COVID-19 Bulletin: February 7

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

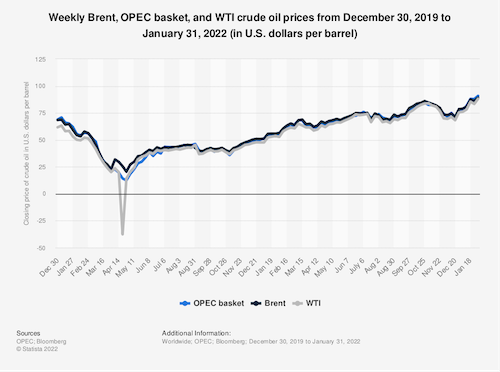

- Oil prices hit seven-year highs on Friday, extending their rally into a seventh week. WTI ended 2.3% higher at $92.31/bbl as freezing weather disrupted production in the U.S. Permian Basin.

- Energy futures retreated in mid-morning trading today, with WTI down 0.9% at $91.52/bbl and Brent down 0.3% at $93.02/bbl. U.S. natural gas was 8.8% lower at $4.17/MMBtu.

- A net importer of natural gas just 10 years ago, U.S. LNG export capacity will reach 13.9 billion cubic feet per day when a new export facility goes live later this week, cementing the nation’s spot at the top of global LNG production.

- U.S. diesel fuel and heating oil stocks are about 15% below their five-year moving averages, as refiners struggle to keep up with strong manufacturing, trucking and export activity.

- Saudi Aramco raised prices for all grades in Asia, its main market, following Brent crude’s jump above $93/bbl last week. The company also is considering selling a 2.5% stake in the company in its second public offering since 2019.

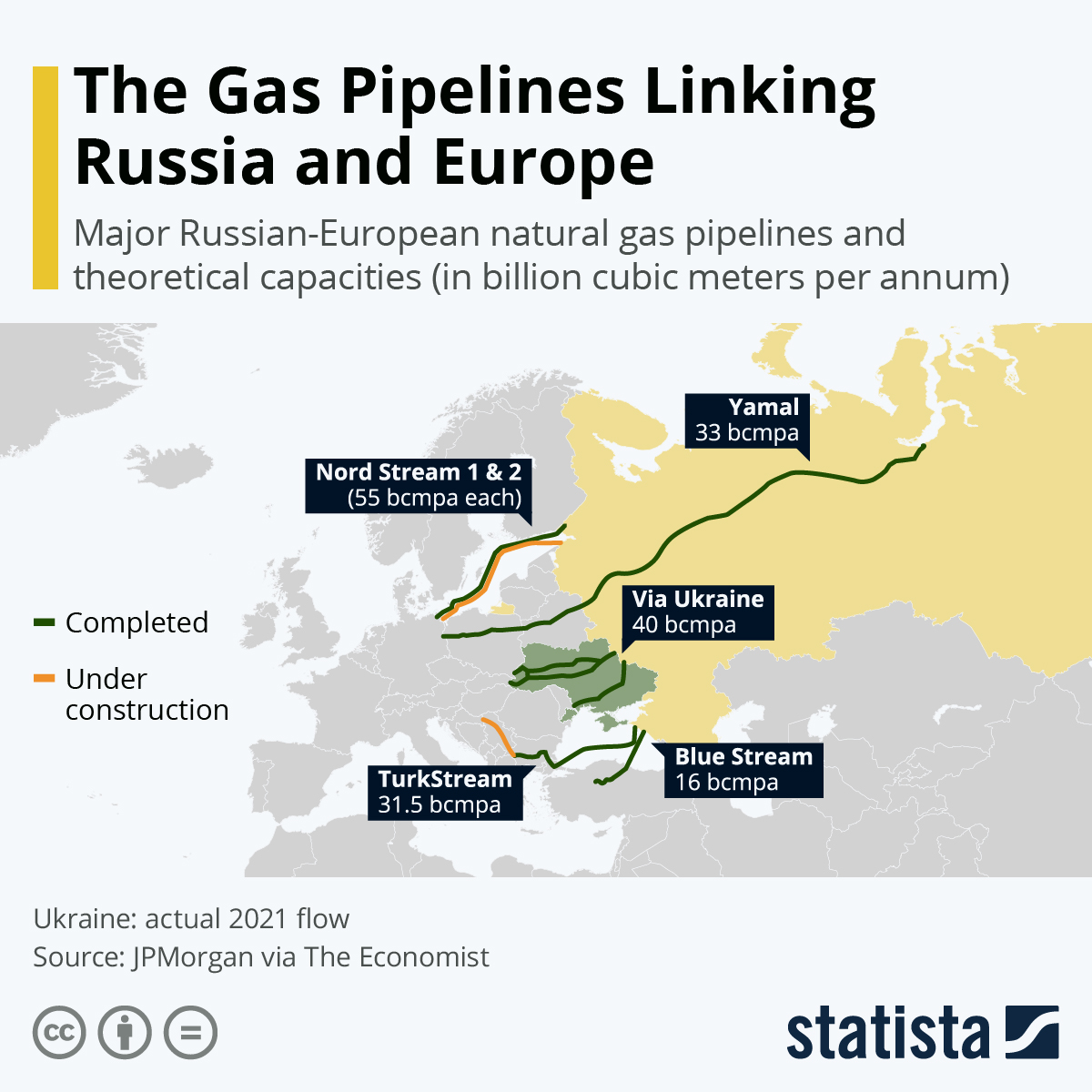

- European natural gas prices are back on the rise after the Yamal pipeline providing one-sixth of Russia’s gas supplies into Europe shut down last week, ending hopes of more exports to the continent.

- On Friday, Russia inked some $117.5 billion in long-term oil and gas deals with China, the world’s biggest energy consumer. Russian diesel exports to the U.S. hit a three-year high of 1.55 million barrels last month.

- Peru authorized Repsol to resume loading and unloading operations at sea at its La Pampilla refinery that was temporarily shut down following an oil spill.

- Carbon prices are continuing to rise in the EU, as analysts expect the price of permits in its carbon market to soon reach 100 euros after the market closed at a record high 96.43 euros Friday.

Supply Chain

- Tens of thousands in Tennessee remain without power after a severe winter storm swept across the southern and eastern U.S. late last week, causing widespread flight cancellations and treacherous driving conditions.

- Trucking, parcel-delivery and warehousing companies added a combined 42,100 jobs in January, signaling the sector’s push to add workers is extending beyond the busy year-end season.

- New U.S. legislation would limit ocean carriers from imposing excessive fees for boxes that sit for longer periods at ports, often due to supply chain logjams outside the control of shippers.

- Canada’s capital is under a state of emergency after 10 days of demonstrations by truckers that have shut down much of the city’s core.

- Airfreight rates from Shanghai to the U.S. rose 7.5% week over week ahead of the Lunar New Year holiday that began on Feb. 1.

- FedEx restored some international airfreight services that were suspended last month due to staffing shortages caused by COVID-19. The shipper’s domestic 2-day and 3-day freight services remain suspended.

- India plans to build 100 new cargo terminals over the next three years, officials said.

- Fourth-quarter rents for warehouses in Southern California rose almost 60% from the previous year.

- Food processors and retailers are turning to temporary workers to alleviate persistent labor shortages.

- Global food prices are at two-decade highs after a year of supply chain disruption, rising energy costs and extreme weather events.

- Major consumer-products companies are upping previously announced plans to increase prices this year, while others are pulling back on some discounts offered to consumers.

- The U.S. administration announced plans to spend $1 billion and issue new rules to address a lack of “meaningful competition” in the meat processing industry, whose profits are soaring amid elevated food prices.

- Ford plans to suspend or cut production at eight of its factories in the U.S., Mexico and Canada throughout this week due to computer chip shortages.

- Computer chip shortages cost the global auto industry some $210 billion in revenue and 7.7 million vehicles last year, consultant AlixPartners estimates. Volkswagen does not expect the shortage to end this year, although it may ease in the second half, executives said.

- The U.S. House of Representatives approved on Friday a bill that would release $52 billion to subsidize domestic semiconductor manufacturing and research.

- Japan’s Toshiba will invest $1.09 billion in a new plant to more than double production of semiconductors for industrial equipment, the firm announced.

- Trucker ArcBest raised its long-term financial targets and said it expects revenue to double to $8 billion by 2025.

- There were more than 2.2 million mentions of “supply chain” on Twitter in Q4 last year, some 500% more than in any quarter of 2019.

- Amazon workers at an Alabama warehouse are prepping to begin a second vote on whether to unionize.

- The White House signed an order Friday requiring “project labor agreements” in federal construction projects over $35 million, a potential boost to unions and the more than 200,000 workers involved in negotiating the deals.

Domestic Markets

- The U.S. reported 47,298 new COVID-19 infections and 358 virus fatalities Sunday. The nation’s total virus fatalities since the start of the pandemic have surpassed 900,000, the highest officially recorded number in the world.

- COVID-19 infections are falling in nearly every state, with cases in New York down nearly 75% over the past two weeks.

- The U.S. Postal Service says it is on track to deliver hundreds of millions of free COVID-19 tests to Americans in the first two weeks of the nation’s rollout. Walgreens and CVS lifted caps on the number of tests consumers can buy.

- New Jersey will formally end its mask mandate in public schools today.

- The CDC is considering lengthening the recommended time between first and second vaccine shots to eight weeks to reduce the risk of myocarditis, a rare heart affliction.

- The federal government is expanding nationwide efforts to track COVID-19 by monitoring virus levels found in sewage, a process that could provide early warning signals for communities about to see an outbreak.

- McDonald’s locations in the U.S. cut back hours by about 10% in mid-December due to staffing shortages caused by COVID-19, as lingering pressures remain for most other large U.S. firms.

- Regeneron Pharmaceuticals beat fourth-quarter revenue estimates, boosted by demand for its COVID-19 antiviral therapy.

- Long Covid could be keeping 1.6 million victims from rejoining the workforce, representing about 15% of current job openings.

- Schools are grappling with a labor crisis as teachers leave the profession in record numbers and enrollment declines in teacher prep programs.

- The U.S. blood supply is at a decade low, says the American Red Cross, after it declared its first ever national blood crisis last month.

- The median selling price for a home in November was $416,900, nearly 25% more than it was in February 2020.

- James Hardie, the world’s largest fiber cement maker, raised its annual profit forecast for the fourth time this fiscal year on surging demand for new homes in the U.S.

- The pandemic has led to a 10% increase in mergers and acquisitions for the global information-technology and business sector, as many companies look to purchase IT firms to fill vacancies in their IT departments.

- U.S. low-cost air carriers Frontier Airlines and Spirit Airlines are merging in a $6.6 billion deal, creating the fifth largest airline in the nation.

- Ford is partnering with Google to convert a former Detroit train station into a research hub focused on electric and self-driving vehicles.

- Cruise lines, among the hardest hit firms of the pandemic, are still broadly reporting losses and could wait months for a return to profitability.

International Markets

- The Omicron variant of COVID-19 has likely sickened more people than at any period in over a century since the Spanish flu killed as many as 10% of young adults and lowered U.S. life expectancy by more than 12 years.

- Russia continues to see its worst days of the pandemic, reporting a record 168,201 new COVID-19 cases Friday, up tenfold from just a month ago.

- On Friday, Austria became the first European nation to mandate COVID-19 vaccines for its general population.

- One in every eight British children in grade school contracted COVID-19 last week, new data shows.

- New COVID-19 cases in Spain are down 52% from two weeks ago.

- Though Europe recorded a record 12 million cases of COVID-19 last week, the high Omicron infection levels could lead to “a long period of tranquility” for the continent, according to the World Health Organization.

- Dozens of new COVID-19 cases are being reported each day inside the Beijing Olympics’ closed-loop system, as authorities attempt to downplay concerns among personnel and competitors. A breakout of nearly 100 COVID-19 cases in the Chinese city of Baise has prompted officials to lockdown the region, telling 3.6 million people to stay at home.

- COVID-19 cases in Hong Kong are doubling every three days. Shelves in food markets are emptying as anxious consumers stock up after the city recorded record new COVID-19 infections Monday and the virus disrupted cross-border trade with China.

- Tokyo upped its virus alert level and warned about dwindling hospital capacity as serious COVID-19 cases across Japan reached a record last week.

- Indonesia temporarily closed the Jakarta airport to foreign tourists to quell a spike in COVID-19 infections.

- Singapore reported 13,208 new COVID-19 cases Friday, an increase of 9,000 infections from the day before.

- South Korea extended its social distancing measures after reporting a record 27,443 new COVID-19 cases Friday.

- Australia will resume allowing all international travelers who have received both doses of their COVID-19 vaccine to enter the nation beginning Feb. 21, ending a near two-year border closing.

- Canada lost a surprising 200,100 jobs in January, its first monthly decline since April 2021 as the Omicron-driven COVID-19 wave peaked.

- European wages could rise as much as 3% this year to meet inflation and labor shortages in critical industries, say officials with the European Central Bank. The bank could make its first interest-rate increase of the pandemic in the fourth quarter of this year.

- The Bank of England raised the national interest rate for the second meeting in a row last Thursday to 0.5%.

- Economic growth in Indonesia accelerated in the fourth quarter, as the economy expanded more than 5% year over year.

- The White House extended most tariffs on imported solar energy equipment for four years.

- Startup battery firm Britishvolt is working with Lotus to develop an electric sports car.

- Airbus said it would likely make its own engines for its zero-emission, hydrogen-fueled commercial planes that could be operational as soon as 2035.

At M. Holland

- Plastics News reported that M. Holland earned a Bronze rating from EcoVadis, a trusted provider of business sustainability ratings. The article reports that our improved annual score for 2021 is due to progress in our diversity and inclusion program, wellness benefits, career development and more.

- Our Healthcare team has published a revised Medical Resin Selection Booklet containing additional resins, new focus grades and new 3D printing resins.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.