of the virus to climb to more than 10 million over the past seven days, nearly doubling the previous weekly record of 5.7 million cases set back in April.

- British officials are telling firms they should expect COVID-19-induced absences of up to 25% of their workforces in the coming weeks. Temporary clinics have been popping up at hospitals across the nation to handle a surge of new virus hospitalizations, while officials renewed vows to avoid more lockdowns.

- France reported more than 200,000 new COVID-19 cases for four straight days to Saturday. A mask mandate takes effect in the country today, along with new rules that cut isolation times for vaccinated COVID-19 victims. The nation imposed a mandatory 10-day isolation requirement for unvaccinated travelers from the U.S.

- Poland is considering implementing new pandemic restrictions on its residents, as a recent surge in COVID-19 infections continues to drive up hospitalizations in the nation.

- Japan reported 554 new COVID-19 cases Sunday, the most since the Omicron variant was first reported. Tokyo reported 103 new COVID-19 cases Monday, its highest in three months.

- India is countering rising COVID-19 infections with new nighttime curfews in every major city and capacity limits on restaurants. Cases tripled in just three days in Delhi last week, while hospitalizations remained flat. The nation began administering COVID-19 vaccines to children as young as age 15 Monday.

- The 13 million people under lockdown in the northwestern Chinese city of Xi’an are facing food shortages as the nation’s latest COVID-19 outbreak grew to more than 1,500 cases.

- South Korea registered its first two deaths linked to the Omicron COVID-19 variant Monday.

- Argentina reported more than 50,000 cases Dec. 30, a record.

- New data shows Russia had its deadliest month of the pandemic in November, with fatalities rising 16% over the previous month as the nation’s life expectancy fell to its lowest level since 2012.

- Israel is expanding eligibility for a fourth COVID-19 vaccine dose to anyone over the age of 60.

- The COVAX global vaccine sharing program increased its deliveries of COVID-19 vaccines by 309 million in December, bringing its total to around 910 million doses for the year, well short of its initial 2 billion dose targets.

- Despite surging COVID-19 infections, many governments are relaxing COVID-19 quarantine requirements to help keep daily life open, most recently Italy, Australia, Wales and Portugal.

- Four international studies since Dec. 24 have indicated that the COVID-19 Omicron variant is more infectious but significantly less deadly than previous virus strains.

- British Airways canceled all flights to Hong Kong through February due to stricter quarantine restrictions for aircrews on the island.

- The U.K. housing market boomed for its strongest year of growth since 2006 last year.

- Apple’s sales in China grew 15.5% in November from a month earlier, new data shows, sealing the tech maker’s top spot in one of the world’s largest phone markets.

- Electric car sales in Norway rose by 48% in 2021, accounting for roughly two-thirds of vehicles on the road for the year, as the nation aims to eliminate the sale of petrol and diesel cars by 2025.

- Multiple foreign automakers are competing for Ford’s vehicle factories in India as the automaker sells its assets in the country.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.