COVID-19 Bulletin: February 15

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices jumped over 2% Monday, edging closer to $100/bbl on fears of war in Europe. Crude futures retreated in mid-morning trading as war fears abated, with WTI down 4.5% at $91.17/bbl and Brent down 4.1% at $92.50/bbl. U.S. natural gas was 1.9% higher at $4.28/MMBtu.

- U.S. gasoline demand jumped 6.4% last week, pushing prices closer to $3.50/gallon compared to $3.30/gallon just one month ago.

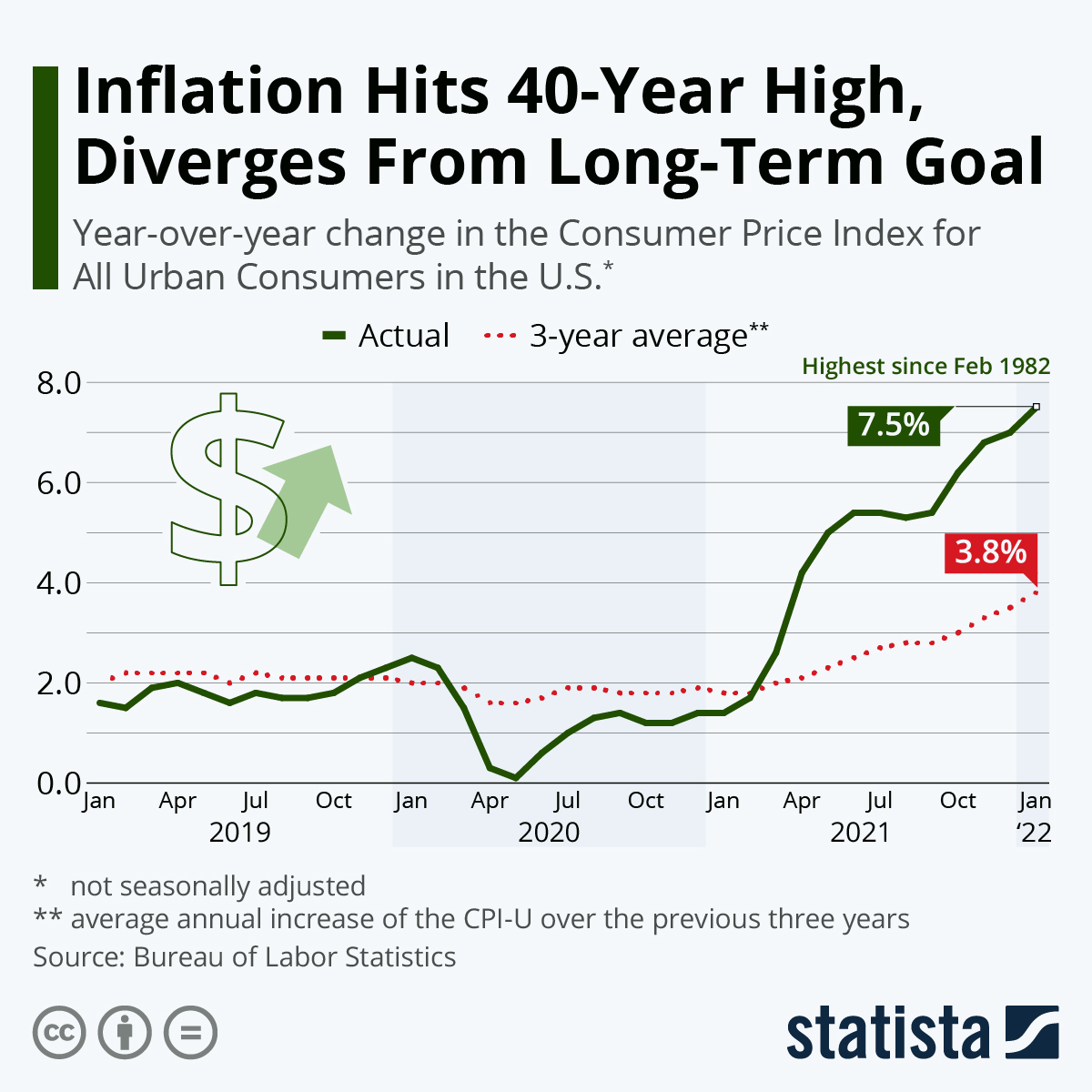

- $100/bbl oil prices could lift inflation by about half a percentage point in the U.S. and Europe in the second half of the year, economists warn.

- Midland Texas crude is set to be added to Dated Brent for June 2023 cargoes, S&P Global Platts said, marking the first time U.S. oil would join the world’s most important crude benchmark.

- The oil supply-demand balance was tighter in late 2021 than originally thought, dampening hopes that stockpiles will be refilled this quarter, according to major U.S. and international energy groups.

- The head of the International Energy Agency called on OPEC+ producers to pump more oil to close the widening gap between boilerplate production quotas and actual output.

- U.S. Permian Basin production hit 5.06 million bpd in January, the second consecutive monthly record. Forecasts show output growing to 5.205 million bpd by March, contributing to a projected 271,000-bpd rise in overall U.S. shale output for the month.

- Every U.S. LNG export terminal was loading or preparing to load a tanker on Saturday, an industry first, as record flows are set to make their way to LNG plants and the U.S. solidifies its position as the world’s top supplier of super chilled power plant fuel.

- January’s count of Drilled but Uncompleted Wells in the U.S. dropped to 4,466, down almost 50% from two years ago.

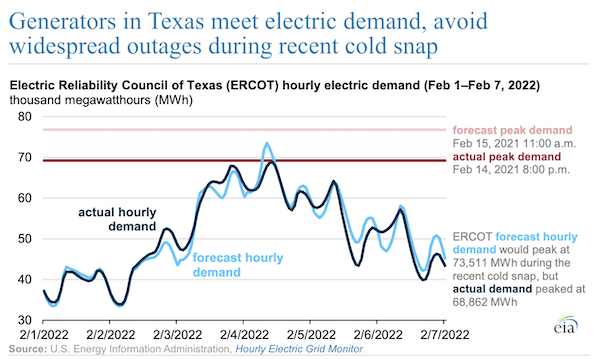

- Unlike February 2021, when extreme cold disrupted the supply of electricity in Texas and left millions without power, generators increased output to meet elevated demand earlier this month:

- TotalEnergies’ $27 billion project plans for southern Iraq are on the verge of collapse.

- Despite the rising popularity of climate pledges, banks across the globe have pumped more than $1.5 trillion into coal since 2019 as energy shortages sent demand for the fuel soaring.

- The U.S. administration released $6 billion in Civil Nuclear Credit Program credits to U.S. nuclear facilities, the source of 52% of the nation’s carbon-free power.

- There are over 90 chemical recycling projects planned or underway globally, with the majority in Europe, according to a recent study.

- Pemex’s lack of environmental and ESG commitments could present problems for the heavily indebted state-owned company, as more lenders shun borrowers with poor ESG metrics.

Supply Chain

- Severe winter storms are expected to swing out of the Rockies and travel across the Plains and Mississippi Valley this week, bringing snow, hail and winds as high as 80 mph.

- In a rare move, the Canadian government invoked emergency powers Monday to help restore full traffic on Ambassador Bridge from Ontario to Detroit following a week of blockades. A disruptive trucker protest in Ottawa, the nation’s capital, stretched into its 18th day, while border crossings in Alberta and Manitoba remain shut down.

- Heavy-duty truck rates between the U.S. and Canada rose 44% the past month, while refrigerated truck rates rose by a third.

- Shipments of dry commodities from the Black Sea — a major export region for oil products, steel and grain — are on course for a 44% drop this month.

- Economists at the World Trade Organization say up to three-quarters of global trade disruption has been caused by excess demand rather than supply chain snarls, a result of the pandemic-induced shift in spending away from services to goods.

- Boeing has almost doubled its capacity for turning passenger jets into freighters since the pandemic began and is considering adding even more, with air freight rates up almost 150% from December 2019 levels.

- Container lines and freight forwarders are struggling to retain staff amid the stress of persistent supply chain disruptions.

- Full-year profit at Qatar-based Nakilat, the world’s largest LNG carrier operator, surged 17% to a record $370 million last year.

- Less-than-truckload provider XPO Logistics saw fourth-quarter operating income nearly quadruple on an annual basis to $126 million.

- U.S. intermodal carrier Hub Group saw fourth-quarter revenue jump 32% to $1.3 billion as a 37% increase in per-load intermodal revenue offset a sharp decline in volumes.

- Annual profit at Greek container ship owner Danaos surged to a record $1.05 billion last year on elevated charter rates.

- The U.S. Postal Service suffered a $1.55 billion first-quarter loss as shipping and package revenue declined 7.3%.

- Knight-Swift Transportation will begin integrating trucks made by autonomous-trucking startup Embark into its truckload fleet, the nation’s largest.

- DHL announced plans for a $400-million expansion of its distribution network for pharmaceuticals and medical devices, an effort to keep up with demand for FDA-regulated and temperature-controlled storage.

- A Swedish tanker operator is starting research on how to convert its vessels into container ships.

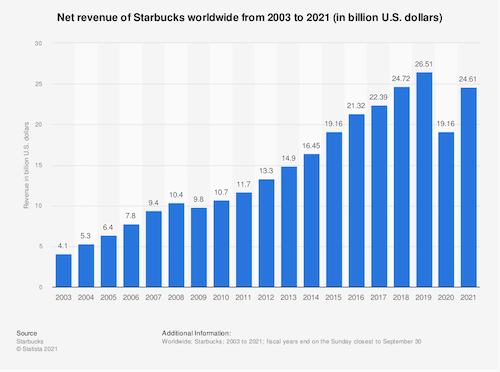

- Starbucks plans further price increases this year due to rising costs and supply chain disruption.

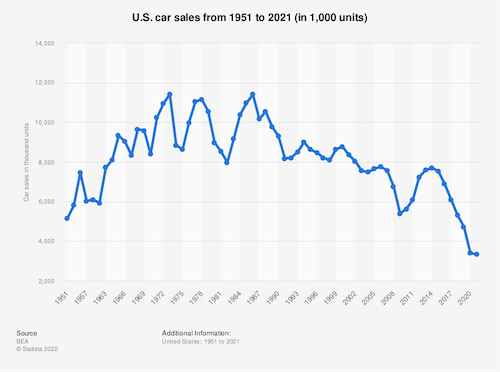

- Toyota cut its March production target by 100,000 vehicles due to supply chain bottlenecks, including blockades on the U.S.-Canadian border that forced the shutdown of its Ontario plants, which have yet to resume production.

- Ford will continue idling production at eight U.S. plants this week due to low supplies of computer chips. The automaker previously said the current quarter would be its low point for vehicle output.

- Advanced Micro Devices completed its $35 billion acquisition of California-based supplier Xilinx yesterday, the largest deal in semiconductor history. Meanwhile, Intel is closing in on a $6 billion deal to acquire Israeli chip company Tower Semiconductor.

- A new plan would unleash $49 billion in public and private funding for new chip production in Europe, part of the bloc’s broad effort to boost its commercial independence in the key manufacturing business.

- Half-year profits at Australian mining giant BHP Group surged 57% on rising prices for metal commodities.

- The U.S. poultry industry is on high alert after several flocks were recently compromised by bird flu, a potential source of even higher prices amid an industrywide labor shortage.

- Costs for everything from seed to fertilizer are sharply rising on U.S. farms, likely leading to higher grocery bills this year.

- The U.S. suspended avocado imports from Mexico’s Michoacán state after a Department of Agriculture inspector was threatened.

- CMA CGM will stop shipping plastic scrap starting June 1.

- Scotland is taking bids to build two green freeports that would give tax benefits and other incentives to firms with long-term climate targets.

Domestic Markets

- The U.S. reported 179,172 new COVID-19 infections and 2,777 virus fatalities Monday. The nation is averaging 175,000 infections per day, a 78% drop over the past month, with fatalities down 10% over the past week.

- New COVID-19 cases among U.S. children fell to less than 300,000 last week compared to more than 1.15 million reported a month ago.

- New COVID-19 cases fell 38% in New York state and 46% in California last week. Case rates are declining slower in Florida, which still accounts for more than 10% of daily infections across the country.

- New York City fired 1,430 workers yesterday for failure to comply with its vaccine mandate.

- Washington, D.C., is ending its proof-of-vaccine and mask requirement to enter indoor public venues today.

- Roughly 2.3% of American workers called in sick during mid-January’s height of the Omicron surge, a record in data back to 1976.

- One-third of workers in 10 major U.S. cities returned to in-person work last week, a small but rising percentage compared to a month ago.

- Microsoft is recalling all U.S. workers to the office Feb. 28.

- The U.S. Producer Price Index jumped 1.0% last month, twice the expected level.

- U.S. consumers lowered their expectations for how much inflation will rise in the near- and medium-term periods last month, a positive signal in the public perception of the economy.

- 3M forecast slower organic growth this year as pandemic restrictions ease and demand for masks goes down.

- U.S. auto inventory levels remained flat in January at 1.04 million vehicles, down from 2.79 million vehicles at the same time last year.

- Australia-based Tritium DCFC plans to break ground this year on a Tennessee factory for electric-vehicle charging stations.

- Ford released files to allow owners of its Maverick pickup truck to 3D print accessories for the vehicles.

- An electric DeLorean will start selling in the U.S. by 2022.

- The current megadrought in the Western U.S. and Northern Mexico could be the worst in 1,200 years, scientists say.

International Markets

- Hong Kong saw a record 2,071 new COVID-19 infections Monday, as pressure rapidly builds on the island’s healthcare system.

- Taiwan is easing quarantine mandates for incoming travelers next month, the latest in a string of tourism-dependent economies to relax travel restrictions.

- China approved Pfizer’s COVID-19 antiviral pill yesterday, the first foreign pharmaceutical product the nation has endorsed for the virus.

- COVID-19 cases in Eastern Europe, including Russia and Ukraine, have doubled in the past two weeks. The CDC added six countries to its Level Four: High Risk warning level, including, Azerbaijan, Belarus and South Korea.

- New COVID-19 cases fell 30% in the U.K. and 20% in Germany last week. Virus fatalities also are trending downward in the U.K., a bellwether for COVID-19 patterns.

- Italy began enforcing its COVID-19 vaccine mandate for everyone over age 50 to enter indoor public venues.

- Swedish officials are telling everyone over age 80 to get a fourth COVID-19 vaccine dose.

- Ontario, Canada, will no longer require proof of COVID-19 vaccination to enter indoor venues.

- Japan, the world’s third largest economy, returned to growth in the latest quarter with a 1.3% rise in GDP.

- The Dutch economy grew 0.9% in the fourth quarter despite a surge in COVID-19 cases that closed restaurants and bars, bringing growth for the year to 4.8%.

- Michelin expects to return to pre-pandemic profit levels this year as rising prices and volumes offset higher costs for raw materials and shipping.

- Key Apple supplier Foxconn will work with Thailand’s state-owned PTT energy group to produce electric cars.

- Rolls-Royce, maker of Airbus and Boeing engines, expects a fully electric small aircraft in three to five years.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.