COVID-19 Bulletin: February 23

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude benchmarks reached seven-year highs Tuesday, with Brent nearing $100/bbl before easing to end the day about 1.5% higher, while WTI touched $96/bbl before settling at $92.35/bbl. In mid-morning trading today, WTI futures were up 0.8% at $92.67/bbl, Brent was up 0.8% at $97.63/bbl, and U.S. natural gas was 2.8% lower at $4.62/MMBtu.

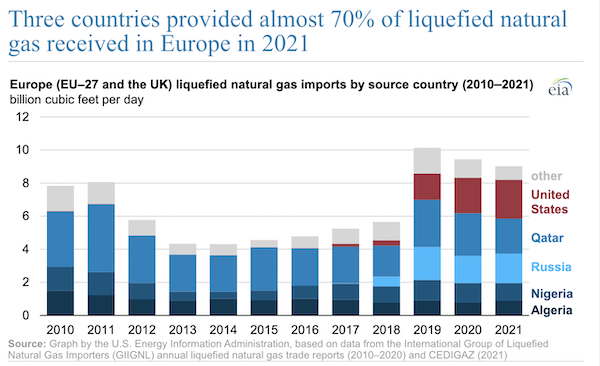

- The Yamal-Europe pipeline supplying 15% of Russian gas shipments to Europe has been flowing eastward back to Russia since December, driving up European gas prices. Combined with escalating tensions in Ukraine, European gas futures briefly jumped more than 13% Tuesday, as traders expect the continent will begin relying more on U.S. LNG shipments.

- Russia’s flagship crude traded at its steepest discount in over a decade yesterday as markets reacted to uncertain future supplies.

- High oil prices offset output declines for Italian major Eni last year, as net profit rose to a decade-high $5.4 billion.

- Malaysian and Japanese producers are the latest to back out of gas projects in Myanmar following a military coup in the nation last year.

- The private equity arm of U.S. investment firm Blackstone is expected to codify a ban on new oil and gas investment, a practice informally in place since at least 2017.

- The U.S. government’s auction of 500,000 acres of federal waters between Long Island and New Jersey for wind-farm development begins today, the largest offshore wind sale to date.

- The EPA is endorsing increased biofuel mandates for U.S. refiners as the industry awaits specific goals from the White House.

- The American Chemistry Council increased its lobbying spending 19% last year as federal lawmakers considered the $1.2 trillion infrastructure bill, which raised taxes on 42 chemicals to help fund cleanups of Superfund sites. Not included in the legislation were proposals to add a tax of $0.20/lb. on virgin plastic.

- Westlake Chemical changed its name to Westlake Corp. to better project a unified brand for its diverse businesses.

Supply Chain

- Severe winter conditions stretching from Texas to the Dakotas and as far east as Maine began yesterday and will continue throughout the week, disrupting travel and causing school closures in many states.

- With inbound ships to the Ports of Los Angeles and Long Beach falling a third since early January, analysts are hopeful that container backlogs will be cleared before potential midyear disruption stemming from union-contract talks and a seasonal import surge.

- As much as 10% of the global boxships fleet — some 2.53 million TEUs — is currently tied up in port congestion, according to Asia-based analytics firm Linerlytica.

- Omicron-fueled COVID-19 outbreaks are rising among cargo ship crews, shippers say, delaying the prospect of stabilizing global supply chains.

- Average shipment delays from China to the U.S. West Coast increased 114% in 2021 compared to a year earlier, with routes to Europe recording a 172% surge.

- Container lines are seeking far higher rates in new trans-Pacific shipping contracts, leading to some of the toughest negotiating cycles ever for U.S. logistics managers.

- Maritime bunker fuel prices are at their highest since early 2020 and will likely remain high even if oil drops due to a tight global gas and oil market.

- Ceres Terminals will modernize the Port of Jacksonville’s TraPac container terminal as part of a $60 million deal to lease and operate the space for the next 20 years.

- Virgin Hyperloop laid off half its staff this week and will shift focus from developing ultrafast train systems for passengers to freight cargo.

- Procurement experts say many companies are seeking to renegotiate supplier contracts to impose higher minimums and more guarantees to account for greater supply chain risks.

- NielsenIQ says U.S. consumer packaged-goods companies lost some $82 billion in sales last year because items were out of stock.

- U.S. spot cotton prices have reached their highest level since 2011.

- A Sunday ransomware attack forced Seattle-based freight forwarder Expeditors International to shut down most of its global operations — spanning some 18,000 workers and 300 sites — with services still disrupted as of Tuesday.

- A terminal at India’s largest container port was forced to reroute at least one vessel following a cyberattack Tuesday.

- Colonial Pipeline Co., manager of the largest fuel conduit in the U.S., hired a Chief Information Security Officer after a cyberattack nine months ago overtook the firm’s private network and halted gas flows to the East Coast.

- Singapore bulk shipper AAL increased its orderbook for 32,000-DWT vessels from a Chinese ship maker from four to six.

- Airbus secured orders for seven A350 freighters from both Singapore Airlines and the UAE’s Etihad Airways.

- The U.S. Postal Service launched a new next-day delivery service geared toward local businesses shipping within their community, with plans for the service to be live in all 50 states by the end of September.

- A pair of maritime fuel suppliers are partnering to boost the use of biodiesel on vessel routes in North America and Europe, a method for lowering emissions without costly modifications required by other alternative fuels.

- Maersk’s offshore unit will install the mooring system for the first floating wind turbine to connect to Spain’s electricity grid.

- South Korea will allow the use of delivery robots on public roads starting in 2023.

- The U.S. Labor Department is stepping up scrutiny of the warehouse and logistics sectors to ensure compliance of workers’ rights legislation.

- The Pentagon will deploy 400 National Guard troops in Washington, D.C., ahead of an expected trucker convoy — reminiscent of recent pandemic restriction protests in Canada — at the White House’s State of the Union address next week.

- The blaze onboard a luxury car carrier that caught fire near Portugal last week has finally died down, allowing a salvage crew to board the vessel today.

Domestic Markets

- The U.S. reported 99,820 new COVID-19 infections and 2,300 virus fatalities Tuesday, as the White House extended the pandemic’s national emergency designation beyond its slated expiration of March 1.

- New COVID-19 cases fell over 34% in New York state last week.

- COVID-19 hospitalizations in Florida are down over 50% since the start of the month.

- Hawaii and Puerto Rico are the last holdouts maintaining their mask mandates amid declining case counts across the nation.

- Royal Caribbean and Carnival Cruise Line are dropping onboard mask mandates.

- Moderna is looking at merging vaccines for COVID-19, the flu and respiratory virus RSV into a single shot.

- U.S. life insurers are expected to have another year of surging non-COVID death-benefit payouts as more Americans delay medical care during the pandemic.

- Service providers led a pickup in U.S. economic activity early this month as manufacturers also reported stronger output growth, according to IHS Markit’s composite Purchasing Manager’s Index. The composite index rose to 56.0, up from 51.1 in January, when it fell to an 18-month low.

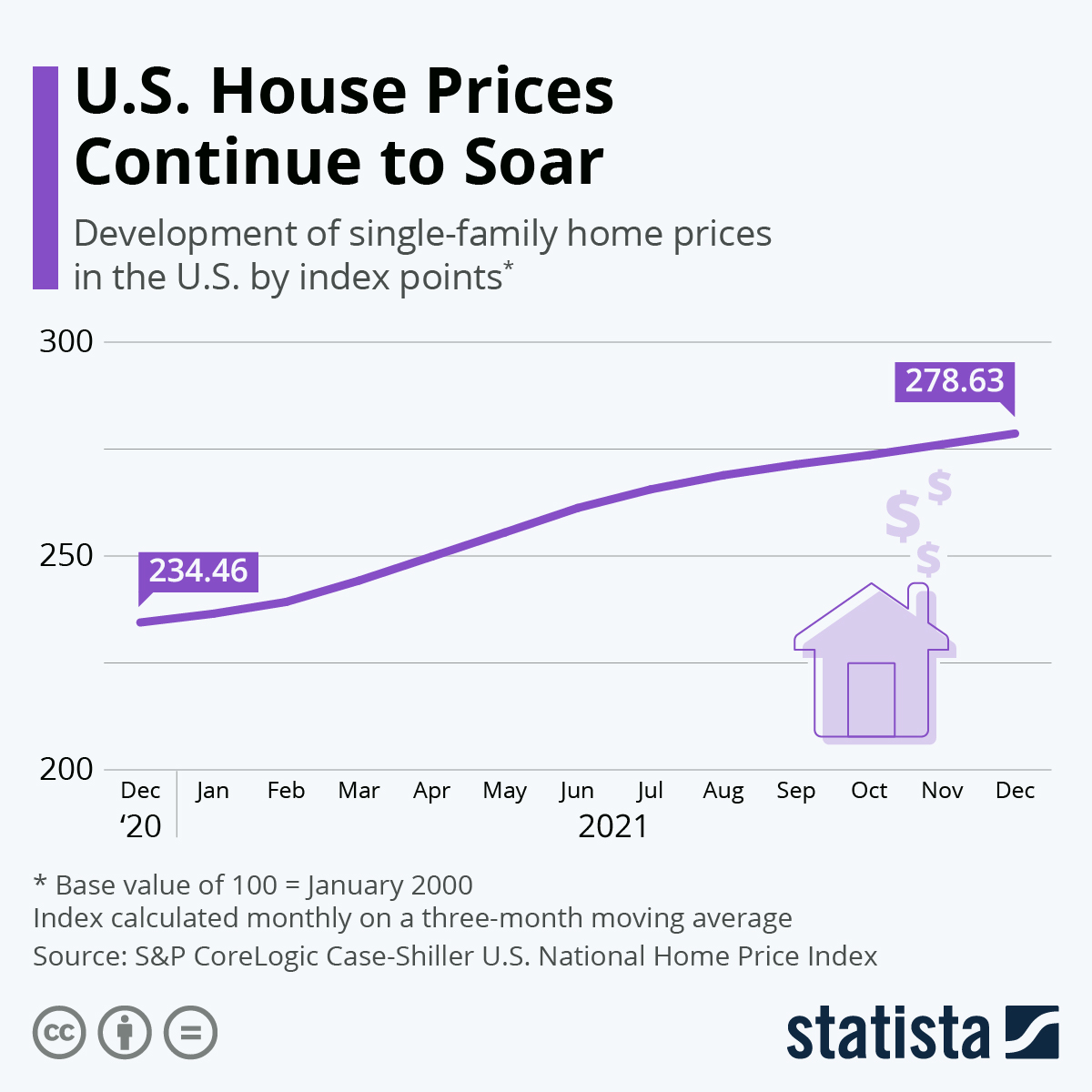

- U.S. home-price growth surged 18.8% last year to a record in data reaching back to 1987. Phoenix homes saw the largest year over year price gain at around 32.5%.

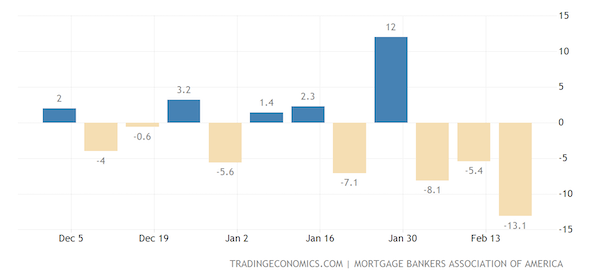

- With borrowing more expensive, applications to refinance mortgages have fallen about 45% over the past six months as mortgage lenders simultaneously plan thousands of layoffs. Original mortgage applications declined 13.1% for the week ended Feb. 18 to the lowest level since December 2019:

- Some companies are abandoning annual salary reviews in favor of more frequent appraisals under pressures of the labor shortage and inflation.

- Home Depot sees slowing growth ahead after surpassing $150 billion in annual sales for the first time in its most recent fiscal year, as strong demand for home-improvement goods at the beginning of the year gradually morphed into surging sales to contractors.

- Macy’s opted against separating its e-commerce business from its brick-and-mortar stores amid calls from an activist investor to boost shareholder returns. The firm saw overall sales spike an annual 28% in the most recent quarter.

- U.S. dry cleaners are reeling as remote work cuts into professional attire cleanings.

- AT&T became the first carrier to completely shut down its 3G network, with lingering effects expected for tech including burglar alarms, older phones, roadside assistance and medical alert devices.

- Greater Detroit will soon see construction begin on both a large seat-making plant and a $9 million electric vehicle tech center.

- Cummins’ $3.7 billion acquisition of Meritor Inc. will make the diesel engine maker one of the few companies that can provide powertrains for both combustion and electric-power trucks.

- Honeywell Aerospace announced it will locate the headquarters for its Americas Aftermarket business in Puerto Rico.

- A California-based startup is championing concrete blocks made from hard-to-recycle items, including plastic bags, yogurt containers and water bottles.

- Industrial, real estate and consumer discretionary companies led the list of the U.S.’s top 100 sustainable firms, according to the research arm of Morgan Stanley.

- A recent survey of more than 1,000 supply chain leaders revealed that over 20% of respondents employ 3D printing in their operations, with nearly a third more expecting to adopt 3D printing in the next five years.

International Markets

- New COVID-19 cases across the globe fell 21% last week, the third consecutive weekly decline, according to the World Health Organization. The BA.2 “stealth” subvariant of Omicron now comprises one-third of global infections, creating concerns among health officials about dropping pandemic restrictions.

- Scotland, Ireland and Poland are lifting remaining pandemic restrictions in the coming weeks.

- The European Union is recommending that member nations ease travel restrictions starting March 1.

- Hong Kong pushed up schools’ summer vacation to March-April so campuses can be used for COVID testing, isolation and vaccination efforts.

- New Zealand will wait another three to six weeks for Omicron to peak before easing pandemic restrictions, officials said.

- Australia opened its borders to vaccinated travelers for the first time during the pandemic this week.

- Supply of COVID-19 vaccines for international distribution outweighed demand for the first time in the 14th round of allocations from vaccine-sharing program COVAX.

- Volkswagen is in advanced talks for an initial public offering of Porsche, a bid to free up cash and fund aggressive expansion into electric vehicles.

- Jeep and Dodge parent Stellantis saw a surge in annual profit last year and expects industry sales to rise by 3% this year in both North America and Europe.

- Nestle will nearly double investments in Brazil this year with plans for a new pet food factory and other increases to industrial capacity.

- Despite global travel restrictions, Dubai’s main airport managed to hold its top spot as the world’s busiest travel hub with around 29 million passengers last year.

- Vehicle maker CNH Industrial, parent of brands such as Case and New Holland, expects revenue to rise 24% through 2024 following the spinoff of its truck, bus and engine units.

At M. Holland

- M. Holland just published a 2022 Logistics Outlook examining continued trucking, ocean freight and rail challenges, plus key takeaways for plastics companies. Read it here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.