COVID-19 Bulletin: February 16

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell over 3% Tuesday on easing political tensions in Eastern Europe. Futures rebounded in mid-morning trading, with WTI up 2.5% at $94.37/bbl and Brent up 2.5% at $95.57/bbl. U.S. natural gas was 5.4% higher at $4.54/MMBtu.

- U.S. crude production will hit 12 million bpd this year and a record 12.6 million bpd in 2023 on higher demand from Asia, the U.S. Energy Information Administration predicts.

- The American Petroleum Institute reported a lower-than-expected draw of 1.076 million barrels last week.

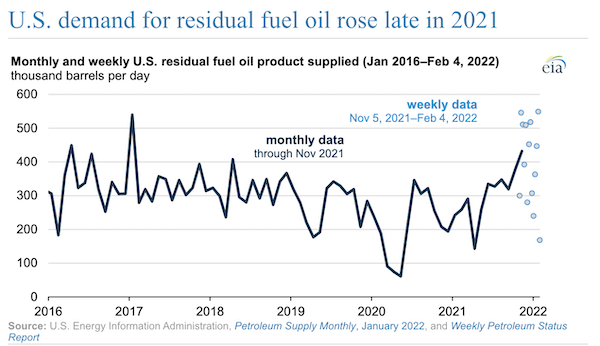

- More relatively high-sulfur residual fuel oil was consumed late last year in the U.S. than during any month since January 2017, the EIA said:

- The data corresponds with rising bunker fuel prices for commercial ships, now just $10 off an all-time high recorded in 2008.

- Russia’s state-owned oil producer expects to miss its May target of pre-pandemic output levels but could restore full drilling activity sometime later this year, officials said.

- Workers at a 200,000-bpd Libyan export terminal are threatening to shut the plant down by the end of the month over wage disputes.

- Shell announced plans to sell half its $1 billion stake in a cluster of British North Sea gas fields, part of a broader retreat by producers from the aging basin.

- German and Dubai firms are partnering to produce green hydrogen in the Dutch North Sea by 2030.

Supply Chain

- A large winter storm will begin moving across the central, southern and eastern U.S. today until Friday, bringing a mix of disruptive rain, snow and possible flooding.

- Canadian border blockades on two routes, one to Montana and one to North Dakota, are expected to ease today following the Canadian government’s invocation of emergency powers. Protests in Ottawa, on the other hand, show no signs of stopping.

- U.S. seaborne container imports dropped to 2.66 million TEUs in January, down 1.4% from the year before and 0.2% from December.

- Global container shipping capacity expanded by 14% last year to a record-high 7.2 million TEUs, according to Drewry Shipping Consultants.

- It could take another month for the Port of Charleston to clear a backlog of roughly 20 container ships waiting to unload.

- Maersk is planning more acquisitions in the U.S. business-to-consumer market after its most recent $1.68 billion acquisition of Pennsylvania’s Pilot Freight Services gave the shipper a foothold in appliance delivery and installation.

- Egypt is speeding plans to make 10 additional kilometers of the Suez Canal accessible to two-way traffic amid persistent global supply chain disruptions.

- Freight forwarder Flexport is partnering with Eastern Airlines on a new express freighter service using repurposed passenger planes.

- Container rates for transporting furniture are up 12-fold since the start of the pandemic, forcing retailers to pass on costs to consumers.

- Aluminum prices have already risen 14% this year to their highest level in 14 years, as soaring energy costs continue to impact production and lower global supplies.

- Returns are up an annual 56% for purchases between Nov. 1 and Dec. 24, the National Retail Federation says.

- Truckload carrier U.S. Xpress, partially owned by autonomous truck maker TuSimple, partnered with a second autonomous-trucking firm, Aurora Innovation, to help bring self-driving software to its fleet.

- South Korea’s HMM saw record profit of $4.4 billion last year, offsetting nearly a decade of losses and prompting speculation of a private sale of the state-managed container line.

- Japanese auto makers are offering a more pessimistic tone than their U.S. peers on expected delivery volumes this year.

- Honda was forced to ration semiconductors to its best-selling vehicles last quarter after flooding in Malaysia wiped out critical supplies.

- Volkswagen warned it may need to cut output at its main factory in Wolfsburg, Germany, on an acute shortage of computer chips for its burgeoning electric-vehicle production.

- Goodyear lost almost a quarter of its market value late last week after executives said raw materials expenses alone could cost up to $800 million more in the first six months of this year.

- Thirty-seven percent of supply chain leaders in a recent survey said they expect to employ autonomous vehicles in their warehouses and factories over the next five years.

Domestic Markets

- The U.S. reported 110,453 new COVID-19 infections and 2,595 virus fatalities Tuesday. Weekly case averages are down to 153,029, the lowest since last September.

- Alaska, Kentucky, Mississippi and West Virginia continue to see the U.S.’s highest case rates.

- California and Chicago announced they would temporarily keep some mask mandates, while Massachusetts and Maryland became the latest states to ease masking requirements. Half of state mask mandates have ended in the past three weeks, while the CDC is expected to loosen guidelines on the face coverings as soon as this week.

- The pace of COVID-19 booster shots in the U.S. is stalling, with less than one-third of eligible Americans receiving the third shot, well behind other developed countries.

- COVID-19 cases and hospitalizations among U.S. children were up to five times higher during the Omicron peak than the previous wave of Delta, new data shows.

- Some of the largest employers in the country are scrapping mask mandates for vaccinated workers and guests, most recently Disney Resorts and Tyson Foods.

- The CDC lowered its risk level for cruises from “Very High” to “High.”

- The U.S. administration is asking Congress to authorize an extra $30 billion in pandemic response aid that would go to securing more antiviral pills and testing kits.

- U.S. retail sales jumped a higher-than-expected 3.8% in January.

- Growth in U.S. wholesale inventories accelerated to 2.2% in December.

- The average U.S. 30-year mortgage rate is up by one-fifth since Christmas to 3.69%, a two-year high.

- U.S. single-family home rental prices rose 7.8% last year to an all-time high. Record investment went into rentals last year, primarily in major cities of Sunbelt states including Dallas, Atlanta, Phoenix and Houston.

- Airbnb posted record revenue last year, capitalizing on surging pandemic demand for suburban rentals.

- Comparable store sales at Advanced Auto Parts rose 8.2% last quarter compared to a year ago, as parts suppliers have so far avoided the same kind of sticker shock as for fully assembled vehicles.

- Marriott saw revenue of $4.45 billion in the latest quarter, more than double the year-ago period on higher occupancy levels.

- U.S. electric-vehicle startup Fisker plans to sell a sub-$30,000 electric SUV starting in 2023.

- GM will resume production of the Chevy Bolt electric vehicle in April following widespread recalls related to battery issues last year.

- The pending shutdown of the nation’s 3G telecommunications network could affect more than just older mobile devices, ranging from home alarm systems to some medical devices to in-car crash notification and roadside assistance systems.

- Coca Cola pledged that 25% of its packaging will be reusable by 2030.

- Sea levels on U.S. coastlines could rise by one foot by 2050, scientists warn, prompting more frequent flooding events from high tides and storms.

International Markets

- Indonesia reported a record 57,049 new COVID-19 infections Tuesday.

- South Korea saw more than 90,000 single-day COVID-19 cases for the first time yesterday, while the nation’s virus fatality rate hit a one-month high.

- Japan reported 236 COVID-19 fatalities Tuesday, a pandemic record.

- New Zealand surpassed 1,000 daily COVID-19 cases for the first time in the pandemic yesterday.

- COVID-19 cases in Mexico are down 40% over the past three weeks. Passenger traffic at the Mexico City International Airport was up 56% year over year in January but remained well below pre-pandemic levels.

- Canada eased testing requirements for incoming vaccinated travelers, now accepting rapid tests in addition to the previously required PCR tests. Ontario and Quebec announced they will phase out their COVID-19 vaccine passport systems.

- Children as young as age 3 are being vaccinated against COVID-19 in Hong Kong, as hospitals begin to overflow amid the island’s worst wave of the pandemic.

- China tightened restrictions in the industrial hub of Suzhou after new COVID-19 cases were detected for the second day in a row. New COVID-19 infections are sharply down in Beijing’s closed-loop Olympics system, now in the single digits for the past five days.

- The Netherlands is scrapping all remaining pandemic restrictions on Feb. 25.

- Austria will drop most COVID-19 restrictions on March 5.

- BioNTech unveiled mobile vaccine production units housed in shipping containers that will deploy across Africa and other regions with extremely low vaccination rates, producing up to 50 million doses per year.

- “Long COVID” is more likely to affect unvaccinated people, new research out of Britain shows.

- Belgium will allow full-time employees to work just four days a week without impacting salaries, a bid to add flexibility in a tight labor market.

- European employment rose 2.1% last quarter to surpass pre-pandemic levels.

- Intra-regional trade in Asia-Pacific economies grew more than 31% in the first quarter of 2021, economists say.

- Chinese inflation eased to 9.1% year over year in January from 10.3% in December as food and energy prices weakened.

- Argentinian consumer prices are up 51% this month from the same time last year, one of the highest inflation rates in the region.

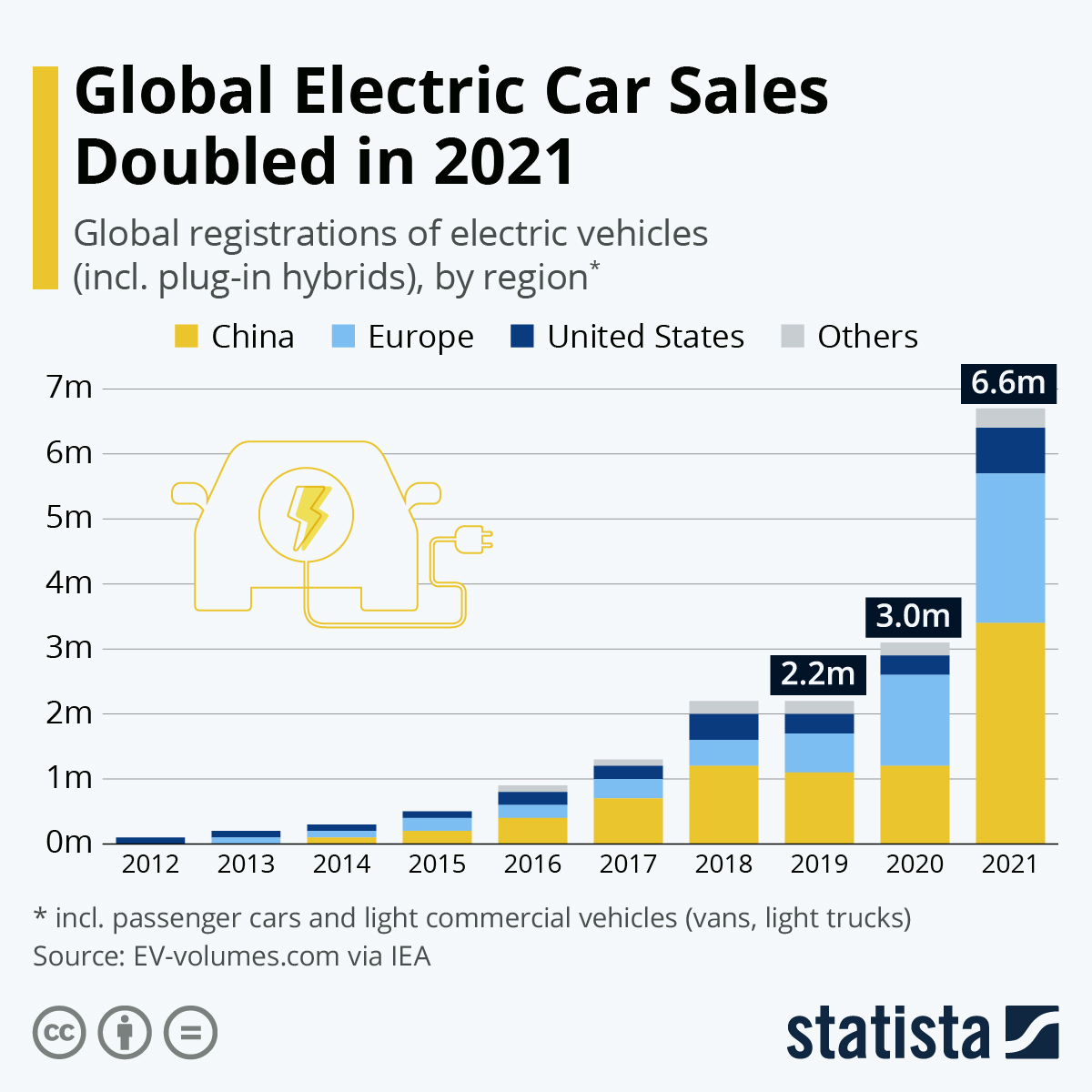

- Electric car sales were up 109% in 2021, versus 4% growth for the overall car market, with China accounting for about half of electric vehicle sales:

- Faster permitting processes helped Italy auction off 1.8 GW of green energy development last month, with economists optimistic that the nation can reach its 2030 emissions targets.

- Third-quarter greenhouse gas emissions in Europe rose 6% from the same time in 2020 when pandemic restrictions induced a sharp economic contraction.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.